Holiday greetings from the Midwest (pictured is our Thanksgiving view of Table Rock Lake from our Branson family rental) and South Central US. We hope everyone had a restful Thanksgiving week and look forward to seeing those of you attending CES early next month.

Speaking of CES, we expanded our table capacity last week, and have four new seats for our “open table” dinner at Gordon Ramsay Pub on Wednesday, January 5th, at 7 p.m. If you would like to join a lively conversation, please let us know by email (sundaybrief@gmail.com) and we will save you a spot.

Jim will also be participating (on behalf of American Broadband) in the Fierce Wireless Digital Divide Summit this month (details and free registration here). Specifically, he will be participating in “The Opportunity For Fiber” panelist session on December 14 moderated by a long-time friend of The Sunday Brief, Craig Moffett. The panelists met last week for a tech check dry run and it will be a lively session – please consider attending.

This week, after our market commentary (the Apple inventory assessment will be posted Sunday evening on the Sunday Brief website), we will parse John Malone’s recent interview with David Faber. We recommended it for everyone as a Thanksgiving view, but it’s so good, we are going to use it to reiterate key themes as the industry prepares for a new year.

The week that was

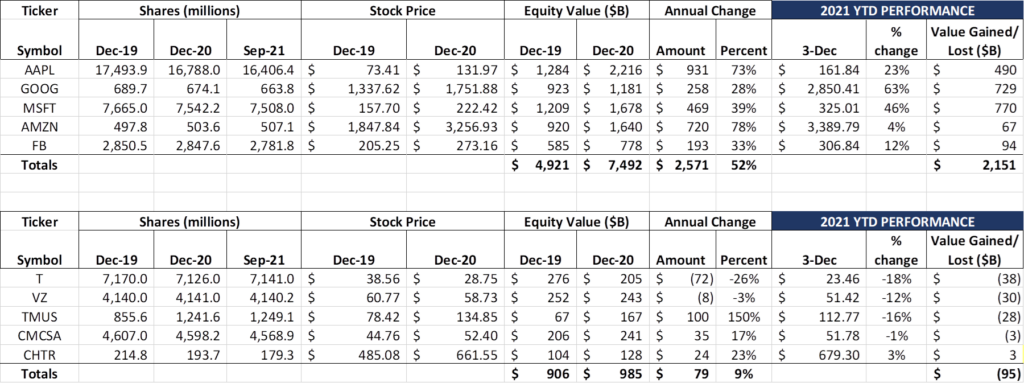

Volatility returned to the markets in the last two weeks sparked by fears of a new strain of Covid. New outbreaks are never welcome news, but we think that most of the selloff was aided by end-of-year “take the gains now” selling. As a reminder, over the last 14 weeks (roughly since Labor Day), the Fab Five have gained just over $207 billion in market capitalizaiton, a little over 10%. The year-to-date gains for the group still exceed $2 trillion, and the worst performer since the beginning of 2020 is up 49% (Facebook). The Fab Five multi-year (nearly a decade) run is unprecedented and only marginally dented by the recent selloff.

With equity value gains come expectations of long-term cash flow growth. When those aggregate expectations comprise a significant majority of (or even exceed) the company’s current total addressable market (TAM), strategies expand into adjacent markets. This is what is happening with cloud expectaitons for Amazon, Microsoft and Google. Not only are the cloud providers quickly collapsing customized chipset design and manufacturing into their solutions, but, as Amazon unveiled this week, they are now extending their reach into 5G private networks:

Adam Selipsky, CEO of AWS, described several new features of the service: a) No per device charges, b) automated configuration, c) AWS-integrated hardware, and d) no license procurement/ shared spectrum. After his short introduction of the service, Seplisky introduced Kyle Malady Jeff McElfresh Neville Ray Marc Rouanne, Chief Network Officer of Dish. Marc speaks about open RAN with authority and experience, having been an executive at both Acatel-Lucent and Nokia.

We have not spent a lot of time at The Sunday Brief discussing Dish for a variety of reasons, the most important of which is that the Patterson Advisory Group was working in late 2020/ early 2021 under a non-disclosure for a potential network partner. But, from publicly available sources (namely presentations by Dish executives where they describe their ambitions in high-level terms) we can confirm that their architecture is scalable and low-cost. It is also highly dependent on the availability of fiber, particularly to the building/ cell site.

Dish currently has an equity market capitalization of $31 billion. Amazon gained more than 2x that amount in market capitalization (in a volatile market) over the last two weeks. If AWS Private 5G succeeds (we see no reason why it shouldn’t), Amazon should be able to support a broad rollout of Citizens Band Radio Spectrum (CBRS) in conjunction with Dish. There’s no reason to believe that Microsoft will not follow suit with a modified Azure offering (we wrote about their 2020 announcement here).

On top of this, we have every reason to believe from the recent debt announcement that Dish purchased an additional $5 billion of mid-band spectrum in Auction 110, consisting of the neighboring 3.45–3.55 GHz band (CBRS extends from 3.5-3.7 GHz). Unlike CBRS, which has a predefined sharing system (see our Sunday Brief on the topic here), the currently auctioned band is licensed to the winner of each 10 MHz portion (there were ten 10 Mhz portions auctioned in each Partial Economic Area or PEA) . This does not prevent the winning provider, however, from creating a shared network for AWS, Google, and Azure (and, for hardware scale, they would be advantaged by enabling shared capacity across the entire band).

Marc Rouanne’s speech at AWS was expectedly light on details. Dish has no reason to overhang the market because they are a component of a much larger solution (and also because many of their named fiber suppliers do not have last mile connections into buildings – yet). That Amazon put the “AWS of Networks” on stage instead of a larger established partner both says a lot about their confidence in the Dish architecture and signals their willingness to enable a completely different approach to enterprise networking.

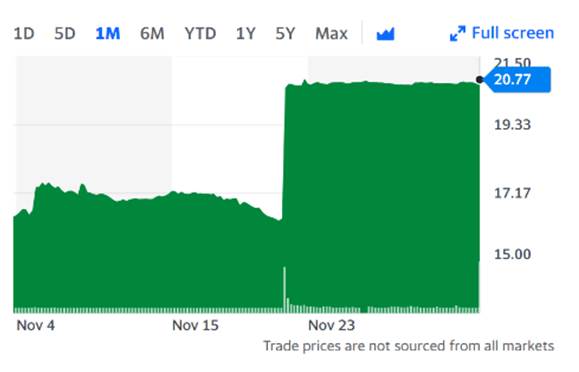

Speaking of completely different, many of us reacted with headturns to Ericsson’s acquisition of Vonage (for $6.2 billion – more in this Bloomberg article and in the Ericsson announcement here). 32x trailing 12-month EBITDA is a lot for any company, especially one who faces competition from providers like Microsoft (who bought Skype a decade ago). Great news for the Vonage shareholder (see nearby stock performance); it’s uncertain whether this transaction puts Ericsson in a leadership position.

We also can’t let the approval and closing of Verizon’s acquisition of Tracfone (announcement here) go without a brief mention. The cash component of the transaction amounted to ~$160 per subscriber, with another $150 or so per subscriber in Verizon stock. With an average customer life of 27 months (100/ 3.8% monthly churn rate), this equates to an implied post-tax value of ~$12/ mo. (assuming some present value assumptions regarding year 2 and 3 customer cash flows). There is no doubt that Verizon bought Tracfone simply for the value of its large customer base – the math simply does not work otherwise (re: the ARPU of an average Tracfone customer in 3Q 2021 was $30/mo. – this implies a base after-tax margin of 40%). Even the “retained value of a large wholesale customer” argument falls apart here, although Verizon’s profitability from every de-prioritized MB of traffic is high.

As we have discussed in previous Briefs, Verizon bought Tracfone because of the value of their 90,000 doors. They are desperate eager for more metro-based offerings as they seek to monetize their 5G Home Internet product. Tracfone fits that need to a tee, targeting specific streets and neighborhoods to specific dealers (see Verizon’s coverage map here to see what we mean). The extent to which dealers need additional support following the pandemic is one risk for Verizon, as is the temporal nature of the channel (with chargebacks rarely exceeding 90 days and many dealers selling multiple brands, it’s hard to see how Verizon’s Internet product will have sub 2% churn). However, it’s a terrific opportunity for Verizon and will place additional pressure on Metro by T-Mobile and Cricket (AT&T). Bottom line: Look for Page Plus Internet or Ready Mobile Internet very soon. Verizon has had a lot of time to plan for Tracfone integration, and they are going to be very quick to market with high incremental margin offerings.

The John Malone CNBC interview – explained and deciphered

Every year, CNBC’s David Faber sits down with Liberty Global CEO John Malone to talk about the state of the communications industry. Most years, the content is shelved to CNBC Pro, a premium service, with selected exerpts posted to YouTube. This year, CNBC posted the entire interview on their website (here). CNBC also has a highly edited transcript of the interview here. It’s full of Malone’s insights, and, while we can’t say we agree 100% with his view of the future, it’s very sound and deserves scrutiny (for those younger readers who need a bio on John Malone, his Wikipedia post is here).

David Faber begins the interview with a series of questions involving value creation in the Direct to Consumer (D2C) segment. While Faber starts the interview focused specifically on Netflix, Malone has a much higher-level response. Here are some quotes from that portion of the interview (roughly the first 20 minutes of the video):

“There will be a broad set of services provided to the consumer, some of which will be entirely ad supported, some of which will be hybrid, and some of which will be subscriber funded only, and the degree to which niches can be crested and defended in the space profitably versus big, broad services offerings that attempt to be everything to everybody in every country. I think we are early in the game.

Success will be driven, by a high degree, by quality perception…. HBO, for many years, when we had three or four premium service offerings… was massively more profitable compared to their competitors. Most of it was perceived quality.

The cable world got overpriced on its content offerings because it tried to incorporate too broad a set of content, particularly in the sports area… We have not yet seen a Direct to Consumer hybrid that includes sports, which has always been an important penetration driver as well as stickiness factor. Disney has a lot to work with in that space, but they also have a lot of commitments… how they morph from the profitable linear sports world into a hybrid world that includes some advertising… these are the evolutionary things that determine that outcome.”

Malone leaves the array of possible outcomes very broad, ruling out only a “gigantic offering” and emphasizing that the pace of change will be evolutionary, not revolutionary. While he may be projecting his desires about the pace of change based on his sizeable Charter stock holdings, it’s a clear acknowledgement that the current linear model will change and that the Electronic Programming Guide (the home screen for many linear cable offerings) will be replaced with a more “random” selection process (we think that there will be more Artificial Intelligence/ Machine Learning applied here and that the EPG will itself morph to look more like the YouTube home screen).

Malone’s comments that there will be multiple means to price content to achieve the highest profitability levels is also important (a bad paraphrase of his quote would be “If you have a lot of information on how the household behaves, use it to extract subscription stability”) Separately, Malone also notes that works in the US should not be misconstrued as a proxy for international expansion.

The next topic (and the last one we will discuss in depth here) is Malone’s perception concerning overbuilding cable’s hybrid fiber coax plant. Malone introduces his views with the following statement:

“Too much competition can kill any business. If you have a lot of cheap money creating too much competition, particularly in capital intensive businesses, it can wreck the profitability of any business.”

David Faber presses him on this comment, asking him if he thought cheap capital + more efficient fiber to the home technologies represented a threat to cable. Malone replies as follows (roughly minute 31 of the interview):

“If you have capital that’s willing to settle for very low returns, it’s a big threat. The biggest threat has always been the stupid guy with a lot of money coming into your business, because they may not end up with much profitability, but they sure as hell can damage the profitabliity of the incumbent. The vulnerability of the incumbent varies from market to market, depending on just how cheap it is to overbuild and just how cheap it is for the incumbent to upgrade. So you could be in the situation where the incumbent is forced to expend that it otherwise wouldn’t, or does it early in order to repel a competitive overbuilder.”

“I can remember when (Verizon) FiOS was the rage, and Ivan [Seidenberg, Verizon’s CEO at the time] was going to overbuild everybody, and his bonus was based upon how many miles he could build. His comment to me was ‘We may not be very smart, but we’re big, and if we fall on somebody we can hurt them.’ Well, that’s not a great motivation for investment return… I think the economic return on what they spent was very poor. Now, it is true that fiber technology has improved, and you can build a fiber network cheaper than you use to be able to, but that’s just a small piece of the total cost of building a business and marketing it and trying to gain share from an incumbent.”

“I think if this evolves to be a stable duopoly in the U.S., Charter has a lot more to gain on the wireless side and the incumbents have a lot more to lose on the wireless side than the incumbents do on the overbuild side. The incremental capital required for Charter and Comcast to step on the accelerator on wireless with aggressive pricing is much more doable, has much less incremental capital requirements, and can extract a bundle price premium better than the incumbent overbuilders do.”

John Malone is correct that historically the case for overbuilding has required higher barriers to entry. Imagine if Verizon had decided only to provide broadband and not FiOS video (and, to a lesser extent, phone). Share would have plummeted because the offering would not have been comparable (and therefore not competiitve). That world is very different today, with increasingly larger percentages of gross additions (e.g., new homes built) subscribing to broadband services only from Charter and others (as of 3Q, the percentage of single product relationships at Charter was 46.4%, up from 42.7% in 3Q 2019).

Malone is correct, however, in his assessment of wireless + broadband as the bundle offer of the future, and that Charter and Comcast have an easier capital equation (and time to market advantage) versus an incumbent AT&T, Lumen, Frontier, Windstream or Verizon. As Malone says in the first part of his response above, it will vary with each market.

It is interesting that both Faber’s question and Malone’s response omit the role of increased broadband funding (grants/ subsidies/ loans) in the overall competitive equation. As underserved areas of metro areas are examined (especially in Multi-Dwelling Units), cable companies could face a third-party competitor with incrementally low costs and a more positive reception than the incumbent (with less/ no interest in high-cost linear video programming). Also, in more rural markets (where, per Frontier’s earnings, cable market shares routinely exceed 70%), additional competition can significantly impact profitability (due to the relative depth of the scale curve due to lower density). Perhaps this is Malone’s libertarian hopefulness emerging, but that overbuilder could be government-funded, and in that case the duopoly goes away for a long time.

What is also not considered in this interview (likely due to time constraints) is the disintermediating role traditional mobile providers play with some segments of broadband. T-Mobile and Verizon have made commitments to take share (again, broadband only or Broadband + mobile), and, given their network architectures, might have the ability to “edge in” for a segment of the population (e.g., 1-2 person households) that has lower overall Internet demands.

Malone also addresses the merger of WarnerMedia and Discovery (minute 35), the role of news in the streaming world (which includes favorable comments on Fox News and his view on the “new CNN”), his role as a shareholder without a special or separate class (minute 41), the timing of any WM/ Discovery transaction (minute 44 – “the deal may happen sooner than people think”), the near-term leverage drawdown driven by operating synergies, and the changing role of live sports, particularly regional sports, in the D2C world (minute 47). Malone then declares Google and Microsoft natural monopolies (minute 52), and then closes with glowing comments on each of his managers.

Bottom line: We rarely get to see through John Malone’s wide-angle telecommunications lens. This interview articulates the dynamics of the industry from a pioneer. While, in our view, he omits a few items, it’s the best assessment of the many competitive and product intersections faced by companies today.

That’s it for this week’s Brief. In two weeks, we will look at the winners from the latest FCC airwaves auction and summarize key themes going into CES. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals, and Go Chiefs!