October greetings from the Midwest. Pictured is yours truly outside of the Rich Hill Café last Friday (one of the Missouri American Broadband territories). Terrific food, excellent service and a great conversation with two of the hardest working techs in telecom (Jason and Chris).

In the spirit of promoting businesses in the ABB surroundings, in nearby Passaic there’s a fantastic meat shop called McBee’s Bratwurst – 30 different varities – more here. Always looking for something different, we sampled the fresh apple gouda and the pineapple jalapeño varieties. Perfect for Chiefs football season, and right off of I-49!

This week, we have both an extensive market commentary (lots of news) as well as our first Apple iPhone 13 backlog report (full PDFs have been posted to the www.Sundaybrief.com website). Then we will discuss a possible solution to Facebook’s dilemma.

Many thanks for the comments and shares of my recent interview with Diana Goovaerts at Fierce Telecom (here) where we covered ABB’s acquisition of the fiber assets of BNT in Wayne, Nebraska as well as some new hires. She is a terrific interviewer. There will be more news to come.

The Week That Was

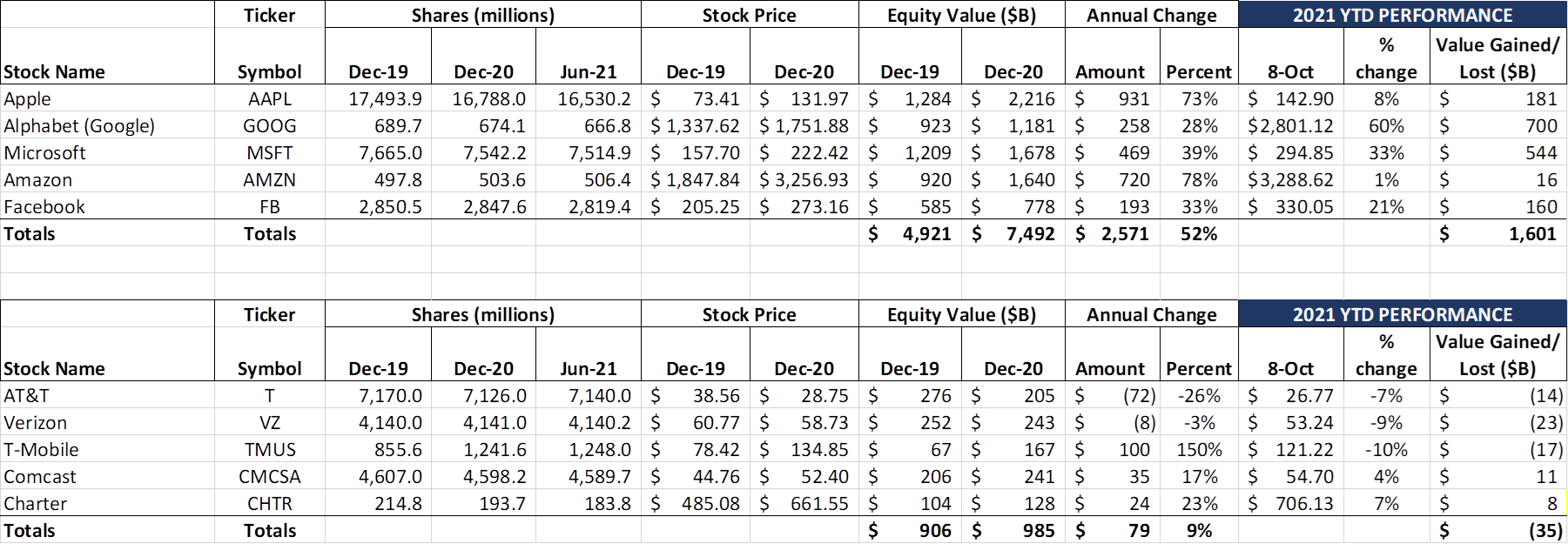

The last week of September and first full week of October were not kind to either the Fab Five (-$269 billion) or the Telco Top Five (-$31 billion) market capitalizations. It was the worst two-week period since February. While the daily headlines are not terrific (especially for Facebook – see below), the Fab Five have still increased their market capitalization by 21% year-to-date and should end 2021 with more than $9 trillion total value (even with some share buybacks which we assume are well underway).

More worrisome than the performance of Amazon (the worst performing of the Fab Five this year, but up $736 billion since the beginning of 2020) is the downright dismal value loss that continues with Verizon (-$23 billion so far in 2021 on top of -$8 billion in 2020). The stock price is within a a few dollars of pandemic-induced March 2020 levels ($51.80 was the lowest close then); Verizon also has the current designation of the worst performing stock of the Dow 30 (table here). While investors await finalization of the new dividend target for AT&T (most analysts assume a 4-4.5% yield) and absorb earnings news from Comcast and Charter, Verizon is expected to continue to grow both top and bottom line in 3Q and throughout the year. It will be interesting to see how management addresses the decline in their earnings presentation on October 20 (a week from Wednesday).

On a related Verizon story, we finally saw the first indications of improved Rootmetrics RootScore T-Mobile network performance (these results are for metropolitan areas only – full list here). Of the 18 markets measured to date in the second half of 2021 (out of 125 potential), T-Mobile tied for the lead in two, was outright second in two, and tied for second place in another four. Verizon won ten of the 18 markets outright (56%), and was tied with one (or both) of their competitors in another six. If this trend continues, then the FirstNet-driven AT&T network performance surge in the first half of 2021 (where Ma Bell won 12% of the markets outright and tied Verion in another 44%) will have been shortlived. Remember, these results are in advance of Verizon’s C-Band deployment which begins late this year and continues throughout 2022.

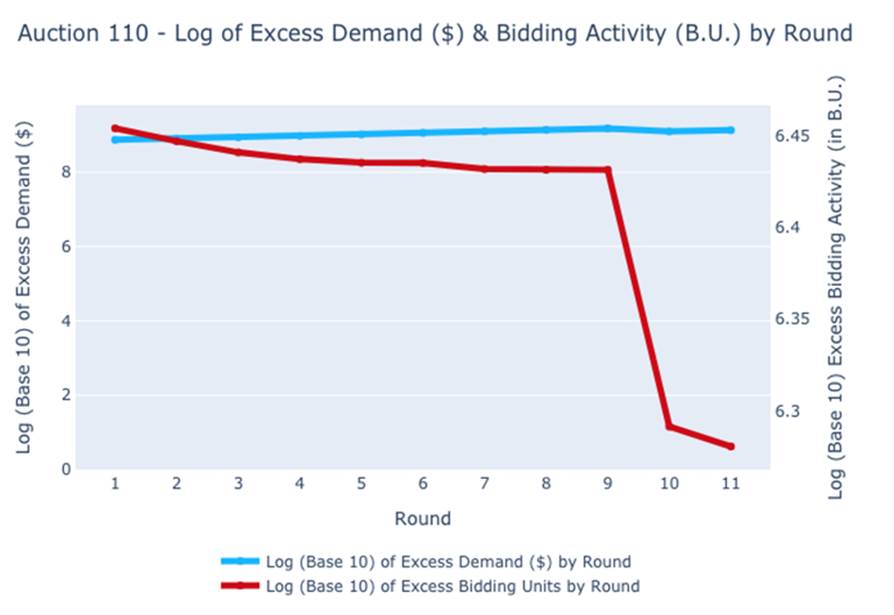

Speaking of spectrum deployments, there’s another auction in the works, and it’s off to a slow start. This time, the FCC is auctioning off 100 MHz in the 3.45–3.55 GHz band in 10 MHz segments. Based on Sasha Javid’s tracking of the progress, there appears to be a large bidder who dropped out of the auction after 9 rounds (see nearby chart which shows the dropoff in bidding activity). More on the auction here from Sasha Javid and here from RCR Wireless. Based on Javid’s calculations in the linked page, the total bids are still about $13.2 billion short of the minimum reserve price – they have a long way to go to hit the minimum (note: we are only four days into the auction). We will be tracking bids for the next two or three Briefs. A full list of initial bidders can be found here.

T-Mobile will also be in focus this quarter as they deal with the fallout from their recent security breach (in case you missed the original Wall Street Journal report on the event, it’s here). Both Peter Osvaldik (CFO) and Mike Sievert (CEO) acknowledged in separate investor conferences that there were fewer gross additions and greater churn in the weeks following the disclosure, but also indicated that the net additions pace had begun to normalize by the end of September. We think that merger synergy overachievement will be the headline story throughout the year.

On a T-Mobile related matter, Roger Entner of Recon Analytics posted Saturday morning that Cox had lost their case in the Delaware Chancery court on Friday and will not be allowed to launch their MVNO on Verizon on October 15. According to this summary on Law360.com, Vice Chancellor Morgan T. Zurn summarized the reasoning as “Cox first promised that if it wanted to go to the wireless services dance, it would go with Sprint.” The full opinion should be posted shortly on the Delaware Courts website here. More to come on this development in the next Brief.

On a positive note, since the last Brief, Amazon held a new products event with a slew of new items (CNET 11 minute consensed version is here). Building on the last Brief’s discussion of the Facebook Portal + product (with an 18 MP front-facing camera), the Amazon Glow is a new product designed to improve communications between kids and remote loved ones (think grandparents). Unlike the Facebook Portal +, the Glow uses a lower-end camera (720 HD). More on the Glow here. This was one of several interesting products (and enhancements) introduced for the Holiday season. Additionally, Amazon has fully embraced the Ring team and is making home security an important part of the portfolio.

The Apple iPhone 13 Backlog

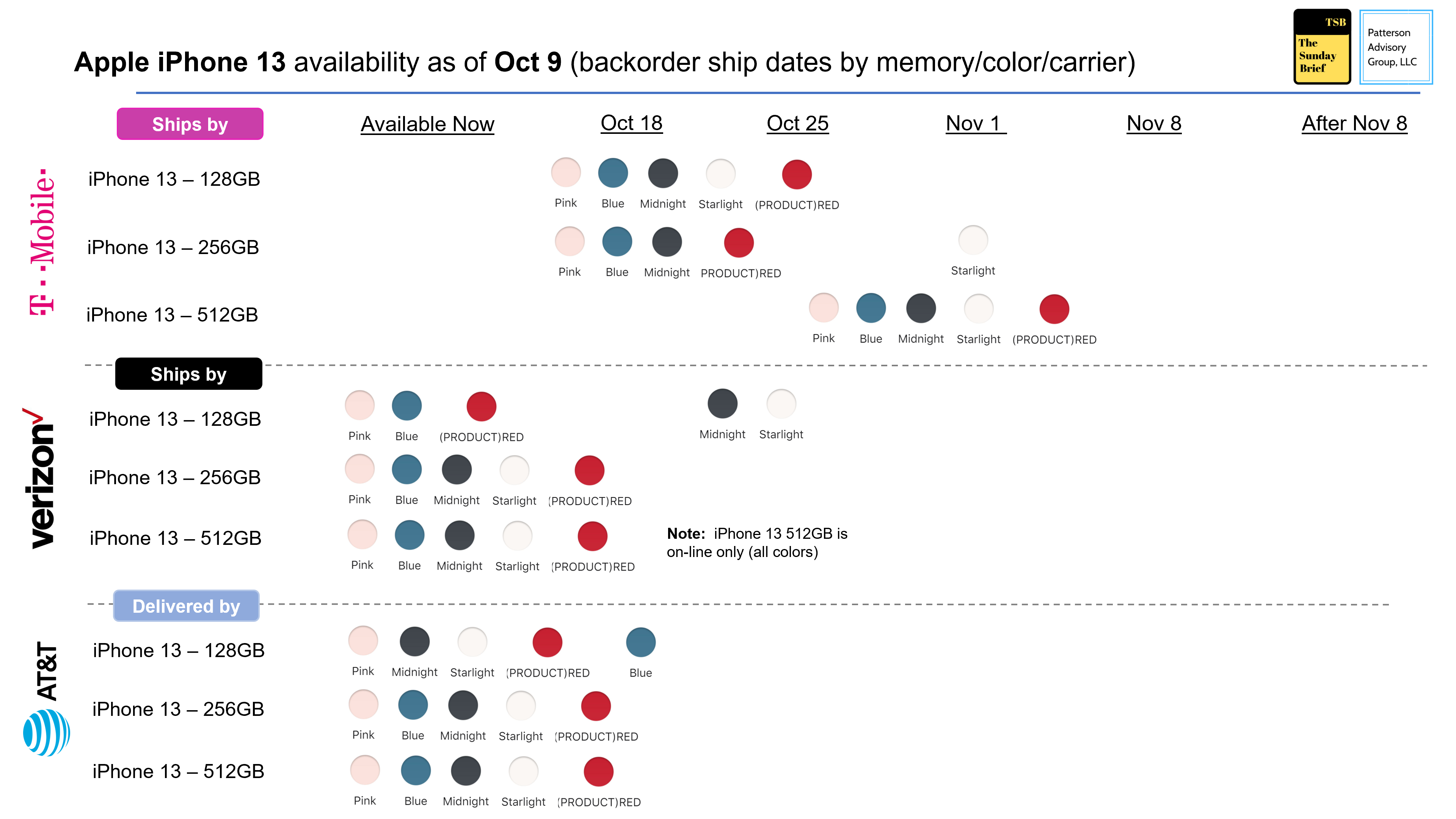

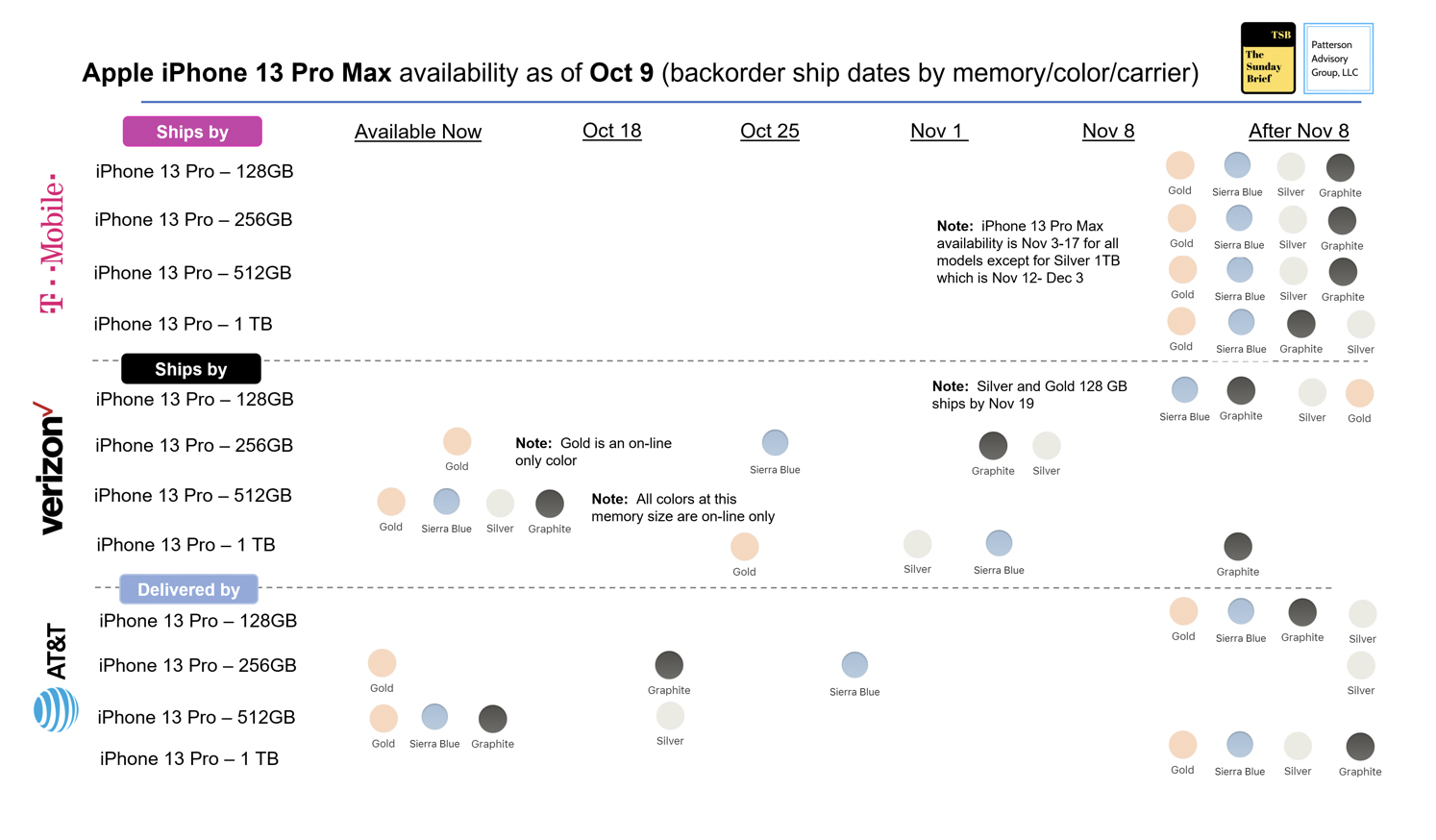

Regular readers recall from time to time we pause to check consumer phone availability. This week we’ve tracked iPhone backlog by carrier (PDF of charts below available through the website). As a reminder, this is solely determined by on-line (carrier website) checks on the Saturday prior to Brief publication – check your local store for availability.

Similar to the iPhone 12 launch, there are no issues with iPhone 13 Mini inventory. We skipped the chart for this model in the slides, but will continue to monitor. What is interesting is the (full size) iPhone 13 availability:

Last year, AT&T began their “existing customers get the same trade-in deals as new customers” promotion. This hindered AT&T’s iPhone 13 availability for several weeks as existing customers flocked to get a 5G iPhone. This year, the iPhone 13 is readily available for all carriers/colors/memory options but T-Mobile. We have seen this in previous launches, and, absent an additional promotion, the iPhone 13 will be readily available at T-Mobile by the end of October.

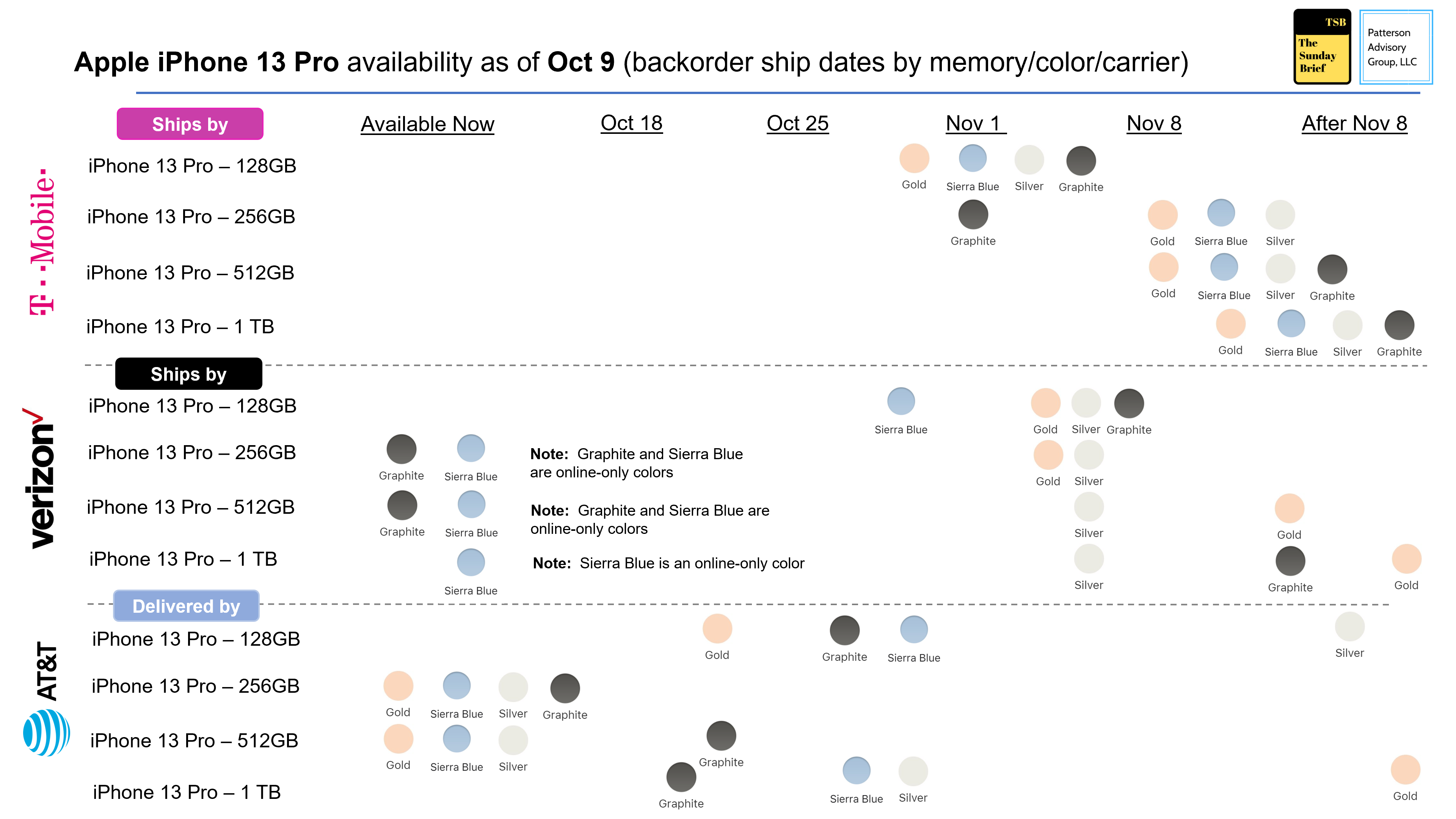

The iPhone 13 Pro adds an additional 1 TB storage option. This results in a split demand between the 512 GB and 1 TB options (and a reason why Verizon decided to make the larger storage options available as on-line only).

Last year, the iPhone 12 Pro was the hardest model to keep in stock. Online availability was pushed out for many models to February 2021. This is not the case this year as the previous chart shows. Apple appears to have learned their lessons from the pandemic-hampered, first 5G phone year. Bottom line: If you want an iPhone 13 Pro, it’s highly likely you will have it by Thanksgiving (if not earlier).

What is more surprising is the iPhone 13 Pro Max availability (re: this is Apple’s highest-priced and highest profit device):

Shortages are widespread, especially at T-Mobile; last year, availability on this higher-end model was constrained at AT&T and Verizon only. Usually, shortages are alleviated in 4-6 weeks, but this indicates to us that T-Mobile is likely the beneficiary of upgrades in this cycle.

Bottom line: This year’s iPhone 13 launch has been a success. AT&T worked through a lot of issues in the last cycle, and appears to have planned for iPhone 13 inventory better in 2021. T-Mobile appears to have benefitted from upgrades to the iPhone 13 Pro and Pro Max models, perhaps an indication of increased customer quality in recent weeks. We will continue to monitor availability and report in subsequent Briefs.

Facebook Needs More (Not Less) Algorithm Development

Editor’s note: Facebook owns Instagram and WhatsApp. Facebook and Instagram should be viewed interchangeably in this section of the Brief.

If you think you had a bad couple of weeks, just look at Facebook. They thought the September 14th Wall Street Journal exposé was going to blow over. Then Frances Haugen went public on 60 Minutes last Sunday, and appeared before the Senate Commerce Committee for three hours last Tuesday (C-SPAN coverage here). In the last four weeks, the company has lost $138 billion in market capitalization (a little over 13% from peak) and their stock price is now at a level last seen in mid-June (but is still up 21% year-to-date). Outside of the last comment, there’s no way to paint the last four weeks in a positive note for Facebook. What should they do?

Facebook’s news feed, advertising, and friend recommendations are driven by formulas or algorithms. Many people post many things on Facebook and Instagram, and, while some relationships are easy to discern (e.g., a young man is suddenly interested in everything a young lady has posted on Instagram for the last several months; comment/ like driven inferences leading to the conclusion that this is a grandparent/ grandchild relationship, etc.), others are more difficult (e.g., how do we introduce a new product/ idea/ celebrity/ candidate/ song to a specific audience?). Keeping people “in the mood” with newsfeed is not that difficult – discernable patterns are easier to correlate than perceived interests – it’s “changing the mood/mind” that’s a lot harder.

Facebook’s money is made from advertising, and personalized algorithms represent the holy grail of social media. There is no better solution for advertisers than large, finely tuned profiles. A Cajun boiled peanuts advertisement to residents of the Garden State is likely wasted. So is an advertisement for B&M brown bread in a can to most of the country outside of New England. But a well-placed ad to the right audience moves the needle – that’s why Facebook continually revises their processes and algorithms.

One of the issues raised in the Wall Street Journal article was the false conclusions drawn by Instagram’s current algorithms (specifically that a younger female interested in increasing her level of exercise should be bombarded with ads concerning losing weight). Algorithms are driven by variables, and sometimes historically correlated keywords are not suited (and in fact are annoying/ offensive) to readers. Better advertising feedback from Instagram/ Facebook users should be incorporated into the process – this yields better ad placement and happier users. This is the nexus of Facebook’s product development.

Interestingly, the handwringing about the panoply of discordant conversations was predicted 50 years ago, long before the Internet was in the mainstream. CBS News President Fred Friendly penned what is now a classic article for The Saturday Evening Post in 1970 (it is from this article that Tim Wu’s book “The Master Switch” is named). In it, Friendly laments the stifling control over programming by the three media networks and discusses the promise of a new technology – cable TV – specifically how it presents the opportunity to increase the quantity of voices. However, Friendly warns of the dangers of technology taken too far, saying (remember – this is 1970):

“The wired city will not be an improvement just because it is there. Sixty channels will not stop the decay simply through diversity. The current monopoly could give way to a new Tower of Babel, in which a half-hundred voices scream in a cacophonous attempt to attract the largest audience.”

It’s interesting to think about what Friendly would say about today’s social media, a cacophony of hundreds of millions of Tweets, Instagrams, and Snapchats.

While we agree that something smells bad in the Facebook story (specifically, management’s apparent inactivity in the face of mounting research), we think that government regulated or centrally managed algorithms are going to be equally unfulfilling and potentially more dangerous.

Our suggestion is that we expand the algorithm to include the most important variable – individual customer-directed preferences. Let the Facebook user steer the Instagram influencers, not the other way around, by tailoring all news feeds (and electing to opt out of advertising altogether for a fee as many other applications do).

Customer preferences can take many forms. If an Instagram user wants to have a separate “Saturday/Sunday Yacht Rock profile” from their Mon-Fri persona, so be it. If they would like to only view news feeds related to their church friends (the “church cohort”), then let them do it. If they want to opt out of all political discourse because their mind is made up, they should be allowed to easily filter out political advertising. This puts the news and advertising feed directly in the hands of the customer – it’s the role of Facebook to make this extremely easy to do.

This involves significantly expanding and refining the algorithm, not stifling it. And it also involves a realization that the result will be better for most, but not all of the hundreds of millions of Instagram/ Facebook/ WhatsApp users. Facebook needs more algorithm development, yielding customer-driven tuning of the news and advertising feed. This is not easy to do, but is a far better alternative than government oversight of Facebook’s newsfeed.

Bottom line: If Facebook’s primary goal is to drive better advertisements and more profits through algorithm refinements, everyone should win. If their goal as a social media platform (not as a content provider) is to “change the mood/mind” then more regulation is imminent (and will whipsaw in a similar manner to net neutrality provisions – the “on/off” switch that changes with each incoming Presidential administration).

That’s it for this week’s Brief. In two weeks, it’s all about Verizon’s (Oct 20) and AT&T’s (Oct 21) earnings. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals, Go Sporting KC and Go Chiefs!