The U.K. has recently been the focus of many studies on performance expectations of subscribers related to their mobile networks. Two of which I will highlight today.

First, is a report Ofcom released, the Infrastructure Report 2014. As a result of the Communications Act of 2003, every three years Ofcom is required to prepare a report for the Secretary of State for Culture, Media and Sport on the status of electronic communications networks and services in the U.K.

It’s not surprising to hear that 95% of households in the U.K. have mobile phones. Of these, 16% are mobile-only households. Although mobile operators map their coverage goals when deploying based on predicting needs within specific locations, the actual users don’t stay in one location and all locations are not created equal. They are indoors, outdoors, moving quickly in vehicles, moving through a city with a lot of buildings potentially interfering with coverage and in wide-open spaces. This creates challenges when trying to ensure consistent coverage.

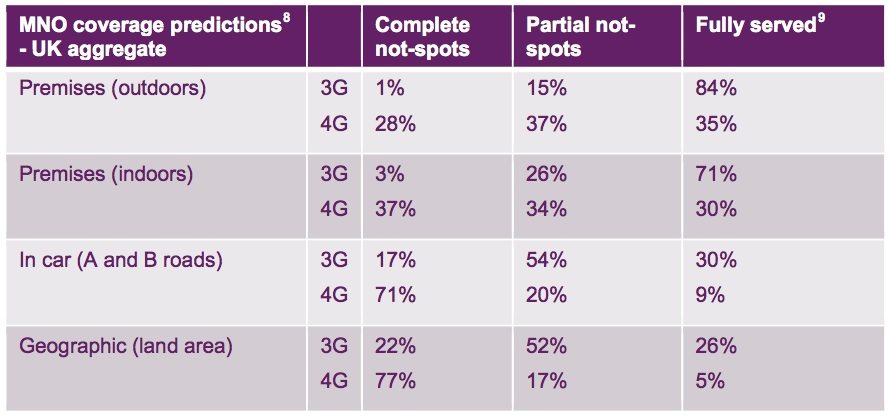

The statistics for those areas with no coverage for making voice calls is quite acceptable. Only .3% of premises have issues with outdoor calling, while 2% of premises have indoor issues and 9% haave issues on roadways. When looking at inconsistent coverage, the rates increase. The definition of this scenario is that only one operator has coverage and it may not be the operator of choice for your service. These statistics rise to 3% of premises having issues with outdoor calling, while 16% of premises have indoor issues and 33% on roadways.

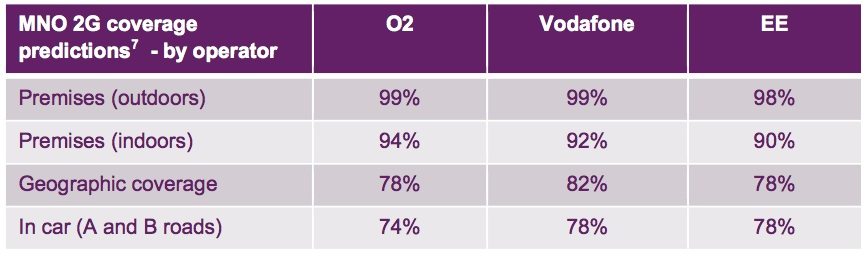

Also interesting is the high amount of 2G facilities still in use in the U.K.

The availability of mobile broadband based on 3G is much lower than the 2G scenario. The projections are 16% of premises having issues with outdoor calling, while 29% of premises have indoor issues and 55% on roadways. This certainly creates a challenge if you’re trying to use your data services on a regular basis while traveling.

Vodafone, O2, EE and Three all operate 3G and 4G networks, although the coverage statistics vary. EE has the most widely available 4G offering at this time, with 68% of premises having outdoor coverage. Currently, 4G services are available to 72% of premises, although only 35% are operated by Vodafone, O2 and EE.

Mobile data use continues to grow. From 2013 to 2014 it grew 53% in the U.K. Web browsing accounts for 42% of the traffic and video streaming 39%. So what do the users actually think about all this?

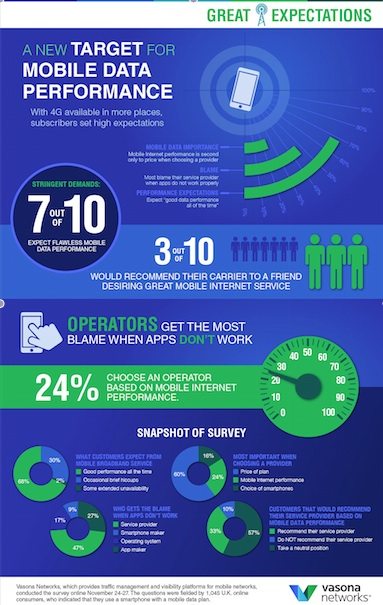

Vasona Networks recently surveyed 1,000 U.K. smartphone users regarding their expectations for customer experience of their data services. The expectations are high. Sixty-eight percent expect good performance all of the time without any problem areas. Almost one quarter of users would choose a mobile provider based on performance over price. But when there is a problem the blame falls on the operator, not potentially the content provider. The good news is that when the service is good, 33% will recommend their provider to a friend. What is their biggest headache? Slow Web page loading was cited by 62% of those surveyed as their highest frustration.

Vasona Networks recently surveyed 1,000 U.K. smartphone users regarding their expectations for customer experience of their data services. The expectations are high. Sixty-eight percent expect good performance all of the time without any problem areas. Almost one quarter of users would choose a mobile provider based on performance over price. But when there is a problem the blame falls on the operator, not potentially the content provider. The good news is that when the service is good, 33% will recommend their provider to a friend. What is their biggest headache? Slow Web page loading was cited by 62% of those surveyed as their highest frustration.

This isn’t limited to the UK. Vasona Networks conducted a similar study in the United States earlier in the year and found consistent results. This should put the operators on alert to the key requirements for customer experience expectations.

Now let’s link this back to the Ofcom report. It seems there is still some work to do in the U.K. for the coverage to support the requirements of smartphone users. The good news is that it appears the report highlights the right items requiring focus.