In-building wireless was the topic of the most recent RCR Wireless News webinar and feature report. Here are four key takeaways from the webinar.

-

1. Buildings want multi-operator support. SureCall’s Frankie Smith, VP of sales, said his company surveys potential customers to find out what operators they want their in-building sytems to support. He said customers almost invariably write ‘all operators’ or list the four nationwide carriers by name.

“There’s a clear mandate for having to support the subscribers from multiple operators,” confirmed analyst Randall Schwartz of Wireless 20/20. “In a public venue like a retail mall or an arena or a hotel or an apartment building, you would expect to see subscribers from all operators and even in an enterprise building where there are multiple tenants.” For the most part, neither carriers nor building owners are prepared to build multi-operator systems.

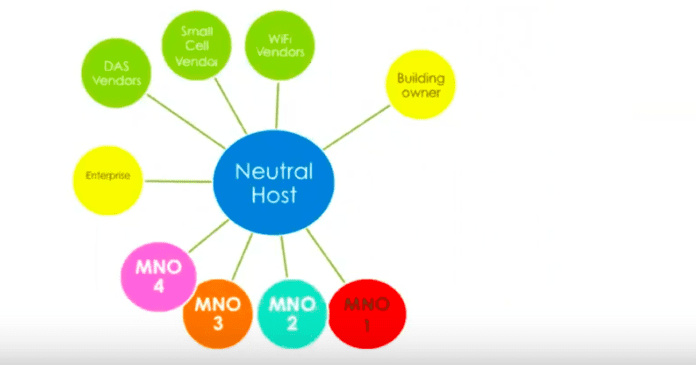

“More and more we see a neutral host, a third party, who will come in and put in a system and then sell service or sell equipment,” said Schwartz. He explained that neutral host distributed antenna systems that support all four operators are available from many vendors. Neutral host small cells are still in development. Although there are small cells on the market that are technically capable of supporting more than one carrier, none of these have yet been adopted by operators or third parties that plan to deploy one small cell unit to support two or more mobile network operators.

2. The so-called “middleprise” sector is struggling to secure coverage. The middleprise sector is defined by Wireless 20/20 as buildings of between 25,000 and 500,000 square feet. Larger venues can often attract at least one wireless carrier as an investor in an in-building system, and smaller buildings can often purchase off-the-shelf solutions that they can install themselves.

Within the middleprise building class, Wireless 20/20 identifies two categories: Tier 2 buildings of between 100,000 and 500,000 square feet, which are usually commercial enterprises or residential towers, and Tier 3 buildings that are between 25,000 and 100.000 square feet, which can include hotels, hospitals, retail establishments and business parks. Wireless 20/20 estimates that there are roughly 100,000 Tier 2 buildings and more than 400,000 Tier 3 buildings in the U.S.

SOLiD Technologies, which is focused on solutions for buildings of at least 200,000 square feet, said that when equipment costs come down, building owners will reverse traditional business models by purchasing infrastructure and selling capacity back to wireless service providers.

“We’re on the cusp of new business models, such that enterprises and building owners, many times in conjunction, will be buying equipment to actually sell capacity back to the wireless service providers,” said Tim Moynihan, VP of marketing at SOLiD.

3. For now, cost is the major barrier to the purchase of in-building wireless systems by the enterprise or building owner. A survey commissioned by CommScope found that when businesses decided not to invest in wireless, cost was the primary barrier for 35% of respondents. For 18% of respondents, technology complexity was the top reason not to invest, followed by network operator issues (11%), lack of skills (11%), lack of building ownership (9%), lack of client demand (9%), and lack of need for a system (4%).

“Only 4% of the respondents were actually saying that there is no need for an in-building wireless system,” said CommScope’s Luigi Tarlazzi, director of small cell product management. “So that really gives you an understanding that there is a need, there is a demand in the market for cost-effective and simple technology,” he said.

Tarlazzi said CommScope has brought costs down with its digital DAS solution that runs on fiber and Cat6 cable, and by increasing the performance levels of small cells, which are often less expensive than DAS. CommScope’s small cells leverage a centralized baseband architecture, which enables capacity management so that users do not lose coverage as they move around a building.

4. Green buildings need in-building systems. “As new buildings become more and more environmentally friendly, signal blockage from the outside becomes more and more critical,” explained Schwartz. He said that changes in building construction standards (especially LEED) are resulting in structures that prevent outdoor signals from penetrating indoors.

All of the above topics were covered within the first 20 minutes of this webinar. To watch the whole program, click here.