Belated Memorial Day and June greetings from Missouri and Nebraska. Pictured is our pooch Abby (left with stick) and the neighbor dog, Lucy, enjoying Midwest spring/ summer weather. Given our recent rainfall, “duck days” is a better weather descriptor than “dog days”!

June marks the traditional beginning of the annual strategic and business planning season. During this time, we often receive requests to dive into specific topics. Several of you asked for a short summary of the recently passed Infrastructure bill. After our normal market commentary, we will spend the rest of the brief describing and analyzing state, federal, and hybrid options that cable companies, traditional telecommunications carriers, and wireless providers are evaluating. We will follow that on June 19th with a discussion of Apple, Microsoft, and Google’s ambitions to subsume parts of the communications domain. This is conveniently scheduled after next week’s announcements from Apple at their annual Worldwide Developer Conference (WWDC) discussed below.

The fortnight that was

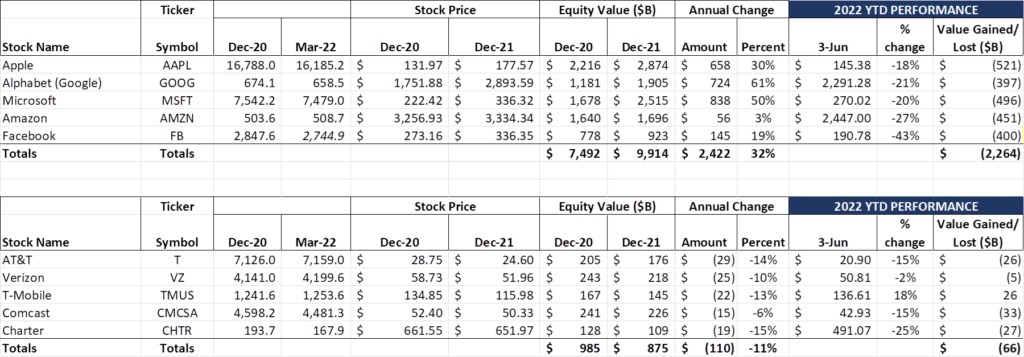

In the last Brief, we had no positive news for the Fab Five. They were truly at a low-water mark for 2022, having given up all of 2021’s gains. Since then, both the Fab Five and the Telco Top Five have recovered, with nine of the ten stocks increasing their market capitalization (Facebook/ Meta was the only loser over the last two weeks, largely falling in sympathy with Snap’s 2Q earnings warning issued on May 23rd).

Since May 20, the Fab Five have collectively gained $468 billion in market capitalization and the Telco Top Five have gained $28 billion. Only 93% of their cumulative 2021 Fab Five market gains have been wiped out (back below 100%), and the Fab Five total equity market capitalization now exceeds $7.6 trillion. Apple, Alphabet/ Google, and Microsoft still have stock prices that are higher than where they started 2021. Like their Telco Top Five peers, there’s some value clustering occurring in the Fab Five, with Apple + Alphabet + Microsoft in the 20% YTD loss cohort, and Amazon and Facebook facing more uncertainty.

Coincidentally(?), Amazon and Facebook also had notable retirement announcements this week, with Facebook’s COO Sheryl Sandberg (Bloomberg article here) and Amazon’s Consumer chief Dave Clark making headlines (Bloomberg article here). Both were fundamentally important leaders: Sandberg brought discipline and structure to a fledgling social media company in 2008, while Clark established a logistics powerhouse and changed home delivery expectations starting in 1999. Both will be hard to replace even though they were good developers of talent. It’s not hard to see a public future for Sandberg, given her writing and speaking skills (a New York Times review of her 2013 book “Lean In: Women, Work, and the Will to Lead” is here; her TED Talk on the same topic that went viral is here), but we are not exactly sure where the past 23 years of start-up experience will take Dave Clark. Both are amazing people who have more than enough financial net worth to pursue whatever they want – what risks each will take in their next chapter will be worth tracking.

As mentioned above, Apple holds their annual developer conference (WWDC) starting Monday. They typically detail operating system software changes in June, and there have been many leaks guesses about what could be announced: better multi-tasking for the iPad, a rewrite of the fitness app for the Apple Watch, and an “always on” display for select new iPhones may be on the docket. We would also not be surprised to see announcements concerning processor improvements and battery power conservation, two important drivers of device upgrades. Mark Gurman’s Bloomberg article (here) details these and other potential upgrades.

There’s open speculation that WWDC could also include bigger announcements, such as a Virtual Reality headset or even confirmation of the rumor that they have secured rights to the NFL Sunday Ticket following the 2022-2023 season. Our guess is that Apple will hold announcing these until late summer (closer to the start of the current football season). As we have written in previous Briefs, Apple TV+ is going to receive increased funding as they continue to see content as an important (and profitable) asset. Apple also has in-house chipset expertise to create a headset that outflanks Oculus. While both would make a lot of headlines, June is probably early for these announcements.

Something to consider – Apple needs to identify and launch new products and services (new “TAMs”) in order to keep their earnings multiple high (currently just shy of 24). Given the significant market growth that Apple has experienced in the last three years, our guess is that Apple needs to discover at least a $500 billion market every 6-12 months to make the case that they are a growth stock. This is what continues to give us confidence that “in home” and “content to home” will be increasingly important market spaces for the Cupertino-based giant.

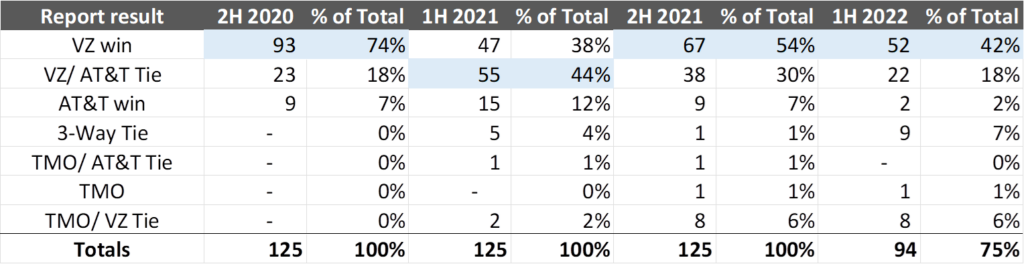

One final news note: We are entering the home stretch of RootMetrics Metro RootScore Reports (here) and thought it would be good to update you on changes in scores and trends. To bring our newest readers up to speed, we have tracked RootMetrics reports since we resumed the Brief in 2019. RootMetrics provides scores on various factors (call performance, text performance, network consistency, network download speed and a few others) for 125 different metro regions and all 50 states every six months. We are carful to use this data to look for longer-term trends, and not read too much into any specific metric or metro. That said, here’re the cumulative winners for the last four quarters (recognizing that RootMetrics is only three quarters complete for 1H 2022 reports):

Verizon continues to hold a commanding lead on outright wins, and it is probable that they will be the winner in more than half of the 125 metros after all of the data has been tallied. The fact that AT&T currently has a mere two outright wins thus far is equally surprising. If Ma Bell wins each of the remaining markets that they won outright in either 1H 2021 or 2H 2021, they would have eight outright wins – that’s likely to be their “best case scenario.” Our view is that it’s more likely that they will only win 4-5 total out of 125, leaving a giant gap between Verizon and AT&T.

This gap is not being filled with a bunch of Verizon/ AT&T ties. Rather, it’s bring filled with 3-Way and Verizon/ T-Mobile ties. In Texas, Dallas/ Ft. Worth (AT&T’s hometown), Denton (north of Dallas), and San Antonio (former HQ of AT&T/ SBC) are all reported as 3-Way ties. Verizon and T-Mobile are sharing the honors in larger markets such as Houston, Milwaukee, Louisville, and Kansas City. In fact, AT&T’s outright wins are in two demographically challenged towns: Durham (NC) and Baltimore. We will wait another month for the remainder of the metro scores to be published but, based on what we have seen thus far, AT&T appears to be falling further behind Verizon in RootMetrics’ eyes and T-Mobile is beginning to close in on the runner-up crown.

Infrastructure funding overview, Part 1: What is a Priority Broadband Project?

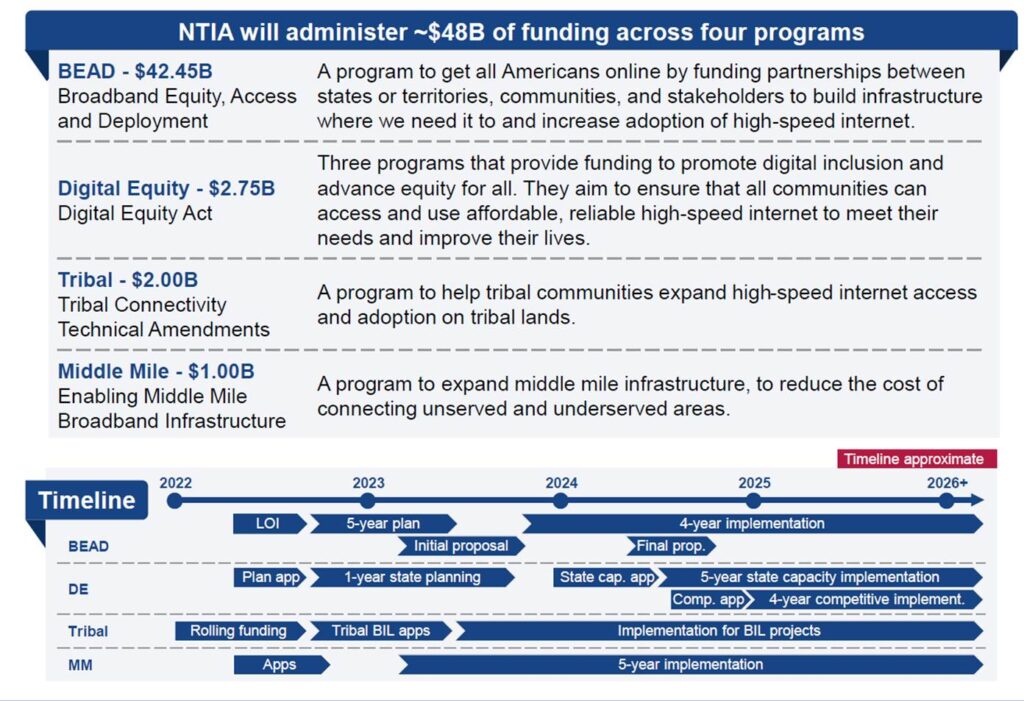

Over the next 24 months (roughly through 2Q 2024), nearly $48 billion in infrastructure funding is going to be distributed to telecommunications firms. Because these monies are likely to be made available through a matching process (25% or 50% contributed by the applicant, with the remainder from the government), the cumulative economic impact of these dollars will likely reach $60-100 billion.

In addition to the Infrastructure Funding (also called Broadband Equity, Access and Deployment or BEAD program), there are a variety of existing programs in place to distribute funds made available during the COVID-19 pandemic. Many of those monies are just being distributed and will be connecting homes to the Internet in 2022-2024.

On top of pandemic-driven and infrastructure funds, there are formal programs administered by the Department of Agriculture focused on rural infrastructure already in place. This program is called ReConnect (more on the program here). The third phase of ReConnect applications were submitted in March and are expected to be awarded by September. The fourth phase of ReConnect applications will likely be due this December.

On top of these three funding sources, there are tens of billions of dollars being spent by AT&T, Verizon, smaller telecommunications companies, and private equity-backed telecommunications firms such as American Broadband.

If your head is swimming, you aren’t alone. However, the National Telecommunications and Information Administration (NTIA) has tasked each state with a) developing broadband maps for each census block in their state; b) identifying unserved and underserved areas; and c) developing an applications and challenge process to drive broadband penetration throughout the country.

Here’s a summary of the federal components and draft/approximate timeline from the Internet for All website:

The extension of responsibilities and funding decisions to the states is critically important to reducing overlapping investments. For example, companies receiving monies from the recently administered (2020) Rural Development Opportunities Fund (RDOF) auctions can claim to be “served” if they deploy fiber or provide wireless using licensed spectrum. If they are fixed wireless solutions using unlicensed Wi-Fi or unlicensed CBRS, or are satellite providers, however, BEAD (fiber to the home) priority applications can be considered.

While the states have a large amount of leeway in determining the technology and the administration of infrastructure monies, the NTIA included a fiber-friendly definition deep in the Notice of Funding Opportunity (page 14 of definitions, and footnote 9):

“The term “Priority Broadband Project” means a project that will provision service via end-to-end fiber-optic facilities to each end-user premises.9 An Eligible Entity may disqualify any project that might otherwise qualify as a Priority Broadband Project from Priority Broadband Project status, with the approval of the Assistant Secretary, on the basis that the location surpasses the Eligible Entity’s Extremely High Cost Per Location Threshold (as described in Section IV.B.7 below), or for other valid reasons subject to approval by the Assistant Secretary.”

“9 A project that will rely entirely on fiber-optic technology to each end-user premises will ensure that the network built by the project can easily scale speeds over time to meet the evolving connectivity needs of households and businesses and support the deployment of 5G, successor wireless technologies, and other advanced services.”

Priority Broadband Projects are considered as follows (page 42):

Selection Among Competing Proposals for the Same Location or Locations. An Eligible Entity’s process in selecting subgrantees for last-mile broadband deployment projects must first assess which locations or sets of locations under consideration are subject to one or more proposals that (1) constitute Priority Broadband Projects and (2) satisfy all other requirements set out in this NOFO with respect to subgrantees.

In the event there is just one proposed Priority Broadband Project in a location or set of locations, and that proposal does not exceed the Eligible Entity’s Extremely High Cost Per Location Threshold, that proposal is the default winner, unless the Eligible Entity requests, and the Assistant Secretary grants, a waiver allowing the Eligible Entity to select an alternative project.63

To the extent there are multiple proposals in a location or set of locations that (1) constitute Priority Broadband Projects and (2) satisfy all other requirements with respect to subgrantees, the Eligible Entity shall use its approved competitive process to select a project subject to the selection criteria set forth below.

While the states have ultimate say in defining terms like “Extremely High Cost Per Location Threshold,” we think this provision may create a lot of fiber converts, especially from the Fixed Wireless Access (using unlicensed spectrum) community.

This has less of an impact on cable than one might think, because all markets that are served with 100 Mbps download/ 20 Mbps upload speeds are already exempt from BEAD funding (unless the Assistant Secretary grants a waiver). Since most cable deployed today is using DOCSIS 3.1 technology, the best solution for cable companies is to upgrade their current plant as soon as possible.

The greatest impact here is in rural markets with fixed wireless and DSL (and un-upgraded DOCSIS 3.0) as the primary means of broadband. There’s a potential secondary impact if the impacted technology solution crosses through or near a “served” area. For example, an application might serve the outskirts of a rural town but need to connect to existing facilities by crossing through an already served location. Or, to get to the unserved location, the applicant passes by several existing cell sites served by an existing cable, telco, or middle-mile provider. The BEAD application maps will be interesting to study as they satisfy the needs of the area yet also create knock-on investment options.

There’s a lot more to cover here, but the bottom line is this: BEAD and related programs will change the cost structure of broadband in low density locations for decades to come. After grants, they will provide a cost basis that will rival their suburban and metro counterparts. And, with additional Universal Service Reform (definition broadened to include broadband, perhaps with a fiber preference paralleling the language above), the cost basis will be matched with additional low-density operating assistance.

We will be writing more about this, specifically analyzing several state proposals as they develop plans to deliver faster speeds throughout their territories. In two weeks, however, we will attempt to answer the question “How will Apple/ Google/ Microsoft impact strategic plans across the telecommunications industry?” Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a great June and go Royals and Sporting KC!