5G market status and technology

5G is already in the mainstream news in 2021, followed by a turbulent year due to geopolitics and COVID-19, but also the realization that telco networks are much more important than consumers, governments, and enterprises used to think they were. Fixed and mobile networks endured throughout the stay-at-home restriction periods and allowed the vast majority of white-collar workers to work from home without disruptions. Telco operators experienced increased traffic, physical restrictions due to the pandemic, and an uncertain macroeconomic environment, but were one of the pillars of the global economy.

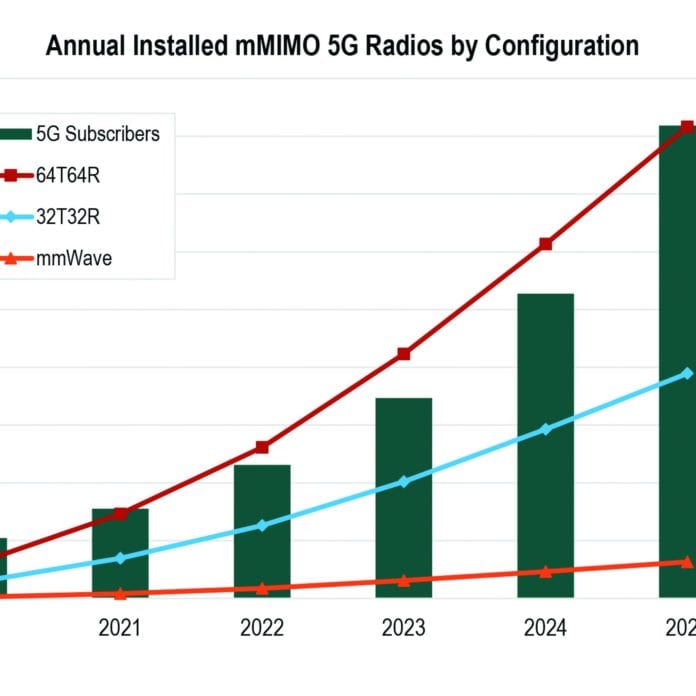

4G and 5G networks were two of the most important pillars that endured throughout 2020 and into early 2021. Mobile operators have continued to invest in their networks, upgrading 4G where necessary and rolling out 5G as originally planned. According to ABI Research’s latest forecasts, there were more than 1.2 million 64T64R 5G Massive Multiple Input, Multiple Output (mMIMO) active antennas installed by the end of 2020, signaling that the new technology has indeed reached a critical mass for both mobile operators and infrastructure vendors. The following figure illustrates ABI Research forecasts for installed 5G mMIMO units and 5G subscribers.

South Korea started the mass market deployment of 5G in 2018 and many markets followed, including the United States, China, Japan, and many Western European markets. This has been driven by the emergence of 5G-capable smartphones and, in September 2020, Apple launched the iPhone 12 with 5G capabilities, which truly accelerated the popularity and usage of 5G networks worldwide.

In terms of new technologies, 5G has introduced several, the most important of which is mMIMO. While Carrier Aggregation (CA) combined with Long Term Evolution-Advanced (LTE-A) allows Gigabit LTE, mMIMO is arguably the most important feature for 5G. It is vital to ensure that 5G base stations can be deployed in existing 4G cell sites, because mMIMO mitigates the use of the higher 5G frequency when deployed in 4G cell sites that use lower frequencies (higher frequencies typically require denser deployments in traditional systems). It allows a significant boost in terms of capacity in mobile networks and introduces spatial multiplexing, i.e., spectrum reuse within the very same cell site for different users’ simultaneous transmission. Developments in mMIMO technology will increase spectrum efficiency, top speeds, energy efficiency, and antenna size in the next few years.

In addition to this defining technology, 5G introduces support for several new concepts, such as support for much higher frequencies, including millimeter Wave (mmWave), cloud-native and micro-services-based architectures, support for much higher densification, Internet of Things (IoT) use cases, and a plethora of smaller additional improvements. Nevertheless, despite the technical superiority of 5G across the board, it is important to consider that most of the traffic in mobile networks today is still transferred via 4G, which is still a cornerstone of mobile networks.

Do Not Forget 4G, but 2G and 3G Start to Fade

Although most of the cellular network investment is currently in 5G, 4G carries most of the traffic. According to ABI Research’s forecasts, 5G will overtake 4G in 2025, due to the currently considered dense and global deployments of 4G that include developing markets. 4G is the foundation on which 5G is built and provides a consistent and high-speed fallback when 5G coverage is not available. Most mobile operators globally are deploying in Non-Standalone (NSA) mode today, with the 5G radio network connected to a 4G core network. This is 5G Option 3, while the long-term goal is Option 2: a 5G radio network connected to a 5G core. There are several options to deploy the two parts of the network and the Next Generation Mobile Networks (NGMN) Alliance has published a paper outlining that Option 4 should also be a priority: both 4G and 5G radio networks connected to a 5G packet core. This will allow dual connectivity for a better end-user experience and highlights the importance of 4G for the success of 5G deployments. Mobile operators have realized that the current financial and global market environment may not justify aggressive 5G nationwide rollouts, meaning that both 4G and 5G will be equally important for the next few years.

Most voice calls, which is still a vital service for mobile networks, are now carried on Voice over LTE (VoLTE) in the packet domain and have introduced new features, including High-Definition (HD) voice, improving the user experience for a service that has remained the same for more than a decade. According to ABI Research’s forecasts, more than 80% of LTE subscriptions in early 2021 are VoLTE-enabled, meaning that most voice calls today are carried through VoLTE, including roaming calls. The transition of voice from the circuit to the packet-switched domain has allowed operators to optimize their networks further and simplify their operations, while VoLTE is the foundation for voice communications in 5G going forward. This means that VoLTE will remain a priority for mobile operators for many years to come.

On the other hand, 2G and 3G networks are beginning to face their sunset for many reasons. The spectrum that has been allocated for these generations will likely be more efficiently used in 4G and 5G, and many operators are beginning to refarm this spectrum for 4G and 5G. Moreover, 2G and 3G infrastructure is aging and was likely deployed a decade ago, meaning that it is inefficient in terms of power utilization and spectral efficiency, and requires increasing expenses to maintain at an operational level. Several operators are now starting the sunset process of their 2G and 3G networks: Australian operators have decided to switch off 2G at 900 Megahertz (MHz) and use this frequency for 4G; Airtel in India will shut down its 3G networks in the next 4 years and maintain its 2G and 4G networks; EE UK is refarming 3G spectrum for 4G in urban areas; Swisscom has announced plans to switch off both 2G and 3G; and many others. It has now become a global priority to refarm 2G and 3G spectrum to 4G and even 5G, while reducing the cost of running networks with a lower number of concurrent generations: 4G and 5G only.

Future Directions

The previous sections summarize the current cellular network activities. 5G is introducing new innovative technologies that are being deployed in millions of units, 4G networks continue to be as important and are providing the foundational layer for 5G, while 2G and 3G networks are being decommissioned to provide more spectrum for newer generations. At this stage, the industry is starting to discuss what is next for 5G and newer generations, and these discussions have already reached a mature stage. The following sections discuss these in different domains.

Technology Evolution

The technology evolution of 5G has not stopped by any means, especially for mMIMO active antennas. Infrastructure vendors are already developing newer generations of their equipment that introduce better energy efficiency, smaller volume and weight, and better performance. These newer active antennas also include new software for advanced beamforming that will improve cell capacity even further and will likely support broader bandwidths and frequency ranges.

Another major evolution will likely come in the uplink domain, which is currently limiting cell coverage. mMIMO does improve downlink capacity, but smartphone transmit power is limited, thus restricting the cell radius. Uplink improvements, including Supplementary Uplink (SUL) that can use lower frequency uplink, while keeping downlink on 5G higher frequency, will significantly enhance the user experience for smartphone users.

There are also several improvements being developed by The 3rd Generation Partnership Project (3GPP) and infrastructure vendors, aiming to enhance both consumer use cases and, most importantly, enterprise cellular applications.

Enterprise Use Cases and the IoT

Enterprise cellular is accelerating in 2021 with private networks and network slicing becoming more important due to COVID-19 and enterprise digitization. For example, many smaller enterprises that are struggling financially may switch to the more flexible cellular subscriptions, rather than their existing wireline connections, pushing operators to rethink their Business-to-Business (B2B) services. Several new enterprise use cases for 4G and 5G already exist in healthcare, industrial manufacturing and many other verticals.

3GPP Release 16 introduced several new features for enterprise applications and Release 17 will introduce even more. For example, Release 16 introduced the following features:

- Support for Time Sensitive Networks (TSNs): The most important aspect of 5G New Radio (NR) R16 is that it introduces support for hard, non-negotiable time boundaries for latency in 5G networking. Previously, all communications have been performing on a best-effort basis with good latency performance achieved through redundancy and over-provisioning. TSN is a technology widely used in manufacturing and native support in 5G may allow existing Ethernet links to become wireless.

- Timing Synchronization: A 5G base station (gNB) can provide a time reference signal for other applications.

- TSN Traffic Characteristics: 5G devices and the gNB can share traffic characteristics’ specifications to enable more efficient scheduling.

These features can elevate the functionality of cellular networks to become critical components for automation. Similarly, in the IoT domain, 5G introduces a new device category, called NR-Light, for IoT applications that require more bandwidth compared with the current categories available in 4G networks. Moreover, 5G introduces support for a larger number of devices that will be cemented in Release 17 with the full specification of the Massive Machine Type Communications (mMTC) use case. Moreover, the support for lower frequencies will play a vital role in the deployment of IoT use cases, especially when low bands offer excellent coverage for both 4G and 5G. This is making the use of low bands a major trend in the mobile industry currently.

Both LTE and 5G NR as fundamental technologies for society and business

The pandemic has illustrated that telco networks are vital national infrastructure that has kept economies running during stay-at-home periods. There is now renewed interest across the globe to ensuring that these networks keep running, despite government restrictions and other global challenges. 4G and 5G networks are key to the continued operation of many business and consumer applications and will continue to be for the foreseeable future.

This article has argued that 4G and 5G are critical for the operation of many businesses, and new features in 5G will start to improve the efficiency and automation of many enterprise verticals. In addition, subsequent improvements in key 5G technologies will continue to increase the available capacity in current networks and offer the high levels of user experience that consumers and businesses expect.