TSMC captured nearly 70% share of the global chipset market share, according to Counterpoint

According Counterpoint’s latest Foundry and Chipset Tracker, several factors contributed to a decline of 5% YoY in Q1 2022 in the global smartphone chipset (SoC/AP+Baseband) shipments, including weaker demand in China and over-shipping from some chipset vendors in Q4 2021. Chipset revenues, however, experienced an impressive growth of 23% YoY in Q1 2022, likely the result of a wider variety of 5G smartphones, which tend to be more expensive, hitting the market.

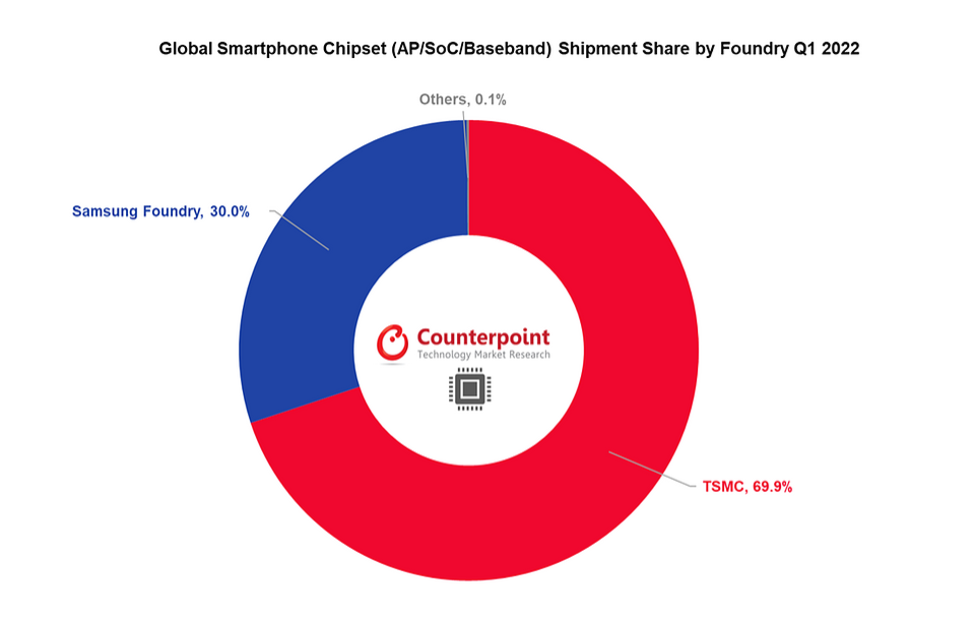

Counterpoint reported that Qualcomm lead the smartphone AP/SoC and baseband revenues in Q1 2022 with a 44% share. On the foundry side of the equation, TSMC captured nearly 70% share of manufacturing the chipsets that go into smartphones from the complete System-on-Chip (SoC) to discrete Application Processors (AP) and cellular modems, followed by Samsung Foundry, which captured a 30% share of the global smartphone chipsets.

“Foundries are extremely high CAPEX, cutting-edge technology businesses which have led to a duopoly for manufacturing advanced chipsets for smartphones,” commented Counterpoint Senior Research Analyst Parv Sharma. “TSMC and Samsung Foundry together control the entire smartphone chipset market and TSMC is more than double Samsung in terms of manufacturing scale and market share. TSMC CAPEX spending is much higher than the competitors. It will invest $100 billion between 2021-2023 in 5/4nm and 3nm chip fabrication facilities, WFE, 3D packaging, and ramp up for 5/4nm and 28nm to meet the growing demand. Thus, enabling TSMC to capture a large share in the advanced nodes.”

This dual-sourcing strategy, though, may put additional pressure on Samsung Foundry’s market share, said the analyst firm.

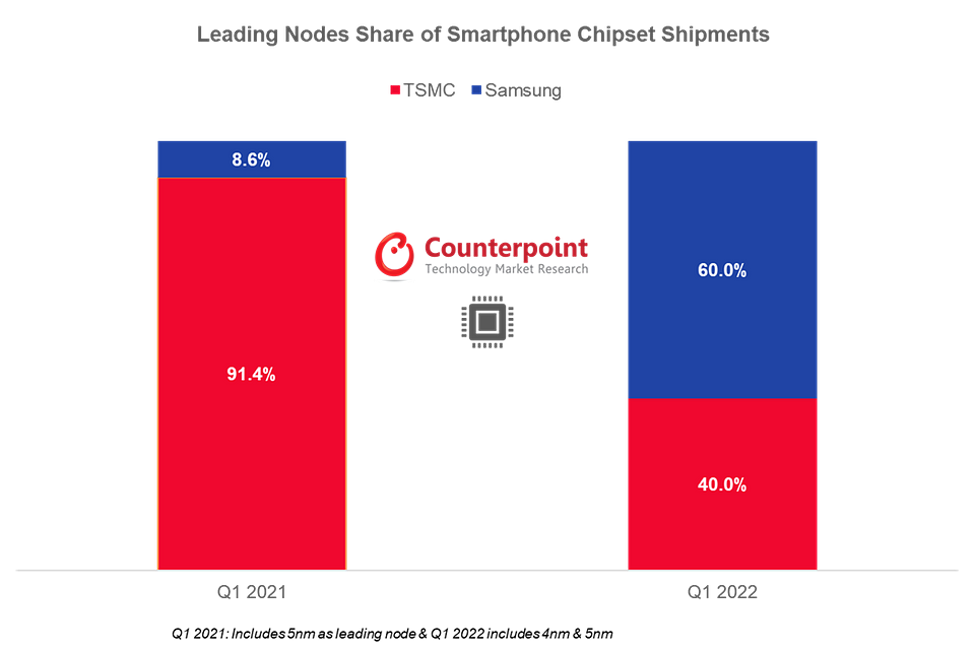

Senior Analyst Jene Park explained that Samsung Foundry’s claim on 30% of the market share is due to Qualcomm and Samsung Semiconductor’s internal Exynos chipset division. “Despite relatively lower yield rates for the leading 4nm process node, Samsung Foundry led the leading nodes (4nm & 5nm) smartphone chipset shipments with a healthy 60% share followed by TSMC which captured a 40% share in Q1 2022,” said Park, adding that the 4nm shipments were driven by Qualcomm Snapdragon 8 Gen 1 which has gained more than 75% share in the Samsung Galaxy S22 series.

TSMC, Samsung respond to chip shortage

With global chip shortages expected to last until at least 2023, Samsung and TSMC have warned of tight production capacity and have focused on expanding capacity. Samsung, for instance, invested $17 billion in a new fab in Taylor, Texas that will produce chips on a 3-nanometer (3nm) process. According to the company’s website, the site will be operational in 2024. Similarly, TSMC is floating the idea of an additional chip plant in Singapore and as of May of this year, said that negotiations with government officials are still underway.