Ookla found that Northern and Southern European countries are leading in 5G availability, thanks largely to 700 MHz spectrum deployments

A new report from Ookla characterizes Europe’s 5G rollout as a “two-speed” race — where some countries are sprinting ahead, while others are limping behind.

According to the firm’s latest data, Northern and Southern European countries are leading in 5G availability, thanks largely to 700 MHz spectrum deployments that significantly boosted coverage. Ookla specifically called out Sweden, which saw a 21.3% year-over-year increase in 5G availability, driven by aggressive 700 MHz rollouts from Telia and Tele2. These efforts focused on closing rural-urban gaps across Sweden’s expansive forested regions, backed by government digital inclusion subsidies.

Italy also made major strides, with a 20.5% YoY increase in availability. Progress there was fueled by multiple factors: the sunsetting of 3G networks, spectrum refarming (including WindTre’s repurposing of the 2100 MHz band), strategic use of EU recovery funds via the National Recovery and Resilience Plan (PNRR), and April 2024 reforms that eased electromagnetic field (EMF) restrictions to accelerate infrastructure buildout.

In contrast, Belgium, the United Kingdom and Hungary continue to lag, with 5G availability levels less than half those of the leaders. Across the EU, mobile users spent 44.5% of their time on 5G networks in Q2 2025, up from 32.8% a year earlier.

Policy, not geography, drives the divide

While spectrum and infrastructure strategies have accelerated 5G growth in some parts of Europe, regulatory decisions have hindered progress elsewhere. In the U.K., for instance, the Telecoms Security Act mandates costly vendor rip-and-replace programs by 2027. Ookla also notes that the country’s 2021 spectrum auction lacked binding 5G coverage obligations, as operators opted into the Shared Rural Network — a program focused more on 4G expansion than next-gen deployment. These policy choices, compounded by post-Brexit funding gaps, have stunted 5G progress.

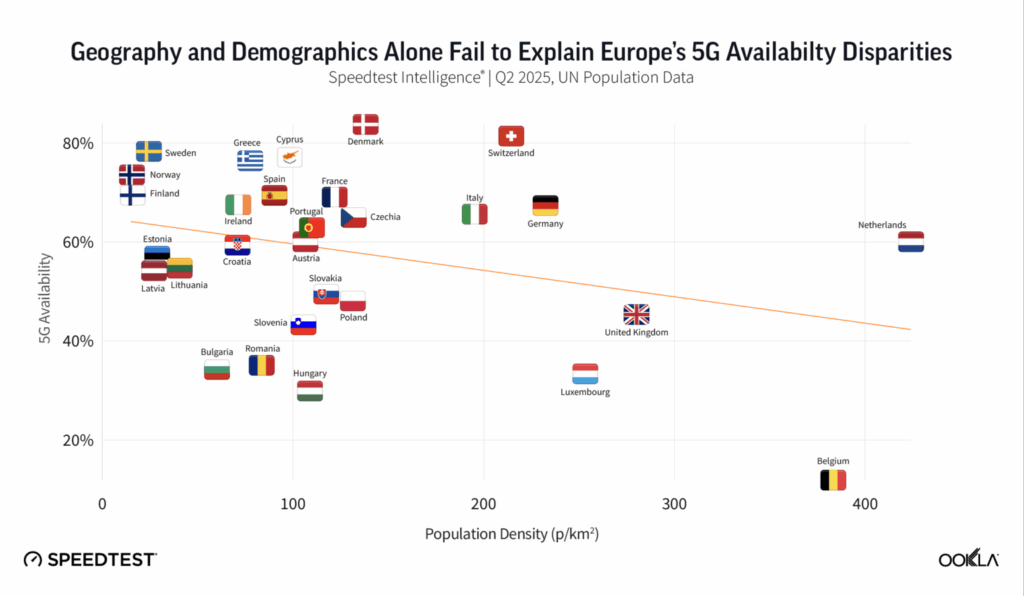

Europe’s 5G fragmentation is less about geography and more about regulatory execution. Ookla found that spectrum allocation timelines, coverage obligations, funding mechanisms and infrastructure regulations have a stronger correlation with 5G availability than population density, number of operators or urbanization rates.

This policy-driven gap is evident in the numbers:

- Denmark: 83.9% 5G availability

- Sweden: 77.8%

- Greece: 76.4%

Versus: - United Kingdom: 45.2%

- Hungary: 29.9%

- Belgium: 11.9%

5G Standalone: Everyone’s behind — except Spain

When it comes to 5G Standalone (SA) — a fully virtualized, cloud-native form of 5G — all of Europe is still playing catch-up. Ookla calls adoption “sluggish,” widening the gap with North America and Asia, where U.S. and China boast SA sample shares of 20% and 80%, respectively. (The GSMA agrees.)

Looking ahead: Regulation will make or break Europe’s 5G ambitions

“Persistent disparities in 5G coverage and long delays in harmonizing spectrum availability show that upcoming regulatory initiatives like the DNA face a tall order to improve Europe’s competitiveness in 5G deployment,” Ookla’s Luke Kehoe concluded.

However, countries that moved early on spectrum strategy and embraced data-driven policymaking show that success is possible — even when facing geographic or demographic challenges. As spectrum allocation and funding emerge as the defining factors, Europe’s 5G trajectory may depend less on technical limitations — and more on political will.