Post-Election Day greetings from North Carolina where we are still counting votes. I included this screen shot of my YouTube TV commercial break because it has been a rarity in the Carolinas since Labor Day. The watchdog site Opensecrets.org reports that over $250 million was raised for the two Carolinas Senate races alone. That translates into a lot of ads, and my friends at Charter (the predominant cable provider in the Carolinas) are very thankful for the bump. TV watchers are equally thankful that November 3rd has come and gone, and we can go back to local auto dealership, fast food and Black Friday(s) ads (with less minor key music in the background).

Post-Election Day greetings from North Carolina where we are still counting votes. I included this screen shot of my YouTube TV commercial break because it has been a rarity in the Carolinas since Labor Day. The watchdog site Opensecrets.org reports that over $250 million was raised for the two Carolinas Senate races alone. That translates into a lot of ads, and my friends at Charter (the predominant cable provider in the Carolinas) are very thankful for the bump. TV watchers are equally thankful that November 3rd has come and gone, and we can go back to local auto dealership, fast food and Black Friday(s) ads (with less minor key music in the background).

This week, we are rounding up wireless industry earnings with a look at T-Mobile’s robust 3Q report. We also will be including the latest iPhone 12 Pro chart and talk about what to look out for with iPhone 12 Pro and iPhone 12 Mini demand.

The week that was

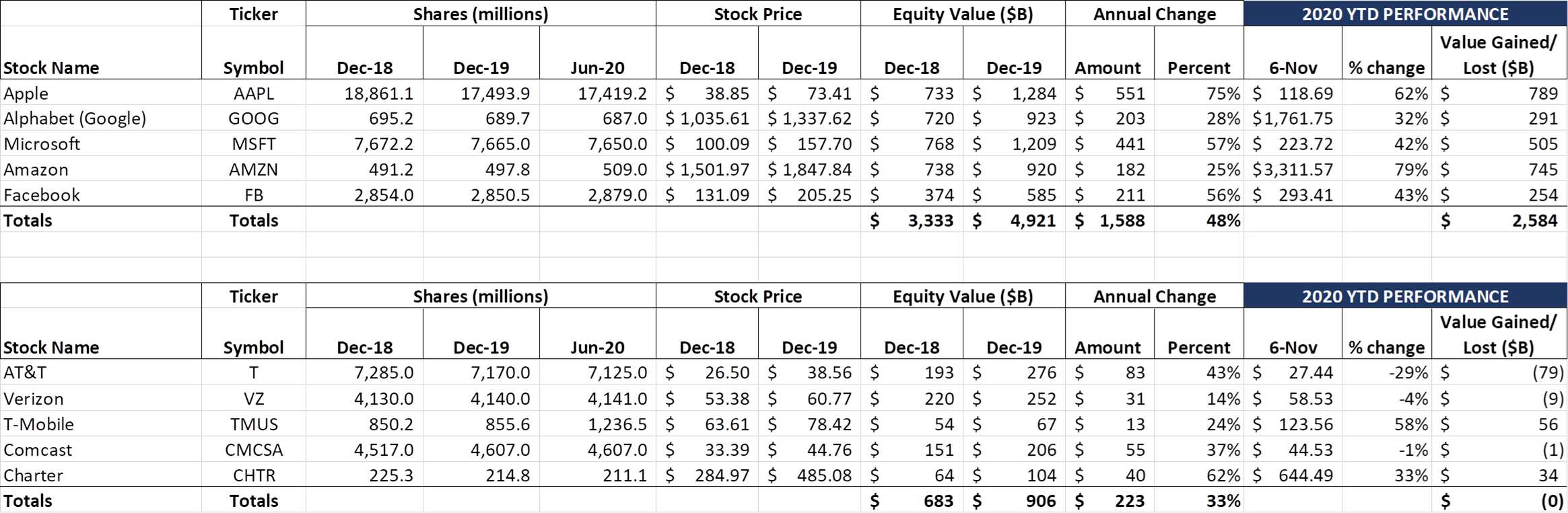

Thanks to what appear to be Election Day results of a Republican-controlled Senate and a Democrat-controlled House, the markets broadly rallied, with the consensus opinion that President Biden and Senator McConnell will be the new “power couple” in Washington. The Fab 5 added a whopping $658 billion in market capitalization this week (more than the combined capitalization of AT&T, Comcast and Verizon), and are definitely on track to surpass 2019’s record growth.

Year to date, the Fab 5 have added nearly $2.6 trillion in value, while the Telco Top 5 have added nothing (except longer debt maturities and slightly higher dividends). Over the past two years (if the current values hold), the Fab 5 will have added over $4.1 trillion in market capitalization or about $19 for every dollar gained by their telecom counterparts. The current difference in total market capitalization is about 8.3x – just a few years ago, that number was below two – see this Brief from the beginning of 2016.

Whether the Biden administration is more or less friendly to these trillion-dollar Silicon Valley companies depends on their approach to anti-trust lawsuits making their way through the courts (latest from the New York Times on the Facebook proceeding here and the Google proceeding here). Senator Elizabeth Warren could be one of the key voices here, and she’s definitely on Attorney General William Barr’s side in this debate (this 2019 New York Times article lays it out very clearly). And, with a high probability that she will not stay in the Senate (despite speculation that Biden would limit his Cabinet to previous, not current Senators – more here), a Secretary of Commerce (FTC) position for Warren would allow her to partner with a progressive Attorney General (perhaps current New York AG and John Legere not-BFF Letitia James). That would be one of the worst outcomes for the Fab 5. Let the parlor games begin!

Two additional notes related to Fab 5 companies. First, there was an innocuous article in ZDNet this week about Microsoft’s plans to fully virtualize Windows (here). When we have written about 5G (original article here), our focus has always been on applications driving adoption. Hardware improvements (smartphones, access points, in-building millimeter wave) set the table, but it’s a software meal.

Our thesis has always been that we are a few software upgrades away from this becoming a reality. Microsoft, with the Cloud PC project, affirms this view. Simply put, virtualizing applications creates a higher dependency on consistent and speedy bandwidth. The Cloud PC dream would be to have a substantially better experience with minimal local software deployment. A virtualized Windows experience is the perfect complement to AT&T, Verizon or T-Mobile enterprise 5G offerings because it standardizes the experience regardless of device screen size and location.

Imagine the cloud PC experience for all Salesforce, Oracle, and SAP applications. This has caused us to modify our thesis about in-building network deployments. Wireless carriers, who have largely abdicated their role as the on-premise wireless experience owner in favor of Wi-Fi offload, are now having their “oh no” moment. Going from 500-600 Mbps in a carrier-controlled environment in the building parking lot to whatever the IT manager decides is most economical for a particular enterprise in the 5th floor conference room means real dollars now. And it no longer is confined to YouTube video feeds – with Cloud PC, the company’s operations are impacted without consistent, powerful bandwidth. Without copious amounts of low-band spectrum (see T-Mobile commentary below), in-building deployments must accelerate.

Where does that 5G connection terminate? To the wireless carrier partner edge data center, of course, which has a Microsoft Azure instance ready to process hundreds or thousands of virtual machines. Wi-Fi is not dead, but it’s threatened by applications that can be written once for mobile, branch office, and HQ. And Microsoft has hundreds of billions of dollars in cash to ensure that their Cloud PC software is reliable and secure. Something to think about as we exit 2020.

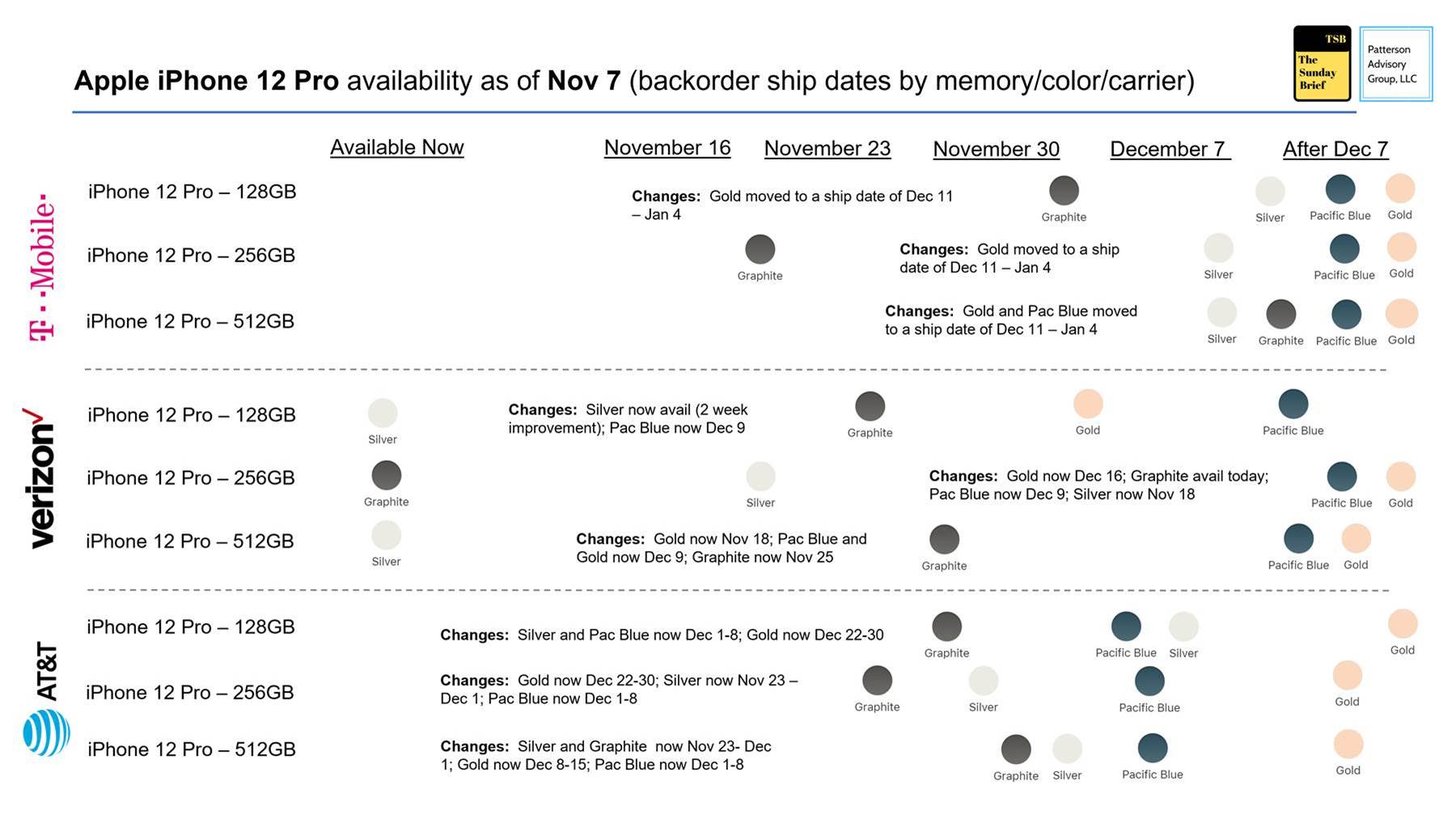

One additional Fab 5 item – the iPhone 12 Pro continues to sell amazingly well as the iPhone 12 Pro and iPhone 12 Mini pre-orders started last Friday. Here’s the latest chart (data as of Nov 7 at noon ET):

As we saw last fall (in October as opposed to November due to launch delays), the mid-line device availability tends to be constrained over the initial launch period. Depending on the color (but especially Gold), this looks to be slightly more supply constrained than 2019. That could be due to supply as much as demand, but the pending launch of the iPhone Pro Max last Friday did not keep folks away from the iPhone Pro. One interesting note versus last week’s iPhone 12 Pro chart is that Verizon and AT&T demand is starting to pick up for certain colors and sizes. The delayed demand could be due to various factors, but it appears that constraints are beginning to show for the iPhone Pro line at Big Red (and getting more constrained at AT&T).

We also took an initial look at iPhone 12 Pro Max and iPhone 12 Mini demand to see if there are any signs of shortages and it does not yet look like these models are experiencing the constraints that we are seeing on the iPhone 12 Pro. Our best indication of supply constraints will be in two weeks (one full week after general availability).

What T-Mobile is doing right

On Thursday, T-Mobile announced earnings that beat expectations across the board and also raised earnings for the remainder of the year. Their full YouTube earnings call is here and earnings information is here.

T-Mobile did many things right, but here are three that caught our attention:

- Sprint postpaid phone customers are giving T-Mobile a second chance. T-Mobile’s monthly postpaid phone churn in the quarter was 0.90%, up slightly from a pre-Sprint 0.89% in 3Q 2019. Normally, acquired customers would be interested in “shopping around,” particularly those with iPhones that were already paid for or off lease. That does not seem to be the case. When asked about this on the earnings call, Mike Sievert gave a small indication that T-Mobile’s legacy churn was below the 0.9% level, but that would imply that the legacy Sprint churn plummeted.

85% of current Sprint devices (and nearly all iPhones) are compatible with the new T-Mobile network (including Voice over LTE which is a critical improvement over legacy CDMA services). Only 15% of the Sprint traffic has migrated. The remaining customers are probably enjoying better coverage on the legacy network (no new traffic going on to it), but also enjoying roaming on T-Mobile’s 600 MHz, 700 MHz and AWS spectrum if their device has those LTE bands. Financially, it’s important to note that T-Mobile’s overall upgrade rate was 4.3% in the quarter, so the churn is not “bought” with cheap/ free Android phone switching offers.

T-Mobile is achieving these changes even with increased store closures (and likely changes in personnel) and with some increase in targeting activity. Treating the legacy network with care is one of the lessons learned from the Metro PCS integration, and T-Mobile appears to have found a successful formula.

The day of reckoning always comes with network migrations. From Neville Ray’s comments, it sounds like that will come later in 2021 and in 2022 (he implied on the call that T-Mobile would like to get more than 60% of the Sprint traffic migrated by the end of 1H 2021). Legacy Sprint churn was going to be a closely watched measure, and it appears to be exceeding expectations thus far.

- Legacy Sprint enterprise customers are not only giving new T-Mobile a first chance, they like what they see and are awarding the company business. When we wrote about critical merger success factors at the beginning of the year (see Brief here), we noted that T-Mobile’s integration of the legacy Sprint sales knowledge was going to be important. T-Mobile does not break out business lines in their results, but our guess is that even excluding strong educational and government performance, T-Mobile for Business did quite well.

Mike Sievert was asked a question by Michael Rollins about legacy Sprint asset opportunities and his response was telling:

“The capabilities that we inherited and that we see in this Sprint team and some of the know-how is fantastic. You really can’t evaluate this team and its capabilities by the former business results of standalone Sprint. That was a company with lots of structural challenges financially. And so, it was easy to kind of side-eye that operation and assume that it didn’t have much to offer. That’s totally wrong. Now that we’ve gotten into it, there’s so many best practices that we’ve been able to begin to adopt into the combined blended total. So that’s very exciting, including the team.”

T-Mobile is just beginning to understand the unique value that Sprint’s enterprise sales teams bring to the table. If 5G must extend through the building (including millimeter wave as Neville Ray noted in his earnings call response), then who better to present than a salesperson with a decade-long relationship with that corporation.

This does not mean that all of the assets must remain within T-Mobile’s control. Sprint’s fiber network was largely constructed in the Reagan/ George H. W. Bush era and needs to be transitioned to Zayo, Lumen, or another global provider. Sprint’s Network Vision project started a decade ago needs to quickly fade with an LTE sunset. And, as we mentioned in the aforementioned Brief, this allows Deutsche Telekom and perhaps even Softbank the opportunity to extend global capabilities for enterprise customers. But T-Mobile inherits expertise and relationships that cannot be easily hired and have rightly recognized their value.

- T-Mobile is clearly setting up new revenue streams for growth with Home Internet and TVision to provide a nationwide alternative to cable. We think that this mission is different from Verizon (who chose YouTube TV as their out-of-region live TV provider) and AT&T (who is focused on reclaiming in-region customers with an AT&T TV + AT&T Fiber promotion).

Here’s one way to think about T-Mobile’s strategy (using my own experience with T-Mobile Home Internet as an example):

- Make it easy for potential customers to try the service. No number porting with Internet or TV services, so already easier than smartphone transitions. Many customers will also run the service on a “side by side” basis for a month or two, and this gives them time to firmly disconnect from cable.

- Make the service most attractive to existing customers (easy addition). This is exactly what they did with Home Internet in the earliest days and are currently going with TV services. They will be the most eager to tolerate early-launch issues and also provide excellent product feedback.

- Validate service consistency and use this (as opposed to speed) as the cable differentiator. One of the things that I have learned from my month on T-Mobile Home Internet is that my aging Wi-Fi access point (the original Google Home Hub) is working just fine. Our cable provider constantly struggled to keep Zoom video working (so much so that I accessed audio through my mobile phone not my computer), and my suspicion was “it’s the Wi-Fi.” T-Mobile Home Internet is LTE-based, and the 5G version will be even faster. But I am finding for 2 TVs streaming college football + 2 connected smartphones + 2 connected laptops, 50-70 Mbps down/ 15-20 Mbps up of consistent broadband service more than suffices.

- Attractively price the service with no contracts or “exploding” offers. Single-play Internet with cable companies (not on contract or promotion) runs ~$60-90/ mo. plus taxes. Modem fees are usually extra. T-Mobile is pricing entry-level live TV + (LTE) Internet for $90 to wireless customers. Could Magenta be using the same bundle tool against cable that Time Warner, Cox, and Cablevision effectively used against the telcos 15 years ago (bundle pricing)? Who will get there first – cable with attractive family plan pricing, or T-Mobile with 2.5 GHz integrated into 200-300 million POPs? That may be one of the most important questions for 2021.

There’s no doubt that T-Mobile could stumble badly with TV. Prior to Thursday’s earnings call, programmers were fuming that T-Mobile had already violated their retransmission agreements (we recall similar grousing when Verizon introduced skinny video bundles). And with AT&T owning CNN, TBS, and TNT, and Comcast owning NBC and other programming, there’s bound to be sparring.

As we stated last week, we think that T-Mobile is going to think about TV as additive to the wireless experience (the $10 Vibe product is particularly intriguing). It should be a very attractive product to current and future customers who want to be entertained without a multi hundred-dollar contract commitment. And best of all, it should be easy to sell through service and store channels. (How T-Mobile will build advertising capabilities with existing small business customers might be their next un-carrier move – what better PR move to overcome the “we’ll be right back” opening picture for this week’s Brief than to feature T-Mobile for business customers in ad slots).

Bottom line: T-Mobile’s market capitalization is within $40 billion of AT&T’s for a reason – they are playing offense. Hitting synergy targets, taking care of their legacy Sprint smartphone base, growing their business presence, and launching new un-carrier products that take advantage of existing network deployments are a few of the ways they are taking charge. No doubt, there’s a lot of heavy lifting ahead as they face the harder synergy challenges, but the first few months of the merger appear to be on track.

Next week, we’ll cover a few remaining earnings items and also discuss three new “Up and Comers” (for the U&C June Brief, click here). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals.

Stay safe, keep your social distance, and Go Chiefs!