T-Mobile US and Sprint are widely expected to consummate their long courtship this fall, and if it actually happens the resulting network could combine the best of both worlds: Sprint’s large portfolio of high-band spectrum and T-Mobile’s recently acquired 600 MHz spectrum, along with both carriers’ mid-band holdings and Sprint’s 800 MHz spectrum. But from a coverage perspective, the combined network might not look drastically different from the two separate networks, according to a new report from Ookla.

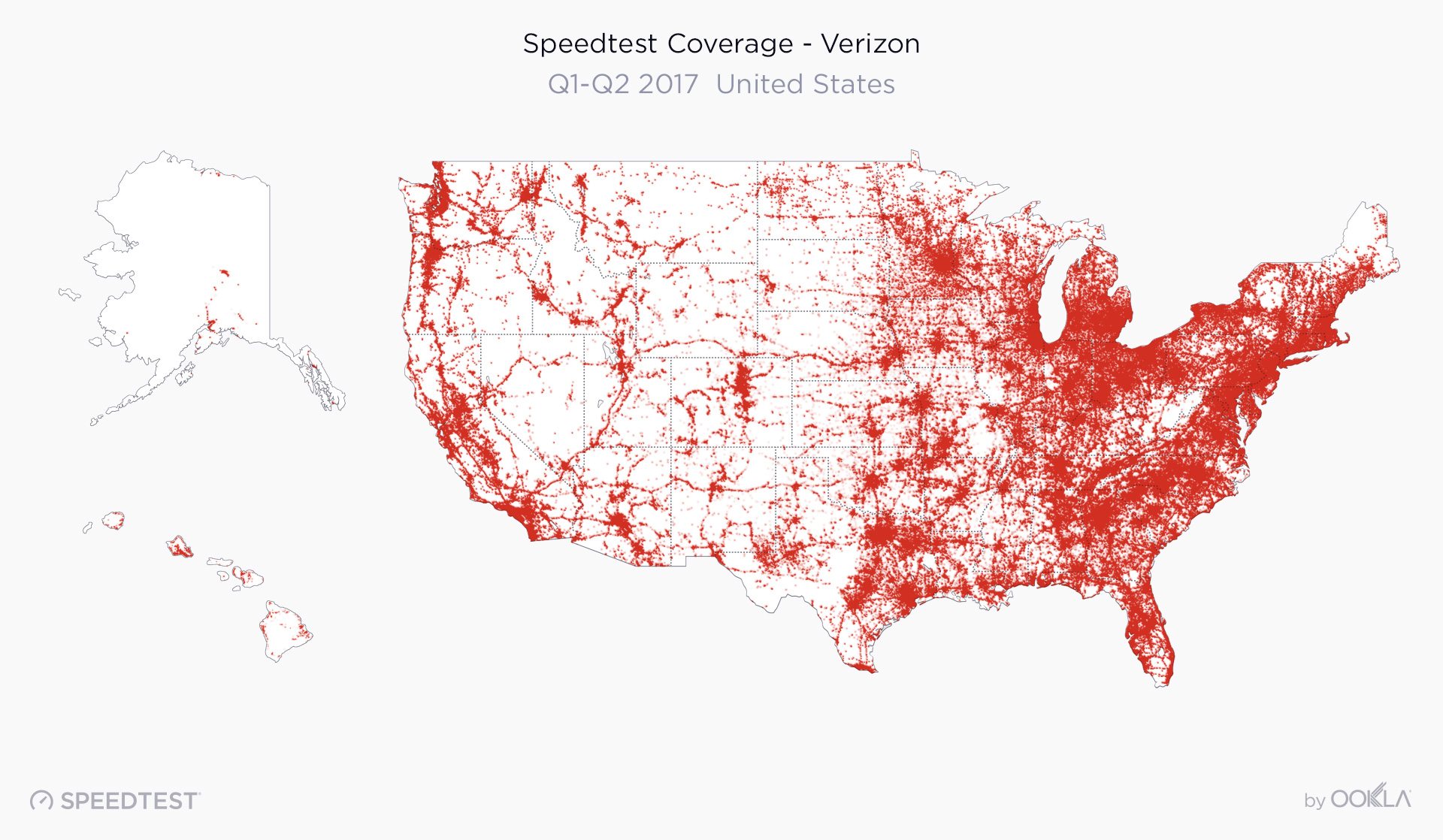

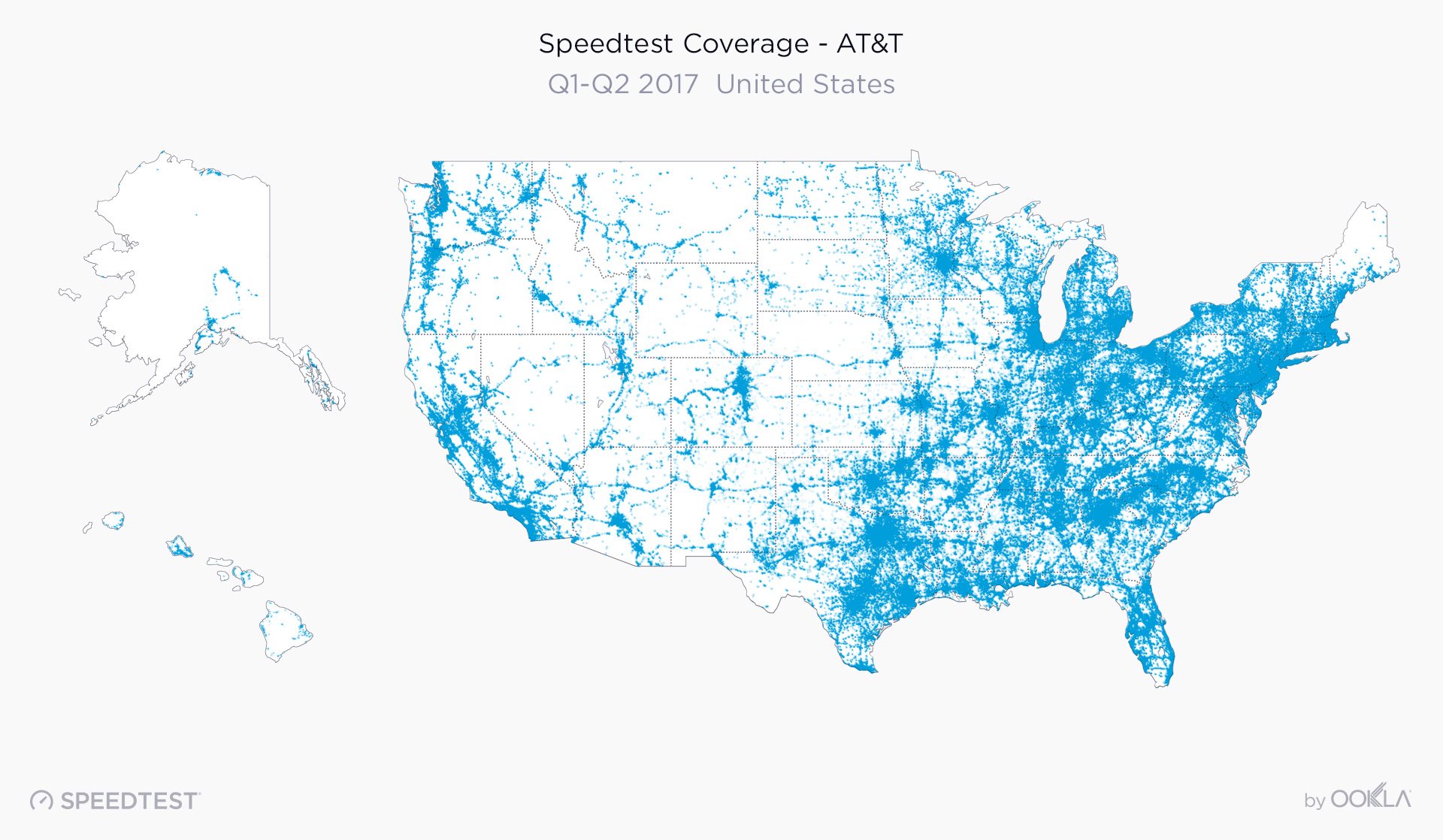

The maps above show where subscribers conducted network speed tests using Ookla’s app. Both T-Mobile US and Sprint cover some of the areas that did not register user activity in these tests, and T-Mobile US says the maps are a representation of user density, not network density.

Nebraska, Montana, Wyoming, North Dakota, and South Dakota are the five states that did not register much user activity for T-Mobile US or Sprint. Verizon Wireless and AT&T appear to have more customers in these states.

Ookla, which produces reports under the name Speedtest, is traditionally very supportive of T-Mobile US, and the company’s most recent analysis is no different in this regard.

“T-Mobile’s cell site density and excellent mid-band spectrum could come in very handy to radically improve Sprint customers’ experience in a post-merger world,” wrote Ookla tech evangelist Milan Milanovic.

Impact on tower sector

A Sprint/T-Mobile US merger is also expected to impact the tower sector, as both carriers are tenants on some towers and could presumably decommission some of these sites. Analyst Robert Gutman of Guggenheim Securities said his firm looks at two potential drivers of “tower churn.” One is overlapping sites and the other is “redundant” sites, meaning sites that are close enough together to render one unnecessary.

“Our analysis shows that using the first methodology (“overlap”), that, on average, 5% of the tower revenues are at risk. Using the other methodology (“proximity”), which is less conservative, our analysis shows that, on average, ~12% of tower revenues are at risk,” Gutman said. “Over a period of five years (the average remaining contract term), the implied incremental consolidation churn ranges from 1-2.5% per year.”

Follow me on Twitter.