TCO reduction and vendor diversification are Open RAN deployment drivers

For part of the recent Open RAN European Forum, RCR Wireless News surveyed 100 members of our audience to gain a better understanding of how they’re thinking about Open RAN deployment. Top motivations include cost reduction and vendor diversification, while concerns range from ongoing interoperability testing to ease of use for private networks. Here we’ll present the survey results along with expert commentary from Mavenir Senior Vice President of Business Development John Baker and Viavi Solutions’ Owen O’Donnell, TeraVM marketing manager.

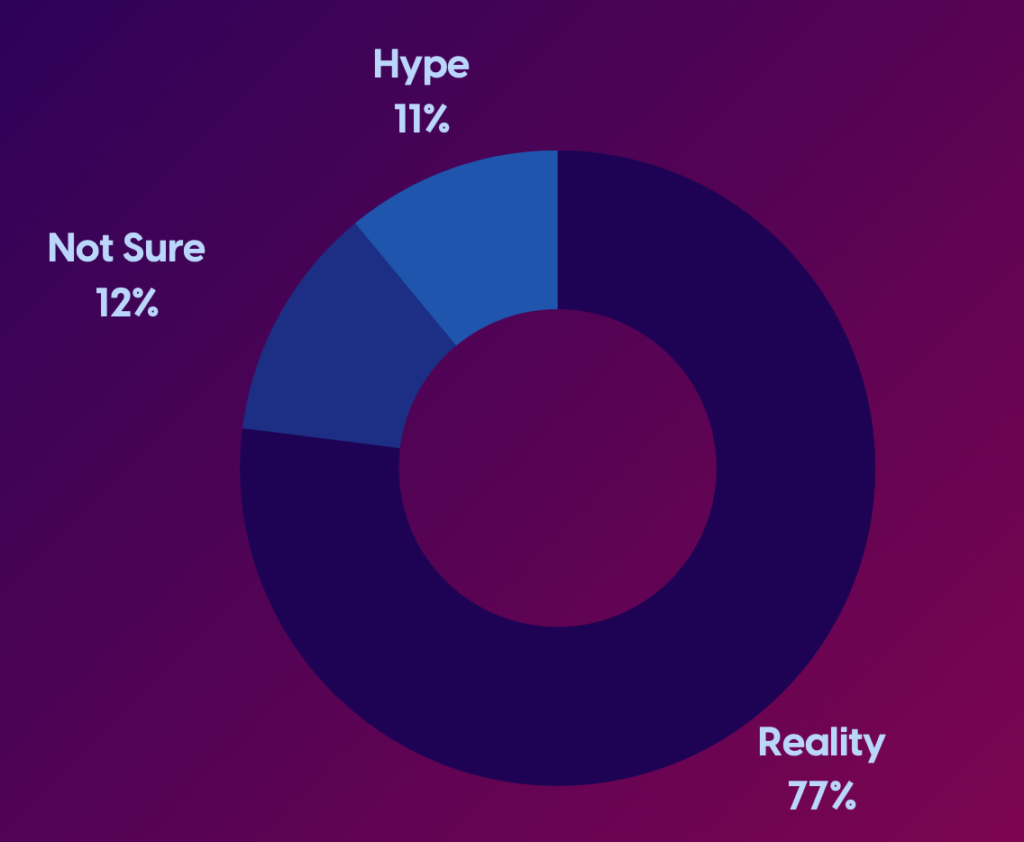

Question 1: Do you think Open RAN is just hype, or will it be a reality?

In response to those unconvinced about the future of Open RAN, “Time will tell and I’ve always said it’s not a revolution, it’s an evolution,” Baker said. “It’s going to take several years to get there and I think proof is in the eating.”

O’Donnell called out work done by greenfield operators Dish and Rakuten Mobile, as well as commitments from brownfield operators like Telefonica and Vodafone as evidence of Open RAN momentum. “The fact that it’s moving, I think really quickly, should show those that are a little bit apprehensive that you need to get on board.”

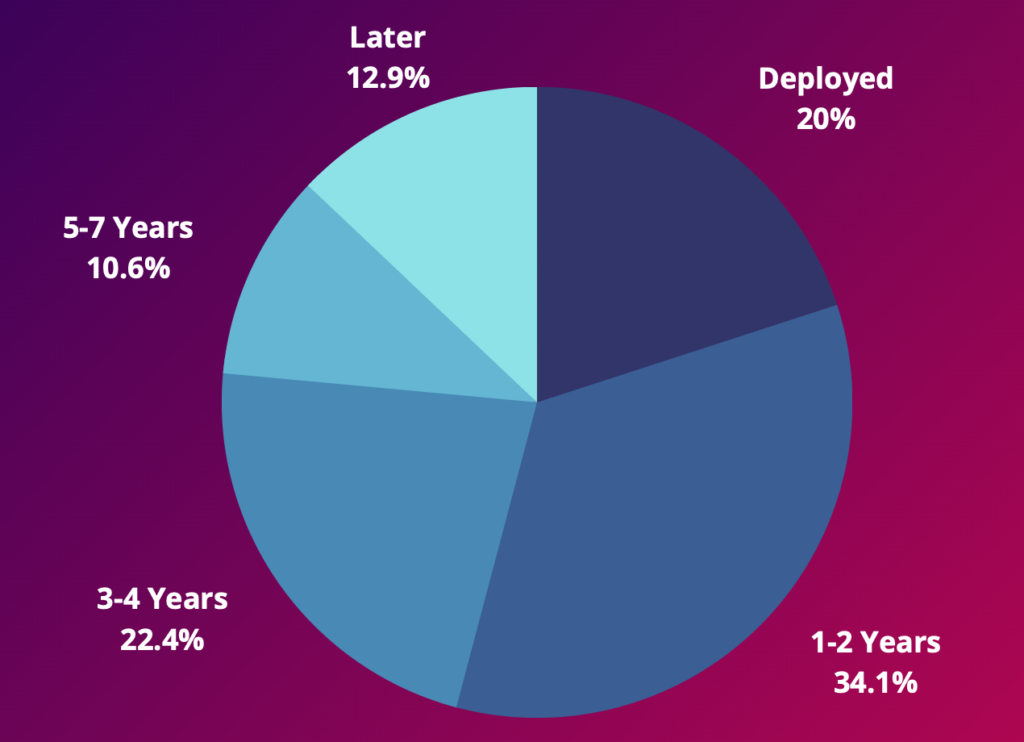

Question 2: Will you be considering deploying Open RAN now or in the future?

“70% of the operators are looking at Open RAN in the next four years which is a huge number,” Baker said. “I think Open RAN…is really all about open interfaces and interoperability. It’s not a technology per se. To that extent there’s absolutely no reason it can’t get deployed today…Whether it’s 4G, 5G, 6G, it doesn’t really matter. We should have open interfaces…level the playing field so suppliers can compete. That’s what this whole thing is about.”

O’Donnell acknowledged interoperability issues that do and will need to be resolved and that success will be by proving out parity with integrated RAN solutions. “Operators themselves want to see those [interoperability issues] fixed and to make sure the KPIs their networks need to show have to be as good as if not better than their traditional network deployments.” He also called out the promise of the RAN Intelligent Controller for automating network operations which he sees progressing significantly in the next four years.

Question 3: What is, or will be, the main driver for you to deploy Open RAN?

“I think the elements are there to encourage cost reduction,” O’Donnell said. “You’ve got the option of at least going to different vendors. You’re not tied to the one vendor who basically has you over a barrel. You can shop around and you can look for companies that are looking to be a bit more cost effective when it comes to supplying components.”

Additional vectors for Open RAN as a way to reduce, O’Donnell explained, include the use of commercial-off-the-shelf components the scalability that comes with moving functions into cloud platforms. With the advanced of the RIC and attendant applications, “You have choice when it comes to xApp developers and vendors. You can bring them onto your RIC, you can pick the ones that suit your network the best.” And back to the relationship between automation and TCO, “If you can take away some of the manpower required to run a network, that’s going to bring that cost reduction as well.”

Baker said the TCO piece has been verified through existing Open RAN deployments. “The reason I honed in on vendor diversity is the whole geopolitical situation and the fact that what you’ve actually got in the marketplace today is a monopoly situation. The current choice of two is not allowing operators to be profitable or differentiate themselves.”

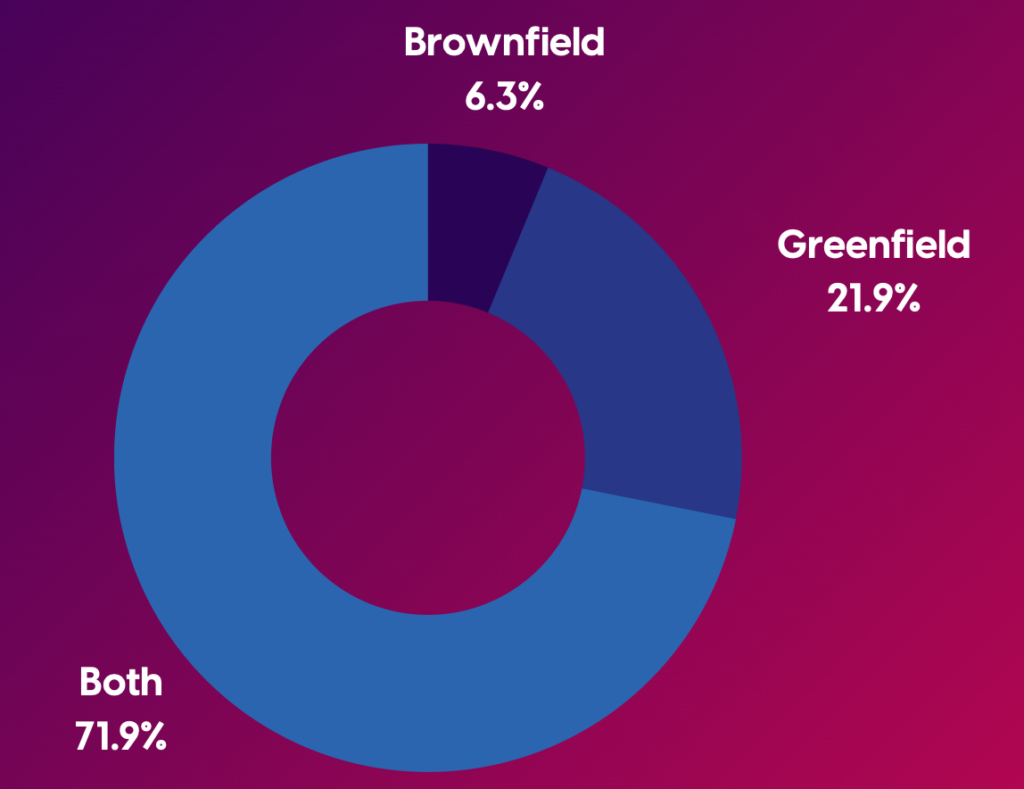

Question 4: Do you foresee Open RAN being deployed for brownfield, greenfield or both?

While scaled, macro Open RAN deployments today have been greenfield builds, there aren’t necessarily many of those opportunities left as noted by Nokia’s Adrian Hazon. What there is, however, is a huge opportunity around private enterprise networks, all essentially greenfield deployments, that could benefit from Open RAN.

“It’s just taking a small little 5G network and dedicating it to a factory,” O’Donnell said. “You have all the concerns you’d have for a bigger network only more dedicated. You just need to match them to your factory. No reason why Open RAN won’t work there.”

“It needs to be a plug and play network and IT guys need to handle it the way they handle a Wi-Fi network today,” Baker said of the Open RAN/private networks outlook.

Question 5: What do you think is the top priority for the industry to address with regard to scaling Open RAN?

With Viavi’s expertise in test and measurement processes underlying Open RAN interoperability, O’Donnell picked that as the place “where we see the biggest issues, the biggest challenge, and also where can help hugely.” Calling out the importance various dedicated test labs and plugfests, he said, “There’s a huge amount of testing that needs to be done. And that’s not going to go away. The interoperability is never going to go away. It’s going to be continuous.”