December greetings from Springfield, MO, and Davidson, NC. Pictured is yours truly standing in one of the world’s largest coal shovels (used for strip mining in rural Missouri in the 1950s). This particular shovel is prominently displayed in a small town (Rich Hill) in western Missouri.

This week’s Brief builds on the events of the last two weeks. We will discuss the impact to 5G adoption of iPhone 12 Pro shortages, the bold WarnerMedia day-and-date change for 2021, streaming offer changes for both Verizon and T-Mobile, and the latest 5G availability and speed analysis from Opensignal. But first, a look at market capitalization changes.

One quick shoutout to the Lucid Drone Technologies team for being awarded a Forbes “30 Under 30” in the Manufacturing & Industry segment. They are a sensational team who are changing the way large venues look at exterior cleaning and disinfecting. More on their progress here and here.

The week that was

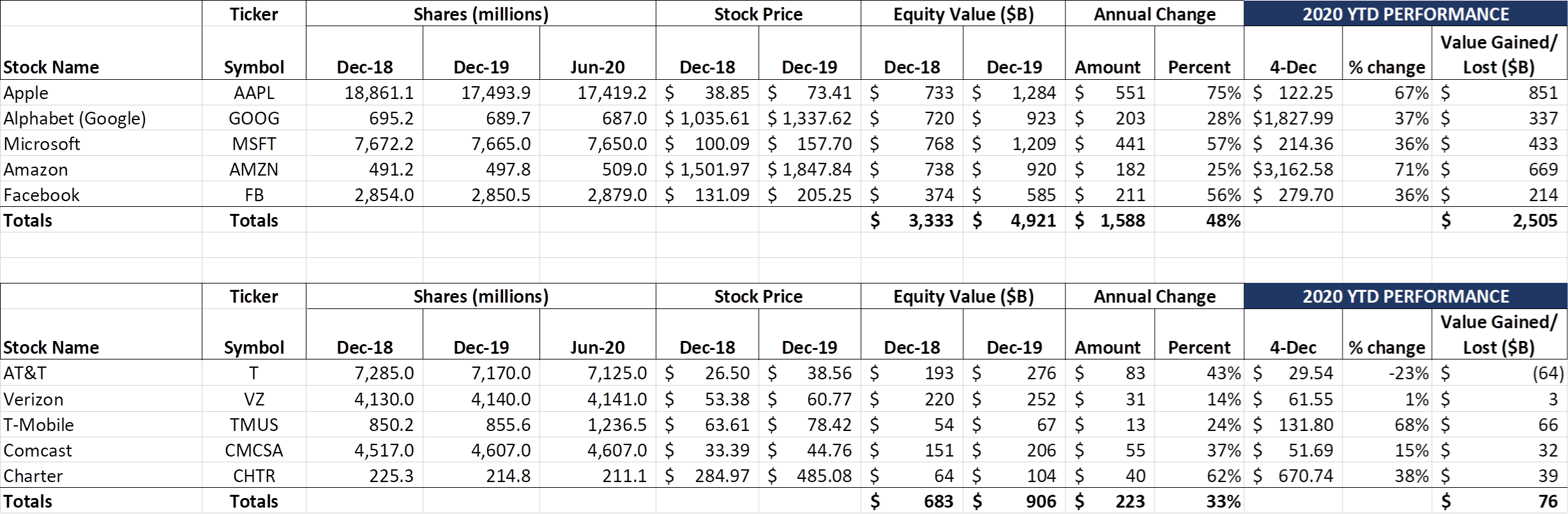

“Steady as she goes” is a good way to describe the equity market activity over the last two weeks. Over this period, the Fab 5 has gained $236 billion (slightly more than one AT&T) with that amount nearly equally split over each week. Leading the way is Apple (+$86 billion), who managed to push above the $2 trillion market capitalization level this week. There appears to be good reason for that as we will discuss below.

Each of the other Fab 5 stocks also had healthy gains over the period, with Amazon (+$32 billion), Microsoft (+$30 billion), Google (+$59 billion) and Facebook (+$28 billion) rallying. The total market capitalization level as of Friday (+$2.51 trillion YTD) is still less than the levels we saw immediately following the election (+$2.58 trillion) and during the late August mini-bubble (+$2.70 trillion).

One of the important consumer electronics developments in November was the release of the Microsoft Xbox X and S models (full review from CNET here). For those of you who are not gamers, it’s still worth understanding where Microsoft could head with cloud gaming. The Xbox appears to be one component of a multi-pronged strategy to improve home entertainment. This includes an app for your smart TV which would allow “lite” versions of games to stream without a hardware purchase. More on this development and a very interesting The Verge podcast with Microsoft’s EVP of gaming, Phil Spencer, here.

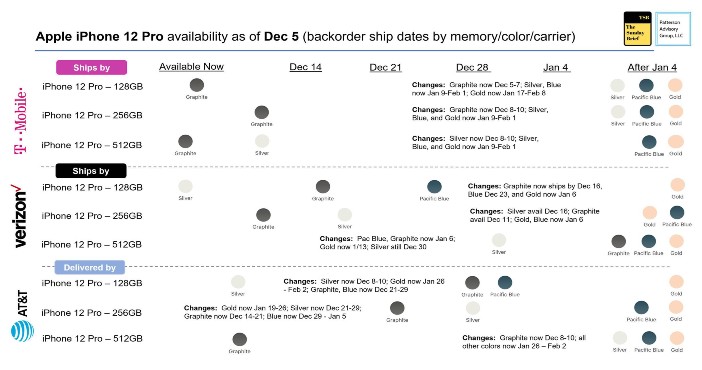

The most underreported headline in personal electronics is not the Sony PS5 or Xbox shortages, but rather the persistently significant Apple iPhone 12 Pro and 12 Pro Max shortages. During the Thanksgiving week, I posted an extremely interesting development on LinkedIn: The iPhone 12 Pro online shortage led Verizon to declare both the Gold 128GB and 512 GB SKUs “out of stock” – no late January date like their peers, but a simple “we don’t know – try your local store.” A bold statement for one of the largest Apple distributors.

If that weren’t enough, iPhone Pro availability worsened this week. Here’s the latest chart:

The iPhone 12 Pro has been in market since October 23rd (6 weeks) and, unless you want Graphite or Silver, you are going to wait at least another 2-8 weeks. These delays are longer than the iPhone 6. Apple, in response, is shifting some components from the current iPad to the iPhone, and recently ordered more than 20 million additional LTE-based devices for the remainder of the selling season (look for a lot of “free” iPhone 11, iPhone SE, and iPhone XR offers as we exit 2020). More on the shortages from this Nikkei Asia article.

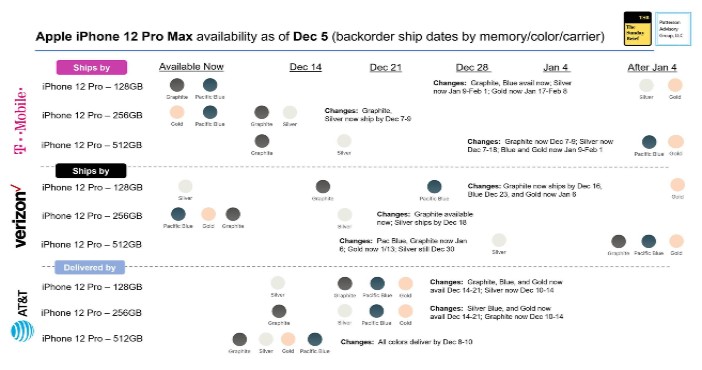

Interestingly, the iPhone 12 Pro (lack of) availability issues are not translating into a parallel iPhone 12 Max shortage. Here’s the latest data on the ultra-premium iPhone 12 Pro Max:

One of the interesting trends to watch over the next week is the backlog for the iPhone 12 Pro Max if Holiday buyers (including businesses) trade up (the cost differential is $100 for each storage option or $3.33 – $4.17/ mo. between the two devices). T-Mobile had a holiday offer a few years ago when they over-ordered on one of the larger storage sizes, so this not unprecedented. We would not be surprised to see this offer as supply chain availability becomes clearer.

Bottom line: Apple shortages delay 5G adoption – more LTE devices do not help. Backlogs translate into delayed unlimited plan upgrades for Verizon and AT&T (at a minimum, lessened opportunity to “beat” ARPU and service revenue estimates) and could dent T-Mobile’s ability to grab a higher share of gross additions. This forecast miss has many repercussions.

AT&T vs. AMC: Can the “Same day” genie be put back in the bottle?

In case you took the end of the week off, AT&T’s WarnerMedia unit made some headlines late Thursday when they announced that they would be releasing their first run movies on HBO Max on the same day that they are released in movie theaters (called “day and date” in the theater business). WarnerMedia expects to release at least 18 movies in this manner (including Wonder Woman 1984 this coming Christmas). Great news for potential HBO Max customers… not so great news for theater operators.

WarnerMedia’s president, Jason Kilar, brushed off the move as virus-related and temporary, according to CNBC. “Certainly, this is pandemic related. We haven’t spent one brain cell on what the world looks like in 2022… I have conviction that for the next several decades there will be a very large volume of consumers worldwide that will choose on any given night, especially a Friday or Saturday night, to go out to a theater to be entertained by a great Warner Brothers movie.”

This is the boldest move AT&T has made since John Stankey took the CEO post last summer. The short-term impact to AT&T’s forecasted 2021 earnings could be in the billions of dollars. In an extreme case, the theater chains stand united against day-and-date practices and AT&T’s lineup is only available to HBO Max customers. Given the way movie investments are recovered (theatrical releases, then to premium movie channels like HBO), this would ratchet the pressure on HBO Max to drive significant subscription additions to make up the financial difference. Perhaps the only thing that could have been worse for theaters (and the REITs who back them) would have been to announce that HBO Max would get the releases before the theaters.

The system needed to change, and AT&T has the most to gain from the change. Kara Swisher penned an excellent opinion column in The New York Times on Friday about AT&T’s moves, including this zinger at AMC CEO Adan Aron (pictured below):

By making these dramatic shifts, Disney and Warner may be giving up hundreds of millions in box office revenue from theaters, of course, but it’s pain that is necessary, even if it means complaints from those owners.

And how, with the howling. Stocks of theater chains plummeted even further after the Warner news, which was apparently not signaled ahead of time to the chains, and after Warner and the theaters had tried to put a happy face on the initial “Wonder Woman 1984” news.

“Clearly, WarnerMedia intends to sacrifice a considerable portion of the profitability of its movie studio division — and that of its production partners and filmmakers — to subsidize its HBO Max start-up,” AMC Entertainment’s Adam Aron said in an email to The New York Times. “As for AMC, we will do all in our power to ensure that Warner does not do so at our expense. We have already commenced an immediate and urgent dialogue with the leadership of Warner on this subject.”

Talk all you want, Mr. Aron, because no one is actually listening and your company’s stock is sinking, even if some people are profusely apologizing and sending you the $795 Christmas morning breakfast box from ROE Caviar. Eat up, because there’s a lot less where that came from. The theater business [is] a very shaky prospect in the long term.”

While we do not profess to be experts on film distribution, we know the importance of HBO Max success to the future of AT&T (see this October 4 Wall Street Journal article if you want more details). We are very skeptical that WarnerMedia can put the day-and-date genie back in the bottle, and do not believe that others (Disney has an investor day next week) will follow AT&T’s lead. If only Ma Bell would be as aggressive about changing the business model for residential fiber deployments as they are about movie distribution.

Speaking of streaming….

As if we needed more streaming options, discovery+ will launch in less than a month in both ad-supported ($4.99/ mo.) and ad-free ($6.99/ mo.) versions. The ad-supported version will be included in all Verizon Unlimited plans (number of free months depends on the plan selected) and select FiOS plans. Over 55,000 episodes of content will be available starting January 4.

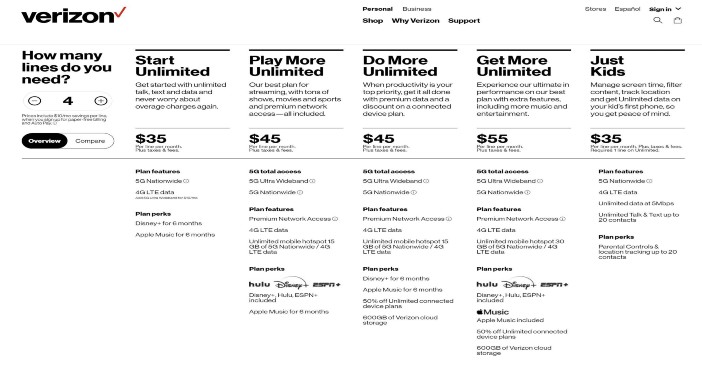

Specific channels covered include HGTV, Food Network, TLC, ID, OWN, The Travel Channel, The Discovery Channel, and Animal Planet. The service will also provide content from The History Channel, A&E, and the Lifetime as well as nature programming from the BBC (The Mating Game, Planet Earth, and Blue Planet series). For those of you who need a reminder, here’s the current inclusions for various Verizon wireless plans (four-line plan pricing shown):

Add Discovery to the mix above, and premium plans become more justifiable, at least for the first six or twelve months where they are included for free. And, with Verizon’s Mix and Match plan structure (discovery+ includes four concurrent streams across five accounts), only one account is truly needed to get more. While this sounds ridiculous on the face, one might ask “When does Verizon have too many choices?” They are providing significantly more content than AT&T (and basic cable) for only $5/ mo. more per line (Apple Music, Disney+, now discovery+), and Big Red’s investments are focused on fiber which enables broad and consistent distribution of included and additional content.

The theses for AT&T and Verizon could not be more different. Verizon is the industry’s streaming launch partner who delivers large numbers of subscribers through innovative bundling and HD-quality networks (akin to the model pursued by the PC industry in the 1990s and 2000s). AT&T has chosen to purchase and develop their own content distribution on a non-exclusive basis.

T-Mobile is not standing still, however, having announced some significant changes to their TVision Vibe and Live offerings through the end of the year (more here). When a customer selects any TVision Live package, they get the 30 Vibe channels for free (Discovery Channel, Food Network, TLC, ID, OWN The Travel Channel, and Animal Planet discussed above are included with Vibe). While they still lack CBS local programming (important during the NFL and college basketball seasons but solvable with a decent HD antenna), as well as a Roku channel (which we have been told is on the way), there’s no doubt that TVision is going to be disruptive. $40 for 64 channels and no surcharges cannot be ignored, and, if a customer only wants Vibe, that’s also available for $10/ month (see our thoughts on Vibe as a disruptive offer here).

Putting this into perspective, a family of four on a T-Mobile Magenta plan and TVision will pay $210/ month ($160 for wireless and $50 + taxes/fees for TVision). They will receive 93 channels through each device and on their TVs, enjoy Apple TV+ for the next year ($4.99/ mo. value) and also score an SD version of Netflix ($8.99/ mo. value). This compares to four lines of Verizon’s Play More Unlimited (which includes Hulu basic and therefore no local broadcast channels, ESPN+, and Disney+) for $190/ month. That $20 difference for expanded and live broadcasts determines whether customers flock to TVision (and T-Mobile for family plans) or choose Big Red (we think that traditional cable probably loses in either scenario).

But what about network performance? Exploring Opensignal’s latest 5G report

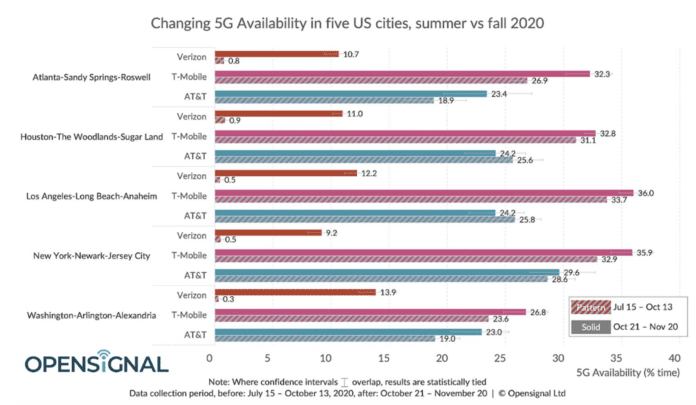

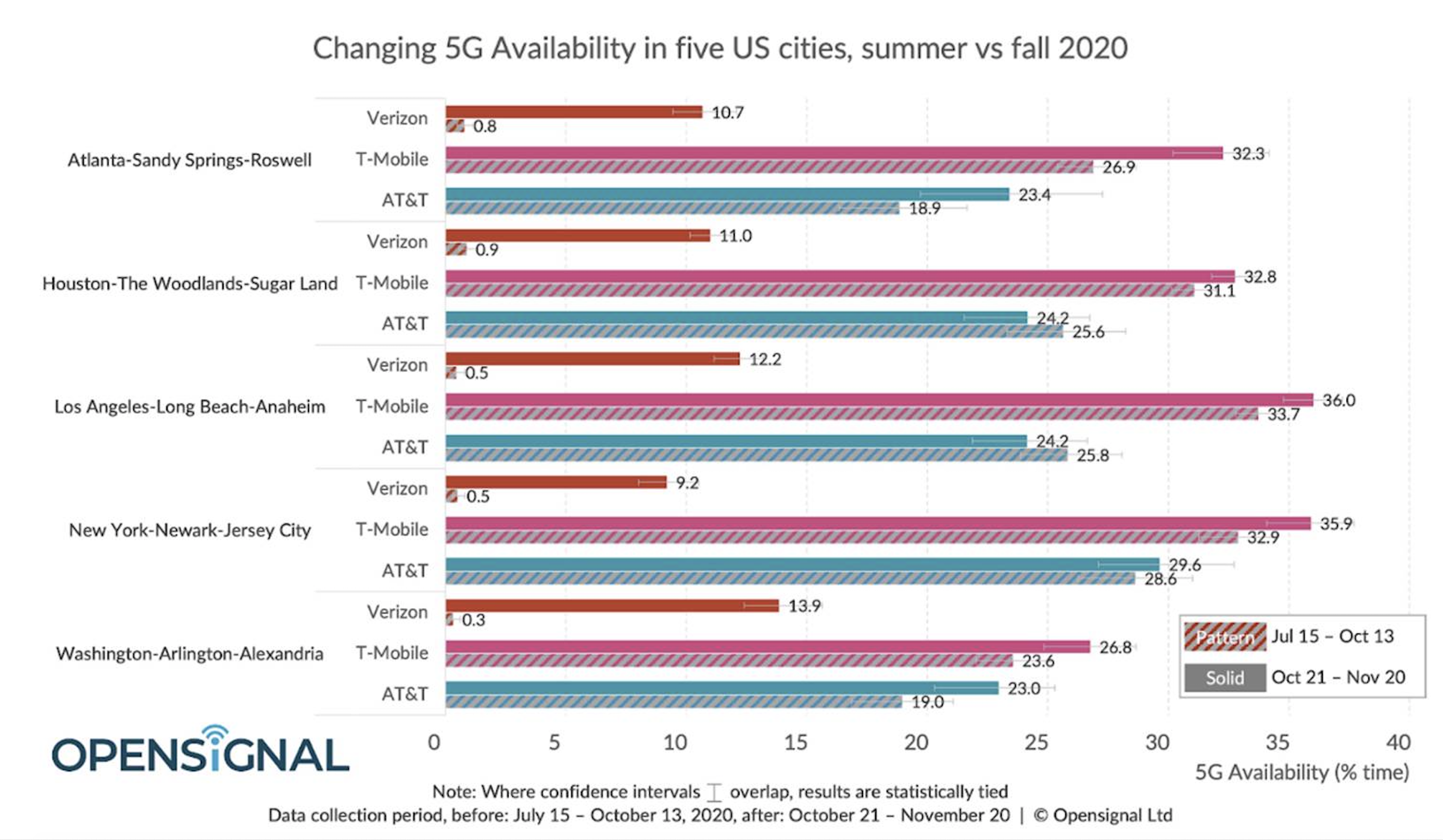

We have been reading and following the latest network tests with great interest (noting that with COVID-19 driving more indoor time than 2019, results could differ in twelve months’ time). This week, Opensignal released their Market Insight titled “The Changing US 5G Experience” which was very informative and educational.

In their report, several key performance metrics are examined for each of the Big 3 US carriers in five large metropolitan areas:

- Overall 5G download speeds

- 4G LTE vs. 5G download speeds

- 5G availability (comparing summer to fall)

- 5G download speeds (comparing summer to fall)

Their conclusions for AT&T and Verizon are not surprising: Both carriers introduced a technology called Dynamic Spectrum Sharing (DSS) that allows 5G to travel on the same spectrum with LTE. This expands 5G availability for both carriers, but, since speeds through DSS are slower than millimeter wave, overall 5G average download speeds are lower.

T-Mobile has been deploying Sprint’s 2.5 GHz spectrum as well as expanding their 5G capabilities over 600 MHz. They have no need to use DSS. As a result, their 5G availability metrics led in each of the five markets, sometimes by a large amount (see nearby chart). This helped their overall download speeds to also lead in three of the five markets (they trailed both of their competitors in Los Angeles and Atlanta).

Bottom line: This report is good news for T-Mobile in the short term (12-18 months). Until additional spectrum is deployed (the C-Band auction starts next week), Verizon and AT&T’s DSS strategy and overall market breadth will need to suffice. T-Mobile’s ability to grow to 200 million POPs of 2.5 GHz + 600 MHz “new network” in 2021 (and to quickly complete any necessary densifications) will determine whether they will have a “cost synergy” or a “growth + cost synergy” narrative. A lot of moving pieces need to come together to make the latter a reality.

That’s it for this Brief. Next week, we will start to look at the top four industry dynamics shaping the mobile world in 2021 (nominations welcome). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Stay safe, keep your social distance, and Go Chiefs!