At UPTIME, Vodafone Business detailed 173 live private 5G deployments in around 20 countries, and also signalled new vendor additions – likely including Ericsson, plus Celona, possibly, or another “enterprise-friendly” player – and delivered a candid verdict on the industry’s slow start: too much “shiny” industrial tech and big-ticket corporate pipedreams, and not enough affordable and repeatable solutions for the mass enterprise market.

In sum – what to know:

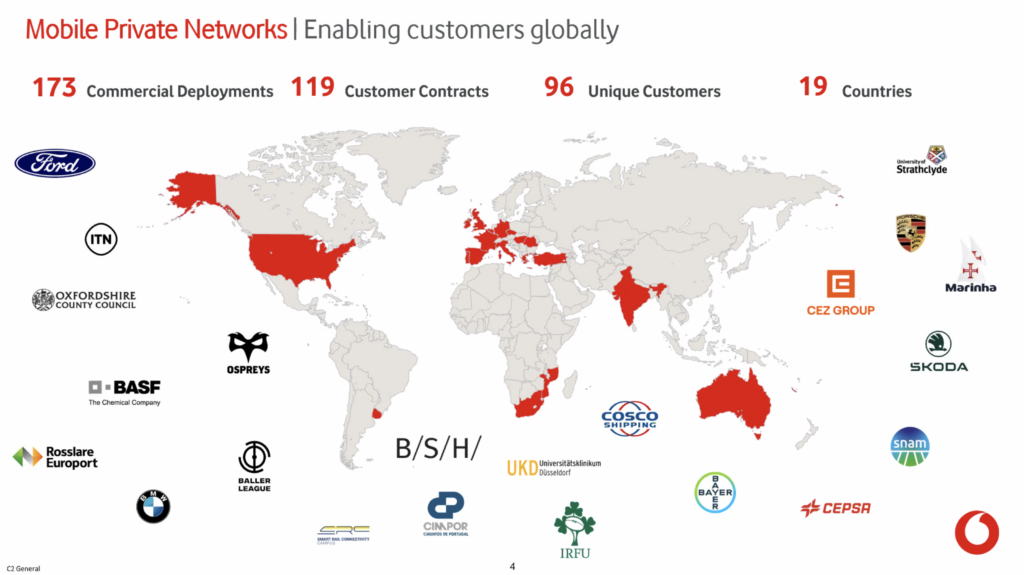

Beyond its footprint – Vodafone counts 173 commercial private 5G deployments across 119 contracts and 96 customers, stretching beyond its op/co base into roughly 20 markets.

Multi-vendor strategy – It will add two new network vendors to its existing (Nokia and HPE) lineup, with Ericsson likely to be the “obvious” choice; nothing to do with the Nokia situation, it says

Market reassessment – It admits the industry “wasted a couple of years” chasing high-end industrial giants, still kicking the tyres on basic apps, and forgetting about SMEs outright.

Some quick updates and anecdotes from another ‘Vodafone’ session at UPTIME today, where the UK-based group business said it will bring two new private 5G vendors on shortly, including Ericsson (likely), and it counted-out its international triumphs in the private 5G space. Which are significant, and have not been covered in these pages, nor given their proper due (versus Verizon, for example, which has communicated very well on the subject). Here is a brief rundown of the main stats and stories from Vodafone Business at UPTIME, as provided by Massimiliano Mesenasco, head of private 5G at the firm.

“We have almost a couple-of-hundred commercial sites with a few-less than a hundred unique customers across different countries – which are not just in Vodafone’s MNO (operator) territories,” said Mesenasco. He had a very decent slide-deck, which filled in some of the gaps: 173 commercial deployments on 119 customer contracts with 96 unique customers (said the slide; see image below). Mesenasco pointed to Vodafone’s private 5G work in “the US, France, and so on”, and the slide showed a map of the world covered in Vodafone-red, going beyond its 15-strong op/co footprint into about 20 countries in total.

So for all the trumpeting about Verizon’s conquests in Vodafone’s European heartlands (Associated British Ports and Thames Freeport in the UK; the Audi Proving Ground in Neustadt, Germany), Vodafone might claim to be taking the fight everywhere, too. It has a brand new contract with Germany-based BSH Hausgeräte, Europe’s largest household appliance manufacturer, at a production site in Turkey. It is working there with Nokia, said Mesenasco. Another slide had all its (public) badges: BASF, Bayer, BMW, CEPSA, CEZ Group, Ford, Porsche, Rosslare Europort, Skoda, Snam, among industrial giants.

It also lists a bunch of sports, broadcast, and education groups. Mesenasco posts a slide, as well, showing all the analyst reviews it has come top of – including that weird Gartner one, which compares apples (operators) with oranges (vendors) and pears (integrators), and puts them all in different baskets in its quadrant. But Vodafone’s looks a handsome roster, by any stretch, and Mesenasco was clear at UPTIME about its service segmentation, and candid its strategy as well. The latter included details about its vendor setup; Vodafone Business will start working with two new vendors shortly (“in 2026”), as alternatives to its stable pairing of Nokia and HPE (Athonet).

He said: “One is quite obvious; the other is a bit less obvious.” As it goes, the expanded quartet will supply private 5G systems for its managed service offer – where Vodafone runs the system for enterprises on a service subscription, from a centralised European NOC in Malaga, in Spain – or sometimes presumably on a bespoke basis at the enterprise site. Alternatively, Vodafone Business is offering tailored one-off builds (‘repeatable bespokes’; see slide) for complex industrial enterprises, where it works with Nokia (“mainly NDAC and MPW”; for reference, see for the separate jeopardy around the Nokia structure), plus Ericsson, HPE, and Huawei (“in specific geographies”).

Asked if the move to open its books to new vendor partners – and Ericsson, presumably – had anything to do with Nokia’s decision to put its campus edge business, home to its seminal Digital Automation Cloud (NDAC) and Modular Private Wireless (MPW) solutions, up for sale, Mesenasco said ‘no’; and he was quite straightforward. “No, I can freely answer. We had the expansion of our pool of vendors in the roadmap before Nokia’s announcement. So that didn’t change a lot for us. We are just going ahead with the strategy. And also, we have never been too close with any single vendor, ever – we have always maintained a multi-vendor stance.”

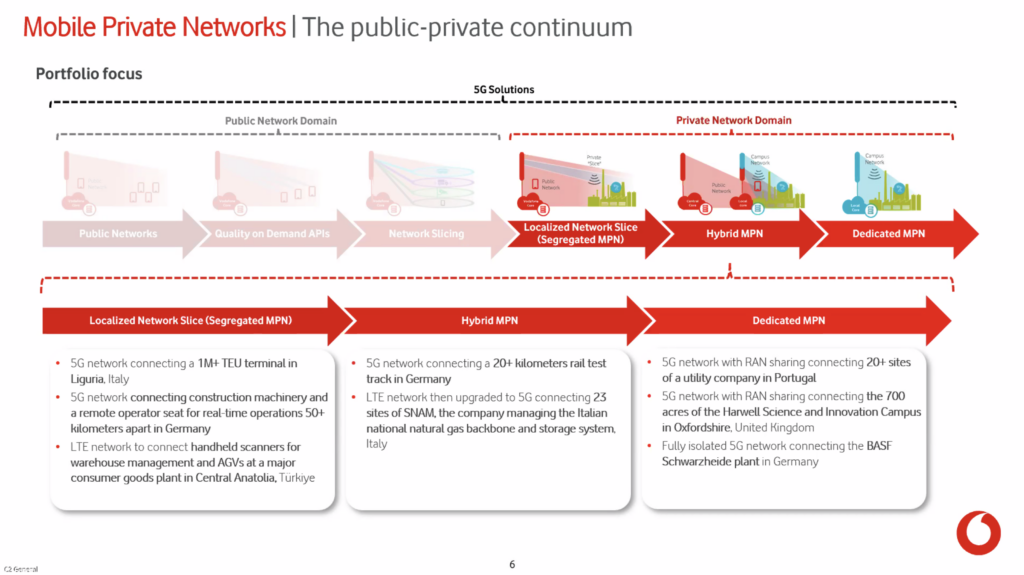

He also split the industry’s broader 5G proposition into two public/private service segments, each splitting in three parts – with versions of public/private 5G slicing either side of the line (see graphic). Conceptually, the industry knows all of this, of course, but a neat visualization is always helpful. Private 5G, for its part, divides three ways, also, along a privacy continuum: from localised network slices, to hybrid private networks, where (mostly) the core is centralised with the public network, to dedicated private networks, where everything is stood-up at the enterprise facility. Asked the ratio of its 173 deployments, sliced/hybrid/private, Mesenasco said almost 60 percent are fully private.

He was asked as well during the session whether the “impediments” have changed in the industry, compared to when spectrum was liberalised for enterprise ownership in certain markets (the US, Germany, Japan, the UK, plus others, progressively). “I will be a bit provocative because it’s only us here,” he joked. “Look, I think the numbers (173 deployments) we have right now are not nearly enough. I believe that the industry in general, us included, wasted at least a couple of years, particularly in Europe, because we were not humble enough. Because four or five years back, most of our playbooks were about very fancy use cases and super shiny Industry 4.0 scenarios.”

Mesenasco’s explanation was good; it has been discussed variously in these pages over the years, but it is good that Vodafone is saying it, and it was the best quote of the day (RCR heard) at UPTIME. And so he can close this article out, uninterrupted.

He went on: “But I had a moment of truth a couple of years back, speaking with a technical president at a global pharmaceutical firm – where he said they were just starting to test AGVs. And I thought, this is not going to work. Because [this industry was] telling companies they needed networks worth millions of euros for shiny automation cases, and one of the wealthiest of them was telling me they’re just testing AGVs. And maybe that’s blunt, but the reality is we focus too much on elite companies that need five-nines (99.999%) reliability and expensive infrastructure – when what we need to serve, which we are still not serving, is the rest of the market.

“I don’t think we are ready for Raspberry Pi solutions running private 5G, but we need to address [the wider market] right now – to serve logistics companies, say, to connect Zebra devices in a reliable and affordable way. And I mean affordable in that it works for the business cases. We need solutions that are enterprise-friendly, first of all, and that don’t need to be built from the ground up every time – like a tailored dress. It is frustrating where Vodafone, Telefonica, Verizon all fight over the one big deal that comes up in a country each quarter – because it would be better for us to win 500-more deals each year between us.”