T-Mobile US and Sprint lost no time in reacting to the Verizon Wireless rate plan changes, announced yesterday.

Although the wireless carrier is set to charge less for each gigabyte of data it delivers to customers, it will also bundle that data into bigger “buckets” and charge more for each one. Rivals were quick to capitalize on the fact the price of each Verizon Wireless data package is headed higher.

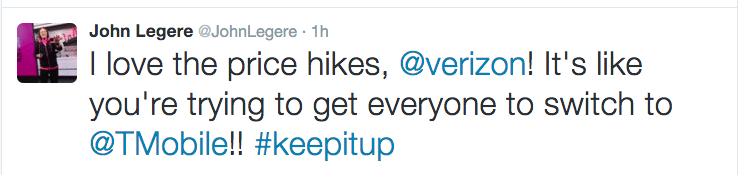

T-Mobile US CEO John Legere tweeted that Verizon Wireless’ “price hikes” would encourage customers to switch, and followed that up by comparing Verizon Wireless to the characters in a TV show that is known as a popular choice with binge viewers.

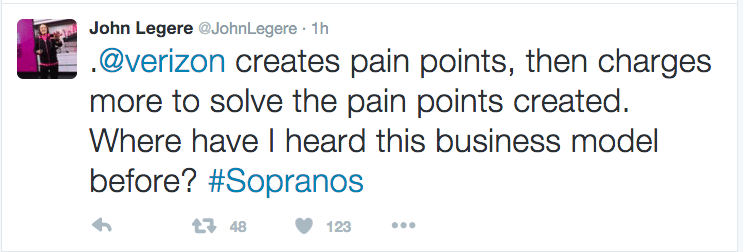

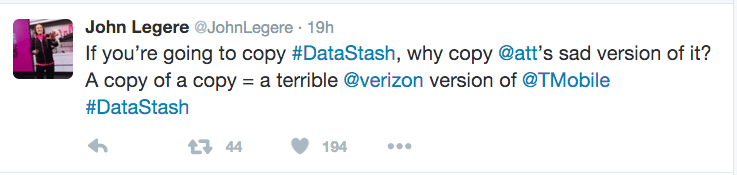

Legere also pointed out Verizon Wireless’ plan to allow customers to keep unused data takes a page from T-Mobile US’ playbook. Although according to Legere, it’s just part of the page.

T-Mobile Us’ “Data Stash” plan lets customers save up to 20 GB of unused, on-network data. Any additional data that gets rolled over each month expires after 12 months. AT&T Mobility’s “Rollover Data,” which is part of the carrier’s Mobile Share Value plan, expires after one billing cycle or when a customer changes their data plan. Similarly, Verizon Wireless’ new “Carryover Data” feature will let customers keep unused data for up to one month.

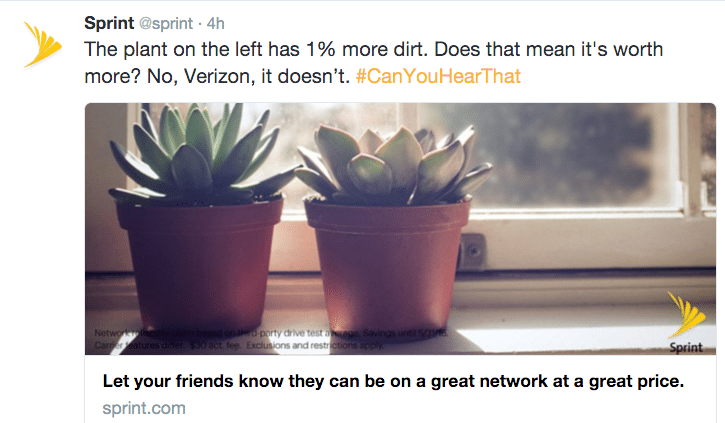

Sprint CEO Marcelo Claure also labeled Verizon Wireless’ rate plan changes as a price hike.

Sprint also continued to promote its message that Verizon Wireless’ network is only infinitesimally better than Sprint’s.

Sprint has been focusing on the 1% number for some time in its marketing campaigns. The company hired former Verizon Wireless spokesman Paul Macarelli, who is best known for Verizon Wireless’ “can you hear me now?” campaign.

“What I’ve found is … the better that some other national carriers claim about reliability is really less than a 1% difference. Does anyone even really notice a difference of less than 1%?” Macarelli asks in Sprint’s new advertising campaign.

Follow me on Twitter.

T-Mobile and Sprint react to Verizon rate plan changes

ABOUT AUTHOR