History

Some estimates put the telecom industry, especially the RAN segment, between seven and ten years behind a normal innovation curve due to the lack of competition in the market. This is a similar situation to the state of the data center industry in the 1990s, during the dot-com boom, and before companies like VMWare and Intel rapidly turned the market upside down. The data center industry – and most enterprise businesses for that matter – saw the value of software-centric approach and transitioned to more open models, with competing software vendors fostering innovation. And now, the telecom industry is going through the same dramatic change that the data centers went through in the 2000s; all driven by Moore’s Law.

The main takeaway: In the data center world, even traditional hardware manufacturers have subsequently moved to software-centric businesses. The ones that refused accept the software-driven world, did not make it.

Why

The lack of a vibrant vendor ecosystem in telecom has limited innovation in the industry and kept the cost of network capacity high. MNOs throughout the world are aware of this and are now working with challenger vendors to address the issue and encourage change.

The main takeaway: Unless they embrace change, the traditional players risk becoming obsolete as the telecoms industry starts demanding networks that are open, cost-effective and flexible.

What

The last 5 years saw significant moves towards the OpenRAN model, a new way of building radio networks based on a software-centric and open infrastructure, disaggregating hardware from software in the network. This helps networks support open interfaces and common development standards, to deliver multi-vendor, interoperable networks and helps avoid any vendor lock in.

The main takeaway: Unless they embrace change, the traditional RAN vendors risk becoming obsolete as the telecoms industry starts demanding networks that are open, cost-effective and flexible. OpenRAN is about the decoupling of hardware and software, providing more choice and interoperability. This gives operators the flexibility to cost-effectively deploy and upgrade their networks, reduce complexity, and deliver coverage at a much lower cost.

When

2016

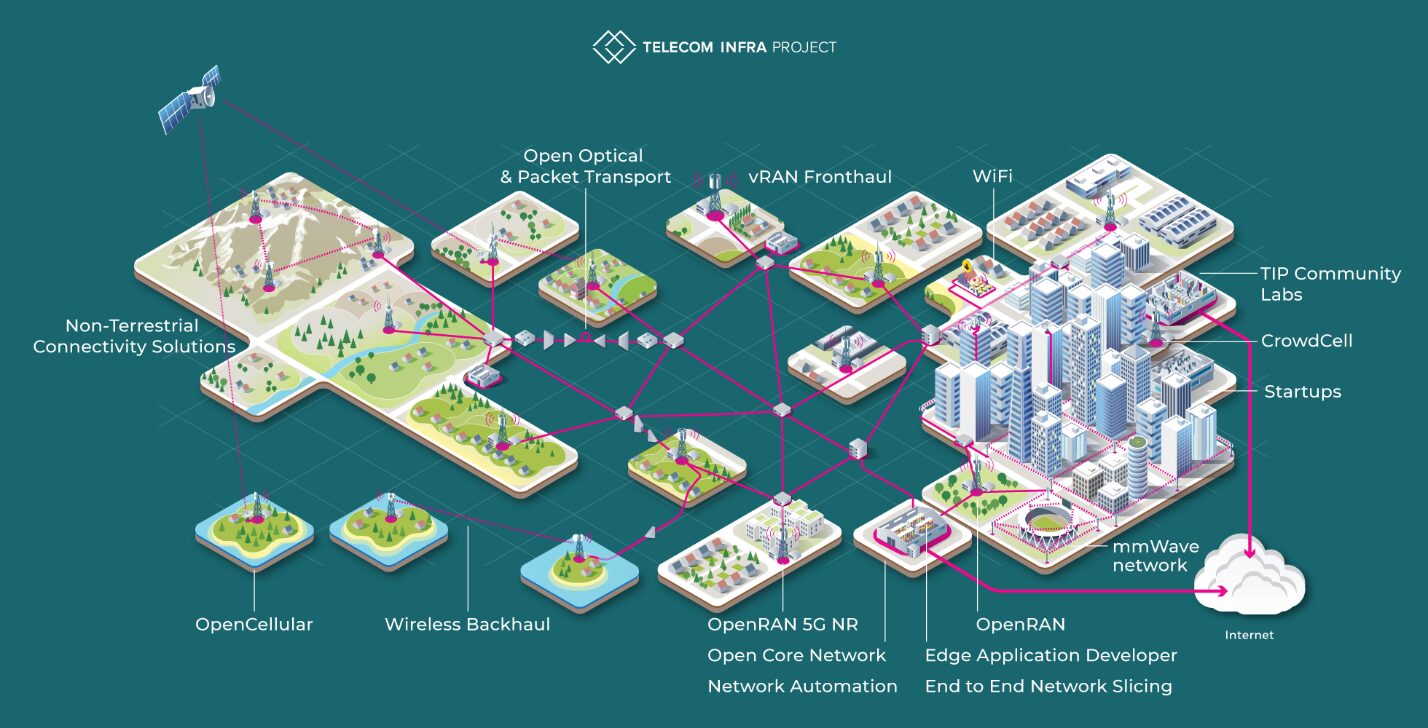

The Telecom Infra Project (TIP) was formed in early 2016 as MNOs were frustrated with a lack of innovation in a highly concentrated/closed ecosystem and high costs in the telecom equipment sector. TIP has brought together operators, traditional equipment vendors and startups that are using open source technologies and open approaches. TIP project groups are divided into three strategic networks areas that collectively make up an end-to-end wireless network: Access, Transport, and Core and Services. By dividing a network into these areas, TIP members can best identify where innovation is most needed and work to build the right products.

Source: TIP

TIP is jointly steered by its group of founding MNOs and vendors, which form its board of directors, and is currently chaired by Vodafone’s Head of Network Strategy and Architecture, Yago Tenorio. Vodafone has been leading efforts within the TIP’s OpenRAN initiative since 2016 with three main goals: – 1. to spur innovation through building an ecosystem, 2. to enable supplier diversity and, 3. to reduce deployment and maintenance costs.

As part of TIP, Vodafone is working closely with other mobile operators to accelerate innovation, new technology and business approaches to help the industry build the networks of the future.

There are over 70 mobile operator members now in the TIP membership roster. With more than 500 participating member organizations, including operators, vendors, developers, integrators, startups and other entities that participate in various TIP project groups, TIP adopts transparency of process and collaboration in the development of new technologies. TIP supports low cost and more competition. They launched PlugFests to accelerate interoperability between vendors, to create a tangible ecosystem and to encourage trials and deployments.

2017

The first OpenRAN trials started in India and Latin America. You might wonder why low ARPU markets became a playing ground for Open RAN? Hint: the answer can be found at the end of this installment.

2018

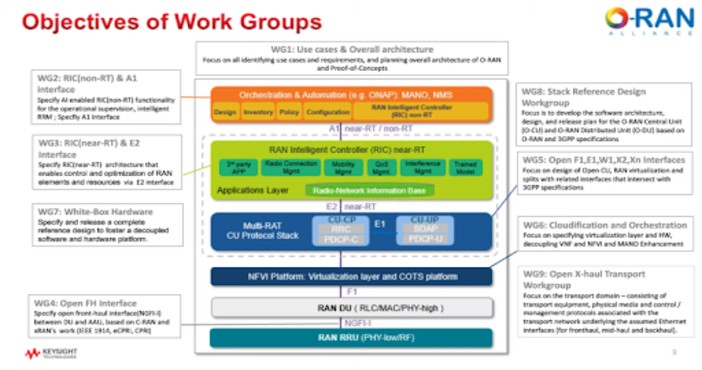

February: The O-RAN Alliance was formed. It’s is a worldwide, carrier-led effort to drive new levels of openness in the radio access network of next-generation wireless systems by creating standards for interoperability – one of the most important being the 7.2 functional split between RU and DU which standardized the use of 3rd party radios. The alliance was formed as a result of a merger of C-RAN Alliance and xRAN Alliance. O-RAN Alliance’s original founding operator members were AT&T, China Mobile, Deutsche Telekom, NTT DOCOMO and Orange, but since then many other operators have joined. As in case of TIP groups, the O-RAN Alliance has its own set of working groups.

Source: Keysight

While 3GPP defines the new flexible standards (Release 16 was just finalized on July 3rd) separating the user and control plane and keeping the different implementation options open, the O-RAN Alliance specifies reference designs consisting of virtualized network elements using open and standardized interfaces and calls for more intelligence in the network with the help of information collection from these virtualized network elements. Recently, O-RAN Alliance introduced a virtual exhibition where 38 Open RAN ecosystem partners demonstrate their innovations.

TIP is not writing specs like O-RAN Alliance, but rather TIP is promoting, educating and deploying OpenRAN globally, starting in LATAM in 2016, then with Vodafone in Asia, Europe and DRC and more in Asia with Indosat Ooredo, Smartfren, ad Axiata and most recently with TIM in Brazil.

February: At MWC 2018, Telefónica announced “Internet para Todos,” a collaborative project to connect the unconnected in LATAM. The initiative is aimed at connecting the more than 100 million people in LATAM who currently have no internet access. Telefónica expanded its collaboration with multiple stakeholders: rural operators, technology firms and regulators. With “Internet para Todos,” Telefónica is expanding connectivity with an ecosystem approach, incorporating a broad range of partners and stakeholders to solve the rural connectivity challenge.

June: Vodafone and Telefónica announced a joint RFI to evaluate Open RAN technologies that are software-based and that run on top of commoditized hardware.

October: At TIP Summit 2018, Telefónica and Vodafone announced the vendors they chose for their Open RAN pilot deployments. Vodafone and Telefónica expressed the importance of disaggregating hardware and software to make networks open, easy and cost-effective to deploy and maintain. Both operators also highlighted the necessity of software-based network solutions being able to support ALL Gs (2G/3G/4G/5G). Both operators were aligned on the need to scale these solutions in their rural footprint as one of the levers for success.

2019

February: Rakuten announces world’s first virtualized, cloud-native greenfield 4G network. It has become a poster child for Open RAN though it doesn’t use O-RAN Alliance defined “open” interfaces. What interfaces do they use? Rakuten’s radio vendor (Nokia) opened up their X2 interfaces to the software from another vendor. This proves our point that openness = open interfaces between different component vendors.

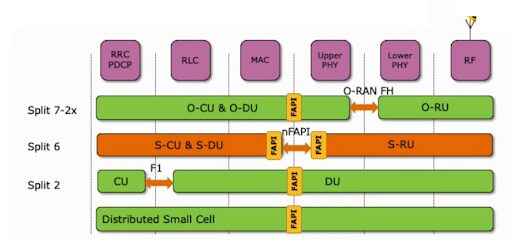

July: The Small Cell Forum (SCF) has enabled a small cell Open RAN ecosystem by defining the PHY API that provides an open and interoperable interface between the physical layer and the MAC layer. 3G and LTE versions are already used in most small cells today. SCF expanded the set of specifications to enable small cells to be constructed using components from different hardware and software vendors to address the diverse mixture of 5G use cases.

These open interfaces are called FAPI and nFAPI (which stands for network FAPI). These interfaces will help network architects by allowing them to mix distributed and central units from different vendors. The SCF nFAPI is enabling the Open RAN ecosystem in its own way by allowing any small cell CU/DU to connect to any small cell radio unit or S-RU. With 5G FAPI, competition and innovation are encouraged among suppliers of small cell platform hardware, platform software and application software by providing a common API around which suppliers of each component can compete. By doing this, SCF provides an interchangeability of parts ensuring the system vendors can take advantage of the latest innovations in silicon and software with minimum barriers to entry, and the least amount of custom re-engineering.

Source: Small Cell Forum

October: At TIP Summit 2019, Telefónica cited the example of its Internet para Todos (IpT) project to showcase the benefits of Open RAN. IpT opened talks to bring a second operator on board after connecting more than 650 sites since May 2019 and covering 800,000 people (450,000 actual customers) with a 3G and 4G rollout in rural Peru. IpT looks to achieve economic sustainability through partnerships with local communities and by using OpenRAN technologies that will reduce the cost of deployment in areas where current technologies are cost prohibitive. These include cloud-like architectures, automated network planning, open radio access solutions and a combination of optimized fiber and microwave networks.

Vodafone made even a bolder move when they opened up their whole European operations to OpenRAN. Vodafone’s tender covered more than 100,000 sites and 400 million people across 14 countries. “Right now, this is the biggest tender in this industry in the world,” Yago Tenorio, head of Network Strategy and Architecture at Vodafone said at TIP Summit 2019. “It’s a really big opportunity for OpenRAN to scale. We are ready to swap out sites if we have to. Our ambition is to have modern, up-to-date, lower-cost kit in every site.”

2020

February: TIP and the Open RAN ecosystem launches an Evenstar program, which is focusing on building general-purpose RAN reference designs for 4G/5G networks in the Open RAN ecosystem that are aligned with 3GPP and O-RAN specifications. Vodafone, Deutsche Telekom, Mavenir, Parallel Wireless, MTI, AceAxis, Facebook Connectivity and additional partners unveiled the Evenstar RRU (Remote Radio Units). RRHs, distribution units, and control unit software have traditionally been only available as a packaged unit. By decoupling the RRU hardware from DU and CU software, mobile network operators will have the ability to select best-of-breed components and the flexibility to deploy solutions from an increasing number of technology partners. The intention is to contribute the proposed solution into TIP’s OpenRAN Project Group to help accelerate adoption. The Evenstar family is expected to eventually include multiple Remote Radio Head (RRH) product SKUs. The RRH architecture is based on O-RAN Alliance Fronthaul specifications based on Split 7.2.

February: O-RAN Alliance and TIP announced a partnership agreement to ensure their alignment in developing and deploying interoperable Open RAN solutions. As TIP is agnostic about the specifications it uses for the solutions service providers need, it has to work with various standards bodies to ensure smooth deployment. This new agreement with O-RAN Alliance allows for the sharing of information, referencing specifications and conducting joint testing and integration efforts. This was an important move to ensure both organizations align in the development of 5G RAN solutions to avoid duplication, while lowering costs and sharing resources. In a blog, Attilio Zani, executive director at TIP, provided an update on the group’s activities, while revealing the partnership between the pair.

May: O-RAN Alliance and GSMA announced they have joined forces to accelerate the adoption of Open RAN to take advantage of new open virtualized architectures, software and hardware to accelerate 5G adoption globally. The press release stated the organizations will work together to harmonize the open networking ecosystem and agree on an industry roadmap for network solutions, consequently making access networks as open and flexible as possible for new market entrants and resulting in better connectivity for all.

May: OpenRAN Policy Coalition was launched. It represents a group of companies formed to promote policies that will advance the adoption of open and interoperable solutions in the RAN as a means to create innovation, spur competition and expand the supply chain for advanced wireless technologies including 5G. Its main goal is to educate governments around open technologies and the benefits.

July: Nokia and Samsung announce OpenRAN product availability for 5G. Ericsson and Huawei have not made any OpenRAN announcements (as of yet). However, Ericsson is a member of the O-RAN Alliance.

An interesting observation is that Nokia’s and Samsung’s announcements were around OpenRAN for 5G, leaving other Gs behind… We believe that if a mobile operator only deploys OpenRAN for 5G, they will have the challenge of managing two networks: a vertical one with legacy equipment and the new one with distributed, OpenRAN architecture. While the operator might have flexibility and will avoid vendor lock-in for 5G, the legacy 2G, 3G and 4G network will still rely on closed RAN components.

The main takeaway: Open RAN is now mainstream, with not only industry organizations joining forces to drive the OpenRAN movement forward, but also legacy vendors opening up their RAN – but for 5G only.

How

It is not a surprise that Open RAN started in rural areas, as that is the most challenging market for MNOs and vendors to address – the user penetration is low, the ARPU is low, and the site and backhaul infrastructure is non-existent. With an ALL G OpenRAN solution, MNOs can address cost and deployment challenges of rural markets globally. Minimizing CAPEX/OPEX is important in these low-density areas where there is high uncertainty regarding return on investment. High operational cost and deployment complexity of low-density deployments have prevented MNOs from bringing coverage to those areas in the past. Traditional 2G voice-only and broadband 3G or 4G networks require high-cost and often bulky equipment to deploy and operate. These types of equipment need large spaces to store, have a short life cycle and consume energy. Hardware-based networks are also difficult to upgrade. By shifting networks to virtual Open RAN architectures, telecom operators can overcome all these problems and deliver coverage at a much lower cost.

Now that OpenRAN has been deployed and proven in those low-density areas for 5+ years, MNOs have started deploying OpenRAN in urban locations for network modernization and for 5G. This will allow global mobile operators to have greater buying power as they continue shaping the OpenRAN ecosystem.