RadioOpt was founded in 2008 as a spinoff of the Technische Universität Dresden. Initially designed to offer voice analytics via a SIM card applet in partnership with Giesecke & Devrient, this idea didn’t pan out for the wider market as it would have required a SIM card swap that wouldn’t be very appealing to mobile operators. Luckily they evolved.

Although this initial solution didn’t work well for people due to the SIM issue, it does work for some “things” and is currently in use in the automotive market. As smartphones became more widely deployed, the focus shifted to an app that can deliver the same type of information and analytics. Traffic Monitor is available for both end-user downloads and bundled with operator offers.

There are currently three models available for consideration.

- As a consumer you can download the app to have a better idea of the performance you are receiving via your smartphone and manage monthly costs. The consumers must “opt in” to allow their data to be sent anonymously to the operator in order for the network performance to be accurate.

- Enterprises might wonder if they are actually getting what they paid for when they purchase SLAs from their mobile operators – another model for use of the app.

- The main model is that of licensing the app to mobile operators in order to provide it to their users via their smartphones. Operators then receive statistics at the device level to help better understand customer’s experiences, and utilize analytics to better plan and manage their networks.

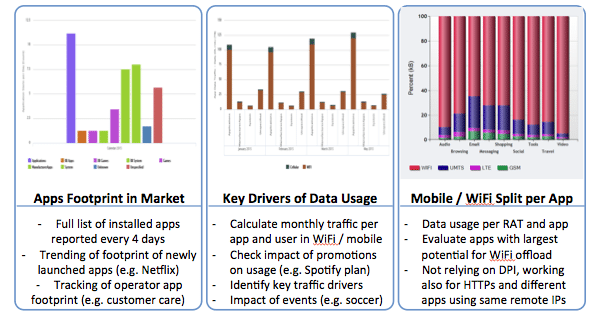

For operators, today’s options for monitoring network performance are costly. They can use network probes, which are expensive. Or they can conduct drive tests, which are also expensive based on technician costs and their time being allocated to this activity vs. fixing actual problems. The information gathered by Traffic Monitor can help identify areas where it would make sense to do drive tests for a more detailed analysis of an identified performance issue. The visual below highlights some of the key measurements operators can gather about their user base – the apps driving the most usage and the usage split between Wi-Fi and mobile data.

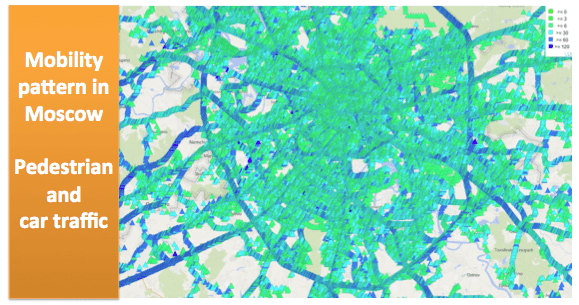

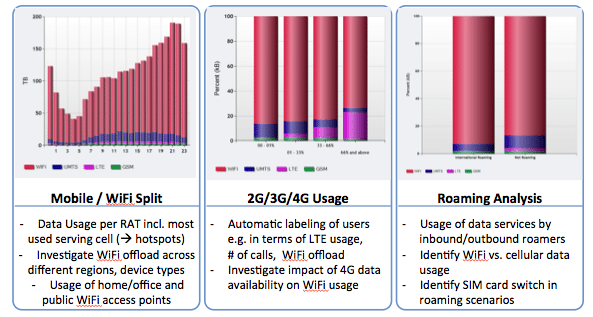

Traffic Monitor in use on over 800 networks worldwide and in more than 20 countries is provided by a network operator as part of their solution. Users move, and as they move the networks they are using may also change. In the analytics shown below, operators can map the performance of 2G/3G/4G infrastructure and also see how roaming usage plays into overall performance.

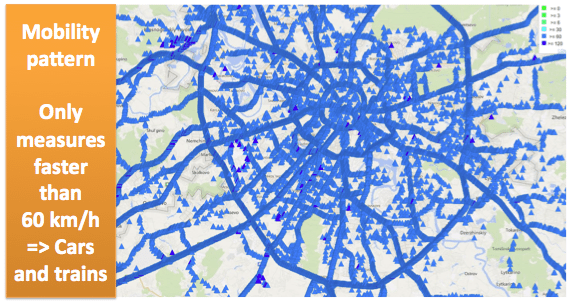

The last point to make about movement is the speed at which the movement takes place. Traffic Monitor is able to determine if movement is at walking speed or driving speed and present results accordingly. Below you can see two different maps of mobile traffic consumed by walkers vs. mobile traffic consumed by drivers for the same location.

What’s next? The ability to measure video traffic and performance will be added to the tool this fall. Customer experience and analytics are words that are used far too often in today’s mobile network discussions, so providers of these solutions need to quickly get to the point of their differentiation with clear proof points. The visuals provided by RadioOpt show some clear opportunities to do so.

Like what you read? Follow me on twitter!

Claudia Bacco, Managing Director – EMEA for RCR Wireless News, has spent her entire career in telecom, IT and security. Having experience as an operator, software and hardware vendor and as a well-known industry analyst, she has many opinions on the market. She’ll be sharing those opinions along with ongoing trend analysis for RCR Wireless News.