Verizon and T-Mobile show most sequential improvements, with all four carriers posting growth across majority of metrics

Compass Intelligence just completed the final assessment of third-quarter subscribers and connections including the comparisons to Q2 2016 in terms of improvements and declines for the U.S. wireless carrier market. We do this each quarter to understand the subscriber and share changes, as well as evaluate the key trends taking place in the wireless industry for both consumer and enterprise markets. We have been tracking the quarterly metrics since 2007. Some metrics are our own internal modeling and estimates, as the market does not report in all categories.

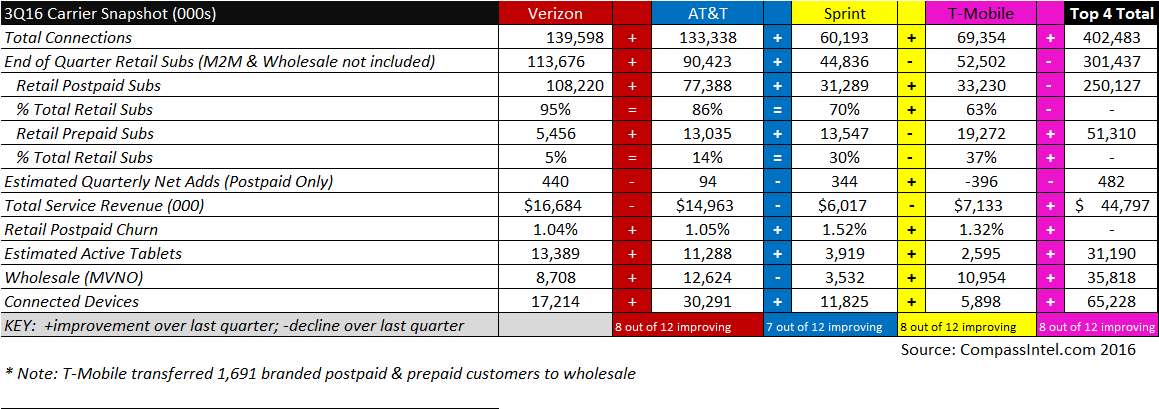

A snapshot of Q3 is below. Compass Intelligence compared last quarter’s results to this quarter to show which metrics showed improvement over others (denoted by + or -).

Source: Compass Intelligence, Carrier Earnings Reports

T-Mobile US reported 969,000 branded postpaid net additions in Q3. Postpaid net additions in our analysis reflect the recategorization of 1.365 million branded postpaid phone customers to wholesale in the quarter following the sale to a mobile virtual network operator partner.

Overall notes

–T-Mobile US added the most overall connections with 2 million net additions, followed by AT&T Mobility with 1.5 million.

–In terms of net postpaid adds, Verizon Wireless came out on top with 440,000 additions, while T-Mobile US experienced a loss of 396,000 due to moving these customers over to their wholesale category.

–The market ended the quarter with about 5.2 million new connections (includes “internet of things” and mobile subscribers) by the top four carriers. The quarter overall added connections experienced about 300,000 in overall adds compared to what was added in Q2, driven primarily by tablet and IoT additions.

Editor’s Note: Welcome to Analyst Angle. We’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.