Summertime greetings from North Carolina, Nebraska, Missouri, and California (the CoBank conference – Jim and Jennifer Fritzsche of Greenhill pictured). As many of you already know, The Sunday Brief is moving back to the City of Fountains next week after a decade-long absence. It will be good to reacquaint with friends, but we will miss our time on Lake Norman and with the Davidson community.

There has been a lot of news over the last three weeks – some of it involved telecom companies. We are going to cover as much of it as possible in the market commentary section, yet leave enough time to start a new “Strongest” topic where we pick one stock from the Telco Top Five and the Fab Five and explore the reasons why they are in a superior position (product, profits, competitive advantage, etc.) versus their peers. Google and Comcast are by no means perfect, but they clearly are leading their respective groups. In this Brief we will cover Comcast, and in early September we will cover Google.

As we indicated at the beginning of July, we are going to evaluate the frequency of The Sunday Brief to maximize its value to readers. Many of you have indicated that you would like a shorter format (e.g., market commentary only) each week, while others have asked for more detailed tomes every month. For now, we are going to continue the bi-weeky format, but really appreciate the feedback. For many of you who have left the industry (or retired), we recognize that the Brief is your way to stay current. We will do our best to provide as much value as schedules allow.

The Week That Was

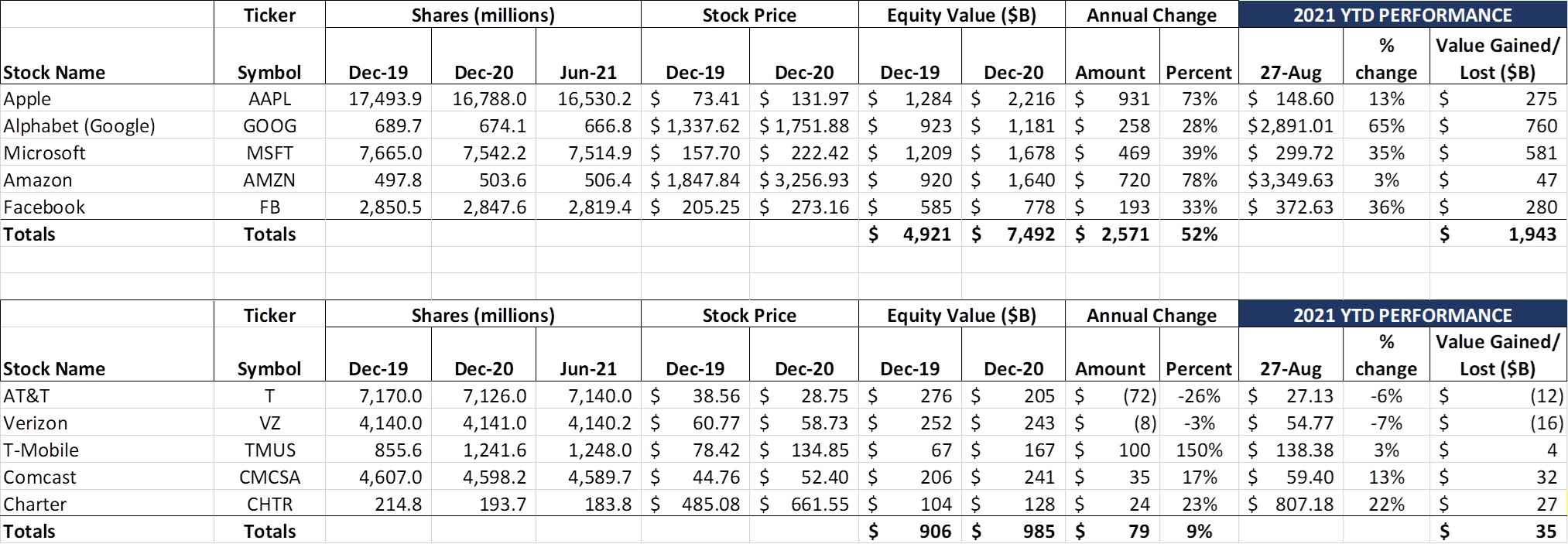

August has been very kind to the Fab Five – they have collectively gained $246 billion in market capitalization over that period. Since the beginning of the year, their total gains are just shy of $2 trillion (or about 2x the total equity market capitalization created by the Telco Top Five since they went public).

Leading the 2021 gains are Google (up $760 billion or about 40% of the Fab Five gain). More on them below. However, Microsoft continues to steadily grow their value as well. Amazon, who had been lagging its peer group in 2021, showed signs of life last week (up 5% for the week and now up 3% year to date). We find it interesting that Apple, Google, and Microsoft have each added between $1.0 and $1.2 trillion since the beginning of last year (and we’ve had a lot of news since then) – Apple up $1.2 trillion, Microsoft up $1.05 trillion and Google up $1.02 trillion. The timing has certainly been different, but over the 20-month period, these three corporate giants have blossomed.

Contrast that growth with AT&T’s (-6% YTD) and Verizon’s (-7% YTD) stock performance. We have chronicled the origins of their respective malaises in previous Briefs, and believe that the recent acquisition of Masergy by Comcast (more in the link and below) will continue to put pressure on the business segments of these two companies.

What’s even more confusing is that T-Mobile received the worst news since the last Brief (California PUC decision on the CMDA network here, a news leak that they might be getting into the wired broadband business in New York City, and the “awful” security – Wall Street Journal article here – that led to one of the largest data breaches in the telecommunications industry), yet their stock was barely dented (-$5 billion over the last four weeks but still +$4 billion in 2021).

We are particularly surprised and amazed at the data breach (and frankly confused about why they are saving certiain information about applicants who never became actual customers) and look forward to continued communication on this topic. The WSJ.com article is particularly damning and clearly points to the legacy T-Mobile lax server security practices as the likely root cause. When the information gathered by hackers allows potential criminals to obtain all information needed in two-factor authentication (phone number, IMEI), then every T-Mobile customer should worry. Change those account PINs at a minimum – today.

Following the “worry” theme, chipmaker TSMC (a.k.a, Taiwan Semiconductor) announced that chipset prices would be rising 10 to 20%, depending on the circuit width (more here from Investors Business Daily). Usually chipset prices go down as the manufacturing process becomes more mature – this is not the case with TSMC (and presumably Samsung if the IBD article is accurate). All of this news is leading many to speculate that Apple will raise the price of the upcoming iPhone 13 to make up for the chipset price (CNET article here). We have not had to worry about inflation since the Internet Era began (roughly 1996) – uncharted waters ahead.

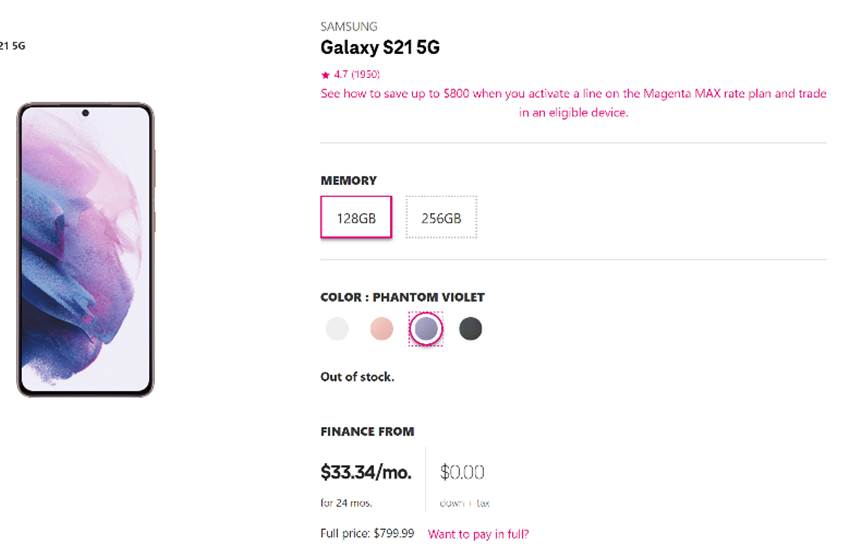

On top of this, Samsung’s flagship Galaxy device remains in tight supply even as they are releasing new super-premium models. For all colors but Phantom Pink, the S21 5G is on backorder at Verizon through Sept 7 (roughly two weeks). At T-Mobile, the Samsung Galaxy A32 5G is on backorder with an estimated ship date of September 14-28, and the Galaxy S21 5G is completely out of stock unless you would like it in Phantom Gray (estimated ship date of September 14-28). Having followed several iPhone launches which triggered backorders, we can’t remember a time when T-Mobile has been so inventory constrained on a flagship device. Shortages will dent their 5G transition, and perhaps slow down the legacy Sprint to T-Mobile conversion schedule. Thankfully, there are plenty of iPhones in stock.

Speaking of Apple, many of us were relieved to hear that Apple settled with a group of app developers and will now allow them to actively promote out-of-app payment options. This agreement is separate from the pending decision from Judge Yvonne Gonzalez Rogers in the Epic Games v. Apple decision (see our discussion on this in the May 23rd Sunday Brief here). To their credit, Apple has reduced the commission for in-app purchases to 15% for smaller developers, and will keep this reduced rate in place for the next three years. But certain senators (namely Richard Blumenthal, Amy Klobuchar, and Marsha Blackburn) continue to push for further opening of app store alternatives (see Senator Blumenthal’s Washington Post comments here). Interestingly, Judge Rogers also presides over and needs to approve this settlement (her decision on the Epic Games lawsuit is due in the next few weeks). More details from the New York Times here and Bloomberg here.

On a final (and lighter) note, Google introduced their lower-cost Pixel 5a with – get this – a headphone jack. To celebrate this remarkable achievement, they launched a two-minute ad (here). It’s good to end such a news-heavy week with a little levity.

The Two Strongest Headed into 2022 – Comcast and Google

We are starting a new quarterly report in this Brief focused on competitive leadership. Technological advances can raise the tide and lift all boats, creating a false sense of success. Within the Fab Five and the Telco Top Five, however, some companies are better situated to nagivate the competitive landscape than others. We think Comcast and Google are clear leaders heading into 2022. Comcast will be discussed in this Brief while Google will be analyzed in early September.

If the analyst community is to be believed, Comcast should have imploded after their full takeover of NBC Universal in 2013. Vertically integrating is risky – there’s no way broadcasting and cable cultures can coexist. Focusing on a better video experience (X1, Flex) is a waste of time. Launching a streaming service called Peacock is going to be expensive and lacks staying power to be competitive with Disney+ or HBO Max. Expanding globally into satellite TV (Sky) creates an unnecessary diversion. And theme parks – really – in Tokyo and Beijing? If the pundits were right, Comcast’s stock price would be down in the teens and the company would be selling/ spinning off non-core assets (just like one of its peers).

Through it all, however, Comcast steadily created value, and is now the undisputed market capitalization leader in the telecommunications sector – now worth $273 billion to Verizon’s $227 billion (20% more valuable than Big Red) and AT&T’s $194 billion (41% more valuable than Ma Bell). Unlike its two largest competitors, Comcast does not own a wireless network, and, until last week’s Masergy announcement, had an average but not superior enterprise offering. How are they doing it?

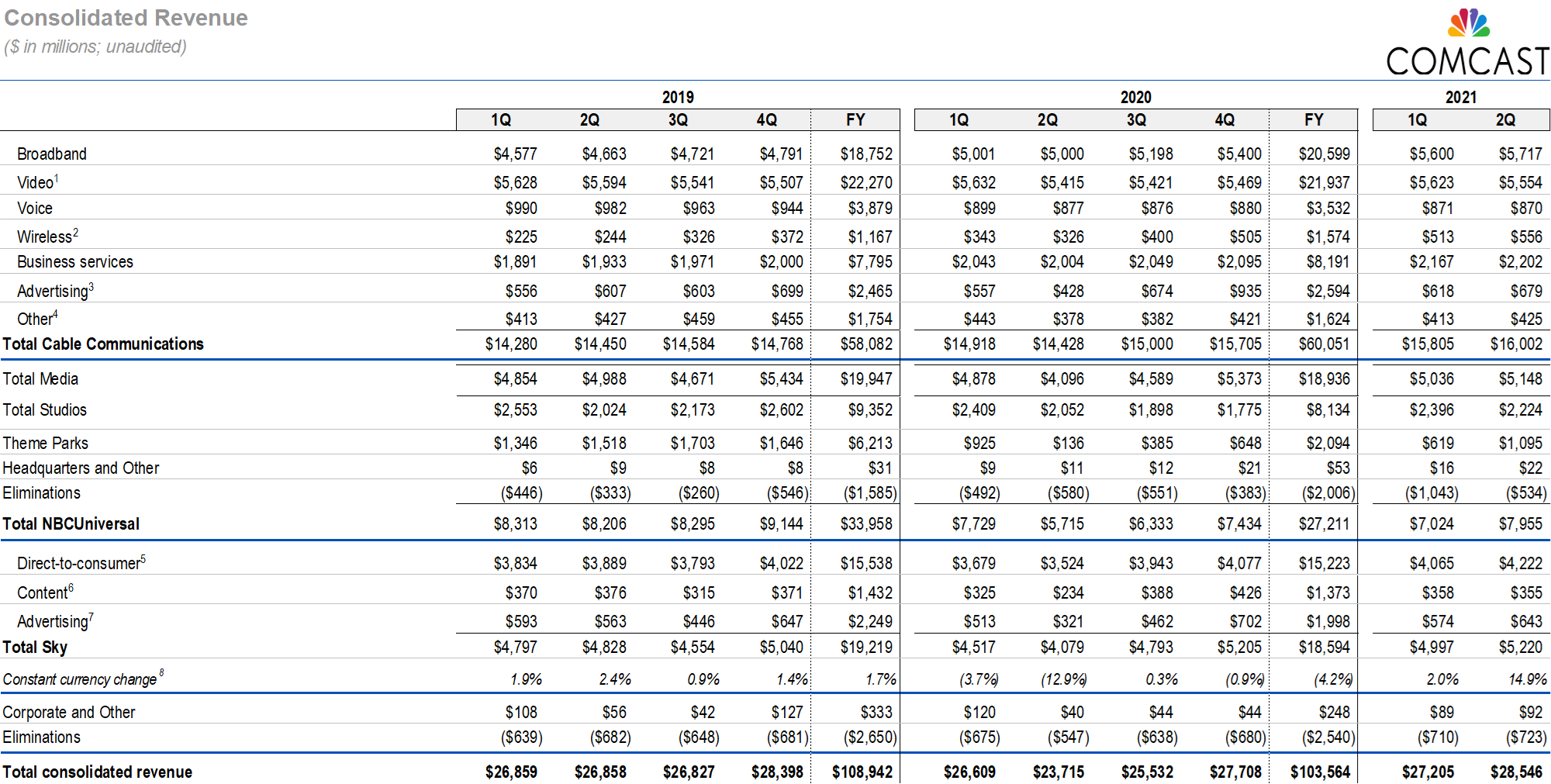

Their second quarter earnings call provides a lot of answers. Before diving into these, however, a quick look at Comcast’s revenue growth:

Heading into 2021, the common refrain was “broadband growth will slow dramatically.” Comcast’s residential relationship growth in 2021 is 8% higher than the pandemic-driven first half of 2020. Residential relationship growth is outpacing passings/territory growth (10% growth in relationships and 3% growth in passings since 12/31/2020). Revenue per customer relationship is up slightly from 2Q 2020, and up from 2Q 2019. And commercial services customer relationships are up 2% from their pre-pandemic (1Q 2020) high.

In their core connectivity business (which generated 70% of their corporate EBITDA in the latest quarter), Comcast benefits from two separate and distinct factors:

- Comcast has deployed DOCSIS 3.1 across large clusters that exceed traditional metropolitan boundaries, and

- Where Comcast has a large market, their telco competition is largely Lumenor AT&T (less Verizon)

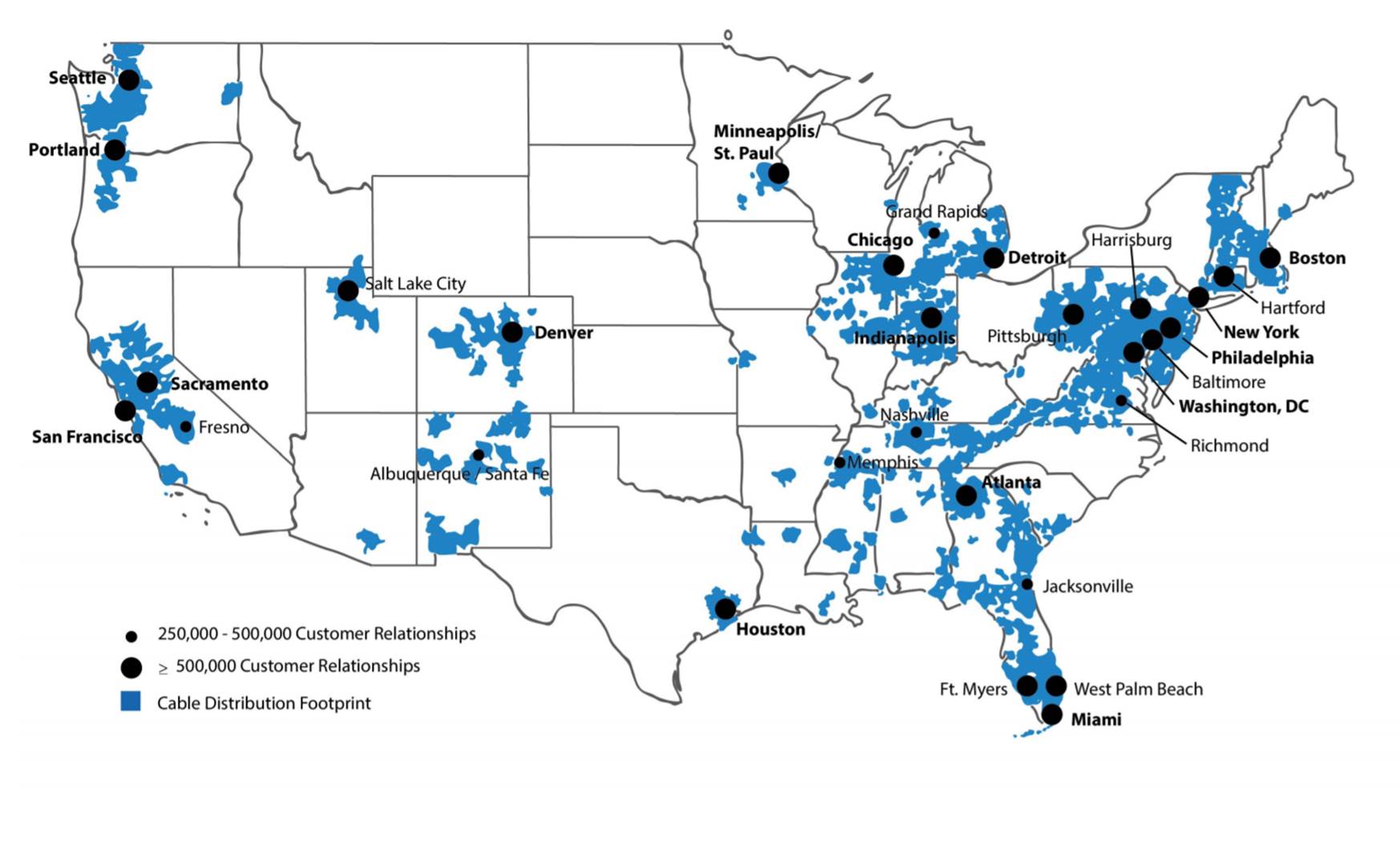

Here’s the latest footprint map from Comcast’s 10-K:

Comcast’s largest non-Verizon markets are Chicago (#3 MSA by population in the US), Houston (#5), Miami (#7) and Atlanta (#9). The Atlanta metropolitan area gew by nearly 20% over the last decade (including Forsyth, Gwinnett, Cobb and DeKalb counties), Harris County (Houston) grew 15.6% since 2010, and Miami Dade County grew 8.2%. These exceptionally strong growth areas offset more slowly growing markets like Chicago (+1.6% over the last decade). AT&T is deploying fiber in these markets, but the product is far less ubiquitous than Comcast’s DOCSIS footprint.

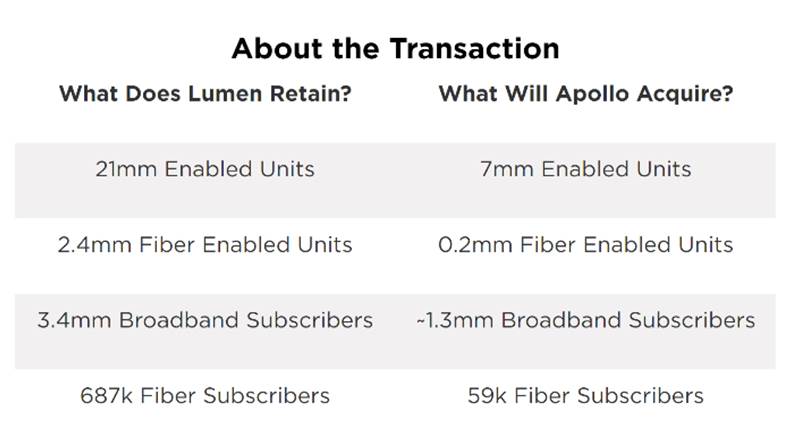

Then we have the West, with Seattle, Portland, Salt Lake City, Albuquerque/ Santa Fe, Denver and Minneapolis/ St. Paul. With the exceptions of Phoenix (a very large MSA served by Cox Communications), Las Vegas (Cox), and Omaha (Cox), Comcast has legacy Lumen markets covered. As a reminder, we have clipped the latest stats from Comcast’s website describing Apollo’s recent purchase. These markets hit the sweet spot of “high growth/ low competitive threat” as shown by the nearby numbers. Only 11% of the “remain” footprint is passed by fiber (and only 29% of homes passed are current subscribers), leaving Comcast with ~75-80% market share in the West (assuming some units choose to subscibe to another provider or rely on their mobile devices for the Internet). We continue to assert that Lumen is, for all intents and purposes, beginning from a cold start against a well-heeled incumbent.

Dave Watson, Comcast’s Cable head, shared some of their key performance metrics on their most recent earnings call (transcript here):

“Just to provide perspective in the quarter, our total agent calls decreased by 10% with total interactions lower at 7%, and we saw a 22% reduction in truck rolls. And this is despite an overall 5% increase in the customer base. So if you go back over time, this is just a continuation. Over the past 5 years, we’ve constantly made progress, taking 37% or almost 100 million calls out of the run rate and reduced truck rolls by 25%.”

Earlier in the call, Watson also created a correlation between margin growth and digital tool development, particularly for residential broadband. Even though capital intensity is falling, Comcast has committed to invest in the next generation of DOCSIS (see more on the “high-split” technology improvement in this article from Light Reading) which should improve upload capabilities in the network. While we think they should increase their fiber density faster as a defensive position against Verizon Home Internet and AT&T Home Fiber deployments, Comcast clearly has the balance sheet flexibility to deploy additional capital.

Comcast also owns Citizens Band Radio Spectrum (CBRS) priority licenses across its footprint and has the capability to continue to deploy Wi-Fi, whether through a dual SSID Wi-Fi router or through metro hotspots. Local deployments, combined with capacity augments from other Cable Wi-Fi consortia members, grows the bandwidth footprint and reduces reliance on Verizon’s network (their MVNO partner).

The reality is this: Comcast has a single product relationship (broadband only) with 43% of their base (roughly 13.4 million customers). They have a terrific network partnership with Verizon. Based on our estimate of Xfinity mobile customer relationships (1.8 lines per customer relationship, much lower than we see with Verizon or AT&T), Comcast has about 1.9 million residential customer relationships (by definition, each of these relationships is at least a double play). This represents a 6-7% penetration of total existing residential relationhips. It’s time for Comcast to more aggressively market wireless to the single-product (broadband only) customers.

The big winners from the iPhone deployment in 2021 might be Xfinity (Comcast) and Spectrum (Charter) Mobile, not T-Mobile. Selling into their current Xfinity broadband base should be relaitvely easy, and, with a greater commercial presence, we would not be surprised to see Comcast offer current Business customers wireless discounts (straight out of the AT&T and Verizon playbooks). This opportunity grows even larger once Masergy is added.

We are highly supportive of Comcast’s bid to acquire Masergy (see announcement link above), a large enterprise global services/ SD-WAN provider. We think that Comcast will quickly improve Masergy’s sales productivity (being sensitive to Masergy’s indirect sales/ master agent approach) and provide in-region credibility. This means more fiber solutions for Masergy customers, both within and through partner cable company footprints (assuming Comcast has a good “brother-in-law” wholesale rate from Cox Business and Charter Business). Finally, cable has a global WAN solution for customers. Bill Stemper’s wildly successful SMB strategy now combines with Masergy’s global know-how. If the integration is managed correctly, the result will be a third competitor to AT&T and Verizon.

Also of high interest (see last October’s news release here) are work-from-home (WFH) solutions that Masergy has implemented with Fortinet. We see this new product capability as a new growth source for Comcast (which might include mobile VPNs in the future).

The question mark in the Masergy transaction is international (particularly European) growth. It’s likely that Comcast will continue with Masergy’s current access partnerships – how Sky helps in the Masergy value creation story is anyone’s guess.

Bottom line: Comcast is using scale to grow their toolset, customer experience, and brand. They are far from perfect, and will face increasing competition from AT&T, Lumen, and smaller players like Consolidated. But a decade of competing against Verizon’ FiOS product has taught them many lessons, namely that transitions (e.g., video cord cutting) do not happen overnight. While we would funnel any share buyback capital (and dividend hikes) back into the business for the next several years in favor of increased fiber density and mobile market share, Comcast’s consistent execution is the best in the industry.

That’s it for this week’s Brief. In two weeks, we will look at Google’s infatuation with TV. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals, Go Sporting KC and Go Chiefs!