Hi again from Davidson, where the COVID-adjusted “new normal” isn’t keeping folks from life. Activity is up from summers past, partially due to an influx of Empire and Garden State escapees. We welcome them with a big “Hi y’all.”

Hi again from Davidson, where the COVID-adjusted “new normal” isn’t keeping folks from life. Activity is up from summers past, partially due to an influx of Empire and Garden State escapees. We welcome them with a big “Hi y’all.”

This week, our market commentary will be slightly longer than normal as we discuss recent content bundling strategies for AT&T and Verizon. We will then briefly dive into telecom regulatory policy under a Biden administration (spoiler alert: moderate changes, but no crazy Bernie stuff), and then check in on the CBRS auctions.

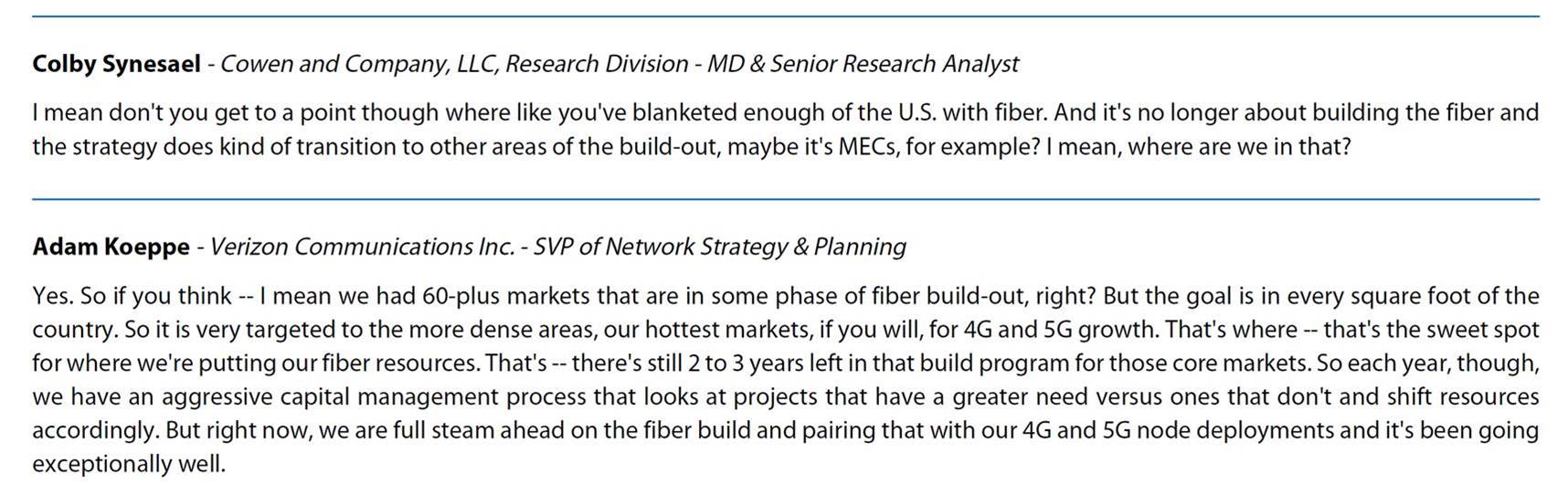

Before going into this week’s equity market changes, a quick correction to last week’s article. There appears to have been a transcription error that was fixed after last week’s Brief. Here’ the before and after:

As of August 15, mid-afternoon (and how we quoted it in the Brief):

And how it is now on the Investor Relations Monday, August 17:

While the meaning of “is in” and “isn’t” is very different, our conclusion remains unchanged: Verizon is going to fiber up beyond the 60 markets, and, like wireless network expenditures, new fiber deployments will be a $2-3 billion annual expenditure for the company in perpetuity. If they increase their One Fiber accountability (“sell where you have fiber/ don’t sell where you don’t have fiber”), Verizon could create disproportionate value in the next decade.

The week that was

Most summers, the end of August is a quiet time for the markets. Folks go on vacation, and there’s some minor chatter in Corporate America about how to finish the year “strong.” This year, we have the extra benefit of COVID vaccine speculation and an unconventional presidential convention/ campaign season.

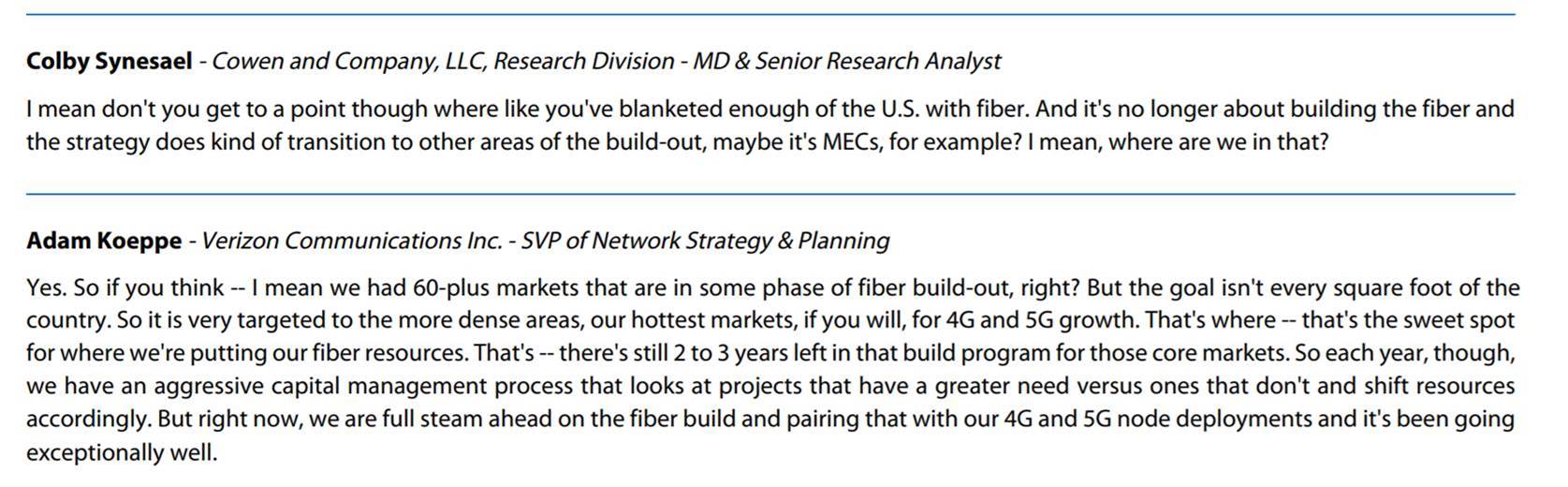

Someone forgot to tell the Fab 5 that this was supposed to be a quiet period. Not only did Apple cross the $2 trillion market capitalization mark, but each of the Fab 5 had meaningful equity increases this week (Google +$50 billion; Amazon +$69 billion; Microsoft +$31 billion; Facebook +$17 billion). Of the $333 billion gain for the week, about half was Apple.

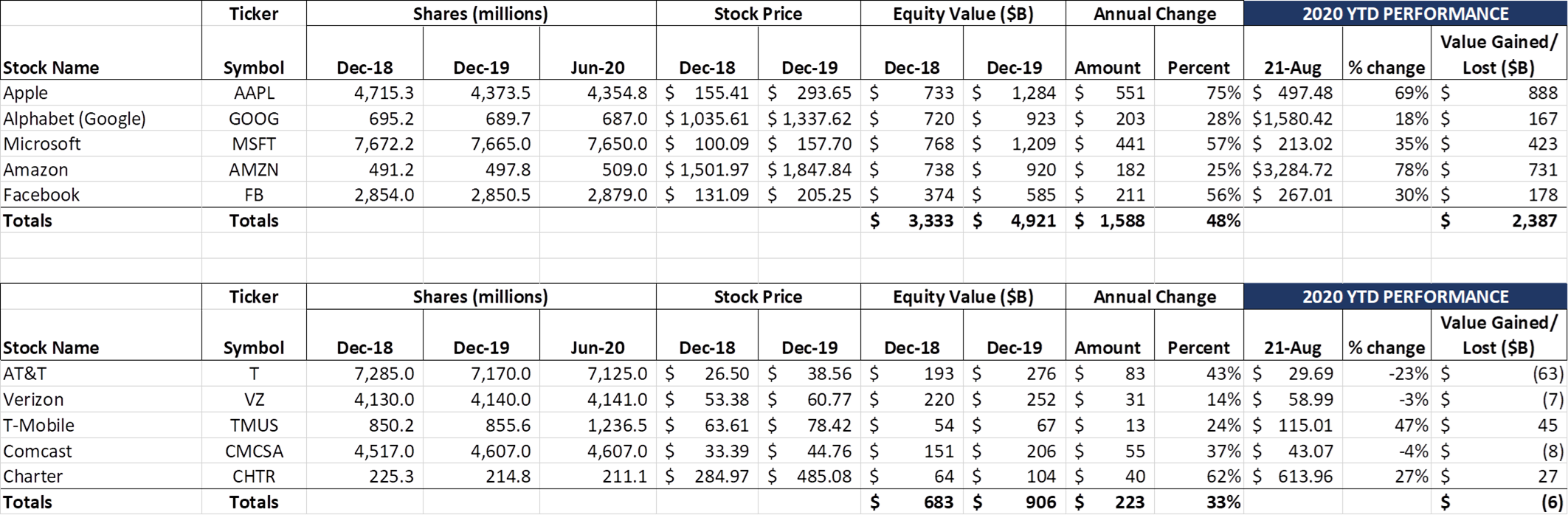

The Telco Top 5 behaved like mid-August sticks should: plus/ minus a few billion change for each stock with a loss of $3 billion in equity capitalization overall. One of you commented to me this week that there continues to be a stark difference in performance for AT&T versus the other telcos we routinely analyze. This is becoming more obvious as Verizon’s stock continues to recover while AT&T remains flat. Below is a Yahoo! Finance chart indexing the prices of VZ and T since the beginning of the year – the difference is very apparent.

The Telco Top 5 behaved like mid-August sticks should: plus/ minus a few billion change for each stock with a loss of $3 billion in equity capitalization overall. One of you commented to me this week that there continues to be a stark difference in performance for AT&T versus the other telcos we routinely analyze. This is becoming more obvious as Verizon’s stock continues to recover while AT&T remains flat. Below is a Yahoo! Finance chart indexing the prices of VZ and T since the beginning of the year – the difference is very apparent.

First, Verizon had a lower floor thanks to greater concentration of broadband and wireless in its revenue mix. But since 2Q earnings, the performances of Verizon and AT&T have been very different (AT&T flat while Verizon is up nearly 10%). Is this a “bet” on who will lose more market share to the new T-Mobile, or is it a reflection of AT&T’s higher dependency on media, film production, and communications than their East coast-based counterpart? Probably more of the latter than the former, but equity performance could not be more different for the two stocks: AT&T has lost 23% of its value in 2020, and Verizon has lost 3%.

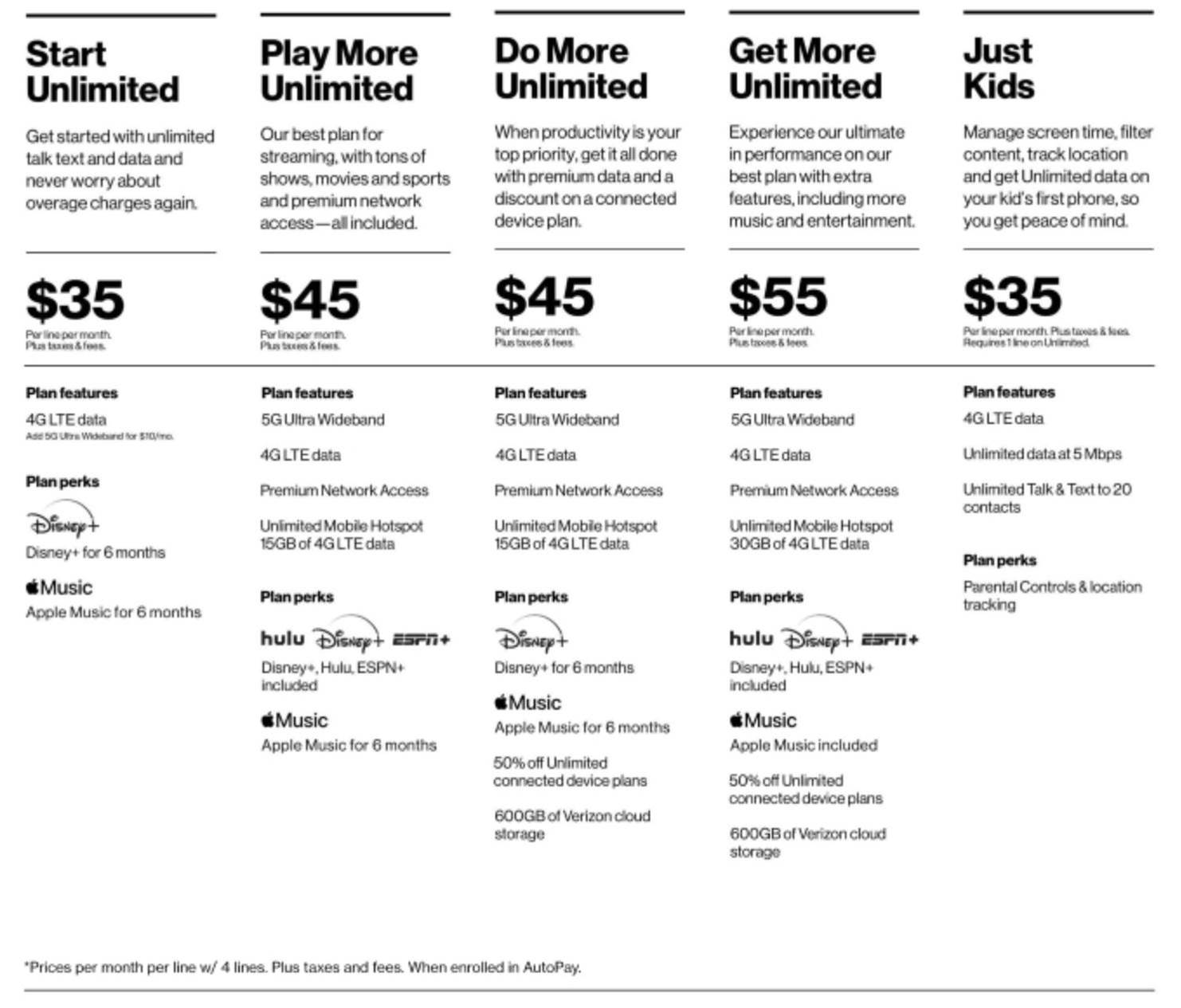

We were reminded of the differences in approach to media partnerships this week when Verizon announced changes to their content bundling packages. Here are the new packages (as of today):

Apple Music for the family retails for $14.99 per month and Disney+ (family) retails for $12.99 per month. A savvy plan buyer could work the math to make this $28/ month expense Verizon’s responsibility (especially with the Just Kids plan now including unlimited 4G LTE data at 5Mbps which should be able to accommodate HD traffic to devices).

While Verizon has not released the details of their Disney or Apple agreements, one can easily surmise from earnings call commentary that they did not pay a lot for either Disney+ or Apple Music (and might be receiving an extra bonus if the customer signs up for service after six months). This has many asking “Is AT&T’s premium content development (vs distribution) strategy the best course for their shareholders?”

Verizon’s Disney, NFL and Apple relationships clearly indicate that alternatives exist and can be implemented quickly (one also has to think that a Peacock Network alternative might also be in the works given their MVNO relationship with Comcast). T-Mobile also has Netflix and MLB and does not appear to be struggling to attract potential subscriber attention. In the end AT&T might get the last laugh, but we are questioning why premium content creation creates sustainable competitive advantage.

“Meet the new boss. Same as the old boss.” Telecom policy under Biden

Editor’s comment: We realize that the line “Meet the new boss, same as the old boss” might be foreign to some. Here’s a YouTube video to jog your memory if you are unfamiliar with the phrase.

There are two schools of thoughts headed into November’s election. The first is much more progressive, and boldly thrusts government into the tech and telecom arenas. Social and environmental policies will form the basis of swift legislation that will change how the data center and telecommunications industries sell their services and operate their networks. And big tech/telecom oversight (e.g., Title II utility-style regulation) will make the regulation of IBM and AT&T in the 1970s look like child’s play.

The second school of thought still brings moderate but meaningful changes. Telecommunications development is a national strategic imperative, and our understanding of how to collect, analyze, and improve lives through data analysis gives America a global competitive advantage. Broadening access to broadband services, especially in underserved metropolitan areas, improves opportunities for those struggling to live the American Dream. Paid prioritization is out, but edge computing (which will place some content very close to the customer) is in.

While there has been a lot of progressive media coverage in the last several months, we think that a new President brings a lot less change to telecom and tech than most think. Consider FCC Commissioner Jessica Rosenworcel’s Friday press release on the state of Broadband in the US (report here; Commissioner Rosenworcel’s statement here). The sources of her dissent are threefold:

- Because of the use of a census block mechanism, we may be undercounting those without proper availability to broadband services

- Our definition of broadband needs to evolve with the market and with increased in-home needs (she stops short of proposing a symmetric speed standard, but her points reflect current market forces)

- The report fails to take into account affordability and digital literacy

While the issues the Commissioner raises are valid, she stops short of mandating pricing for a “basic” Internet service (which we saw from candidate Sanders – see our March Brief on the topic here). Companies like Broadband Now have most/all of the information needed for part a (speeds by carrier by street address), and there’s no doubt that concurrent users on an asymmetric upload speed will see degraded experiences which could impact the “learn from home” experience.

The bigger question for the FCC should be “Why solve the broadband divide through wireline?” especially in rural markets. The thought that upgraded copper solutions into very rural homes make the best solution has been disproven, with the most recent sign of that coming from Charter Communications prior to the CBRS auction (Craig Cowden’s January comments from a Light Reading conference in January are here).

On top of Charter, T-Mobile made significant commitments to the DOJ and even more to specific states to gain their support for a merger. These included:

Deploying 5G to 97% of Americans by April 1, 2023 and 99% by April 1, 2026

- Deploying 5G to 85% of rural America by April 1, 2023 and 90% by April 1, 2026

While there might be additional questions on the quality of 5G services in small towns like California, Missouri (population 4,278) or San Jose, Illinois (population 642 – US Post Office pictured), the commitment still stands prior to any additional infrastructure bill passage. Will T-Mobile improve US Cellular’s overall service quality where they have a new competitor? Very likely that it will. Will Mediacom improve DOCSIS coverage (or follow Charter’s CBRS deployment) in San Jose? If the economics support it, they will definitely stand their competitive ground.

Bottom line: Wireless is a better solution to solve the “homework gap” than wireline. To eradicate the gap, carriers need more access to spectrum and towers. Consensus is highly likely, with conversations about “Who pays what?” being the remaining dividing issue.

“Same as the old boss” also holds for antitrust?

This is a very interesting question. The current administration has a very selective strategy when it comes to antitrust policy: Sue to stop AT&T and WarnerMedia from merging, find a resolution in the T-Mobile/ Sprint merger to allow them to merge, and investigate a wide variety of antitrust allegations against Google, Amazon, Apple and Facebook.

As we have mentioned many times in this column, it’s hard to see stock price appreciation for many service providers and tech companies increase without thinking how they could more aggressively use their currency (especially their stock). The allure of acquisition also is helped by record-low interest rates. At the same time, however, it’s hard to see many of these companies survive regulatory scrutiny of a transaction, particularly in the states of California and New York.

For example, Mediacom would be an excellent merger partner for Altice (and specifically Suddenlink within the Altice footprint). The synergies from consolidating operations would be significant in many rural communities where territories adjoin. But could they pull off a merger in the more progressive administration? It would be tough.

Even more salient would be a DirecTV/ Dish merger which many (including us) think inevitable. Using the Sirius/ XM radio merger as a proxy (although it was completed after a 57-week review process at the end of the George W Bush administration), the case should be straightforward. But it would inevitably face a state AG challenge – could the merger partners withstand that scrutiny? What additional concessions might Dish need to make (perhaps to its wireless unit) to put it over the wall?

For more insights on antitrust in a Biden administration, we suggest this short article from The Brunswick Group.

“Same as the old boss” applies to unions/collective bargaining?

Actually, there is a real and meaningful difference when it comes to unions. The joint Biden-Sanders document is very clear – more union jobs on all infrastructure work – the words “union” or “unions” or “unionize” are mentioned 37 times (about once every three pages). Again, their recommendations do not embrace all of the Sanders campaign rhetoric, but definitely will create some discussion in the corridors of tech and telecom.

Our bet is that the flashpoint for collective bargaining will be at T-Mobile. Few Sunday Brief readers remember the T-Voice skirmish with the Communications Workers of America (Mike Dano’s Light Reading Article is here), but more administrative cover for unions is a read headwind for Magenta if the CWA succeeds (we were unable to determine if T-Mobile appealed the ruling described in the article – any insights would be welcome).

Verizon has had long-running issues with their unions (the 2016 New York City strike is still clear in many minds), and a new administration could mandate a softer tone from management in exchange for government contracts. More on Verizon’s 2019 union scuffle with the CWA here.

Because of the economic hardships brought on by COVID-19, unions will be more attractive to some in the communications industry, particularly with many stores not reopening. With 14% of the telecommunications industry workers represented by unions in 2019 (data here), there’s a lot of room to grow.

Bottom line: There are many variations on the way telecom and antitrust policies could evolve. Our crystal ball is still hazy, but we think there will be laser focus on broadband availability (favoring wireless in a Biden administration), little interest in approving big mergers, and more unionization imperatives in a future Biden administration. Nothing crazy like mandated municipal broadband or mandated Internet minimum rates (with symmetric multi-hundred Mbps speeds). If the Dems sweep, all bets are off.

CBRS auctions likely to conclude this week

CBRS auctions likely to conclude this week

There was a fair amount of activity in the last 20 rounds, and things have started to quiet down at the CBRS auctions. The latest data from Sasha Javid is nearby (site here). After 67 total rounds, there are 10 markets where demand is greater than supply, and each of the 20 largest markets has an equal level of supply and demand.

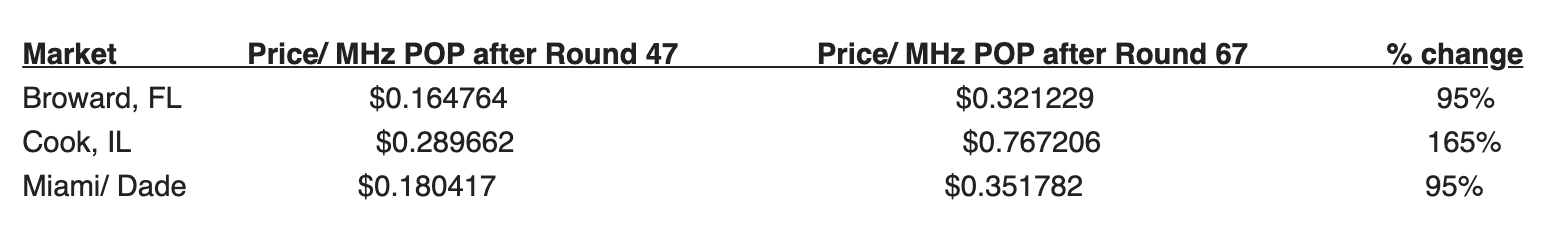

Last week, we discussed the fact that there were three remaining markets in the Top 20 where demand was greater than supply. Here’s how the last three markets turned out:

Our prediction is that Verizon and cable will be well represented in the CBRS auction results (very good news for Federated Wireless), particularly in the major metropolitan areas, and there will be “fill in” locations for many other service providers (including AT&T, Dish, and T-Mobile). We may know the winners in time for next week’s Brief – stay tuned.

That’s it for this edition of The Sunday Brief. Next week, we will attempt to explain what a second Trump administration’s telecom and tech policy will be (spoiler alert – even more spectrum, and more rhetoric). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!