5G is picking up acceleration. The total installed 5G global cell sites are expected to expand from 986,000 cell sites in 2021 to 6.6 million cell sites in 2027 at a Compound Annual Growth Rate (CAGR) of 44.9%. It is not just infrastructure. 5G mobile subscriptions are forecast to grow from 664 million subscribers in 2021 to 4.39 billion in 2027. Similarly, the traffic generated from 5G in 2027 is estimated to increase to 6,268 exabytes and will account for 83% of all cellular traffic. Aside from upgrading traditional network services, 5G is enabling a range of connectivity scenarios that can cater to not only the prosumer market, but also to enterprise verticals, such as manufacturing, healthcare and financial services.

Mobile backhaul links continue to grow

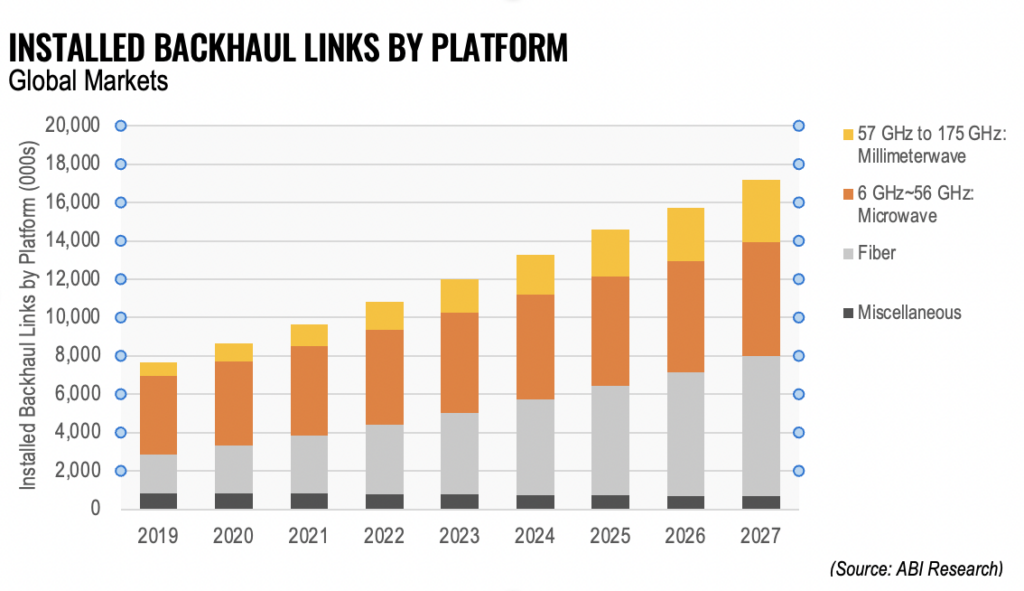

ABI Research forecasts that the total number of macro cell links will increase from around 8.1 million links in 2021 to 11.1 million links in 2027, while the number of small cell backhaul links will increase from 1.6 million links in 2021 to 6.1 million in 2027 at a CAGR of 25.8%. Fiber has made inroads into supporting the cellular Radio Access Network (RAN) infrastructure of the mobile telcos, but has a Total Cost of Ownership (TCO) profile that can only be justified in certain deployment scenarios depending on the market. Therefore, microwave backhaul will still account for the majority of global backhaul links from 2021 to 2027, with around 65%. Wireless backhaul has justified its presence in the market through several innovations in spectrum use and communications technologies. In particular, the use of the E-band (71 Gigahertz (GHz) to 86 GHz), which can support wider channels, has been a game changer.

Leveraging the E-Band

Spectrum channels are substantially larger in the E-band — typically 500 Megahertz (MHz) to 2,000 MHz. In comparison, channel sizes in the traditional microwave bands (6 GHz to 56 GHz) typically range from 28 MHz to 56 MHz in width. Data throughput for the E-band is substantially greater than the traditional microwave bands. The narrower spectrum channels of traditional microwave means that throughput is typically in the order of 0.25 Gigabits per Second (Gbps) to 0.5 Gbps per channel, whereas the E-band can achieve at least 3.2 Gbps to 6.4 Gbps for a 500 MHz and 1 GHz channel, respectively. Additional technology enhancements can push these scenarios even higher. In the past, traditional microwave solutions (e.g., in the 15 GHz to 23 GHz bands) were advocated, as they had longer transmission distances. However, using the latest mmWave antennas, bonded channels, Cross Polarization (XPIC), improved modulation schemes, radio signal stabilization technologies, etc. is pushing the E-band signal propagation distance beyond its previously humble ~3.5 Kilometers (km) and 3.2 Gbps to 6.4 Gbps data throughputs:

- XPIC: An example of these enhancements to E-band Millimeter Wave (mmWave) backhaul solutions can be seen in Huawei’s E-band long-reach solution that can deliver 20 Gbps in urban and suburban environments, which leverages XPIC. XPIC is a technique that can double the spectral efficiency by propagating two signals in a horizontal and vertical plane over the same channel.

- Channel Bonding: By bonding a microwave band (e.g., the 18 GHz band) with the E-band, mobile operators can boost the propagation range from 3.5 km to 7 km. The link in the lower band is used to assure carrier-grade availability (i.e., 99.995%).

- Antenna Stabilization: Another novel mmWave technology that has boosted signal strength and distance is antenna stabilization. mmWave transmissions effectively travel in a very narrow beam. This is useful for frequency reuse, but high winds and inclement weather can misalign the transmissions. Huawei’s Intelligent Beam Tracking (IBT) technology leverages algorithms to maintain the stability of beams, thereby significantly increasing the tolerance for E-band deployment on cell sites. This intelligent tracking technology enables larger antennas (i.e., 0.6 Meter (m) and 0.9 m) to be deployed and increases the E-band signal transmit power to secure a link over longer distances.

By combining these technologies, Huawei has reported that its long-reach E-band solution can reach 10 km by implementing an integrated, high-power solution that boosts the transit power to 24 Decibels per Milliwatt (dBm) compared to the industry average of 18 dBm to 20 dBm and offers data throughput of 20 Gbps.

Multiple transceivers

As infrastructure vendors have continued to innovate and miniaturize their electronics, the backhaul Outdoor Units (ODUs) have come down in size and weight. This has made backhaul equipment highly integrated, and more viable on cell sites. As 5G traffic throughput grows exponentially, mobile operators will have to resort to multiple channels needed per cell site. Previously, only the larger macro-cell sites required such multiple channel configurations for high-traffic links.

Traditionally, to carry multiple microwave channels, mobile operators would deploy multiple ODUs on a given tower, e.g., four ODUs for four frequencies. These configurations are, however, bulky and take up valuable antenna mount space. The latest solutions from backhaul vendors like Huawei now offer up to 4-in-1 transceivers in a single ODU. This represents a 75% reduction in volume and a 30% reduction in power consumption. This multi-transmitter and multi-receiver hardware design has been proactively implemented with the E-band, such as a forthcoming 2T2R E-band transceiver with optimized dual polarization that can transmit up to 25 Gbps with single hardware ODU and up to 50 Gbps with an advanced Multiple Input, Multiple Output (MIMO) setup.

Rural and dispersed suburban communities need backhaul

The E-band is ideal for central business districts and urban centers, but rural communities, or indeed highly dispersed small towns, often require backhaul hops that support high data throughput, as well as propagation distances of 10 km to 20 km or more. One versatile approach has been to adopt a parallel link solution that can support the capacity through multiple bands, which is bulky and difficult to deploy, while new innovations can enable bonding multiple bands together through compact hardware and a single antenna. By using three combined microwave channels (selected from the 6, 7, 8, or 13, 15, 18 GHz bands), the mobile operator can take advantage of a lower TCO profile and sustain long-distance transmissions with data throughput that can support 5G usage. Compared to equivalent standalone deployments, hardware costs are reduced 50% and the tower space footprint by 67%. Huawei has demonstrated this in its SuperLink solution, which has integrated three 4-in-1 ODUs and has a single 3-in-1 antenna. Such links can deliver 10+ Gbps capacity over potentially 20 km.

Backhaul needs to be green

Since the 2021 United Nations Climate Change Conference, several industries have started to realize they need to lean into green initiatives, but they also need a 360º perspective. It is not just the Carbon Dioxide (CO2) impact of manufacturing the telecommunications equipment that matters, but also the CO2 footprint of deployment and long-term maintenance. Over a 10-year period, microwave equipment results in a 1,100 Kilogram (Kg) CO2 footprint, fiber-optic cable deployed on telephone poles equates to 2,400 Kg and buried fiber results in 4,400 Kg. The differential is the result of the additional machinery, site excavation, poured concrete, masts and conduit, etc.

Energy savings can also be generated through power consumption efficiencies, such as by using highly integrated equipment, such as multiple transceiver ODUs and multiband antennas, for a constrained power consumption profile. Furthermore, traffic-aware strategies like Huawei’s ECOwave microwave technology can result in 8% to 10% power consumption savings.

Conclusions

5G subscriber adoption is ramping up as 5G-capable handsets have gone mainstream. 5G cell site rollouts are also starting to build up, not just in very developed markets, but across geographies and demographics. Fiber-optic will remain a useful backhaul platform for mobile telcos, but microwave and mmWave backhaul systems are proving to be vital platforms for a range of small cell and macro cell deployments in urban centers, as well as rural communities. Historically, mobile operators have opted for microwave links in situations where they could not deploy fiber-optic, but the rapid pace of innovation and equipment miniaturization has now opened the mmWave bands. A raft of technologies, such as highly integrated multi-transmit, multi-receive ODUs, multi-band antennas for traditional bands and an enhanced E-band range, have improved the propagation characteristics substantially, while delivering on the much-needed 5G-capable capacity.

In March 2022, The 3rd Generation Partnership Project (3GPP) announced the finalization of Release 17. Release 17 and Release 18 presage a range of “5G-Advanced” features that will herald a number of upgrades for cell sites and mobile devices. Release 17 RAN upgrades include further enhanced massive MIMO, enhancements to the uplink control and data channel design that improve coverage, potential access to additional spectrum (24.25— 52.6 GHz up to 71 GHz), the introduction of enhanced Integrated Access Backhaul (IAB) to support simultaneous Transmit (Tx) and Receive (Rx) and a simplified repeater solution for lower-cost cell site deployments in rural areas. These developments will boost the data throughput handled by each cell site, but as a result, mobile operators will need to take the requisite steps to upgrade their backhaul infrastructure to keep up with 3GPP and prosumer developments.