Greetings from Cedar Rapids (Iowa) and Camdenton, Jefferson City and Kansas City (Missouri). Pictured are some protesters walking by our lunch location in Jefferson City last Saturday (the sign reads “Things are so bad, even the introverts are here”). This gets our prize for creativity.

This Brief will have shorter than normal market commentary to leave enough time for a thorough analysis of the telecom industry and second quarter earnings. While there are few unique events shaping the second quarter, there are many questions that need to be answered about personnel, strategy, and operational effectiveness.

One additional administrative note – we will not be publishing a Brief on July 6th but will be converting all of our email subscribers to our WordPress format that weekend. The next full Brief will be on July 20.

The fortnight that was

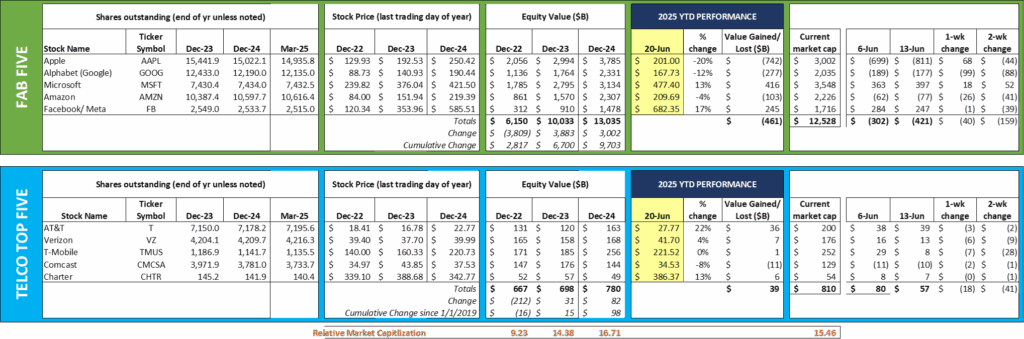

The Fab Five are largely marking time as everyone awaits news on the threats of a full-scale war in the middle east and the long-term impact of US tariff policy (many of the tariff pauses expire on July 9). Over the last two weeks, this group has lost 1.25% in total market capitalization. The $461 billion decrease so far in 2025 is at a similar level seen at the beginning of March (re: this level peaked at $2.6 trillion immediately after the initial tariff levels were announced).

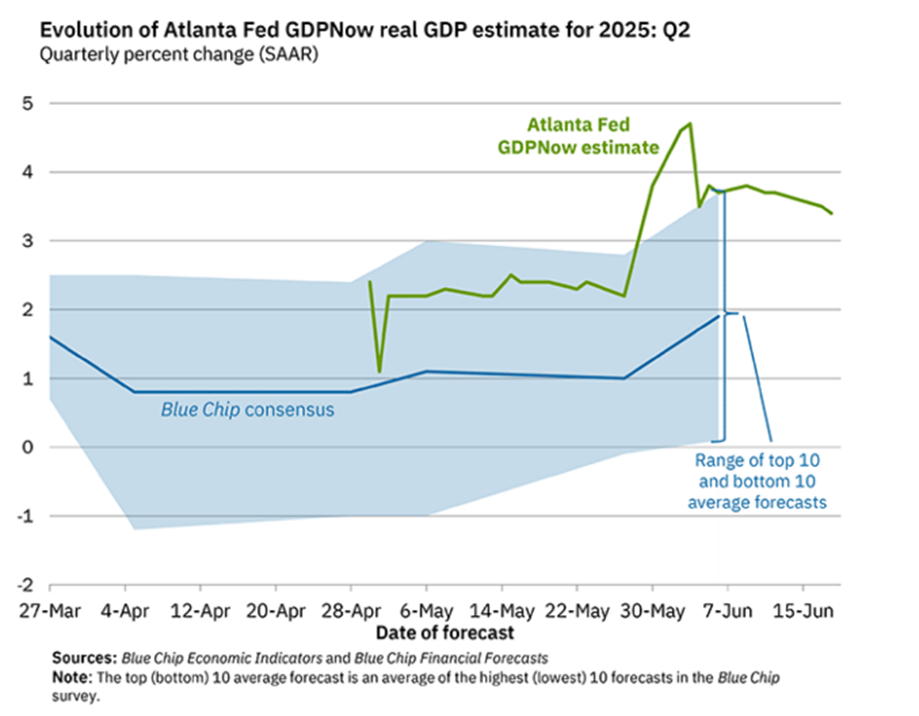

The question that remains is the impact of tariff increases on economic growth and interest rates. Our favorite measure of projected growth comes from the Atlanta Federal Reserve’s GDP Now, which is currently projecting 3.4% GDP growth for the second quarter. This estimate is essentially unchanged from two weeks ago. Reduced import levels are driving the quarterly revisions. For more details, here are two terrific reports (here and here).

nterest rates, federal budget deficits and inflation are also correlated. Sustained elevated deficits, regardless of which party is in power, will keep interest rates high and pressure them higher. But so will inflation, which has continued to be flat to slightly lower (Core PCE – full report here – is actually at the lowest level since 2020). The PCE report clearly shows that consumers are seeing rising incomes but keeping the money in savings for now. When that money will be spent is anyone’s guess.

One undeniable trend is the increase in data center spending. Microsoft, Amazon, Meta, and Google have collectively announced that they will be spending over $50 billion in the second quarter on data center capital. This does not include additional expansions by legacy data center companies (e.g., Digital Realty, Equinix, Iron Mountain, QTS, others). A majority of the $50 billion is being spent in the US, spiking demand for heating and cooling manufacturers, electric products, as well as generator companies. It’s also great for shelter companies like CellSite Solutions (the day job).

When the Fab Five are not competing for power letters (a key component to data center builds), they are spending large sums on AI companies and talent. Meta recently (June 12- announcement here) plunked down $14.8 billion for a 49% stake in Scale AI. On Friday, Bloomberg reported that Apple (a company not known for large acquisitions) had looked at buying part of all of AI firm Perplexity. And, to top it all off, certain key employees currently working for OpenAI have been offered $100 million signing bonuses to move to competitors (which, according to this Business Insider report, resulted in counteroffers from OpenAI to retain them).

2Q earnings preview—the questions no one will ask (but should)

In the last Brief, we looked at two quotes that peaked our interest: 1) Frank Boulben’s (Verizon) comment that “cable port ratios have peaked” and 2) Jason Armstrong’s (Comcast) “What Just Happened?” comment. We appreciate the many comments and emails from you on our analysis.

This week, we will pose several questions (in no particular order) that should be asked by analysts on the calls.

Questions for Charter and Comcast:

- How many gross additions represent customers who are returning to cable broadband from fiber?

- How many gross additions represent customers who are returning to cable broadband from fixed wireless?

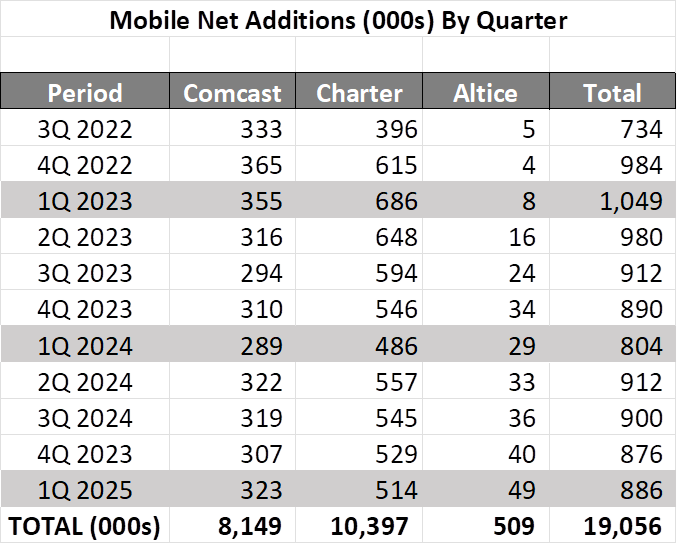

- How has wireless churn changed over time for the cable MVNOs? Have port-ins really peaked?

- What is the wireless penetration rate for Comcast Business and Spectrum Business customers? How has this changed over the past year? Is the market confined to the small and medium business segments only? How can Comcast and Charter create further differentiation in this area vs. a non-converged provider like T-Mobile?

- How will Comcast eliminate the wireless penetration gap versus Charter?

- What percentage of total gross additions come from new passings (including Charter’s RDOF-enabled rural expansion)?

- As Comcast and Charter have expanded their non-RDOF passings, what has their penetration rate (and ARPU) been? How does this compare with pre-COVID metrics (hypothetical example: in 2019, for every 10,000 new homes passed, Charter would see 30% penetration at slightly higher ARPAs than established areas within the first six months. Today, that figure is 25% over the first six months at 5% lower ARPA levels)? Is it harder to compete with Starlink and fixed wireless incumbent providers in these areas?

- Does the delay in Apple Intelligence improvements (now estimated to be 2Q 2026 – more here) impact the cable MVNO gross additions outlook for the second half of the year? Why or why not?

- When the Charter+Cox merger is completed, does it make sense to create a single business-focused entity that serves the needs of US and global businesses?

- When will Comcast adopt Charter’s innovative strategy with channels who also have a streaming presence (e.g., Max, AMC, and others)? Will this happen prior to or after the spinoff of Versant? Does the company see Charter’s strategy as a better alternative?

Our take is that very few (outside of MDUs and movers) customers who have fiber are moving back to their cable provider. This significantly limits the broadband terminal growth prospects for Comcast and Charter. When these companies expand their non-subsidized (non-RDOF) footprint, they are still experiencing disproportionate growth but winning over T-Mobile Internet or Verizon customers is not guaranteed (in fact, promotions may have to be used due to monthly pricing differences). But, if customers still have traditional MVPD services (likely satellite TV service prior to cable’s expansion), the opportunity for triple play (broadband + video + wireless) product penetration is higher.

We don’t think that there has been a recent discussion of a single, unified business services organization, but that will change when the Charter+Cox merger is approved (in roughly a year).

We do think that wireless will be front and center for Comcast throughout 2025, but that a meaningful gap of 1.8-1.9 million lines will remain with Spectrum/ Charter (see nearby chart for the latest figures).

One bonus question we doubt will get asked to Comcast is “What is your internally calculated “sum of the parts” valuation and what is the implied valuation discount shareholders are paying to own Comcast?” Since the end of 2020, the company’s market cap has decreased by $120+ billion or 46%.

Bottom line: We continue to believe that Charter’s mobile and video innovations are reducing churn and driving growth, and the company’s broadband metrics are also improving (see the latest ACSI Customer Satisfaction metrics here). We think that 2Q will be a strong one for Xfinity Mobile (Comcast), but it’ll also be good for Spectrum Mobile (Charter). While there is value in a converged bundle, the source of long-term value creation for cable (beyond consolidation synergies) continues to be a mystery.

Questions for the big three wireless carriers

- How will Verizon gain the approval of states like California and New York for the Frontier acquisition? Will Verizon need to provide a low-cost ($15/mo.) plan throughout New York state? Will this plan extend to fixed wireless if fiber has not been deployed to that location?

- What is Verizon’s plan (and/or acquisition obligation) to upgrade Frontier’s copper to fiber as a part of the merger approval? If Verizon and Frontier both have copper assets in that state, will they be required to upgrade both?

- What is the overall plan to upgrade copper assets (Frontier, Verizon) to fiber? Note: 39% of Frontier’s Q1 2025 revenues come from copper-based customers (more here), and 48% of Frontier’s total passings are copper.

- Does the delay in Apple Intelligence improvements (now estimated to be 2Q 2026 – more here) impact the postpaid retail gross adds outlook for the remainder of 2025? Why or why not?

- Who will be running T-Mobile on June 30th, 2026? How will the strategy change as a result? How will the new leadership restore a $300 billion + valuation? Note: T-Mobile’s value is down $38 billion since the news of a possible leadership change surfaced two weeks ago and down $58 billion since the stock hit a $270/ share in March.

- What is the non-mover churn rate for fiber (Sampath from Verizon implied in his discussion at the 2025 Bernstein Strategic Directions conference that it was below 1%)? When a non-mover customer leaves AT&T or Verizon’s fiber services, where do they go? Is it always back to cable?

- How many additional raw land cell sites will need to be added for Verizon and AT&T’s C-Band spectrum in secondary and tertiary locations to create a consistent speed experience vs T-Mobile (T-Mobile primarily uses 2.5 Ghz EBS spectrum while C-Band operates at 3.7-4.2 GHz)?

- What is the game plan for integrating US Cellular assets into T-Mobile? How will T-Mobile improve coverage across the existing US Cellular footprint?

- What is the timing of and integration plan for AT&T’s acquisition of Lumen’s existing fiber assets? Similar to the question for Verizon, how will AT&T respond to demands for perpetual low-cost plans?

- Will T-Mobile follow a similar “three tier + limited-time Founders Club” pricing strategy when the Metronet acquisition closes? Has that strategy been effective for Lumos/ T-Mobile thus far (the pricing should have been out for at least six weeks prior to the 2Q earnings call)?

We look forward to each of the Big Three earnings calls. AT&T has the most to gain in the second quarter, while T-Mobile probably will experience the greatest volatility up to earnings. Verizon indicated that both port-ins and port-outs had increased (versus 2Q 2024) but were remarkably upbeat on the quarter (perhaps port-ins were materially better than expected). If that is the case, AT&T would likely be a disproportionate loser.

We look forward to the fixed wireless metrics for both T-Mobile and AT&T. With limited marketing, we think AT&T is taking market share in Internet Air markets (because the product is both new and high performing). Their business product, which is offered nationwide, has widespread appeal and very low churn as a backup product. As we have said many times, our expectations continue to be high for AT&T broadband because they have fiber in states like Texas and Florida (see full list of fastest growing cities/ markets here).

Bottom line: AT&T has a lot of momentum. Verizon has a large merger to close, and, while prepaid appears to have turned the corner, the dynamics of that market segment can change quickly. T-Mobile is having leadership and strategic changes thanks to their German ownership. Each of these three creates value differently in the next twelve months. Our money is with T-Mobile and AT&T.

That’s it for this week. Absent any big news, we will be diving into AI and each of the telecom carriers in the next Brief (July 20). Note that Verizon announces earnings on July 21 before the market opens. Until then, if you have friends who would like to be on the email distribution, please have them sign up directly through the website.

Finally – Go Royals and Sporting KC!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.