Over the next 6-8 weeks, the governors of all 50 States and territories will have a critical decision to make – what public safety interoperable network solution will be deployed in their state and operated for the next 25 years? Wireless 20/20 has published a new white paper What Should States Look for in Responses to Public Safety Network RFPs to address this vital decision.

FirstNet Panel at CCA 2017 Annual Convention

Wireless 20/20 is moderating the following panel on FirstNet on October 25, 2017, at the CCA 2017 Annual Convention in Fort Worth, TX. This session will offer attendees an opportunity to hear from state SPOCs that have issued RFPs, learn the benefits of issuing an RFP, and understand the process for pursuing an opt-out alternative which would enable the state to select an alternative provider to deploy its FirstNet RAN. The panel on “FirstNet…What Does It Mean for the Regional and Rural Carriers?” will follow this session.

| CCA Convention October 25, 2017 2:30-3:30 |

FirstNet and Opting-Out…What You Should Know About the Process

|

In a previous white paper, Wireless 20/20 recommended that states conduct RFPs over the next 6-8 months by June 28, 2018, when a final decision has to be made.

By issuing an RFP, states can define their needs, make their demands known and review competitive bids. Any state that does not explore its options regarding FirstNet is doing a great disservice to its constituents and First Responders. Only by issuing an RFP, can states ‘take control of their own destiny’ in getting the coverage, capacity, service quality, low cost and revenue sharing potential made possible by FirstNet. States should not be rushed to accept the initial proposals made by FirstNet to serve their public safety needs for the next 25 years.

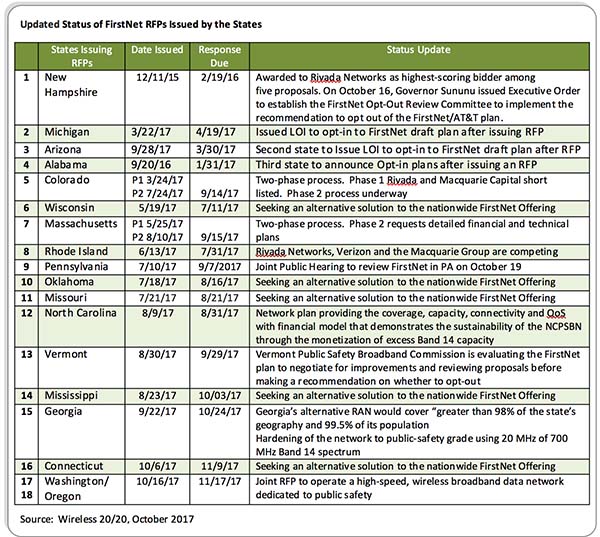

Wireless 20/20 reviewed several FirstNet RFPs and conducted interviews with several state POCs to identify best practices for evaluating State Public Safety proposals, and devise a “scorecard” of criteria for evaluating alternate proposals versus AT&T/FirstNet plans. In our new white paper, Wireless 20/20 provides 12 key factors and criteria that a state should evaluate as part of the RFP process and while making their decision. These criteria include Band 14 network coverage, public safety network capacity, priority and pre-emption, service quality and QoS, network quality and resilience, use of local partners, cost of service, financial considerations, new jobs created, and the ability to address risk factors and technology evolution during the next 25 years.

This scorecard is summarized here along with our view on whether the FirstNet/AT&T proposal adequately addresses these factors. Based on the information publicly available, Wireless 20/20 believes the current FirstNet/AT&T proposal does not adequately address what most states need or should expect for its public safety first responder network. It also does not seem to adequately value and compensate the state for access to this valuable spectrum, NTIA grant money or the opportunity to serve first responders with an interoperable national network.

The FirstNet/AT&T solution does not offer a network specifically built for FirstResponders and instead provides a rate plan on AT&T’s commercial LTE network. AT&T’s first responder network will provide coverage for only 76.2 percent of the continental US, with several tiers of coverage availability.Wireless 20/20 believes:

- States should be most concerned with the design, deployment and build-out schedules for their true purpose-built Band 14 network. AT&T has testified that it will deploy infrastructure on the 20 MHz of 700 MHz Band 14 spectrum licensed to FirstNet only in geographic locations where it needs additional bandwidth capacity.

- The current FirstNet/AT&T proposal does not adequately address what most states need for Quality of Service, Priority and Pre-emption (QPP) on the public safety first responder network.

- An essential element of State FirstNet plans is the use of local partners in network deployment and implementation. States should carefully compare the AT&T/FirstNet plan to alternatives looking for the use of qualified local partners in the public safety network design, deployment, operations, maintenance, and customer support.

- The cost of service under the AT&T/FirstNet plan may place a significant burden on local organizations seeking access to the national public safety and related applications.

- Financial sustainability of the public safety RAN at the state level will rely on revenue sharing and the effective monetization of excess capacity. AT&T has not offered revenue sharing, and this should be considered a net negative factor on the scorecard.

- States that opt-in to the current FirstNet/AT&T plan are leaving hundreds of millions of dollars of benefits on the table. Since FirstNet is merely an extension of AT&T’s existing network/business there would be limited opportunity to benefit from incremental revenue or job growth from telecom infrastructure assets.

Status update of FirstNet RFPs and decision-making

FirstNet has updated its secure portal by posting the official updated state plans for all 50 states and three territories on September 19, 2017. These updated state plans covering network design, technology and pricing are considered confidential and are available only to a state’s single points of contact (SPoC) and their designees. FirstNet recently delivered initial state plans outlining public-safety LTE deployment plans to governors in the U.S. territories of Guam, American Samoa and the Northern Mariana Islands, although timetables have yet to be established for those governors to make their “opt-in/opt-out” decisions.

All states and territories will be eligible for State and Local Implementation Grant Program (SLIGP) 2.0 funding, and those that “opt-out” will apply for their “pro-rata” share of the available $5.5 billion. The official release of the NTIA construction-grant funding level determination (FLD) for each state and territory was delayed until September 29. This delayed the start of the statutory 90-day period, and governors now have until December 28, 2017, to make their “opt-in/opt-out” decisions. This makes the last week of the year potentially a busy one for FirstNet decision makers, and sets up 2018 as a big year for the public-private partnership regarding network build-out.

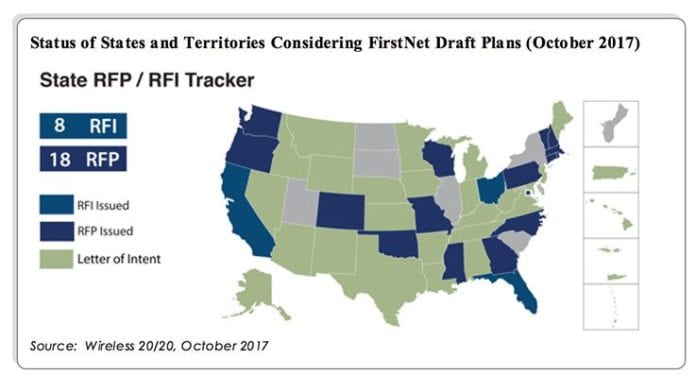

The following map provides an update of State-level FirstNet actions as of October 20, 2017. The associated chart provided in the white paper shows that a total of 15 states have issued an RFP and active procurements that would enable them to select an alternate provider to deploy its FirstNet RAN and maintained it for the next 25 years. Another six states and territories have issued “requests for information” (RFIs) which may lead to a more detailed RFP RFIs. A total of 10 states and territories are still undecided about whether to issue RFPs and pursue the “opt-out” alternative.

Meanwhile and 27 states and territories have issued an LOI to opt-in to FirstNet plans as of October 20. This includes Nebraska, Maryland, Texas, Idaho and Louisiana that announced plans to opt-in during September, as well as Alabama and Indiana that announced opt-in plans in October. It is not clear why these states would decide to opt-in before issuing an RFP and carefully evaluating alternative plans. These LOIs are reported as being “non-binding” letters of intent and not formal opt-ins. There is no record of any formal opt-ins at the FCC, and we believe that any of the states that have issued LOIs to opt-in are still free to opt out in December and continue their evaluation of their alternatives.

Update on active procurements and RFPs for alternative FirstNet RANs

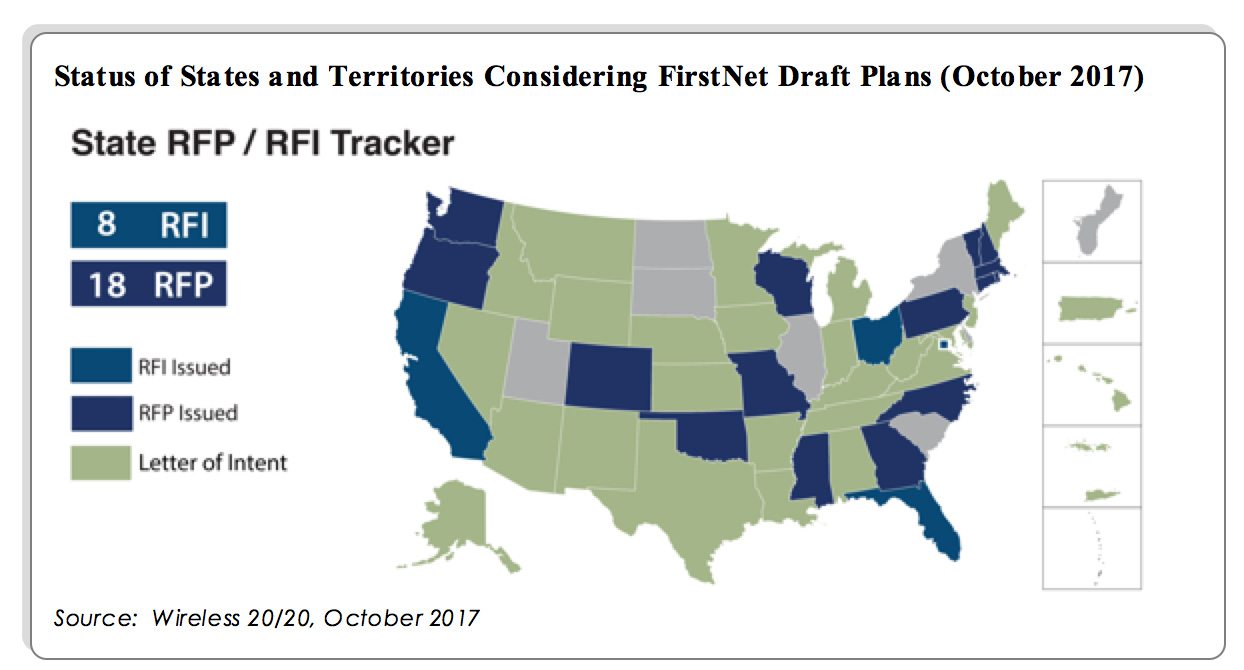

THe following chart provides an update on the active procurements and RFPs for alternative FirstNet RANs. With the release of the RFP on September 22, Georgia became the 15th state to issue an RFP seeking alternative RAN bids for FirstNet. Connecticut became the 17th state to issue an RFP initiating procurement for an alternative-RAN vendor when it issued an RFP on October 6, with RAN proposals due November 9. The states of Washington and Oregon recently issued a joint RFP to operate a high-speed, wireless broadband data network dedicated to public safety. These two states released their RFP on October 13 and plan to close the response period on November 13. By issuing an RFP to solicit bids from other vendors, these states are empowered to conduct effective due diligence that ensures the best service for first responders in the Northwest. Once proposals have been submitted, the states will weigh them against the merits of joining FirstNet/AT&T.

On October 16, New Hampshire Governor Chris Sununu issued an Executive Order establishing the FirstNet Opt-Out Review Committee to review “the regulatory and financial risks” associated with an opt-out plan and Rivada’s financial capacity to achieve the successful provision and implementation of the state’s PSBN. In a press release, the Governor stated this committee is a direct result of the recommendation from the State Interoperability Executive Committee (SIEC) that “an opt-out of FirstNet is far and away our best option.” Governor Sununu also stated. “As part of this review, we will seek clarification of certain proposed fees, as well as clarification of penalties that may be imposed by FirstNet if an opt-out were to fail.” Sununu went on to say the potential FirstNet imposed fees “appeared to be arbitrary and primarily designed to deter states from opting out of FirstNet plans.”

This news comes as Vermont prepares to decide whether to opt-out of the FirstNet/AT&T plan. The Vermont Public Safety Broadband Commission is due to make a recommendation to Governor Phil Scott by November whether to opt into the FirstNet/AT&T plan. A recent “confidential draft” memo on FirstNet letterhead is circulating among state officials indicates that a state wishing to opt out would have to put its “full faith and credit” to contract with an alternate operator that could meet the exacting standards set by the national FirstNet program. This memo related to the FirstNet Spectrum Manager Lease Agreement (SMLA) further states that failure to carry out this alternate program could result in penalties against the state of up to $173 million. It is not clear whether other states have received similar threats of proposed fees and termination penalties that may be imposed by FirstNet if an opt-out were to fail. Wireless 20/20 believes states should not allow these threats associated with contract penalties to detract or dissuade them from continuing to evaluate their FirstNet alternatives.

NTIA Funding Level Determination (FLDSs)

The NTIA Funding Level Determination (FLD) developed for each state indicates the amount of construction grant funding a state or territory could receive if it opts out of the national network. States that opt out can apply these funds to deploy and maintain their alternate public safety networks, and for states that opt-in AT&T will receive their share of the grant money. A chart with these FLDs is provided in Appendix 1 of the Wireless 20/20 white paper. The FLDs are based on population in a tiered system where the most-populous states such as Texas and California may be eligible for $300-400 million, whereas smaller states such as Vermont or Wyoming may receive only $30-40 million. Officials from Colorado and Washington, who are deciding whether to opt out, have reported they believe the FLDs didn’t correctly account for federal land such as national parks. NTIA officials report that the grant funding will cover only the construction portion of RAN build-out in a given state, and may not be sufficient to cover the total cost to construct, operate, maintain and improve the FirstNet RAN within a state or territory over a period of 25 years.

Many other questions remain for the 31 states and territories still mulling the decision whether to opt-out of having AT&T deploy radio access networks (RANs) in their states. Governors have more to consider than simply whether they like the deployment plans presented by FirstNet and AT&T. They need to base their decisions on a careful evaluation of the proposed AT&T/FirstNet plan versus alternative plans submitted in response to their RFPs, based on an articulated set of priorities and evaluation criteria. Wireless 20/20 believes states should not allow these threats associated with contract penalties to detract or dissuade them from continuing to conduct an evaluation of their FirstNet alternatives.