Greetings from Lake Norman, North Carolina, where temperatures are not waiting for the official start of summer (June 20) – school is out, commute times are more often measured in feet for many of us than miles, and many boats and swimmers (as pictured) are out and ready for the Lake.

There’s a lot to talk about this week as we head into second quarter earnings, and we’ll quickly touch on market gains and economic waves yet to come as a result of the COVID-19 pandemic. We will also cover in detail a new wireless adoption study published this week by Deloitte that we thought was very insightful, and close with a short but sweet challenge to Verizon and AT&T on how they can actively help eliminate bandwidth injustice.

The week that was

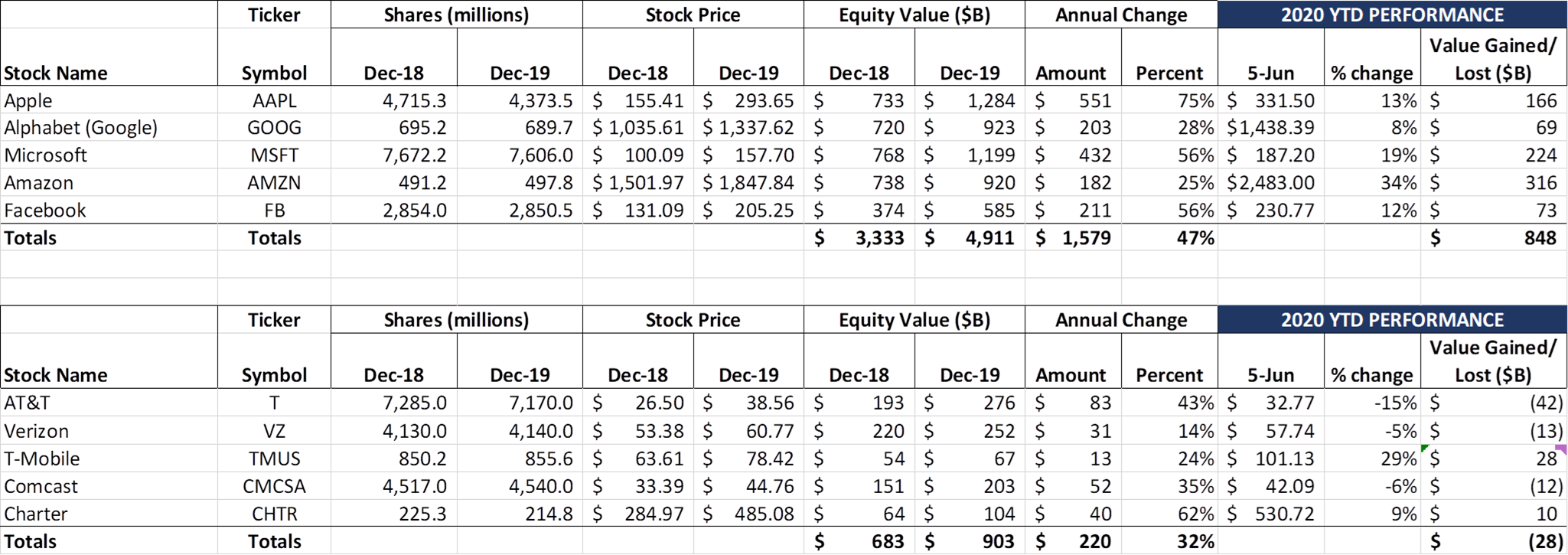

The ascent from the March lows continued this week, with the Fab 5 adding just over $130 billion and the Telco Top 5 adding $25 billion. Four of the Fab 5 now have double-digit YTD gains (and we are not half way through 2020) and T-Mobile is up 29% in 2020 even with absorbing Sprint’s shareholder base (and living through the distribution of Softbank shares to the public in May). Those Sprint shareholders who converted are up ~20% since April 1, and there’s more certainty in the ranks that this time the stock gains will stick.

As shown in the weekly chart, the Telco Top 5 is ahead of its overall valuation at the end of February, signaling that the COVID-19 impact was less than expected. Interestingly, there have been no earnings warnings from any telecom company so far (we might be a little early for that, and estimates have largely been pulled, so stay tuned). In fact, the only warning that made news this week came from Broadcom CEO Hock Tan, who made comments this week that suggested the upcoming 5G iPhone would be delayed (more from Bloomberg here).

As shown in the weekly chart, the Telco Top 5 is ahead of its overall valuation at the end of February, signaling that the COVID-19 impact was less than expected. Interestingly, there have been no earnings warnings from any telecom company so far (we might be a little early for that, and estimates have largely been pulled, so stay tuned). In fact, the only warning that made news this week came from Broadcom CEO Hock Tan, who made comments this week that suggested the upcoming 5G iPhone would be delayed (more from Bloomberg here).

There are many signs of recovery from the unusually steep drop, but, as many of you reminded me on Friday, the US unemployment rate is still in the teens and much of May’s gains were due to furloughed employees being called back to work (a different type of employment gain than what we witnessed pre-COVID).

As we have said many times when discussing the next six months, the impacts from the COVID-19 pandemic are going to come in several waves (some of which might be concurrent):

- Wave 1: The weakest businesses realize that they cannot recover and sell/ declare bankruptcy (see J.C. Penney news this week). This happens in every recession, but this time certain industries will be hit very hard (travel/ leisure, petroleum services, and maybe a surprise or two)

- Wave 2: Governments are going to come under intense pressure (see employment report link above – this is already starting with 500K+ layoffs in May)

- Wave 3: Personal bankruptcies will increase (although might be less than expected)

- Wave 4: More companies are going to forecast 2H 2020 earnings guidance – it will be mixed at best (especially in telecom). More focus will be placed on what each company is doing to prepare for 2021.

- Wave 5: Some temporary (?) relocations will occur (from Northeast to South and West) if there are concerns about a fall outbreak (the converse is more certain – not many families are relocating to New York and New Jersey right now).

- Wave 6: Retailers are going to get conservative on Holiday spending and order less for the stores. Even with the reins pulled in, this will be the weakest Holiday selling season in over a decade.

These waves, while impactful, will have relatively little effect on the telecom/ tech industry unless COVID-19 related trends continue with no sign of positive news by the end of the year. As of today, that does not appear to be the case, but we are one election result and one COVID-19 relapse (with no vaccine) away from an entirely different narrative.

Strategic primer reading – Deloitte talks adoption rate

Each June, we have had an entire issue of The Sunday Brief focused on the “big picture.” Given the multiple variables transpiring in the macro economy (and the fact that we are really the strategic primer every few months), we thought we would point the way throughout this month with some very good articles for you to consider.

When we had our last strategy issue (December 15 – see here), we outlined three 2020 trends:

- Increased Home Broadband competition (led by Verizon and AT&T fiber builds)

- Increased “Channelization” of content (led by Verizon and AT&T)

- Increased focus on Commercial activity (led by Verizon’s One Fiber initiative)

Trend #1 and #3 are behind schedule thanks to COVID-19, but Verizon continues to push forward with their fiber-led densification efforts. Content channelization has accelerated as we have discussed in several Sunday Briefs, with AT&T, Apple, YouTube (TV), Netflix, Hulu and Disney+ all gaining ground so far this year thanks to increased stay-at-home availability and interest.

This week, Deloitte extended our thinking on how commercial activity would be accelerated with their study on enterprise adoption of 5G and Wi-Fi 6 (copy of the study is here). This is a very thought-provoking piece that dives into change drivers (not just bottom-line impacts). The study has a good mix of executives, with 77% IT-focused (23% from lines of business) and is shaped generally by mid to large company opinion (75% of the survey is made up of executives of companies with < $5 billion in annual revenues). While the survey was taken prior to the worst of COVID-19, the authors reason that COVID-19 might drive faster adoption in certain areas (specifically health monitoring).

The primary authors (Dan Littmann, Jack Fritz, and Phil Wilson) begin with a strikingly bullish comment:

“Our survey respondents are going “all in” when it comes to advanced wireless technologies. Fifty-seven percent report that their organization is currently in the process of adopting 5G and/or Wi-Fi 6 (including planning, testing, and piloting), and another 37% plan to adopt these technologies within the next year. More than nine in 10 of these networking executives regard advanced wireless technologies as “very” or “critically” important to their business success today.”

They then surmise what isn’t driving the shift to 5G and Wi-Fi 6:

- The survey respondents already have newer networks. Network obsolescence is not the worry.

- They are generally happy with the quality of their LTE networks today.

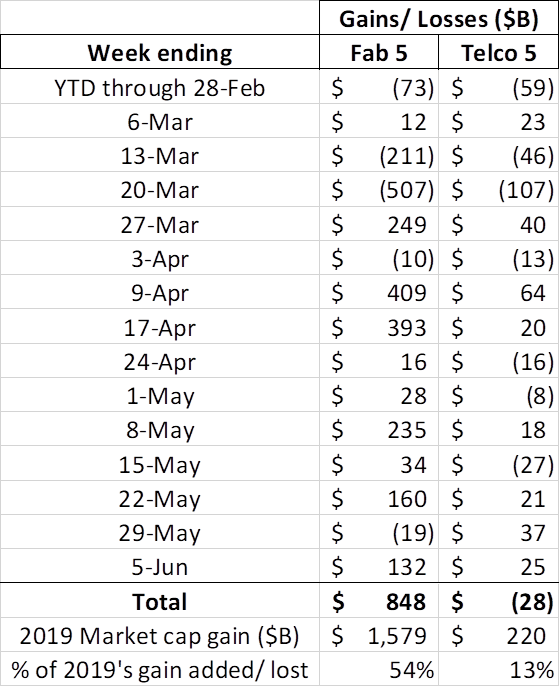

The thing driving these companies (mid to large enterprises but unlikely the largest) is the opportunity to create and innovate. The Wi-Fi 6 and 5G tools, while based on standards processes that have existed for decades, enable entirely different products and services to be created. And, as the chart below shows, most of the survey respondents believe that these changes are going to impact their companies and industries quickly:

The thing driving these companies (mid to large enterprises but unlikely the largest) is the opportunity to create and innovate. The Wi-Fi 6 and 5G tools, while based on standards processes that have existed for decades, enable entirely different products and services to be created. And, as the chart below shows, most of the survey respondents believe that these changes are going to impact their companies and industries quickly:

“Of greatest importance is the ability to use these technologies to improve business efficiency. Given the timelines in the nearby chart, the CIO and CTO sponsor organizations seem to be willing to put their “budget” money where their technology mouths are. This alignment has not happened in a long time and has been made all the easier by long-time technology and cloud companies such as Microsoft providing private network advocacy.”

Nearly as important is the ability to improve information security (this could happen, for example, with the movement from Wi-Fi 802.11ac to a licensed LTE spectrum like CBRS or to 5G). Keeping connections and data secure in a blended Work From Home (WFH) environment is a challenge.

The final reason for the rapid embrace of advanced wireless technologies is to provide and organize operating information to enable better decisions. Decision frameworks will need to be redesigned to be more agile, and downline impacts of product decisions warrant a very flexible manufacturing or development environment. Everything will accelerate.

However, in one of the side boxes, the authors discuss the prioritization differences between IT and LOB executives (emphasis added):

“IT and LOB executives prioritize different use cases for employee connectivity. IT executives appear strongly focused on easing the work lives of employees: Workplace communication, IT administration (e.g., remote troubleshooting or management of devices), and advanced collaboration tools are the top three use cases. For LOB executives, the top two use cases are IT administration and automation—suggesting a strong desire for efficiency—followed by workplace communication and advanced collaboration. In contrast, automation appears nearly at the bottom of the list for IT executives. These differences suggest that IT and LOB decision-makers aren’t fully aligned on priorities for connectivity. It could be wise for providers of networking products and services to be mindful of these differences when engaging with their enterprise customers and crafting solutions for them.”

For those of us who have been involved in business planning, these perspectives are no surprise. What will be interesting to note (and outside of the scope of the article) is how richer and accelerated information flows drive messaging, advertising and promotion as well as the customer service experience. Advanced network solutions are not cheap, and it’s likely that advertising and promotion efficiencies will be needed to justify some of the cost.

For those of us who have been involved in business planning, these perspectives are no surprise. What will be interesting to note (and outside of the scope of the article) is how richer and accelerated information flows drive messaging, advertising and promotion as well as the customer service experience. Advanced network solutions are not cheap, and it’s likely that advertising and promotion efficiencies will be needed to justify some of the cost.

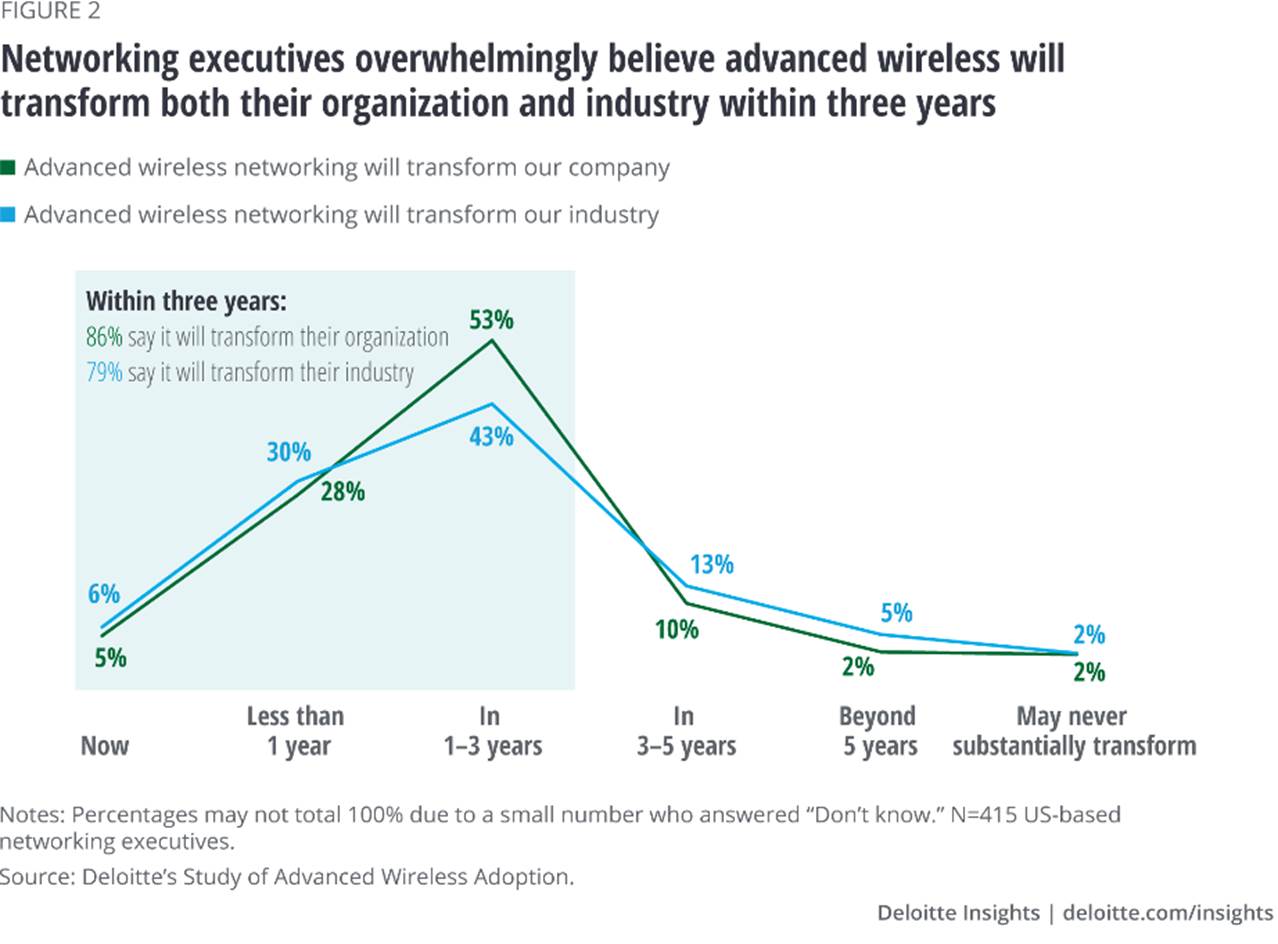

One of the most important findings of this survey is that enterprises are rarely choosing one over the other – both Wi-Fi 6 and 5G (and CBRS) are being adopted. The nearby chart shows that 62% of those surveyed will be using both technologies in the next year. This is more than having a few CIOs with the latest 5G or Wi-Fi 6 enabled smartphone. Most companies are looking to technology to enable productivity as everyone heads back to work.

While many of you might view this article as being as optimistic as a Cisco or Ericsson forecast (and, as they have shown, most times they were right on target), it is worth taking the time to understand how technologies will change the competitive landscape, especially with respect to supply chains and software development schedules.

The willingness to try something new also extends to networking suppliers. The report concludes with a challenge to all incumbents (emphasis added):

“Not only do many adopters of advanced wireless engage with a wide variety of providers, but they are also very willing to explore using new providers. Across the diverse range of providers offering wireless implementation and management services—whether infrastructure, component, or network equipment providers, wireless carriers, private network providers, or consulting firms/integrators—three-quarters of advanced wireless adopters say they’re willing to reconsider the providers they use. This signals an increasingly competitive landscape in which nontraditional players and new entrants are likely to pursue new opportunities in an effort to win market share.”

This probably does not mean that there will be widescale firing of incumbent providers, but the 75% figure is the largest “Want to Investigate Further” estimate we have seen. This is good news for smaller equipment providers with developed channel strategies, and also for companies like T-Mobile for Business.

Bottom line: It’s a lengthy read, and it’s one data point, but one of the best “puts and takes” assessments of advanced wireless development we have seen this year. It will spur discussion with your team/ colleagues.

Addressing bandwidth injustice with increased broadband availability

There has been a lot of discussion this week on racial justice, and the telecom community has been at the forefront of corporate responses (Hans Vestberg here and Randall Stephenson here). All of us are shocked and saddened by police brutality, but the underlying question becomes “how can the telecom industry improve the opportunities for all (but specifically non-white) Americans?” Our answer for the industry is to boldly address in-territory bandwidth injustice.

We have been looking at fiber penetrations for several clients using several databases (notably Broadband Now, Zillow and Zip-Codes.com). In the process, we found many discrepancies in how fiber is deployed in major markets. Some of those discrepancies are due to motives that are completely distant from social justice motives (e.g., deploying fiber in non-aerial locations like a downtown is extremely difficult and time consuming), but we found several metro areas where there’s some work to be done. To not single out one carrier, we have examples from both AT&T and Verizon:

AT&T Houston – Greenspoint neighborhood (zip code 77067). Many of us know this area as “fiber central” thanks to an abundance of data centers. It straddles the Sam Houston Parkway (TX-8) so is not rural. Population growth has been abundant (+18% in the last decade), and the Zillow Home Value Index continues to list zip code 77067 as “Very Hot.” Add link Yet AT&T’s fiber deployment in residential areas (zip code population = 48,000+) is a measly 9.6% in this 60+% non-white neighborhood. Said another way, 9 out of 10 residents regardless of color have Comcast (88.2% of homes have Xfinity access) or AT&T DSL (93.1%) as choices. There may many reasons not to invest in this area (Greenspoint Mall), but when the adjacent zip code (77060) has over 41% AT&T fiber penetration (still below other nearby areas, but over 4x more), you need to ask “Why?” Tons of fiber right next door, with fast population and home growth.

AT&T Honorable mentions: Kansas City, MO zip codes 64113 and 64131 (61.8% difference in fiber penetration for Brookside vs. Troost neighborhoods), and The Dallas Zoo area (zip code 75203 has 36.9% fiber penetration while Kessler/ Bishop Arts to the west has 86.1% and Cedar Crest to the south has 80.1%).

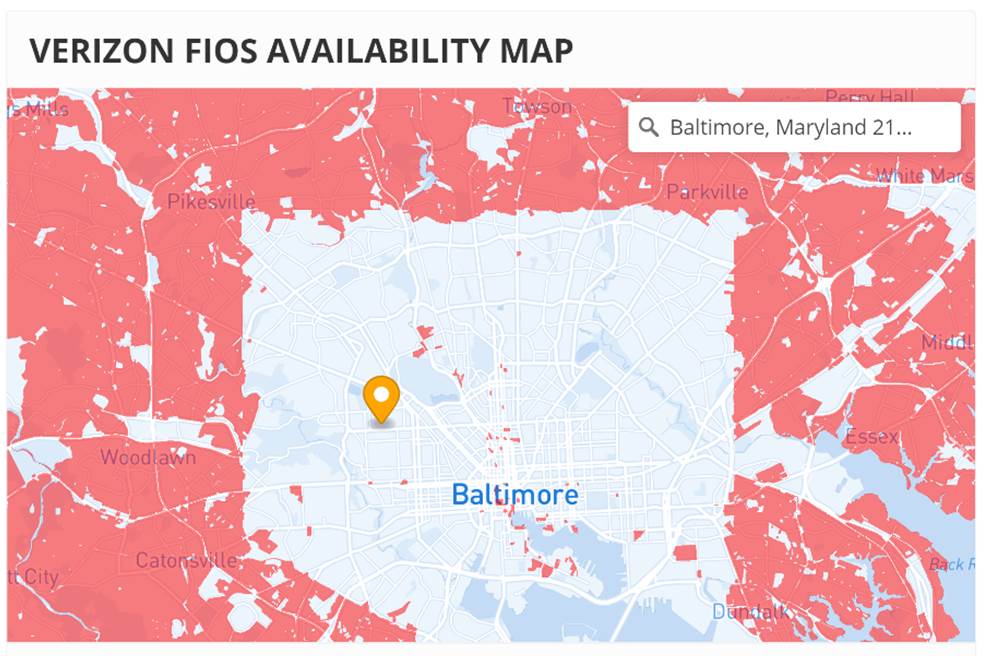

- Verizon Baltimore – Central Park Heights (zip code 21215) and Walbrook neighborhoods (zip codes 21215 and 21216). FiOS deployment in the Baltimore area has long been a subject of discussion. Courtesy of Broadband Now, below is a map of the FiOS deployment in Baltimore City (note: this has been an issue for at least the last decade).

Since Lochearn and Woodlawn (21207) are outside of the city of Baltimore, they have a 70% FiOS penetration (and 50% higher average property values than their neighboring zip codes). Central Park Heights zip code is nearly entirely in the City, hence the 4.2% FiOS penetration, and Walbrook is a goose egg. Simply put, Comcast has free reign over Baltimore City, and both sides are to blame for the sustained impasse. But Verizon spends $17 billion on capital each year, and Baltimore City is not small. Ignoring 5G buildouts (not one of the listed markets) and not building FiOS (yet collecting universal service revenues for the copper customers in that area) might be the right decision for shareholders… but Baltimore stakeholders? If Verizon is going to walk the Corporate Social Responsibility talk, why not make Baltimore City a priority?

Since Lochearn and Woodlawn (21207) are outside of the city of Baltimore, they have a 70% FiOS penetration (and 50% higher average property values than their neighboring zip codes). Central Park Heights zip code is nearly entirely in the City, hence the 4.2% FiOS penetration, and Walbrook is a goose egg. Simply put, Comcast has free reign over Baltimore City, and both sides are to blame for the sustained impasse. But Verizon spends $17 billion on capital each year, and Baltimore City is not small. Ignoring 5G buildouts (not one of the listed markets) and not building FiOS (yet collecting universal service revenues for the copper customers in that area) might be the right decision for shareholders… but Baltimore stakeholders? If Verizon is going to walk the Corporate Social Responsibility talk, why not make Baltimore City a priority?

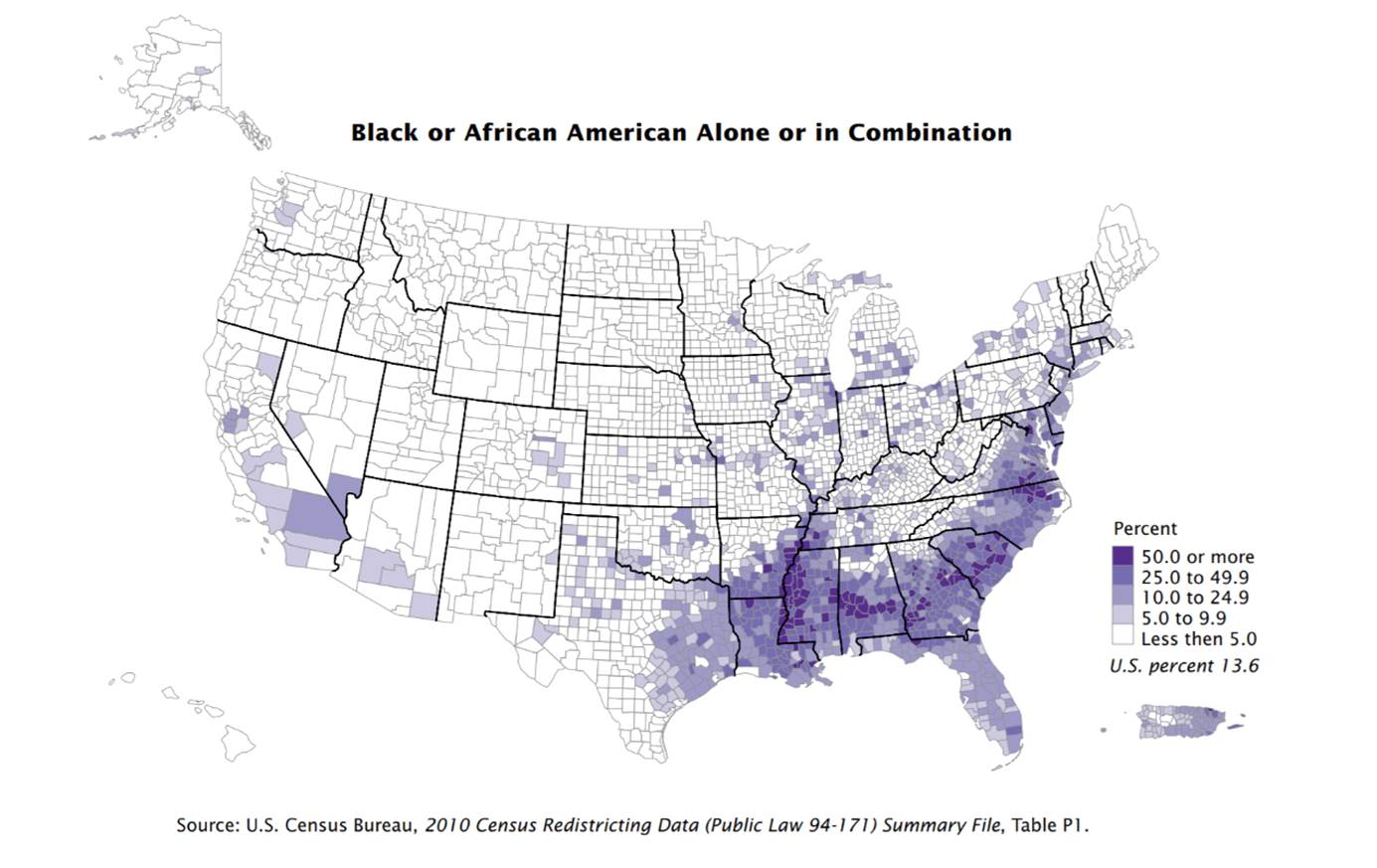

While on the topic of densifications (and no doubt, Verizon is investing significantly in fiber), where is their 5G millimeter wave presence in the historically African-American South (see Census report here and see map below)? Jackson MS (2nd highest concentration of African-American population of any US city – see previous link), Birmingham (#4), Baltimore (#5), New Orleans (#7), Montgomery (#9), Nashville (37% non-white), Richmond (59%), Raleigh (42%), Durham (58%), Columbia (SC – 48%), Louisville (25%), Orlando (42%), Tampa-St. Pete (37%), Mobile (55%), Chattanooga (42%), and Tupelo (41%) are not on the list of cities where Verizon is making a very concerted fiber-based densification investment. While these cities do not make the cut, others do: Boise (89% white), Denver (69%), Grand Rapids (65%), Omaha (73%), Sioux Falls (87%), and Panama City (90%). The events of the day are emotional (we are all sickened), but shouldn’t the South (where a lot of growth is occurring) get a higher degree of fiber deployment? Why confine deployments to Miami, Atlanta, Charlotte, Greensboro, Norfolk/ Hampton Roads, and Memphis?

While on the topic of densifications (and no doubt, Verizon is investing significantly in fiber), where is their 5G millimeter wave presence in the historically African-American South (see Census report here and see map below)? Jackson MS (2nd highest concentration of African-American population of any US city – see previous link), Birmingham (#4), Baltimore (#5), New Orleans (#7), Montgomery (#9), Nashville (37% non-white), Richmond (59%), Raleigh (42%), Durham (58%), Columbia (SC – 48%), Louisville (25%), Orlando (42%), Tampa-St. Pete (37%), Mobile (55%), Chattanooga (42%), and Tupelo (41%) are not on the list of cities where Verizon is making a very concerted fiber-based densification investment. While these cities do not make the cut, others do: Boise (89% white), Denver (69%), Grand Rapids (65%), Omaha (73%), Sioux Falls (87%), and Panama City (90%). The events of the day are emotional (we are all sickened), but shouldn’t the South (where a lot of growth is occurring) get a higher degree of fiber deployment? Why confine deployments to Miami, Atlanta, Charlotte, Greensboro, Norfolk/ Hampton Roads, and Memphis?

Honorable mention for Verizon includes East Highland Park area in North Richmond (zip code 23222 – 44.8% FiOS) in comparison to the Henrico County zip code just to the north (23227 – 85.7% FiOS). Unlike AT&T (with broader geographic coverage such as Houston, Verizon is generally either “in” or “out” with FiOS. It’s a lot harder to find examples of 20-30-40% FiOS coverage in a zip code than it is to find 80+% or 0%.

When I was having a discussion on this topic with a Sunday Brief loyal reader this week (who worked for a large ILEC), I was reminded of the phrase “a thousand million.” This was a common corporate refrain as incumbents contemplated spending $1000 per home for home connections * 1 million homes = $1 billion (or more) to fiber up residential neighborhoods. “We could not see spending it” this executive said, but then quickly added “I wish we had.”

The telecom community has the greatest opportunity to eliminate bandwidth injustice. Will it have the resolve to see this as a social good or remain deadlocked in its current share buyback/ dividend increase mindset? Will the federal government have the fortitude to revise the universal service rules to mandate fiber in poor (a.k.a., underserved) neighborhoods? And will the rest of tech back up the bandwidth commitment with low cost equipment to enable greater opportunities for all Americans in these lower-income zip codes?

Our view is that fiber providers have a big part to play in deciding social outcomes: that’s something we can all (except, perhaps, the coax cable monopolies) get passionate about.

Next week, we will have our periodic “Three Up and Comers” issue and comment on any news relating to second quarter earnings. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here.

Also, If you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!