In sum – what to know:

Growth decade – IoT devices to hit 40.6bn by 2034, with cellular IoT tripling, non-cellular LPWA tech like LoRaWAN almost quadrupling, and short-range IoT still top.

Diverse cases – IoT market to spiral 146% to $908bn, led by China, Europe, and North America, with expansion across the utilities, retail, and transport sectors.

SGP.32 standard – IoT spec for eSIM raises demand for ‘eSIM orchestrators’ to handle connectivity, compliance, billing, and device lifecycle across networks.

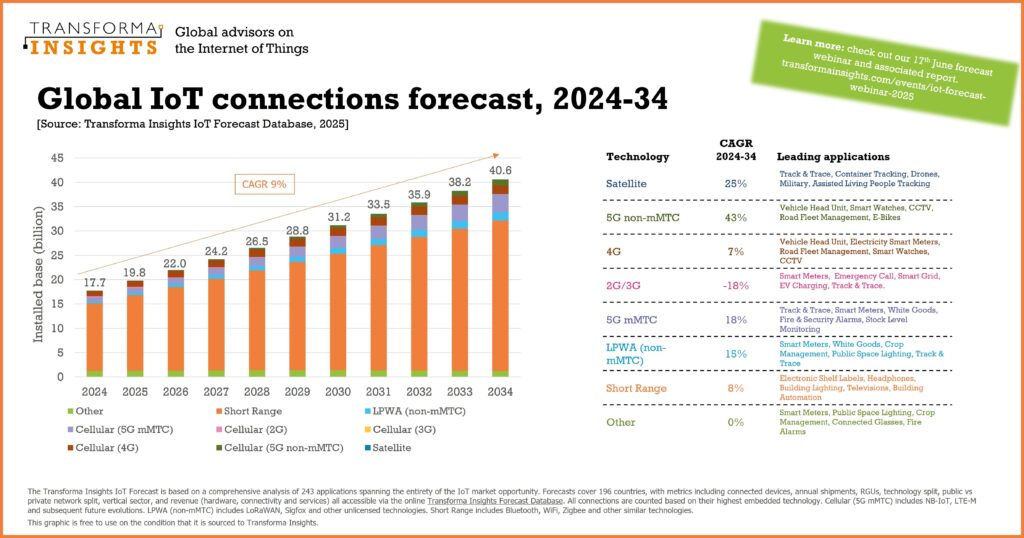

IoT is going from a “market with potential into a major demand centre”, according to Transforma Insights. A new forecast report from the firm says the total number of active IoT devices will more than double over the next 10 years to reach 40.6 billion, up from 17.7 billion today. Compound (CAGR) growth, from the end of 2024 to the end of 2034, is pegged at nine percent per year over the period. Annual device sales will grow from 4.3 billion to nine billion in the period, with a CAGR of eight percent.

The report covers the whole IoT market, including cellular and non cellular technologies, from short-to-long range. Short-range IoT will continue to dominate, accounting for three quarters (76 percent) of connections in 2034. This is a slight reduction compared to 2024, when about four in five (79 percent of) IoT units are on Wi-Fi, BLE, RFID, Zigbee, Thread, and so on. Cellular IoT connections will grow from 2.1 billion at end 2024 to 6.7 billion at end 2034.

This is a 200 percent jump (a tripling; up 219 percent). By the end of the period, nominal 5G-based IoT will account for about three quarters (4.9 billion), but only 1.2 billion (18 percent; fewer than one in five) will be 5G-proper, based on New Radio (5G NR) standards. The traditional LTE-bred low-power wide-area (LPWA) twin-set, NB-IoT and LTE-M, which are forward compatible with 5G as part of the ‘massive machine-type’ (mMTC) spec, make up the rest.

The (“substantially”) biggest non-LPWA 5G-based IoT use case is vehicle head units, accounting for 48 percent of cellular IoT connections in 2034, said Transforma Insights. The rest of the cellular IoT total (1.8 billion out of 6.7 billion) will mostly comprise legacy LTE-based 4G IoT connections. Meanwhile, non-cellular LPWA tech like LoRaWAN, notably, will grow from 439 million connections in 2024 to nearly 1.8 billion in 2034.

This represents total growth of 310 percent, and a CAGR of about 15 percent – some way outrunning the cellular LPWA growth rate in the period. In revenue terms, the total IoT market (including connectivity modules, “value-added” connectivity, and “core associated” applications) was worth $369 billion in 2024, rising by 146 percent to $908 billion in 2034, at a CAGR of about 9.4 percent.

The consumer sector will account for 65 percent of device shipments. A third (33 percent) of enterprise shipments will be for “‘cross-vertical’ use cases such as generic track-and-trace, office equipment, and fleet vehicles”, said Transforma Insights. A further 17 percent will be for utilities (mostly smart meters), 15 percent will be for retail and wholesale (mostly payment devices and electronic shelf labels), and seven percent will be for transport and logistics.

China, Europe, and North America will account for 31 percent, 21 percent and 20 percent of total IoT connections in 2034, respectively. “Despite rising trade tensions and inconsistent consumer sentiment… the IoT market continues to grow at a steady pace. As always, the consistent growth of the IoT market obscures the erratic movements of the thousands of micro-markets that it encompasses,” said Matt Arnott, principal analyst at Transforma Insights.

“Over the past year, rising sales of cellular devices in India have transformed it from a market with potential into a major demand centre. Similarly, the looming arrival of non-terrestrial cellular networks has created greater potential in the most remote parts of the world, and for the most underrepresented use cases. In order to forecast the future of the IoT, it is crucial to understand how these small components build the greater whole.”

Separately, Tranforma Insights has a position paper on cellular eSIM management, prompted by the new SGP.32 eSIM standard, plus new regulations around data sovereignty and permanent roaming, and “more selective network operator policies”. Written together with IoT MVNO Eseye, the paper calls for a “significant reassessment of connectivity management strategies”, and suggests IoT connectivity vendors might set-up as ‘eSIM orchestrators’.

A new orchestrator (connectivity manager) could handle eSIM profile and lifecycle management around “downloads and swaps”, and “network availability, regulatory compliance, and commercial factors”. The point is to shift from basic SIM resale to holistic eSIM management, addressing network and device capabilities, billing, support, compliance, and commercial plans through trusted partnerships and comprehensive managed services.

Matt Hatton, founding partner, said: “The new SGP.32 standard provides a powerful tool for remote SIM provisioning. In conjunction with a more demanding regulatory and MNO landscape, our analysis points towards a fundamental shift requiring businesses to be more strategic. This is where we see the emergence of roles like the ‘eSIM Orchestrator’ becoming critical.”

Ian Marsden, co-founder and chief technology officer at Eseye, commented: “Proactive companies will be looking beyond the immediate technical changes, like SGP.32, to understand the broader… implications. Having a clear strategy for device connectivity management, which considers the need for specialised eSIM orchestration, will be increasingly important to de-risk operations, ensure compliance, and maintain a competitive edge.”