Editor’s Note: The ecosystem of big data and analytics, and its intersection with mobile networks and cloud computing has increasing relevance to wireless in areas that include service assurance, customer experience management, mobile marketing, location-based services and more. Here is a look at the week’s news in this space.

—Syniverse has completed the acquisition of Aicent, announced earlier this year, for $242 million. The purchase enables Syniverse to support IPX Diameter signalling traffic and is expected to expand Syniverse’s reach in Asia, plus augment its ability to provide real-time intelligence services.

— Teradata reported its second-quarter results, with revenues up 1% year-over-year to $676 million. Profits were down slightly to $96 million from $108 million due to stock-based compensation expenses and other special items, the company reported.

Mike Koehler, president and CEO of Teradata, said the company “made good progress in several areas of our business in the quarter, and for the first half.”

The company’s international revenue was up 14% for the quarter and Koehler noted that it had its second-highest ever Q2 wins for new data warehouse customers. However, it saw revenues slide 8% in the Americas, with negative currency impacts of about 7%.

“We continue to experience strong activity with our Unified Data Architecture, Teradata Aster and big data-related solutions and services, as customers build out their analytical ecosystems,” Koehler added.

Teradata expects its full-year revenues to grow between 3-7%. Its telecom customers include Verizon Wireless, KDDI, Telefonica, Hunan Telecom, Comcast, Swisscom and others.

–Safer driving through intelligent apps? Maybe. A venture-backed company named reQall launched a beta version of a context-aware app designed to “intuitively decrease phone-related text and email distractions while driving.”

The company said that the Android app detects a user’s Bluetooth connection and puts his or her device into “requallable InCar mode,” so that the handset identifies high-priority contacts and will only alert to user to notifications from them, will sift through emails and texts and read aloud “critical details” from them, and enable voice-activated replies. Less important emails and texts are held back until drivers reach their destination or the Bluetooth connection is lost.

“The app calibrates the phone to work as if purpose-built for driving: screening contacts, highlighting key message details for clear, explicit communication, and leveraging Bluetooth audio for hands-free and car-smart message commands and replies,” said Rao Machiraju, co-founder and CEO of reQall.

ReQall’s beta version of the app can be downloaded from Google Play; the company also has developed virtual assistant technology for Google Glass, Samsung Gear and several smart watches.

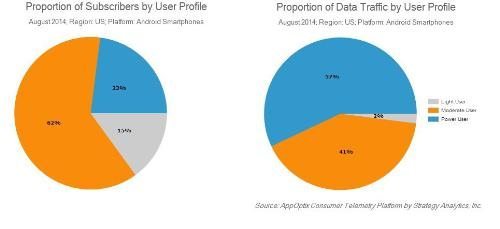

–According to data from StrategyAnalytics’ AppOptix mobile research platform, there are three distinct types of Android smartphone users in the U.S.: light, moderate and power users. The data is based on Strategy Analytics’ Consumer Telemetry Platform that includes a telemetry app, an opt-in panel of users who are rewarded for their participation, and big data analytics for gaining insights. The analysis of users is based on more than a million individual app sessions on more than 1,500 Android devices in the first half of this year, geographically based in the U.S.

Strategy Analytics found that only about 15% of the user base could be considered light users (consuming less than 50 MB a day, or 2% of the overall traffic), while nearly 2/3 of users had moderate use of 50 MB-300MB per day and accounted for 41% of traffic. Power users accounted for 23% of the user base but had a 57% share of the traffic.

“Although the Moderate User profile represents the single largest segment across all wireless operators accounting for more than half of the total subscribers, the AppOptix platform data suggests there are significant variations in data usage across operators, which in turn brings new opportunities in usage-based pricing plans,” said Bonny Joy, chief of consumer telemetry platforms for Strategy Analytics.

The numbers combine both cellular and Wi-Fi network users, with the majority of traffic for all user types coming via Wi-Fi. Light users had 69% of their traffic via Wi-Fi, moderate users 76%, and power users relied on Wi-Fi for 82% of their data traffic.

“Wireless providers have to consider data consumption patterns across the identified customer segments in retooling their service plans, handset portfolio and content selection in reducing churn and attracting new subscribers,” said Barry Gilbert, VP at Strategy Analytics.

Big data & analytics: Syniverse completes acquisition of Aicent

ABOUT AUTHOR