Merger and acquisition activity in the tech space is up, according to a new report, and mobile companies are driving the growth.

Ernst & Young’s (EY) update on global tech M&A for the three months from April to June of this year reflected a 57% year-over-year increase in aggregate deal value for the second quarter, to $52.4 billion. For the first half of the year, deals included $119 billion in disclosed value, a boost of 70% from the same period last year.

The first quarter of 2014 was particularly busy, and the second quarter declined 21% from first-quarter figures.

Jeff Liu, who is global technology industry transaction advisory services leader at EY, said that global tech M&A “is on course for a blockbuster year in 2014,” with cash-rich tech companies seeking to take advantage of low interest rates.

“Moreover, rapidly changing technology continues to create many new opportunities,” Liu added, and said that “cloud/Software-as-a-Service (SaaS) and smart mobility continued to drive 2Q14 technology deal-making, together accounting for more than 42% of volume for the quarter.”

Despite the high percentage of cloud and mobility-driven deals, EY pointed out that the highest-value deals came in the area of payment and financial services technology (which includes point-of-sale and mobile payments-related M&A). There were about 60 finance-related tech deals in the second quarter, accounting for $8.7 billion; EY said that figure is 141% higher than the quarterly average during 2013.

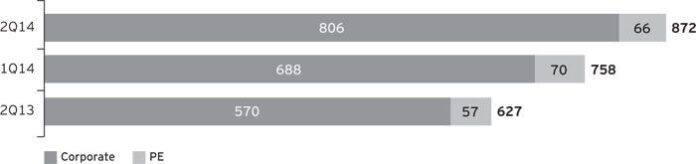

EY also found that deal volume was up almost 40% year-over-year to 872 deals, and there have now been four straight quarters of volume increases, with corporate deals seeing particular strength. Private equity transactions were up 16% compared to the same period last year, even though there was a slight sequential decline for the first time in five quarters.

Areas of M&A that grew faster than the overall market included cloud/SaaS, smart mobility, big data analytics, storage, advertising and marketing, education, and collaboration technologies, according to EY.

“Nothing less than a technology-induced reinvention of all industries has begun, moving toward ‘sense and respond’ relationships between businesses and their customers and driven by the five transformational technology megatrends: smart mobility, cloud computing, social networking, big data analytics and accelerated technology adaptation”, said Liu. “At the same time, macroeconomic conditions are supporting dealmaking with low interest rates, appealing lending terms and stability in equities markets. This confluence of factors will continue to drive record, or near-record, global technology M&A for the foreseeable future.”

Read more of EY’s M&A update here (pdf).

EY: Global tech M&A is booming, driven by cloud and mobility

ABOUT AUTHOR