There is a key role for small cells in broad network densification, for mobile operators to meet mandates and promises. But the real action is with enterprises. (As told to a packed house at Small Cells World Summit in London.)

In sum – what to know:

Enterprise drives growth – indoor enterprise networks are engine of small cell growth.

Steady, not flashy – stable 9.4% CAGR forecast to 2030; no hype, just steady expansion.

Hybrid leads demand – hybrid private-public enterprise networks top investment drivers.

RCR was at Small Cells World Summit in London for a couple of hours today (June 3), and left with a bunch of session recordings, including a smart market overview courtesy of a late-morning scene-setter from Caroline Gabriel, analyst and content director with Small Cells Forum (SCF). So here’s a rough replay – for anyone who didn’t make it down to Somerstown, to a rather austere theatre venue next to the British Library, where SCF is hosting 400-odd industry types for two days (June 3-4), and spinning a good yarn (which RCR readers know very well). It goes like this…

There is no hype, here, and no hockey-sticks – said Gabriel to an (almost) full house. This is a serious technology for serious people with serious purposes. Forget about your consumer nonsense – and forget, as well, to a degree about macro rollouts (said Nokia in an earlier presentation). Yes, there is a key role for small cells in broad network densification, for mobile network operators (MNOs) to meet mandates and promises (and merger contingencies) on new SA coverage, and to close digital divides in rural climes. But the real action is with enterprises, of various stripes.

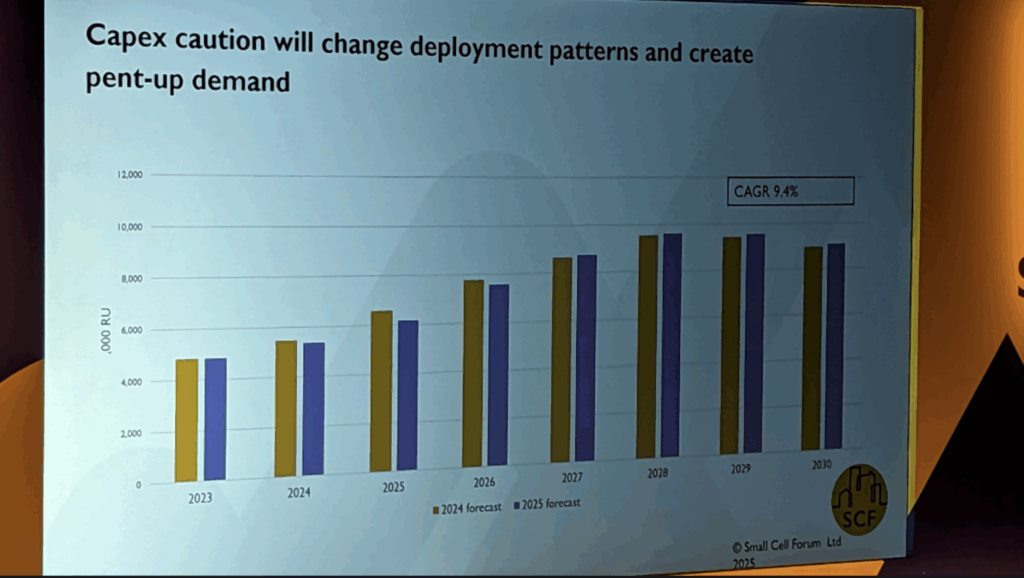

In other words, the story of small cells, mid-2025, is mostly about private enterprises and public services. This is where the growth is, and there is enough of it – and enough promise in it – that SCF has raised its compound annual (CAGR) sales forecast marginally – from 8.4 percent to a 9.2 percent (9.4 percent, in the slide) growth in the period to 2030. It is a unit measure, advised Gabriel – for radio deployments, including DAS shipments, rather than revenues (which will be available in the summer, apparently, when SCF publishes a full market forecast).

It is not the kind of growth rate or uplift (“relatively modest”) that makes a vendor ecosystem rich, or quickly-rich anyway, but it is steady and helpful business, she suggested – and nailed-on if the ecosystem can further reduce complexity and cost. It is also valuable business for government agencies, local authorities, and critical industries, variously deploying small cells to light up their hybrid, shared, and private networks – according to earlier presentations. “We are on track. The industry is stabilizing; it is a little more predictable,” said Gabriel.

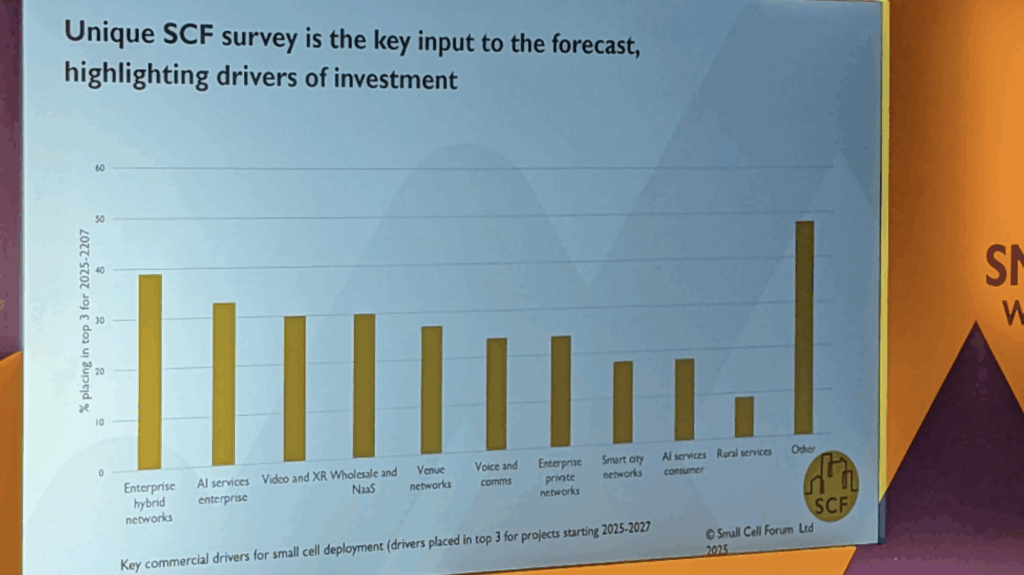

The SCF forecast is based, in part, on an annual poll of 90-odd companies from across the small cell ecosystem, on both sides of the supply line. Gabriel presented a slide, based on their responses, about ‘drivers of investment’. She said: “By some way the biggest [driver] is enterprise networks, and particularly enterprise hybrid networks – where private or indoor networks interact with the public network. These involve an MNO, typically, but other stakeholders as well.” Judging by the slide, almost two in five respondents place hybrid networks among their top three ‘drivers’.

About one in four also/or place private networks in there. Taken together, those results suggest proper demand. Otherwise, modish enterprise AI services (her characterisation; “AI is very much front-of-mind at the moment”, she said) and video and ‘extended reality’ are driving interest in small-cell networks – the survey says. ‘Venue networks’ is another popular answer, it seems – more so than smart cities, rural services, or consumer AI, anyway. But then, the graph shows a long tail of ‘other’ investment cases, cited by almost half of respondents.

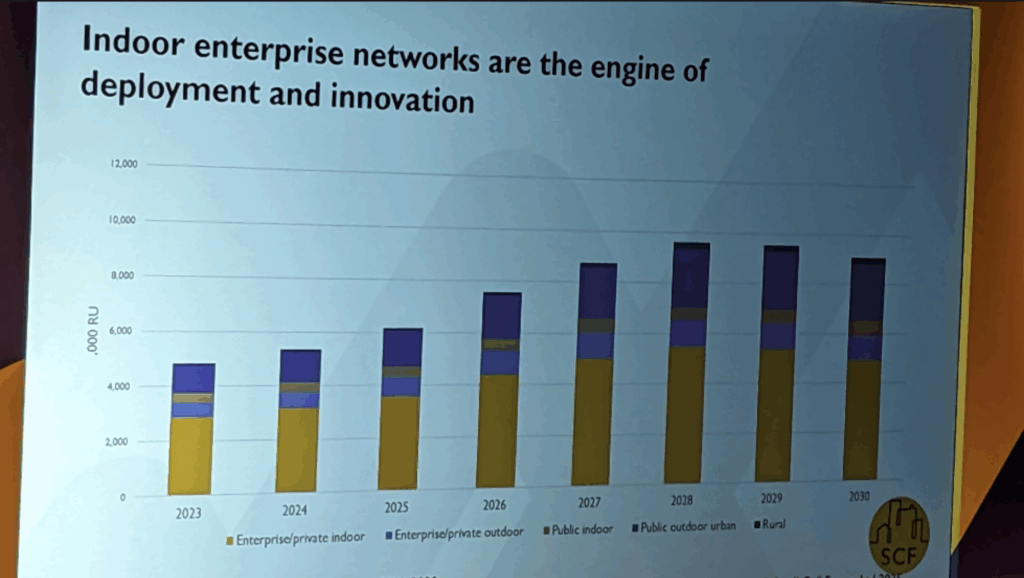

“The engine of deployment is indoor enterprise networks,” said Gabriel, showing another slide which bucketed-together all the ways enterprises might leverage small-cell infrastructure to get better indoor capacity, speed, reliability, quality. Public and private outdoor setups, also supporting applications and driving investments, are “fairly small categories”, by comparison. The painpoints are where the pinchpoints are, which is indoors – where people are. In unit sales, something-less than four million (3.75 million?) out of something-more than six million (about 62 percent?) will go on indoor private networks in 2025.

That is what the slide says – and indoor private networks will host more than half of small cell deployments in 2030, it seems, even if sales start to decline at the end of the decade. The other major key setup for small cells is public outdoor macro networks, growing steadily through the rest of the period – to connect something-more than two million units by 2030 (versus about 4.5 million on indoor private networks), out of something-more than 8.5 million (about 25 percent versus about 55 percent). “It shows there is a lot of growth potential,” she said. “We left the hockey sticks behind long ago.”

And she followed with a quote that probably summed up the talk, and the whole event (and increasingly every single telecoms event). “The engine for scale and innovation – in technology and business models – is undoubtedly the enterprise market, as it really always has been. Because the need for those in-building systems remains so important, and increasingly important for enterprises to become more digital and invest in a wide array of different applications… This is a market of gradual steady expansion – of people building on the experiences of a few pioneers, and driving a market to the scale it absolutely requires.”

There was other good stuff in there, too: about barriers to entry, gradually falling away (notably, site and spectrum access); deployment and investment models, slowly diversifying (offered / managed pretty evenly by integrators, vendors, operators); shared infrastructure (DAS is here to stay, but neutral-host systems are the future – they say); and also usage of new spectrum (with high-density high-band mmWave FR2 frequencies tipped to host up to 40 percent of new radio units by 2030 – if not to support 40 percent of networks).

But we have a deadline, and have to put a pin in it (maybe we will follow up).