With the market for 5G devices set to grow exponentially in the next 18 months, there are several complex challenges ahead for the OEMs. Chief among these is the ability to solve the integration of the whole 5G cellular system design into their devices, from the antenna to the modem, supporting cellular innovation as it emerges. This needs to be done while still maximizing device performance, thereby optimizing power consumption without compromising overall device design or cost. To overcome these challenges, OEMs will need to move away from component assembly and adopt a system-level design so that they can focus more effectively on customer experiences and deliver more reliable products, reaping the most benefit from 5G adoption. This delegation of modem-RF system design brings with it many advantages, but such a strategic approach has been carried out by few in the market thus far. This article looks at the rationale behind moving to a simplified 5G components sourcing process and identifies who is currently best placed in the industry to provision 5G device end-to-end performance in fully integrated system designs.

1. 5G growing fast and beyond the mobile devices market:

5G is now the fastest-growing cellular generation ever. In 2020, the technology is expected to reach out to new device types and new markets beyond smartphones, to include tablets, mobile broadband routers, fixed wireless access CPEs, notebooks, wearables, and computing-centric and industrial IoT devices, among others. The 5G devices market will expand exponentially across all 5G mobile device types from a collective total of just under 20 million units in 2019 to well over 200 million in 2020.

However, 5G will also bring new challenges to the device technology supply chain. The technology implementation requires new Radio Frequency (RF) and RF Front-End (RFFE) components, features, and functionalities, as well as more processing capabilities, which will lead to substantial changes in the design of mobile devices. This is particularly challenging for the OEMs, as it makes their components procurement process and system design far more complex, which could lead to lengthy product development cycles, more expensive devices, and huge constraints on device industrial designs. The following sections will provide more detail on the challenges presented by the RF systems.

2. Complex challenges ahead for OEMs in the fast growing and competitive 5G market

Through the addition of 5G, the device user experience can be improved immeasurably from previous generations making integration highly desirable and advantageous. Such immediate enhancements include improving online cloud gaming through reduced latency and allowing for 4K/8K video streaming owing to higher data rates. Other features such as AI and AR/VR will also be stimulated further by the addition of this high-performance connectivity but without compromising power consumption.

However, the 5G roadmap is significantly more complex and faster-moving than previous generations, which brings with it a whole raft of technical challenges. Some OEMs that will bring 5G connectivity to new device types or those that are challenger smartphone OEMs, such as Xiaomi, OnePlus, ViVo, and OPPO, have little-to-no experience or expertise in cellular connectivity. These OEMs will, therefore, rely heavily on 5G chipset suppliers to help design high-performance 5G systems to enable them to quickly accommodate best-in-class features and innovation, which will help differentiate their offerings.

An area to be hit hardest during the transition to 5G is the RFFE, where the related discrete components, features, and functionalities in smartphones and other portable devices will expand exponentially. This owes much to the growing demands expected from networks and new radio features designed to enhance the network spectral efficiency and support a wide spectrum of frequency bands and modulation techniques. In addition, and despite this complexity, most of the world’s largest OEMs are looking increasingly to provide a single global SKU for their flagship models to reduce operational cost and harmonize experiences. As a result, the new 5G environment becomes very challenging for OEMs to create adequate RF designs capable of maximizing device performance, thereby optimizing its power consumption, without compromising overall device design or cost. To overcome these challenges, OEMs will now have to move away from component assembly and adopt system-level design from the antenna to the modem.

It is here that the use of RFFE modules and help from end-to-end specialized RF solutions providers will offer welcome support to OEMs. This support will significantly help with the whole cellular system design from the antenna to the modem and speed time to market, supporting cellular innovation as it emerges. These high-end solutions will fulfill a need that the 5G devices industry desperately craves: enabling OEMs to focus on customer experiences and deliver more reliable products with the required scale and availability, negating their need to deal with a proliferation of future component types and suppliers.

3. The increasing need for a simplified 5G components sourcing process

The reference design of mobile devices becomes increasingly complex with the migration to new generation networks. This is particularly true for 5G as all aspects of device end-to-end performance, from the modem through to the antennas need to be addressed. The radio system and modem designs are required to be tightly correlated to take full advantage of all benefits offered by the modem capabilities to efficiently tap into the network capacity.

RFFE system design is currently the remit of established OEMs. It has long been a key differentiating factor, as it is tightly correlated with the overall industrial design of the mobile devices. Vendors traditionally procure different components from heterogeneous manufacturers to take advantage of the highly competitive component landscape and reduce reliance on a single supplier across their portfolio. For example, Apple has traditionally used between 5 and 10 RF and modem suppliers for each generation of its iPhone. However, when making these choices, OEMs need to take ownership of RF system design while ensuring that it has a minimal-to-no impact on industrial design. The control of the RF system design has become a key factor for OEMs to consider in an environment where they are required to create SKUs that can serve the market better and address the requirements of different network types and spectrum bands.

The supply of bundled and monolithically integrated components such as filters, PAs, duplexers, and switches has continued apace, from the likes of Murata, Skyworks, Avago, EPCOS, Qorvo, and Qualcomm, which is helping OEMs alleviate the burden of RF system designs. However, while the offer of these high-performance monolithically integrated modules is necessary, such an approach is not enough to enhance overall 5G performance. In addition to this, there is an imminent need for modem-RF system design to enhance the overall solution further while lowering power consumption. This becomes ever-more crucial when considering the RF complexity associated with 5G, which is brought by the addition of new spectrum bands and new RF features and functionalities, such as MIMO, antenna tuning, beamforming, and envelope tracking.

Chipset suppliers with comprehensive RF and modem portfolio will be able to help OEMs and provide them with an end-to-end system design from the antenna to the modem, thereby allowing the delivery of mobile products at scale and on time. This means OEMs will no longer have to go through complex RF component sourcing processes involving many RF chips suppliers.

The delegation of modem-RF system design by OEMs to specialized third parties brings with it several advantages, many of which have become increasingly stark as the devices market transitions to 5G. Among the most critical advantages of this approach are:

- Simplify component sourcing: Helps the process as OEMs need to deal with far few suppliers or, ideally, just one vendor who supplies the whole system from the modem to the antenna. This will enable OEMs to save both time and money in bringing their 5G devices to the market while adopting the most innovative 5G features as soon as they are available.

- System level integration: Helps maximize system performance while lowering power consumption compared to assembling various RF components from multiple vendors. This approach is currently unique to Qualcomm as most of its modem competitors, including MediaTek, UNISOC, Hisilicon, Samsung, and Apple, still lack key RF components in their products portfolio.

- Technology complexity: This is taken out of the hands of the OEMs so that they can focus on offering better experiences to end customers, concentrating their efforts on industrial design and user interfaces, and developing more products to serve diverse market needs.

- Accelerates time to market: This is especially true for new device types and form factors, such as “always-on” notebooks. Time to market is equally important for smartphone segments submitting to rapid product intro cycles.

- Simplify device testing across various networks: Pre-designed RF-systems are tested across multiple networks, so when deployed in the device it should significantly simplify testing of interoperability across networks and shorten time to certification across various regions.

- Accelerates adoption of new 5G features and functionalities: Enables OEMs to accelerate 5G adoption to remain competitive and relevant in this fast-moving market landscape.

- Cost advantage: Enables a level of cost advantage when the modem-RF system is adopted at a large scale.

This third-party modem-RF system design will no doubt be very attractive to ‘tier 2’ OEMs and new entrants that often lack the right expertise for designing radio systems. This approach is also crucial for OEMs targeting new market segments, such as “always-on” 5G connected notebooks, ultrabooks, Chromebooks, CPEs, and other consumer devices. These OEMs often lack expertise in connectivity, so using third party modem-RF designs will be the key to accelerate the time to market for their devices while keeping pace with innovation brought by 5G. Overall, this approach will become even more critical as 5G radio design increases in complexity, and new RF and RF front-end features and components will need to be integrated into these designs.

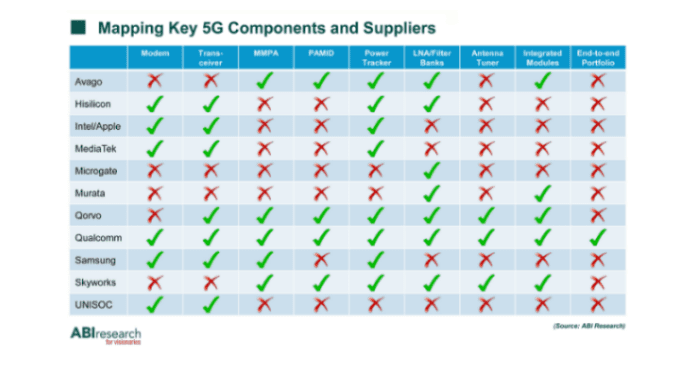

As shown in the chart below, such a strategic approach has been carried out by few in the market thus far. Currently, Qualcomm is the only supplier able to offer an end-to-end product portfolio from the antenna to modem. While companies such as Qorvo and Skyworks have provided several packaged solutions that have played a significant role in the miniaturization of RF components and modules, the most advanced has been by Qualcomm, supplying products with end-to-end performance in fully integrated system designs. The company has already revealed the first wave of its 5G Modem-RF System designs at the Qualcomm Snapdragon Summit in December 2019 in Hawaii. These initial designs support Qualcomm’s Snapdragon 865 Mobile Platform with the X55 Modem-RF System for high-end smartphones, the Snapdragon 765 Mobile Platform with X52 Modem-RF System for mid-range smartphones as well as bringing Always-on connectivity to many computing devices and FWA CPE devices.

Other modem competitors, including MediaTek, UNISOC, Hisilicon, Samsung, and Apple, still lack key RF components in their portfolios and unlikely to be involved in any Modem-RF design anytime soon.