Jim Patterson breaks down what’s needed next by Frontier and Cablevision, and asks if wireline is cool again

This week, we will take a look at the last quarterly earnings call from Frontier prior to their acquisition of Verizon Communication’s California, Texas and Florida properties, and also highlight a series of announcements made during February which point to a resurgence in wireline interest.

Frontier’s ‘to do’ list

1. Close the Verizon California, Florida, Texas market transaction with as few issues as possible.

2. Identify and implement $600 million in planned synergies as a result of the Verizon transaction starting at transaction close (while minimizing customer-facing impacts).

3. Expand current video products to 3 million to 4 million additional homes in 40 markets over the next three years. Clearly demonstrate that video growth will be profitable and the best use of incremental capital expenditures.

4. Translate additional broadband capacity improvements in Connecticut into lower customer churn and improved average revenue per residential customer.

5. Manage promotions to grow revenue, increase the customer experience and reduce the impact of post-promotion churn.

6. Continue to translate Connect America Fund deployments into incremental customer relationships, especially for the 100,000 additional homes planned for 2016.

7. Translate improved bundle capabilities into lower residential voice churn.

8. Grow and demonstrate the value of self-service tools.

9. Improve business (small- and mid-sized) competitiveness as a result of the Verizon properties acquisition.

10. Maintain or improve leverage and dividend payout ratios. Use increased cash flow to clean up some of the debt maturities on the balance sheet.

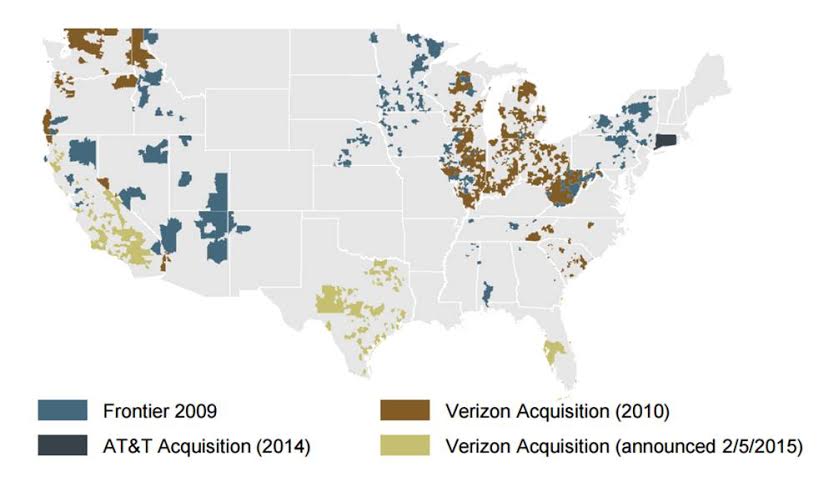

Frontier Communications reported decent earnings last week as they prepare to double their size with the acquisition of Verizon properties in California, Texas and Florida. Included is a map management used in their first-quarter earnings report describing the company’s footprint evolution (remember, the pending acquisition doubles the company’s size). This map tells us a lot about where Frontier is headed.

First, they are following the general population and moving south and west. Los Angeles and Dallas suburbs are growing faster than West Virginia and upstate New York (see census data here). More moving equals more (and less costly) choices than overthrowing the incumbent at existing households. Any near-term upside in subscriber growth will likely come from this secular trend.

Second, Frontier’s overall footprint density is going to improve with the Verizon transaction. There are real operational and capital cost improvements from this change. Trucks have to travel less, there are more multidwelling/multitenant units and lower network unit costs are possible. MTUs present a double-edged sword, because this also means business/enterprise offerings need to be robust and competition (not only from cable but from fiber-based competitive local exchange carriers such as Alpheus in Texas) will be intense. How Verizon Enterprise supports and grows these legacy connections will be one of the interesting dynamics of a post-close Frontier.

Finally, they set the stage for further clustering. Frontier’s model to date has been “buy and manage” – they have done little if any trading of properties (common in the cable industry after large transactions such as Adelphia Communications acquisition by Comcast and Time Warner Cable). It’s interesting to think about the potential for central Florida, the Great Lakes region and Texas from a few transactions. Texas consolidation is especially ripe for this opportunity with Windstream and CenturyLink under-indexed in their exchange presence.

As if these three dynamics were not enough, their cable competition is also involved in a large three-way merger (Tampa, Florida, is largely served by Bright House Networks, who is being acquired by Charter Communications; Texas and California properties have a decent overlap with Time Warner Cable, who is also being acquired by Charter Communications). Because Bright House and Time Warner Cable are performing quite well, it’s unlikely Charter will make the kinds of dramatic changes that would open up the door for Frontier. Stranger things have happened, however, and the Charter/TWC/Bright House transaction is still awaiting California and federal approvals.

Bottom Line: Frontier has managed to do something that other independent local exchange carriers have not – grow the high-speed subscriber base in the middle of speed and technology transitions. The acquisition of selected Verizon properties will improve their customer density, network competitiveness and product diversity (particularly in the business arena). They should use this opportunity to demonstrate their operating effectiveness and to recluster/reconcentrate their footprint.

Cablevision’s ‘to do’ list

1. Get the Altice transaction approved by the end of Q2 2016 without compromising the overall terms.

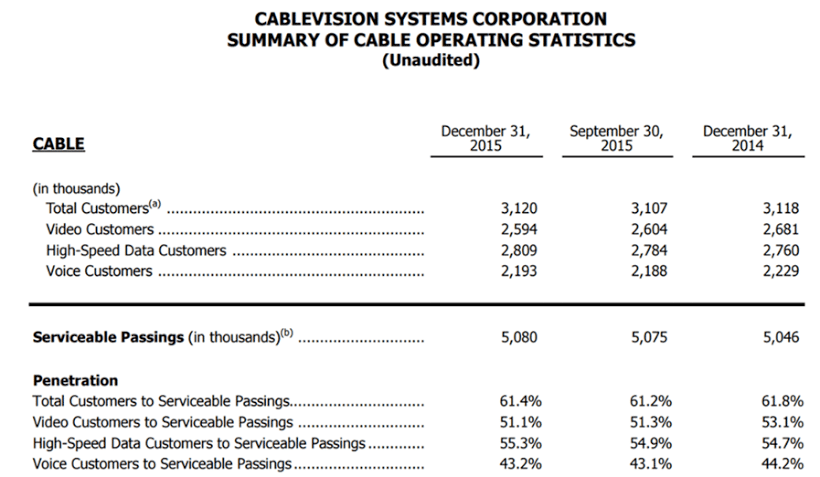

2. Continue to grow the quantity (2.8 million) and quality (monthly RPC = $155.88) of high-speed data customers (Cablevision serves 3.2 million customers overall).

3. Reduce customer service expenses through fewer trouble calls (down 33% in 2015) and truck rolls (down 23%).

4. Improve number of Optimum Wi-Fi users (currently only 1 million or 36% of the HSD base) as well as the quantity consumed (nine gigabytes per month).

5. Maintain competitive positioning and operating cash flows at Cablevision Lightpath (fiber-based business division).

6. Respond to market need of “skinnier” video bundles while minimizing revenue write-downs.

7. Continue to manage capital expenditures to an $800 million to $840 million range.

8. Keep churn at record-leading levels (Q4 represented the lowest voluntary churn in six years).

9. Improve cash burn at “other” business units (Newsday, News 12, etc.).

10. Get the Altice transaction approved by the end of Q2 2016 without compromising the overall terms.

The headline said a lot more about the economic improvements in their service area than the company overall: “Cablevision delivers organic customer growth for the first time since 2008”. While this is a great sign, there are plenty of headwinds facing the Bethpage, New York, company. Two of their three primary products are under heavy substitution threats (current video packages from smaller, more selective varieties; home phone service from wireless substitutes), and there’s an opportunity for wireless “5G” services to threaten high-speed data by the end of this decade.

Regardless of when/if the transaction with Altice is approved, Cablevision needs to continue to grow and innovate. Their out-of-home Wi-Fi footprint is the benchmark for their cable peers, and their overall revenue per customer for high-speed data is $44.70, among the best in the industry (TWC led the fourth quarter with $48.20 per month in average revenue per high-speed data customer; Comcast close behind with $47.15 per month). Cablevision has historically had strong customer service/experience metrics compared to their peers, but continues to lag behind Verizon FiOS, according to last September’s J.D. Power survey.

Bottom line: Cablevision is in many respects a victim of their own success. They are maintaining high product penetration in an increasingly competitive environment. And, once the Frontier transaction closes, Verizon will be squarely focused on improving operating metrics in the Northeast. Increased speeds and sponsored data opportunities represent new growth frontiers for the company or their successor. Cablevision is in danger of losing their pioneering reputation, however, because of the Altice transaction uncertainty.

Wireline is cool again

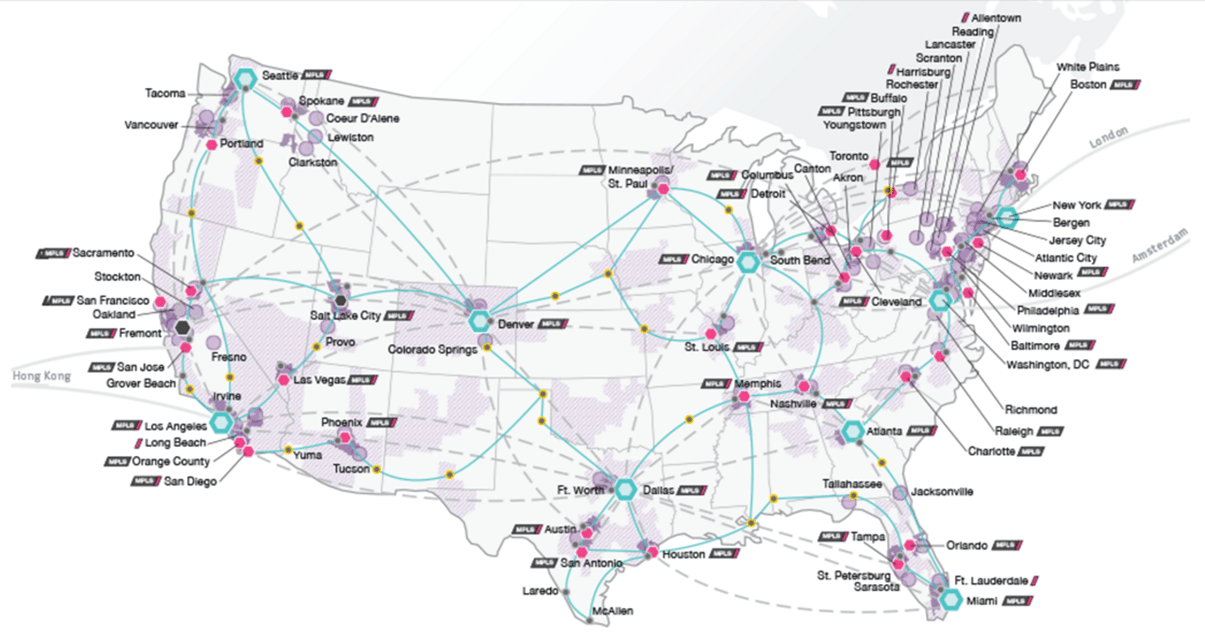

I never thought I would be able to use the words “wireline” and “cool” in the same sentence again. But, after AT&T’s announcement that they would be spending $10 billion in 2016 to support enterprise wireline activities (much of this for wireless fiber backhaul in Mexico), and after Verizon’s surprise purchase of XO Communications for $1.8 billion, wireline has gone from a footnote to a headline (XO network map is pictured nearby).

This is the push and pull of the dramatic rise of data consumption from today’s world: if the server is not sitting next to the tower serving the customer, some amount of transport/backhaul/longhaul is required. Verizon estimates in the announcement above that they can save $1.5 billion from the transaction in synergies – this is likely only the fiber leverage opportunity and does not include Verizon’s replacement cost for the aging MCI network (XO leverages the Level 3 network).

Without a doubt, servers are moving closer to customers. At the same time, however, connectivity to highly scaled cloud servers for businesses are increasing the need for reliable national and international connectivity.

Overcapacity was an issue for the wireline industry … in 2002. Thanks to increased DOCSIS, DSL and fiber deployments since then to support hundreds of millions of video-hungry broadband and wireless customers, most intercity capacity has been absorbed. Regional capacity continues to be built out (see companies like Lightower/Fibertech for a good example in the Northeast), but independent national backbones are largely the same as existed a decade ago: Level 3, 360 Networks (now owned by Zayo) and XO Communications (now owned by Verizon).

Bottom line: Wireline is cool again, as it should be. More investments will be required.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.