Three sides of Industry 4.0 – industrial 5G in numbers (part 1)

Private 5G continues to outpace the broader telecoms market, with enterprise deployments expanding and industrial use cases taking shape. New data from Dell’Oro Group shows sustained almost-double-digit growth and a gradual shift in focus – from enterprise connectivity experiments to production-grade industrial applications.

In sum – what to know:

Outlier-outrunner – revenue from private 4G/5G systems grew 40% in 2024 and is tracking 20% higher again in 2025, compared with flat growth for public RAN.

Industrial momentum – adoption is accelerating beyond China and into critical industrial environments – notably manufacturing, logistics, mining, and energy.

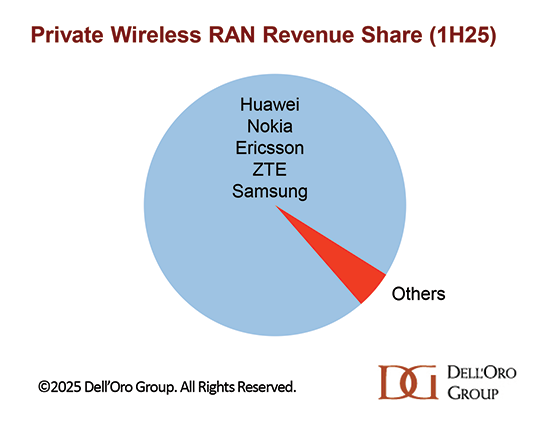

Concentrated market – the top five RAN vendors are Huawei, Nokia, Ericsson, Samsung, and ZTE; integration and scale requirements favour established suppliers.

Note: this article is the first in a short three-part series about the new tech foundations of Industry 4.0: industrial 5G (private wireless), industrial IoT, and industrial AI – linked but distinct technologies that form the connective, sensory, and cognitive layers of modern industry, driving digitalisation in hard-nosed industrial environments. Here is part one, based on figures from Dell’Oro Group, with some market-sizing about the state of the private 5G market. Part two (IoT) and part three (AI) are available here and here.

Global revenue from the sale of private 4G and private 5G radio access network (RAN) systems to enterprises grew by nearly 40 percent last year (2024), according to analyst Dell’Oro Group. That momentum has “extended” through the first half of 2025, it said, and revenue growth will be about 20 percent up on 2024 (on 40 percent growth on 2023) by the end of the year. Private wireless continues to shine as a bright spot in the telecom market,” said the firm.

Private RAN sales are outrunning “flattish” sales in traditional public cellular networks, operated by big operator groups, mostly for consumers. Private 4G/5G now represents a “mid-single-digit share” of total RAN sales, said Dell’Oro Group. Adoption is “accelerating beyond China”, it said, and “toward industrial applications”. The temptation, here, is to translate that private 4G/5G is being engaged more closely in operational technology (OT) in Industry 4.0.

The sense is that private cellular has found its métier in industrial environments – in manufacturing, logistics, oil and gas, mining – where it has been mostly deployed, initially, for worker safety and camera analytics, adjacent to production systems. But Dell’Oro Group does not conclude, actually, that private 4G/5G is now being deployed into precise critical operations; it reckons, instead, that the market has ‘pivoted’ from traditional enterprise environments”

It stated: “The market remains highly concentrated. The same five leading public RAN suppliers continue to dominate the private RAN landscape. This overlap reflects the market’s pivot away from traditional enterprise environments toward industrial applications, where scale, performance, and integration requirements favour established vendors.” Huawei, Nokia, Ericsson, Samsung, and ZTE (listed in that order) are the top suppliers, it said.

Growth in the first half was driven by both local-area (campus) and wide-area deployments; the latter led the growth, it said. China was the largest market by revenue, but growth outside of China is accelerating at a faster pace. The top suppliers by total revenue this year are Huawei, Nokia, and Ericsson; outside of China, The top three are Nokia, Ericsson, and Samsung. Huawei leads for wide-area deployments in the period, Nokia for local-area deployments.

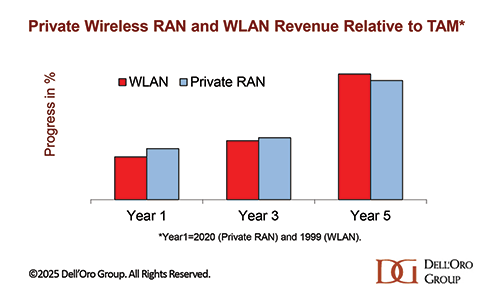

Dell’Oro Group described the market as a “still-untapped, high-growth opportunity”. Total private 4G/5G RAN revenues have “accelerated rapidly” in the first half of 2025, it said, going from a “low single-digit share in 2022” to a “mid-single-digit share” of total RAN revenues today. Growth is “tracking closely” with the trajectory of enterprise Wi-Fi adoption during its first five years. It will account for five-to-10 percent of total RAN by 2029; public RAN is expected to decline at a two percent CAGR over the same period.

It stated: “The high-level message has not changed – private wireless is a massive opportunity. Still, it will take some time for enterprises to embrace private cellular technologies.” Dell’Oro Group has a report all about it.