Beginning of year greetings from Las Vegas and Kansas City (picture is of the LG “booth” which many of us fondly remember as one of the must see displays at CES). This was a news-generating two weeks, so we will shorten the market commentary and spend most of our time focused on CES and some early preannouncements from T-Mobile and AT&T.

The week that was

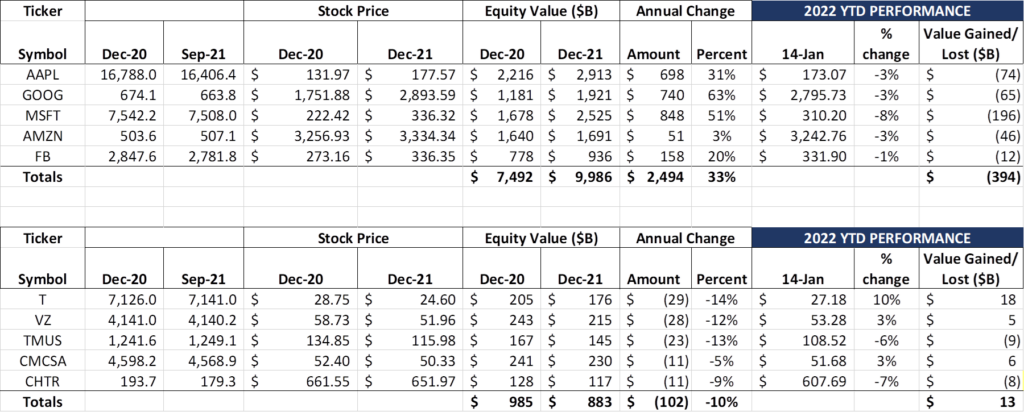

Another year’s beginning, another pre-earnings announcement selloff for the Fab Five. Last year, they lost $305 billion for the two weeks ending January 15. In 2020, prior to COVID lockdowns, they lost about $200 billion in the first two weeks of the year. Our prediction is that earnings season brings a comeback, but, as we incorrectly predicted for 2021, $2 trillion market capitalization gains for the group as a whole will not continue in 2022.

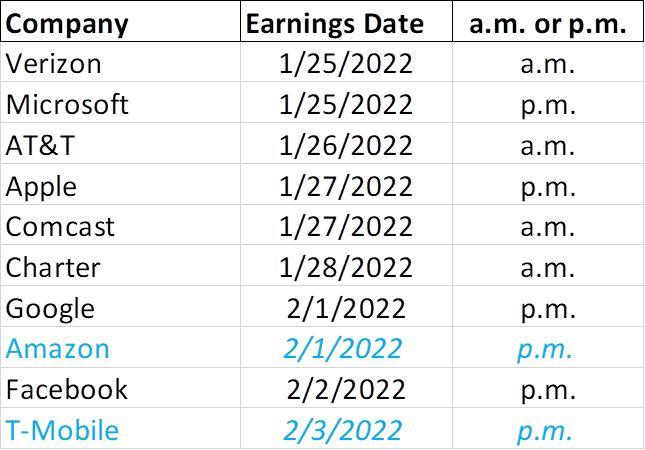

For those of you are wondering exactly when that comeback will occur, nearby is the earnings calendar as of January 15 (Amazon and T-Mobile are estimated dates using last year’s earnings day as a proxy). As we will discuss below, both AT&T and T-Mobile have preannounced some subscriber metrics, but most companies are pretty tight-lipped until all costs come in. We expect a very strong quarter for Apple, especially for iPhone on a year-over-year comparison due to the iPhone 12 sales delay (Q1 2022 will be a more difficult comparison). We also expect some discussion of supply shortages (impact to Xbox and Surface sales; impact to Amazon’s total business) and discussion of the severity and projected duration of inflation. By the time we publish the next Brief, we should have the beginnings of a 2022 thesis on these topics.

On Friday, the latest wireless auction winners were announced (link here) and, to no one’s surprise, AT&T and Dish were the big winners, with already mid-band spectrum rich T-Mobile a distant third. Per Sasha Javid’s report (here), it appears that both AT&T (40 MHz) and Dish (30 MHz) won areas covering 100% of the continental US. This win for AT&T brings them a lot closer to Verizon (who won no licenses in Auction 110), but T-Mobile still continues to outpace both of their competitors in deployment timeline and MHz per market.

In case you are not up to speed, things continue to brew behind the scenes with respect to C-Band, the FAA and Verizon/ AT&T. While both of the major carriers agreed to delay their spectrum launched until Wednesday, January 19 (see Bloomberg summary here), the FAA came out with a new warning last Friday for all Boeing 787s (per the Washington Post article here, there are 137 such planes in the US and they are predominately used for longer flights). Per the order:

“The FAA determined anomalies on Boeing Model 787-8, 787-9 and 787-10 airplanes due to 5G C-Band interference which may affect multiple airplane systems using radio altimeter data, regardless of the approach type or weather. These anomalies may not be evident until the airplane is at low altitude during approach.Impacted systems include, but are not limited to: autopilot flight director system; autothrottle system; engines; thrust reversers; flight controls; flight instruments; traffic alert and collision avoidance system (TCAS); ground proximity warning system (GPWS); and configuration warnings.

During landing, this interference could prevent proper transition from AIR to GROUND mode, which may have multiple effects. As a result, lack of thrust reverser and speedbrake deployment and increased idle thrust may occur; and brakes may be the only means to slow the airplane. Therefore, the presence of 5G C-Band interference can result in degraded deceleration performance, increased landing distance and runway excursion.”

Per the Washington Post article, there could be other makes and models impacted. Both the FCC and the two large carriers are adamant that there are no safety concerns, and they have also agreed to keep 5G guard bands in place around airports through July.

AT&T and T-Mobile preannounce operating results – implications for the telecom industry

One of the great events that usually occurs alongside CES in Las Vegas is the Citibank AppsEconomy conference. While virtual this year, there was no lack of participation and content. Both AT&T and T-Mobile preannounced selected fourth quarter metrics. AT&T’s CEO, John Stankey, appeared at the conference as well as Hans Vestberg from Verizon and Peter Osvaldik from T-Mobile.

AT&T announced the following (news release here; John Stankey’s edited transcript here):

- 880,000 postpaid phone net additions for the fourth quarter

- Over 400,000 postpaid other net additions for the quarter (~1.3 million total postpaid net additions)

- 270,000 fiber net additions for the quarter

- 2.6 million incremental homes passed with fiber (for all of 2021), with another 400,000 homes coming online early in 2022 (Stankey reaffirmed AT&T’s 30 million homes passed with fiber by the end of 2025 objective)

- 73.8 million total HBO Max customers (which includes international)

It’s important to place these numbers into the timeline and context of John Stankey’s tenure as AT&T’s CEO. In September 2020 (a few months after taking the helm and still in the middle of the COVID-19 pandemic), AT&T made the decision to offer the same promotions to existing and new customers. This was roundly viewed as an expensive (and perhaps desperate) marketing ploy, but AT&T remained resolute in their strategy, arguing that “it’s more valuable to keep an existing AT&T customer than to acquire a new one.” Simply put, the argument is that lower monthly EBITDA per customer driven by increased promotion is offset by increased customer tenure and therefore higher customer lifetime values. While AT&T did not pre-release their churn figures for the fourth quarter, their historical postpaid trend has been positive, with monthly postpaid churn reduced eight basis points to 0.91% in the first three quarters of 2021, and postpaid phone churn steady at 0.72% for the same period.

In his Citibank appearance, Stankey also reiterated the following technology and customer strategy:

“We want to make sure all of our network deployment, whether it be fiber or 5G is done in a way where we’re taking advantage of our dense and rich fiber networks and we’re putting the bandwidth where customers need to do it, and we’re evolving a product in a way that we can have a relationship with a customer that says, it doesn’t matter where you go, we will handle your bandwidth needs. And we may choose to do that on 5G or we may choose to do that on fiber. At the end of the day, that should be something that’s fairly transparent to the customer. It should be done in a way that makes sense for them and a product that makes sense for them.”

This is an interesting comment in many respects. The most striking element is it’s geographically-focused tone. This statement makes a lot of sense for Miami, Atlanta, Chicago, Dallas and Los Angeles customers, but what about New York City, Seattle, Denver, Washington DC, Boston, Rochester or Cincinnati? Stankey goes on in his appearance to state (our paraphrase) that, because of the migration to 4K and 8K resolutions, combined with the transition from broadcast to unicast transmission, fiber will likely be the best solution for 70% of the homes in the United States (or, said differently, that 30% of the homes in the US is going to be the addressable market for a fixed wireless solution).

It’s a bit premature to say that AT&T is throwing in the towel for out-of-region consumer relationships, but it is not an over exaggeration to state that their investment priorities are rapidly shifting to AT&T’s fiber markets. If the “it doesn’t matter where you go, we will handle your bandwidth needs” statement is true, AT&T’s focus appears to be rapidly turning to owning as much of the home communications needs as possible. Interestingly, that mirrors the same objective as their cable competitors, who effectively eliminated AT&T’s foothold in tens of millions of households with their LEC-quality phone services in the 2000s.

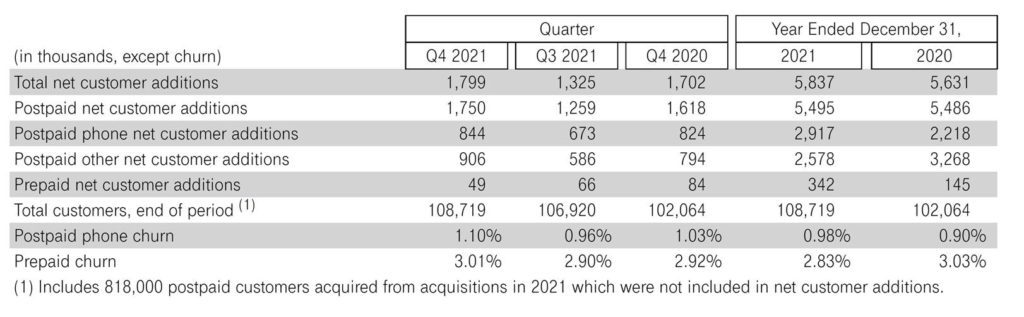

Where does that leave T-Mobile (who preannounced most of their subscriber metrics on January 6)? Here are their most recent results in table form (full release here):

T-Mobile’s CFO, Peter Osvaldik, appeared at the same Citibank conference the day after John Stankey (webcast here as T-Mobile does not provide transcripts). As we have discussed in previous Briefs, T-Mobile’s 4Q earnings storyline is going to become more focused on the Sprint transition than merely on their share of gross additions. In his presentation, Peter made an interesting observation that had Sprint matched Magenta’s churn, postpaid net additions in the quarter would have been 1.4 million, the highest in history. While this is a nice “what if” statement, the point is that some Sprint customers chose another carrier than stay with T-Mobile, and those 550-600K customers likely boosted AT&T and Verizon’s figures.

There is no doubt that the transition rubber is meeting the road at T-Mobile as they continue the difficult process of migrating [non-iPhone] Sprint customers. Peter reiterated the CDMA and Sprint LTE sunset targets of Q1 and Q2 2022, respectively, and discussed the need to make sure that every transitioned customer can access T-Mobile’s 600 MHz spectrum band (LTE Band 71). T-Mobile also has an additional advantage of low market share in two large segments: Enterprise customers and rural. We expect more color in both of these areas.

The big story for T-Mobile, besides the continuing network deployment success and Sprint customer migration, is their Home Internet success. T-Mobile added 224,000 net customers in 4Q and 646,000 net customers for the year. About a quarter of their total “postpaid other” net additions came from Home Internet (a $50 ARPU product yielding above average incremental margins), and also highlights how dramatic the drop was from tablet and other sales on a year over year basis (from roughly 3.2 million postpaid other net additions in 2020 to just over 1.9 million in 2021). Those gains are likely someone else’s loss — we will determine the impact on Lumen, AT&T, Frontier, Windstream, Consolidated and others over the coming weeks (although Frontier preannounced here and it looks like they were net gainers for the first time in five years).

The last major point T-Mobile made in the Citi presentation was capital acceleration – moving as many of the 2023 objectives into 2022 as possible. While Peter did not disclose the amount of the increase, we would not be surprised to see up to $500 million of accelerated network investment in 2022. These will be used for both coverage (e.g., meeting the 300 million mid-band 5G objective sooner) as well as capacity.

Implications for the telecommunications industry are twofold. First, T-Mobile, as they quickly complete their consolidation to one network in 2022, is going to have more cash to increase capacity, make selected acquisitions, or return to shareholders through stock buybacks. There’s a lot more fuel for the tank, and T-Mobile continues to operate Sprint’s wireline network.

Second, T-Mobile’s initial success with Home Internet puts the pressure on Verizon to demonstrate the value of their out-of-region fiber deployments. To date, outside of increased capacity for metro 5G handsets and sports stadiums, the value has been difficult to explain. T-Mobile is beginning to post real numbers, and the expectation is that Verizon will follow suit.

Some final thoughts on CES 2022

Despite the myriad of cancellations (including the to-be 6th annual Gordon Ramsay’s Pub dinner) and the continual guessing game of “I wonder who was supposed to show up here?” as I walked the floor, the show was a personal success. My conversations (especially with Samsung, TCL and Roku) were deep and informative, and Eureka Park (home of many startup companies from across the globe) was bustling. I normally take two days at the show an leave knowing that I could not have covered it all in two weeks. This year, that overwhelming feeling was replaced with affirmation that innovation continues despite COVID setbacks.

There were many impressive products, but the one that seemed to be the most innovative was not a laptop or a TV or even a vehicle. It was a solar shingle from GAF that can be nailed to a home (see nearby picture and article from CNET here). The Timberline Solar product nails to the roof just like a shingle, and, as a result, protects the roof warranty.

This got me thinking… if a roof can collect solar rays, could an improved version of this product also improve wireless coverage? Said another way, what if Samsung and GAF produced a solar and wireless solution?

That’s it for this week’s Brief. In two weeks, we will discuss the first round of earnings results. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals, and Go Davidson Wildcats and Go Chiefs!