Wireless 20/20 looks north to see if the pending Shaw acquisition of Wind Mobile is the model for U.S. cablecos

Shaw Communications agreed to acquire Wind Mobile in a deal worth approximately C$1.6 billion (around $1.16 billion). Headquartered in Calgary, Alberta, Shaw competes most directly with Telus and serves about 2.6 million cable TV, 2 million broadband Internet and 1.2 million digital telephone customers in British Columbia and Alberta, with smaller systems in Saskatchewan, Manitoba and Northern Ontario. While the acquisition awaits approval by Industry Canada and the Competition Bureau, Shaw has been working to arrange the financing necessary to complete the acquisition.

Financing the acquisition of Wind Mobile

Shaw recently announced an agreement to sell 100% of its wholly owned broadcasting subsidiary, Shaw Media, to Toronto-based Corus Entertainment in a cash and stock deal worth C$2.65 billion. The divestiture will fund the Shaw acquisition of Wind Mobile and give the combined company a cash injection needed to invest capital in improving and expanding the Wind Mobile network.

Although the media assets are very profitable, the sale to Corus positions Shaw as a leading pure-play connectivity company, focused on delivering consumer and small business fixed and mobile broadband communications services. Like Telus, the deal reflects Shaw’s belief that directly owning video content and TV stations isn’t necessary to compete with larger companies like Rogers Communications and BCE. Shaw is refocusing its efforts on the synergy between fixed cable and wireless broadband networks in the western Canada market.

After the deal closes, Shaw Communications will own about 39% of the equity in Corus Entertainment, including both class A and B shares, but will focus its own business on communications infrastructure rather than media content. Shaw will transfer the ownership of 13 independent broadcast TV stations and 19 specialty TV channels to Corus, including Global, Food Network Canada, HGTV Canada, History, Slice, National Geographic Channel and Showcase. If approved by regulators and shareholders, the deal would make Corus a major player in Canadian media content with 32% of all English-language television viewership. With 45 specialty TV channels and 13 independent broadcast TV stations, Corus will have the size and scope to compete with larger rivals Bell and Rogers in Canada.

The transaction comes in advance of major changes for the Canadian TV market due to new CRTC rules that will mandate cable companies offer so-called “skinny” basic packages priced at C$25 per month by March 1. They will be followed by “pick-and-pay” plans that will give consumers more choice in what channels they want to include in their subscriptions. These changes in the cable landscape have media companies scrambling to best position themselves for an uncertain future.

Wind Mobile history

Wind Mobile was launched in 2009 by Globalive Capital with the goal to create a long-term viable fourth competitor in the wireless communications markets in British Columbia, Alberta and Ontario. With no Canadian investors willing to take on the three incumbent carriers from the outset, Globalive was primarily financed by nearly $2 billion of capital from Orascom Telecom Holdings, an Egyptian corporation that owned a number of other “Wind” branded telecommunications companies. In 2008, Globalive bid C$442 million to secure 1.7/2.1 GHz wireless spectrum required for the launch of its initial HSPA+ network.

VimpelCom acquired Orascom to become Wind Mobile’s majority shareholder in 2014, and following a dispute with the Canadia government the new parent company pulled out its financial backing for Wind Mobile’s bid in the 700 MHz spectrum auction. This cast doubt on the company’s ability to deploy LTE services due to a shortfall in its spectrum holdings. VimpelCom’s interest in Wind Mobile was then acquired by company founder Anthony Lacavera’s holding company Globalive Capital, and the ownership of the spectrum licenses was transferred to Mid-Bowline Holdings, which was formed by Globalive and a consortium of Canadian and American investment companies in September 2014. Wind Mobile is now Canada’s fourth-largest wireless carrier serving approximately 940,000 subscribers, operating more than 300 retail stores and counting 1,800 employees.

Shaw entry into the Canadian wireless market

Shaw Communications has pursued several approaches to enter the wireless market in Canada, starting with the C$189.5 million acquisition of wireless licenses in the 2008 AWS-1 spectrum auction. After a strategic review in 2011, Shaw decided to abandon the C$1 billion plan to build out a greenfield wireless network and instead launched the far less costly Shaw Go Wi-Fi network of more than 75,000 hot spots serving more than 2 million registered devices. Shaw recently upgraded Canada’s largest Wi-Fi network allowing its cable Internet customers to enjoy complementary Wi-Fi download speeds that are six-times faster, with included capacity that far exceeds mobile data plans.

During a larger deal to acquire Mobilicity for C$465 million, Rogers Communications agreed to a C$100 million acquisition of Shaw’s AWS-1 spectrum licenses that remained unused since 2008. Rogers kept two of the Shaw licences and acquired some of Wind’s current spectrum. As a result of this transaction, Rogers gained more contiguous spectrum making it easier to deliver more bandwidth and faster speeds. Wind Mobile also benefited from this deal through a significant increase in its spectrum holdings. Wind acquired 26 new spectrum licenses as a result of the transactions – 16 licenses from the Shaw spectrum and 10 licenses from Mobilicity. Wind Mobile now has a 20-megahertz AWS-1 corridor from Victoria to Ottawa, enabling the operator to deploy a new LTE network and other services.

Wind Mobile network modernization

The Wind Mobile network currently includes more than 1,400 cellular transmission sites across Ontario, British Columbia and Alberta and the company has 50 megahertz of spectrum in each of these regions. Wind Mobile recently secured C$425 million in financing from a syndicate of major Canadian banks to upgrade from 3G to a higher-speed LTE network. Wind Mobile selected Nokia Networks as its sole network infrastructure provider to deploy an advanced LTE network with new radios and cloud-based virtualized evolved packet core based on OpenStack to support IP-multimedia-subsystem, HSS, voice-over-LTE and voice-over-Wi-Fi services. Under the 5-year deal, Nokia Networks will provide an end-to-end solution that includes network implementation, network planning, systems integration, optimization, operting support systems and care services in order to ensure a better network and customer experience. By implementing cutting-edge technologies, offloading its voice traffic and better utilizing its spectrum, the modernization of Wind Mobile’s network will significantly increase network efficiency, speed and capacity.

Resetting competition in the Canadian fixed and mobile broadband market

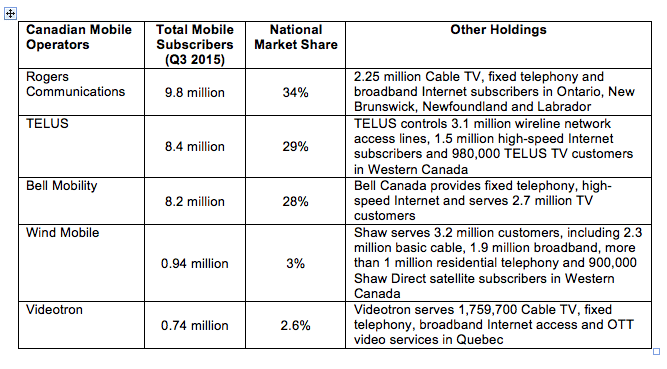

The integration of Shaw and Wind Mobile will undoubtedly reset the market for both fixed and mobile broadband services in Western Canada, and may realign national competition between traditional cable companies and telcos. Telecom operagtors Telus and Bell Mobility benefit from a network sharing agreement and together serve a total of 16.6 million mobile subscribers. Rogers and Videotron also benefit from LTE network sharing in Quebec, and Shaw could benefit from network sharing and roaming agreements with its cable counterparts. The Shaw acquisition of Wind Mobile will bring the number of mobile subscribers controlled by Canadian cablecos to nearly 11.6 million customers.

But this distinction may be short-lived as the origins of these companies may be long forgotten by a new generation of subscribers more interested in mobile video streaming than traditional fixed cable TV and telephony services. Most Canadians still watch cable or satellite TV, but cord-cutting is catching on as more people seek potentially cheaper and more versatile viewing options. Cable, telephone, broadband and mobile service markets have become saturated and established carriers are competing intensely on prices. But video viewing is getting more mobile and on-demand, and Canadian cablecos want to capture the largest part of that growth.

Shaw has already started to reposition itself as a mobile video service provider. At the 2016 CES show, Shaw launched the FreeRange TV mobile streaming app, bringing the company in line with rivals in free offering mobile access to its full TV service to any of its subscribers with an Internet or mobile data connection. Shaw had already partnered with Rogers Communications to launch Shomi, a streaming video on-demand app that offers access to a library of movies and TV shows, but does not include live channels. FreeRange TV is based on Comcast’s X1 cloud-based platform and is the first free app to include all the channels in the customers’ package as well as Shaw’s on-demand content.

A model for US cablecos?

The bigger question is why U.S. cable operators have yet to enter the wireless mobile industry in a major way after a history of past missteps and failures. Most U.S. cablecos face only one or two competitors in their core fixed cable TV and broadband business, while four mobile operators are competing intensely on price. While both the cable and mobile markets have become saturated, mobile video streaming is growing rapidly and as in Canada, the U.S. cable giants still want to capture a major part of that growth.

But U.S. cablecos have not demonstrated the commitment necessary to seriously compete in the U.S. wireless market. Comcast was the first U.S. cable MSO to enter the cellular industry in 1988 when it acquired American Cellular Network serving Pennsylvania, New Jersey and Delaware. In 1999, this company – renamed Comcast Cellular – was sold to SBC Communications for approximately $1.7 billion, and Comcast acquired AT&T Broadband for $52 billion in 2003.

In 2006, the SpectrumCo joint venture of Sprint Nextel and cable MSOs Comcast, Time Warner Cable, Cox and Advance/Newhouse Communications acquired 137 wireless licenses for $2.37 billion in the Federal Communications Commission’s AWS-1 spectrum auction. Cox was the only SpectrumCo partner to begin deploying a 3G mobile network using its AWS spectrum, and in 2011 Cox reversed course to decommission its 3G network and became a mobile virtual network operator on Sprint Nextel’s CDMA network. Cox Wireless services were discontinued two months later as the latest in a long series of false starts for U.S. cablecos and their wireless industry aspirations.

In 2012, Verizon Wireless paid $3.6 billion to buy the nationwide AWS spectrum licenses held by the SpectrumCo joint venture. Under terms of the agreement, the cable partners secured the option of reselling Verizon’s Wireless service as MVNOs on a wholesale basis. After selling their spectrum, the SpectrumCo partners formed the Cable WiFi Alliance, which has deployed more than 12 million Wi-Fi access points – the largest Wi-Fi network in the U.S. Comcast is now planning to invoke a provision in the SpectrumCo sale to become an MVNO reselling Verizon Wireless services under its own brand. Although the details have not been announced, Comcast is expected to launch an integrated Wi-Fi and cellular network service that relies on its large Wi-Fi network and uses Verizon Wireless’ network only where Wi-Fi is not available. Comcast and other U.S. MSOs may also participate in the FCC’s 600 MHz spectrum auction.

Wireless 20/20 remains skeptical that Comcast’s Wi-Fi-first MVNO strategy will be strong enough to offer a competitive quad-play offering to compete with AT&T and Verizon Wireless. AT&T is integrating its U-verse and DirecTV platforms and has started aggressively bundling video and unlimited mobile data services to increase average revenue per user and gain market share. Verizon recently launched a new Custom TV offering and has begun bundling Verizon Wireless and FiOS broadband services. These initiatives put increasing pressure on Comcast and other cable MSOs to leverage their Wi-Fi investments and ultimately mobile broadband services to compete with AT&T and Verizon. Meanwhile Sprint and T-Mobile US remain wireless pure plays with little or no opportunity to offer competitive bundles. Some investment analysts believe Comcast will inevitably re-enter the mobile market and acquire an existing wireless operator. With Rogers leading the Canadian mobile market, Videotron offering quad-play bundles in Quebec and now Shaw acquiring Wind Mobile, Canada is now providing the role models for U.S. cablecos as they ponder their future in the U.S. wireless market.

Wireless 20/20 helps mobile operators and their vendors develop their 4G LTE launch strategies, service offerings, marketing plans, technology roadmaps and business cases. More information about the WiROI™ Neutral Host Network Venue Tool can be found at www.wireless2020.com/WiROINeutralHost/.

Editor’s Note: Welcome to Analyst Angle. We’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.