A new Ookla report traces the blistering growth of the satellite broadband provider that has been the subject of countless scoops of late

Starlink is outpacing every other player in the satellite broadband race. New data from Ookla confirms that the provider is acing in almost all categories of tabulation.

Runaway growth

The satellite broadband market emerged some thirty years ago, but has seen some rapid transformations in the last decade. Brisk deployment of low Earth orbit (LEO) constellations have amped up service speed and scope for many existing providers, while new players have entered the increasingly crowded marketplace, pursuing near timelines to activate service worldwide.

However, amid the market maturation, Starlink’s position has remained unshaken. With over 9 million subscribers worldwide, and a constellation of 10,790 satellites, the company holds the title of the world’s largest satellite broadband service provider. The Ookla report on the global satellite broadband performance by analyst, Mike Dano, captures the rapid rise and market evolution of the Elon Musk-led company really well.

Between November and December of 2025, Starlink reported a 1 million jump in subscribers. The company took to X, now also owned by Musk, to announce, “Starlink is connecting more than 9M active customers with high-speed internet across 155 countries, territories and many other markets.”

With a global presence and an early headstart, that number may not sound completely unrealistic, but note that Starlink launched commercially only five years ago.

The striking growth of the user base stands in sharp contrast with key competitors like, Viasat, which lost over 50% of its U.S. customer base and is now down to 157,000 subscribers only, and HughesNet at 783,000 subscribers.

And it’s not just the subs, the speed of the satellite-delivered Internet service too has rocketed leaving other players in the dust.

According to Ookla Speedtest conducted in the third quarter of 2025, Starlink’s median download and upload speeds are rising across all major markets, with the number doubled between Q3 2022 to Q1 2025.

The service also showed consistent improvement in latency tests but fell short of geostationary Earth orbit (GEO) satellites. “Starlink’s highest latency – 282 ms in the Marshall Islands in the third quarter of 2025 – was still less than half that of the fastest GEO satellite latency measurements,” the report said.

Market edge

The provider accounted for 97.1% of the Speedtest samples collected globally, with Viasat trailing at 1.7% in second place, and HughesNet close behind at 1%.

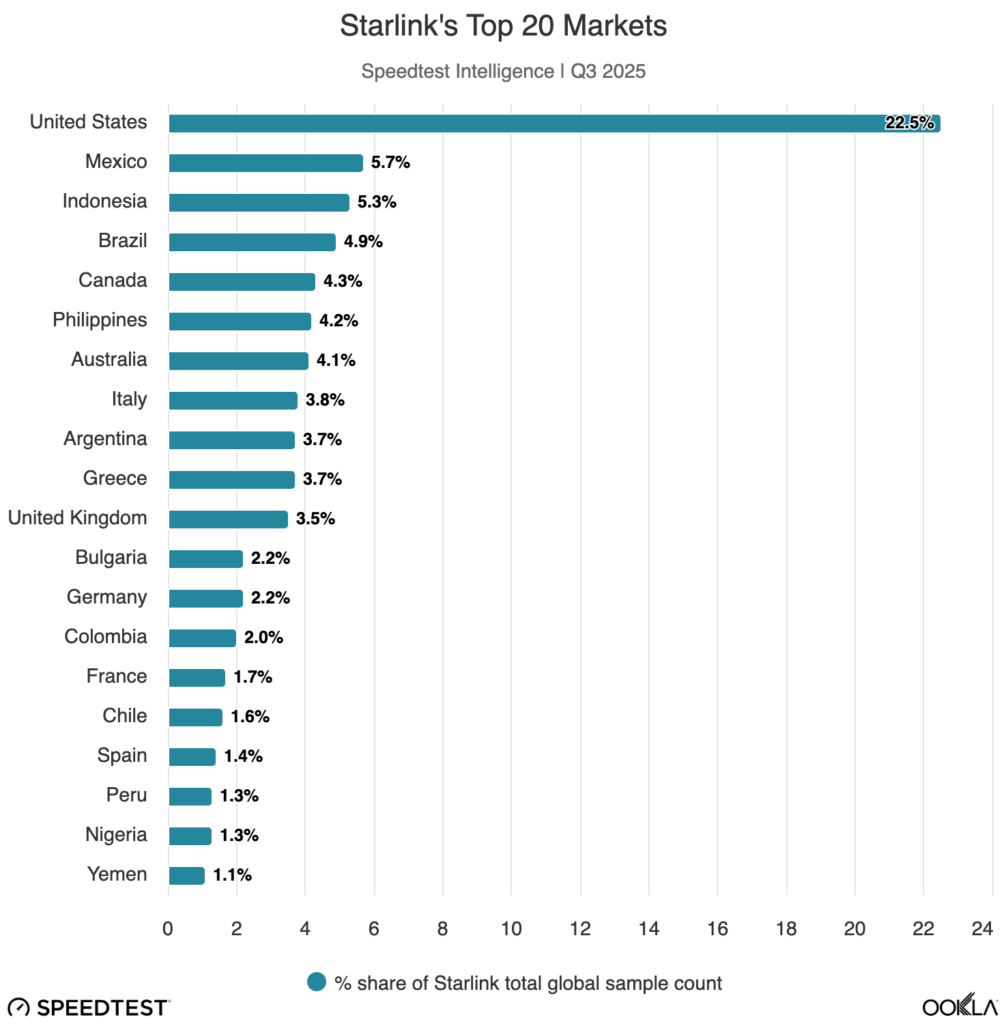

U.S. (number 1), Brazil (the second largest, according to a Starlink official), Mexico, Indonesia, and Canada make the top five markets for Starlink, the report said. Speeds in these top markets have shown a general upward trend in the past five years, it added.

The report ties its mercurial rise to parent company extraordinary SpaceX’s launch cadence, which is “almost daily” at this point.

“Those launches are the figurative and literal engine of Starlink’s global satellite internet expansion. Each successful launch – mainly using SpaceX’s reusable Falcon 9 rocket – adds dozens of new satellites,” the report said. With each new satellite added, the network capacity and coverage grows exponentially.

For perspective, of the 165 total orbital flights SpaceX completed in 2025, 123 was Starlink’s. “This operational rhythm is the single greatest differentiator for Starlink.”

The report also cites price drops as a key catalyst. As the speeds have gone up, the service prices have come down, giving the provider a distinct edge over local players. For example, in the U.K, Starlink service costs £35 ($47 USD) monthly for 100 Mbps speeds.

How does that compare with other providers? The new pricing, according to New Street Research analysis which the report draws on, is less expensive than competing offerings from BT, Vodafone, and YouFiber.

In the U.S. too, prices have dropped significantly in some rural areas to up to $80, as the company launched a more affordable Residential Lite plan, making it an attractive broadband service for many consumers.