November greetings from the Midwest and Southeast, where we are hitting the road and logging many miles. Pictured is the Vernon County, Missouri courthouse.

After a short summary of market capitalization changes over the past two weeks as well as a short discussion of iPhone backlogs (which are not improving at the pace we saw with the iPhone 11 launch in 2019), we will dive into several intriguing comments made by corporate executives during their earnings calls. This week, we will focus on Charter, Comcast, and T-Mobile, and will complete our analysis in the November 21 Brief with discussions from other players.

One administrative note – Jim will be attending CES 2022 this year, and, like years past, we will have an “open table” dinner at Gordon Ramsay Pub on Wednesday, January 5th at 7 p.m. Seats are limited, but conversation topics are not. Please let us know by email (sundaybrief@gmail.com) if you would be interested in joining.

The week that was

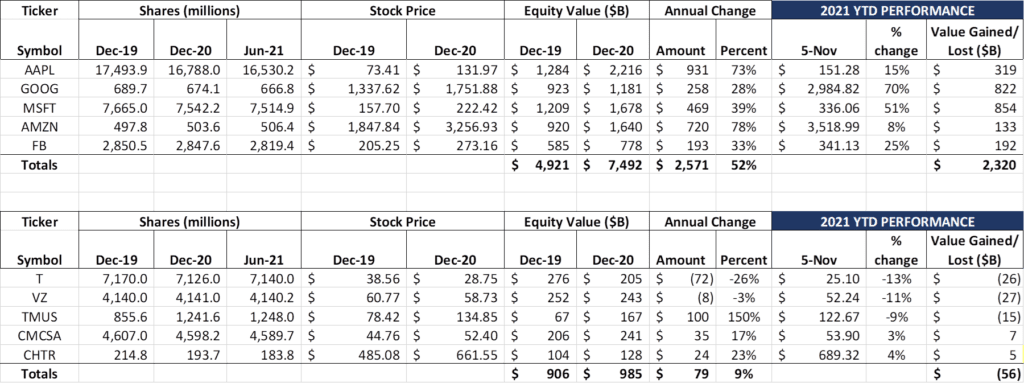

Each of the Fab Five announced earnings since our last Brief, and the markets liked what they saw. Over the last two weeks, each stock in the Fab Five (including Facebook) rose, and the group as a whole added $526 billion in market capitalization (led by Microsoft +$202 billion, and Alphabet/ Google +$142 billion). This contrasts with the Telco Top Five, where four of the five stocks lost value in the last two weeks and the group as a whole lost $8 billion.

Please note that we will address new share counts in the next Brief as well as ending cash balances for each of the Fab Five. Spolier alert – more share buybacks and constant cash balances are on the horizon (which may change if inflation accelerates beyond current levels).

Should any “Santa Claus” rally occur, the Fab Five will likely exceed last year’s $2.6 trillion annual market capitalization gain, something we did not think would happen. Four of the five could exit 2022 with company valuations exceeding $2 trillion, a feat not contemplated for any individual company a few years ago (re: the entire value of the US telecom services industry is less than a trillion – 50% (or less) of the value of Amazon, Apple, Google, or Microsoft). A benign blog post like the one mentioned in the last Brief (Microsoft entering the long-haul transport business) now sends shock waves through Lumen/ Level(3), Verizon, and AT&T. When the cloud titans have tens of billions of cash to devote to their efforts, how relevant and influential are Ma Bell or Big Red?

Since our last Brief, there was a partnership announcement between Dish and Helium Networks, one of our earliest “Up and Comers” companies (October 2019 post here). Helium, already successful in forming a user-driven 900 MHz network of over 240,000 hotspots (map here), has expanded their network reach to include a flavor of the CBRS band called General Authorized Access (GAA). Think of it as the femtocells of the last decade meet the shared spectrum monetization opportunities of this decade. (Full disclosure – we put the Helium Hotspot through its paces earlier in 2021 while we lived in North Carolina and earned a few thousand dollars in Helium Network Tokens. We will receive our new CBRS version later this month at our Kansas City location).

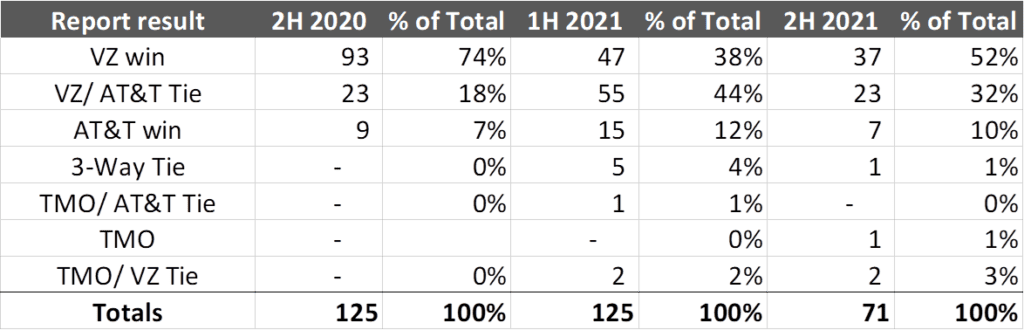

Finally, many of you have asked about the latest RootMetrics RootScore reports. We still continue to track them, but not as closely as in previous years. Through Friday, they had published 71 metro reports, and Verizon continues to dominate:

For those of you who are not familiar with the RootMetrics RootScore reports, a full description of their methodology can be found here. Our view is that they should be viewed in conjunction with other third-party measurements (Ookla, Opensignal, umault, etc.).

What we like about the RootMetrics analyses are the long-term trends that emerge from each metro measured. That’s why we were surprised at AT&T’s strength in the first half of 2021 when they drove the most common result away from “Verizon win” to “Verizon/ AT&T tie.” We think that the excess FirstNet capacity deployed was one of many sources of AT&T’s surge, and are not surprised to see 2H 2021 results revert to an “in between” result. Verizon is breaking many of the 1H 2021 ties, while AT&T is flipping cities like Baltimore, Orlando, and Philadelphia into wins. T-Mobile also registered their first outright win in the latest results. Full findings are here.

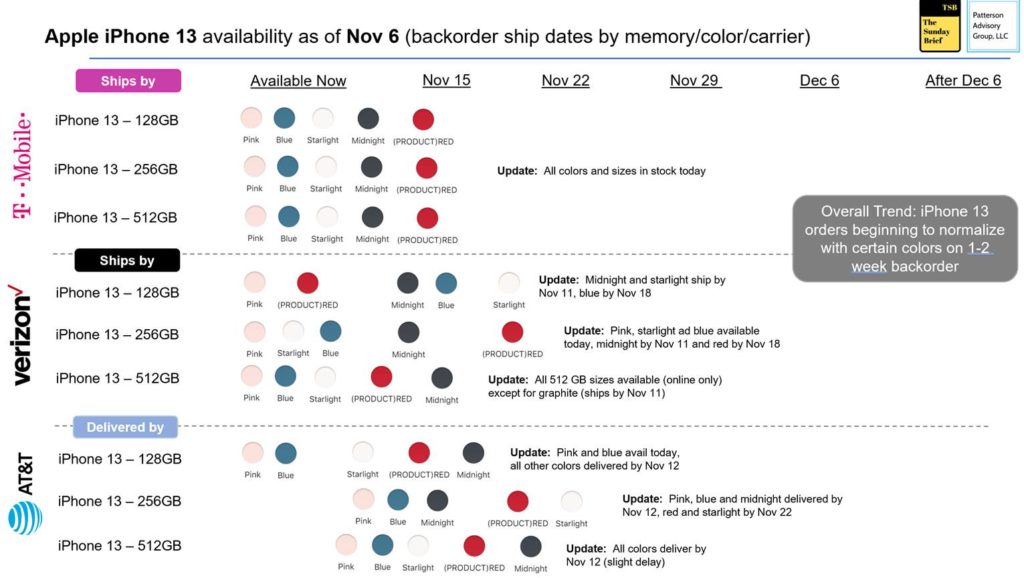

iPhone 13 availability – even Apple has constraints

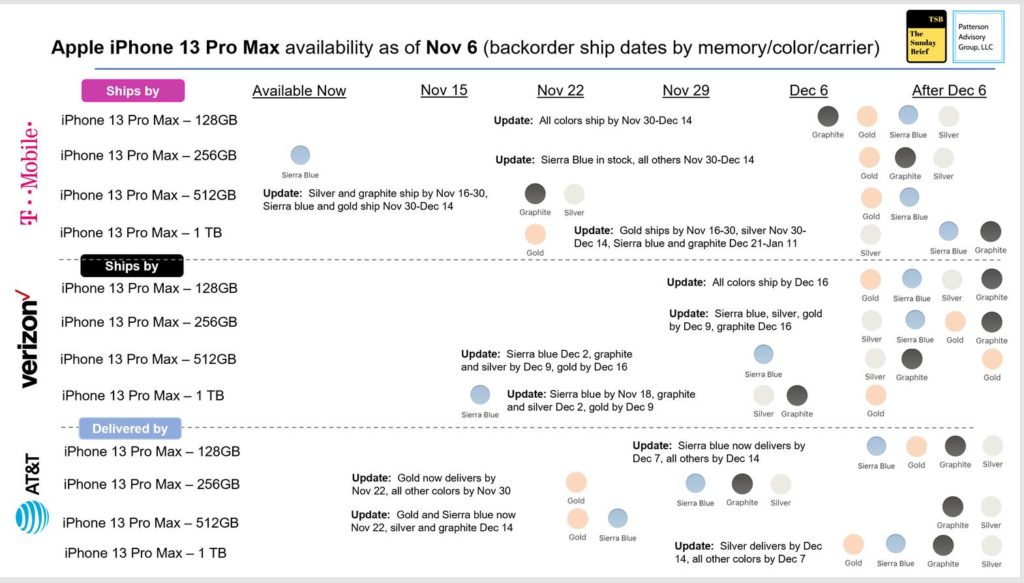

For those of you who have not been keeping up with our online posts (here and here), we will include a short summary of the iPhone 13 supply chain situation. Keep in mind that this is an online check only: in-store inventories may differ. We have been checking each of the Big 3 wireless carrier websites on Saturdays for the last several weeks, and chronicling their “ships by” (T-Mobile and Verizon) or “delivered by” (AT&T) dates.

If you are interested in an iPhone 13 (not the Pro or Pro Max), the situation looks similar to previous iPhone launches – specific color/memory size backlogs, but no widespread outages. Even AT&T, who has been applying new customer promotions to existing customers, has limited backlog with the iPhone 13:

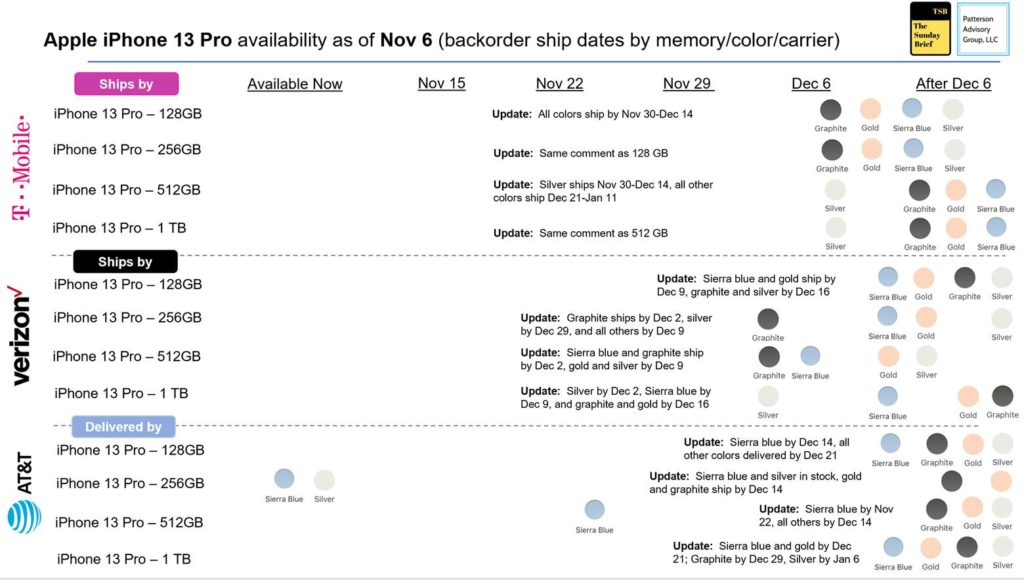

Absent some supply constraints with 256 GB or 512 GB sizes at AT&T, things are pretty stable for iPhone 13 availability. This is definitely not the case for the iPhone 13 Pro and iPhone 13 Pro Max. Here are their charts (iPhone 13 Pro first):

The iPhone 13 Pro has been supply constrained since launch. When 31 of 32 color/ memory size options at Verizon and AT&T are showing availability dates 3-4 weeks out (note: it’s a full six weeks after the first devices went on sale), there’s a problem. Usually, this clears up around the beginning of December (selected color/ memory size issues, but generally available by the Holidays). If the reports from the Nikkei Asia are to be believed, however, that may not be the case. They reported last Monday that Apple is redirecting chipsets from iPads to iPhones, resulting in 50% production cuts for the former, prompting Apple CFO Luca Maestri to guide down iPad sales for the current quarter on Apple’s earnings call.

That has already happened, and the system continues to be stretched. Last year, it was a little easier to manage inventories with consumers turning to on-line channels (versus retail stores) for fulfillment. While this remains popular, in-store purchasing is still preferred by many shoppers. Anything that hinders the “reopening” experience will not be received well by prospective switchers, even though it’s a common theme for a broader array of products and services in the post-pandemic world.

Bottom line: Apple is the undisputed king of smartphone supply chain management. But even the king can experience issues. We will continue to post updates to the site for the iPhone 13, iPhone 13 Pro and iPhone 13 Pro Max models until the model reaches a steady state, but we have a sneaking suspicion that availability will continue to slip. This impacts the gross additions pool (particularly important for T-Mobile and the cable MVNOs).

What they said on those earnings calls (Part 1)

In the last Brief (here), we discussed AT&T and Verizon earnings. Here are a couple of conclusions from that report:

- AT&T is going to have a difficult operational and financial knothole to pull through as they convert copper customers to cable

- Verizon’s dependency on the cable MVNO growth vector is increasing

- Cable will increase their messaging that residential customers purchase a consistent bandwidth experience, and not a specific technology

- Verizon’s local fiber deployments, initially for 5G, provide a differentiator versus AT&T. While Big Red continues to have asset utilization issues pertaining to their local fiber (One Fiber has not taken flight – yet), at least they have a new, dense, out-of region asset to monetize

- As a result of increasing debt loads and minimal profitability improvements, investors are becoming impatient with AT&T and Verizon, driving down investor returns (AT&T down ~$100 billion in market capitalization since the beginning of 2020; Verizon down ~$35 billion).

One additional theme that we did not discuss in the last Brief but which prevails in some circles is the idea that “our competitiveness will get better with C-Band.” There is no doubt that copius mid-band spectrum is important to overall speed gains (see this report from Opensignal), but video quality on a smartphone does not materially change with C-Band (unless it’s extremely poor, which we know from the RootMetrics RootScore reports is not the case). How will an (U)HD-quality screen demonstrate the benefits of 50 Mbps versus 350 Mbps? The picture will be no different as it’s already receiving the throughput required to deliver the highest quality.

The differentiators lie with less congestion/ higher simultaneous device performance and fixed wireless Internet services (an application that does not require the aforementioned screen). This is why we have a better feeling at the margin about Verizon’s prospects than AT&T’s.

However, all of this pales in comparison to Comcast and Charter’s array of options. Both have been deploying fiber deeper into their networks (Charter referenced greenfield builds to housing developments and Multi-Dwelling Units (MDUs) that were completely fiber), and both have intensified their deployment of hi-band DOCSIS 3.1 deployments in preparation for DOCSIS 4.0. That “inside out” transition is a lot easier than copper to fiber.

Here are Dave Watson’s (CEO and President of Comcast Cable) comments on the topic (full earnings transcript here):

“Our approach is to consistently focus on value and whether it’s fiber or not. Our goal is constantly innovate, position the greatest network, I think, for today and tomorrow. And we’re constantly adding speeds. We’ve improved coverage, great devices, the gateways, the pods, control improvements that we’ve had, streaming with the Flex, now XClass and mobile. We’re surrounding broadband with products that eases some of the pressure around pricing when you can package with so many alternatives.

The other thing that we do is we provide multiple tiers of broadband. And we market — we break down the broadband marketplace into segments. So we have a lot of choice out there. And so it is — we go, and we consult with the prospects upfront and customers all the time what’s best for them. And we put them in packages that work and that gives an opportunity to drive ARPU when you do it that way.“

Comcast (and Charter) are incumbents, developing the “walled garden” of products and services to keep broadband customers on their network. Interestingly, neither company has followed Verizon’s content bundling strategy. Why? They do not need to dilute their product with the operating expense that accompanies a content bundle, a concept that every cable operator is extremely familiar with. They would rather take on Roku/ Apple TV/ Amazon Fire TV with a unit that already includes Comcast’s operating system (see October’s XClass TV announcement).

Could we see the day where an 80 inch ultra high-definition TV is leased to Comcast customers, with smaller sizes included in the baseline service? We wouldn’t rule it out. More importantly, can we see the day where DVR revenues are absorbed into a single fee along with the TV and the actual subscription? Wait, that would look an awful lot like a… smartphone lease.

Comcast (and to a lesser extent, Cox and Charter) are thinking about the converged world differently than AT&T and Verizon. They have a multi-decade history inside the home that has constantly traded off technology upgrades, programming costs and bandwidth improvements – each competing for scarce coax capacity. More importantly, they understand the terminating equipment (TV) that hangs on the end of every cable DVR.

Bottom line: XClass TV is a bold move for Comcast, the beginning of a licencing revenue stream that may yield it’s own business unit in the not too distant future.

Charter has not invested billions into an X1 operating system, but they are investing a lot of capital to improve their capacity, as CEO Tom Rutledge described in their earnings call (webcast here – quote is at 7 minute mark):

“In order to increase the capacity and speed on our network for next-generation products and services, we’ve developed a multi-faceted approach to our network evolution, comprised of a number of technologies which will be deployed where they make the most sense strategically and economically, delivering the very fastest speeds and lowest latency at the lowest cost and time to deploy. We continue to expand our capacity by splitting nodes, but we have a cost -effective approach to deliver multi-Gigabit speeds in the downstream and Gigabit per second symmetrical speeds in both downstream and upstream directions, all using our deployed DOCSIS 3.1 platform. And high-splits, which are currently being tested in market, not only allow for increased speeds in the near-term, but are also a capital-efficient way, as they currently use deployed DOCSIS 3.1 customer premises equipment and reduce the need for node splits, which will be required as consumer bandwidth utilization increases… What I’m saying there is that the high-split actually uses the capital that was needed for node splits.”

Will Charter need to materially overbuild their current plant with fiber to compete with AT&T in Dallas or Verizon in New York City? The answer is no. Can Charter maintain their market share without a costly fiber overbuild (and corresponding asset upgrade write-off)? The answer appears, at least for now, to be yes, provided that they can effectively substitute capital that was previously allocated for node splits to high splits.

So far, this strategy has worked. Augment the current network until DOCSIS 4.0 is ready for wide-scale deployment. Use fiber for new construction where it’s economically prudent to do so. And leverage scale to drive lower costs and richer promotions, especially those that build scale in Spectrum Mobile.

Bottom line: Charter has a needle to thread as they move to DOCSIS 4.0, and they have building competition from AT&T in Dallas/ Ft Worth, Austin, San Antonio, and Los Angeles markets. Like Comcast, however, they have a plan for each foot of their network to grow market share, and so far, it’s working well.

Finally, there’s T-Mobile. Everyone was bracing for disaster, and the result was anything but. Over 90% of Sprint’s traffic and 53% of the entire Sprint customer base has been transitioned to the T-Mobile network. Postpaid phone net customer additions were higher than Comcast + Charter + Altice combined (530K total mobile net additions vs. T-Mobile’s 673K postpaid mobile phone net additions). Churn was up (see nearby chart from the 3Q Fact Book) but much of the increase was due to accelerated customer migration efforts. T-Mobile CEO Mike Sievert put it this way on their earnings call (webcast here – quote is at minute 12):

“With our Magenta business firing on all cylinders, we’re also working rapidly through the integration of the higher churning Sprint base. Just to put this in perspective, if the Sprint base had the same churn as our Magenta base, our phone net adds in Q3 would’ve been about 1.2 million – way ahead of anyone else in the industry. That shows you the potential future tailwind to our growth engine as we work to get Sprint churn down to Magenta churn levels. And it reinforces that our gross adds flows are right where we want them to be, at least for this point in our journey.”

T-Mobile has a lot of initiatives running in parallel: iPhone 13 launch (and store “reopenings”), rural greenfield deployments, distribution expansion through Walmart, T-Mobile Home Internet launches, and 5G network expansion. While all of these are important, all pale in comparison to the Sprint network and customer transition. The 47% of the base (consuming less than 10% of traffic but very likely producing more than 10% of the “at merger close” Sprint revenues) that needs to transition is not going to migrate without help. Lots of attention and handholding will be needed for cutovers, just as device supplies run tight and Holiday activities compete for transition scheduling.

Bottom line: We are not surprised that T-Mobile extended the date to sunset the CDMA network. But they need it as much as Dish/Boost does if the figures disclosed in the earnings release are any indicator. We definitely think that new network deployments are going to prove valuable to both Magenta and Sprint customers, but T-Mobile is not over the transition “hump” quite yet, and the 15-20% of the “straggler” base remaining entering 2022 has incremental value.

That’s it for this week’s very lengthy Brief. In two weeks, we will continue the earnings discussion with a focus on Altice, Frontier, Windstream, and Lumen. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals, Go Sporting KC and Go Chiefs!