From global private-5G deployments at Vodafone Business to national spectrum policy gridlock at Vodafone Idea, plus the looming exit of Nokia, the private 5G market looks both more mature and more fragile than it did a year ago. The numbers are improving, if not fast enough; the messaging and mindset still need work.

Just to continue the conversation from yesterday – because RCR has slept on it, and thinks there’s more to say. So here are some quick bullets (edit: long ones), inferred or imagined from the twin ‘Vodafone’ commentaries about private 5G at the UPTIME forum yesterday (February 12). Note, these might be worth looking up – about Vodafone Business here and Vodafone Idea here – if you are just joining us. Note as well, that (post edit) the summary below misses something: that the private 5G market thinks it is ready to scale, at last.

This was evident at UPTIME in the commentary from Vodafone Business, as reported yesterday. The key quote was: “We need solutions that are enterprise-friendly, first of all, and that don’t need to be built from the ground up every time – like a tailored dress. It is frustrating where Vodafone, Telefonica, Verizon all fight over the one big deal that comes up in a country each quarter – because it would be better for us to win 500-more deals each year between us.” It was also evident in the nominal private 5G target, bandied about, perhaps random, referenced below, of 500,000 deployments. Maybe this is the biggest takeaway; but there’s lots in the minutiae, as well – as follows…

1 | Vodafone Business has its house in some kind of order.

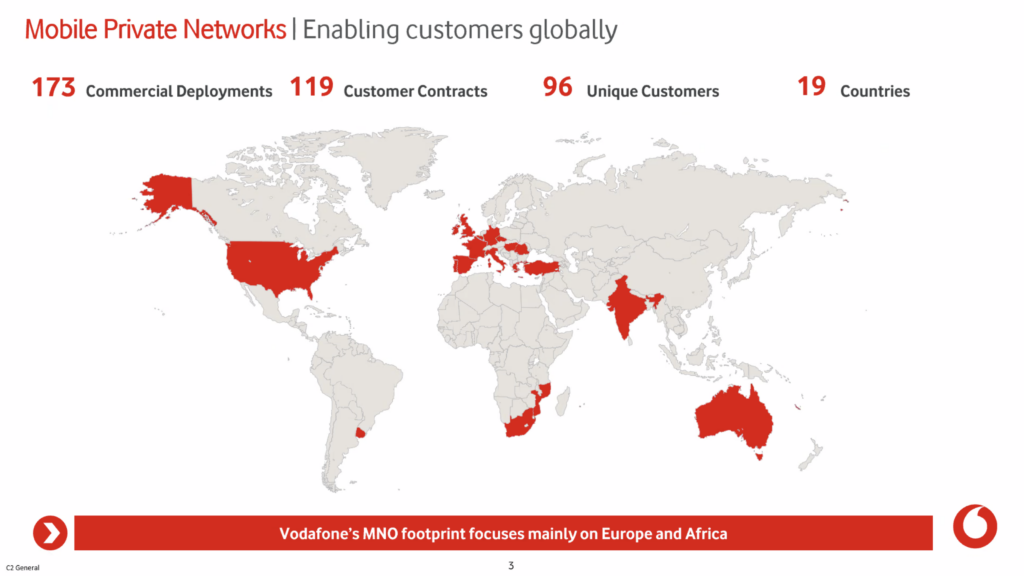

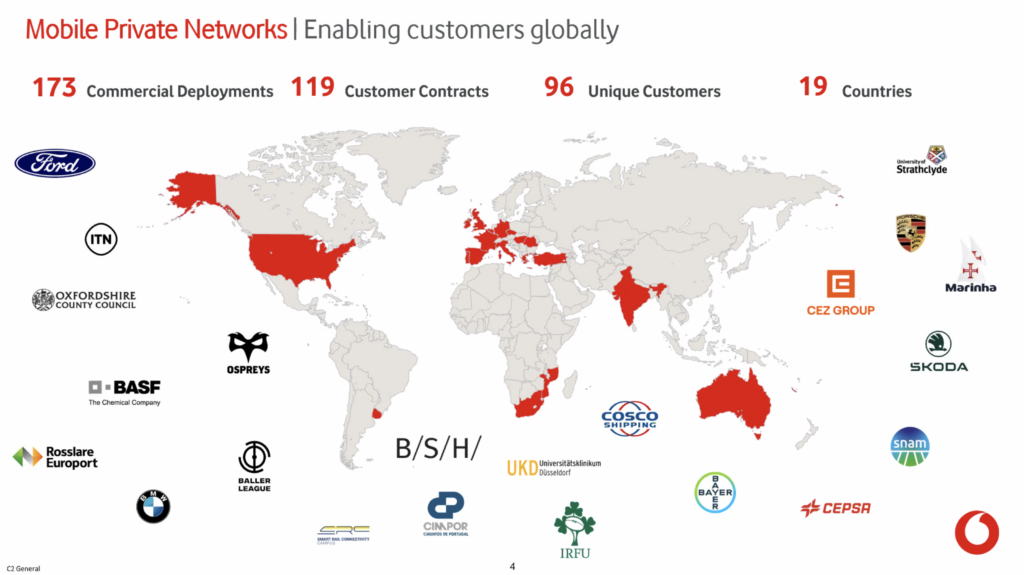

This is the obvious takeaway from these sessions – and the top-line message from Massimiliano Mesenasco’s presentation at UPTIME. Almost 200 (173) private 5G deployments with almost 100 (96) customers in almost 20 (19) countries looks like a decent half-time scorecard – relative to the pace of the game, the condition of its rivals, the 5G rollout more broadly, and the idea that Nokia’s exit forces a break in the play. On the last point, it might be noted that all / practically-all of Vodafone’s 173-count is for campus-edge projects – and so this is the market we are discussing, which Nokia is quitting. Yes, a chunk of Vodafone’s deployments (about 40 percent) comprise network slices and hybrid systems, but the rest (almost 60 percent) are all-edge affairs – and all of them are geared towards campus environments of one sort or another.

2 | Vodafone Business needs to talk about it – and lead.

The firm has not communicated its successes very well. Not many of the big tier-one mobile operators have – Deutsche Telekom hasn’t, Orange hasn’t, Telefónica hasn’t; T-Mobile hasn’t, AT&T certainly hasn’t. China Mobile turned up at Industrial Wireless Forum at the end of 2025, and said a few words; there’s stuff happening in Japan, too, but it rarely carries. Really, the only operator that has its story down – and told it rather well, for a couple of years – is Verizon (Business). Perhaps this reflects on RCR, which has been covering this market – closer than anyone – for a decade at least. Except it doesn’t, because RCR has badgered and bothered, and not heard back – and given up their chase. Which is weird, because Vodafone (Business / IoT) has talked well about IoT for ages, and private 5G is a sub-plot there (see below).

Perhaps Vodafone is just better with analysts – which place it high in their reviews (per Mesenasco’s UPTIME slides). But then, the analysts haven’t communicated the Vodafone story, either – or else (certain of) their reviews are sus. The point is, Vodafone should / could take stock during its half-time team talk, and emerge from the tunnel again like an industry leader – if it wanted to. Certainly, the sector needs another carrier champ to feed all the ballers in the channels. It certainly does if it is to make a proper game of private 5G – and deliver 500,000 systems (the new target number for global deployments doing the rounds at UPTIME) into a broader mass enterprise market.

3 | Vodafone Idea (or India) does not have its house in order.

This is less a criticism of one company as of national policy. But the comparison between India-based Vodafone Idea, on an early panel at UPTIME, and UK-headquartered Vodafone Group, with a session of its own, is telling. The world map the latter showed goes some way (about 30 percent) beyond its global operating territories – to where regulators have liberalised spectrum for ownership and usage by domestic enterprises, for activation and management by non-domestic suppliers. Which is, in part, why US-based Verizon Business appears to be crushing it – because it is picking up major contracts in markets where it has no networks or airtime, including in Vodafone’s heartlands in the UK and Germany. Vodafone’s presentation at UPTIME worked as a riposte to the notion that Verizon is stealing one-way, from under its nose.

But Vodafone Idea is working in a different market. Various factions – some big enterprises, mostly big integrators and vendors – have lobbied the Indian government to open the airwaves for dedicated local usage with private 5G systems. But the operator community, a mixed bag of public/private set-ups, has pushed back, and the opposition has fizzled out. Either way, the implication from Vodafone Idea at UPTIME that enterprises might be blamed for the problems with private 5G (integration, consultancy) is unfair, and also ungallant. The accepted line these days, borrowed from IoT, is that private 5G is a team sport and speculative pursuit – and that the onus, plainly, is on the vendor ecosystem to discuss, solve, design, build, and manage (as requested). Any failures are on them.

The IoT market knows this (see below). Verizon Business talks very well about it. Beyond new vendor partnerships, Vodafone Business did not say much about ecosystem building at UPTIME, but it should – as discussed above, and as it does already in the IoT space. Equally, Vodafone Idea’s defence of operators and dismissal of integrators at UPTIME – that integrators lack telco know-how (like that’s the deal breaker) and capital flexibility to be able to design and bankroll big enterprise projects – does not scan. Because integrators in progressive private 5G markets hold the IT/OT keys – and progressive operators like Verizon and Vodafone will, here and there, hire them as boots-on-the-ground. Integrators also have ties with the best vendors to fund enterprise service deals on their own.

So most of this stuff has been resolved elsewhere, and operators must recognise that – in the global private 5G market – they are not always a starter, and must earn the right to play. Which mostly comes down to service consultancy, problem solving, and ecosystem management – and, maybe somewhere down the line, to public/private roaming services. We need to wrap this one up, but Mesenasco’s final comments say it all: “Look, I think the numbers (173 deployments) are not nearly enough. I believe that the industry in general, us included, wasted at least a couple of years, particularly in Europe, because we were not humble enough. Because four or five years back, most of our playbooks were about very fancy use cases and super shiny Industry 4.0 scenarios.”

4. Private 5G is (officially) part of the (private) IoT family.

And well, hallelujah – because RCR Wireless has said this for years. And so it felt important and helpful that Vodafone Idea said the same at UPTIME: “Private 5G and IoT go hand in hand. That’s the right way to see the product [set] from an enterprise standpoint.” Some of the logic for this is explained above – IoT for sensing for AI for sense-making, and 5G (and Wi-Fi etc) to join the dots; parts of the same collective solutions and collaborative sales. Except that, again, we might read between the lines, and suggest a wide-area telco-view of IoT is the wrong master. Because the private-5G correlation is not (primarily / initially) with public IoT, but private IoT; they combine to monitor and track assets in factories and warehouses, and not on roads.

The public piece matters, of course – for stitching together private and public domains as goods move through supply-chains, through production, storage, distribution, and sale. But on site IT/OT integration at device level, mapping to system level, comes first. More importantly, it is about mindset: IoT vendors have had their own dark nights of the soul, over many years; but they are brighter, happier, and perfectly familiar in industrial setups — and they know what it takes to design solutions within an ecosystem, rather than just to sell tech. Again, see the quote from Mesenasco above, and the longer version in the writeup.

5. Yellow-bellied Nokia is nowhere – and also everywhere.

This is pushing it, and (rival) parts of the market will flinch at it, but it also just-about true: that this has been Nokia’s game, until now. Not exclusively; a number of smaller specialists have also been influential. But of household names – including Verizon and Vodafone, as discussed here; plus also Ericsson, as its nearest competitor – Nokia has run the field. And yet – shame, shame – its parent has hooked it, and (shortly) it won’t reappear after the break in the same kit. As it stands, and as reported, Nokia is looking for a buyer for its bold campus-edge division – which has, meanwhile, been gagged. (See comment at the top about the real subject here – if you want to split hairs about what’s on the block.)

But even so, without much mention, Nokia was all across Vodafone’s presentation at UPTIME – and much of the event. Yes, Mesenasco said Vodafone is doubling its roster of vendor partners for its managed service – from two (Nokia and HPE) to four, to probably include Ericsson (TBC; but “one is obvious”) and possibly Celona (or similar; total guess, but described as “less obvious”, and logical based also on talk at the end about the industry needing to pitch-up to the SME market with simpler solutions). And no, the shake-up has nothing to do with Nokia’s pending exit from the space. “The expansion of our vendor pool for our managed MPN offering was in the roadmap before Nokia’s announcement,” he said. But Nokia remains one of only two (with HPE, also) for heavy-lift bespoke industrial drops.

And the customer slide at the start – emblazoned with BASF, Bayer, BMW, CEPSA, CEZ Group, Ford, Porsche, Rosslare Europort, Skoda, Snam, among industrial giants, plus sports, broadcast, and education groups – is stacked with Nokia users. Plus, again, all the good IoT-style language around integration, consultancy, and collaboration has been conspicuous in Nokia’s channels for years – with savvy industrial integrators, big and small, and with clued-up mobile operators like Verizon and Vodafone (plus Orange and Telefónica, actually), as well. It is unclear where Nokia’s private-5G unit will end up, but, for its bold vision and brave work, its sale still looks like a strange choice.

It might make business sense, on paper, but the new inference story brings the edge back into play (as Verizon Business has started to articulate, already, as others should explain), and makes new-Nokia look chicken.