Memorial Day Greetings from Lake Norman/ Charlotte, NC where cold spring rains gave way to a Carolina summer filled with heat and humidity. That means more boats on Lake Norman (boat purchases increased during the pandemic) and making homemade strawberry ice cream. We hope you are enjoying the extended weekend in a similarly pleasing manner.

Memorial Day Greetings from Lake Norman/ Charlotte, NC where cold spring rains gave way to a Carolina summer filled with heat and humidity. That means more boats on Lake Norman (boat purchases increased during the pandemic) and making homemade strawberry ice cream. We hope you are enjoying the extended weekend in a similarly pleasing manner.

This holiday edition TSB will focus on several accelerations that we believe will become evident (if not already so) over the summer. Since most of you are not shy about sending comments and ideas (we had over 100 from last week’s Brief), the request for input at the end of this Brief is probably moot, but there is also request for help.

Before diving into accelerators, a quick look at market value changes and iPhone SE availability.

The week that was

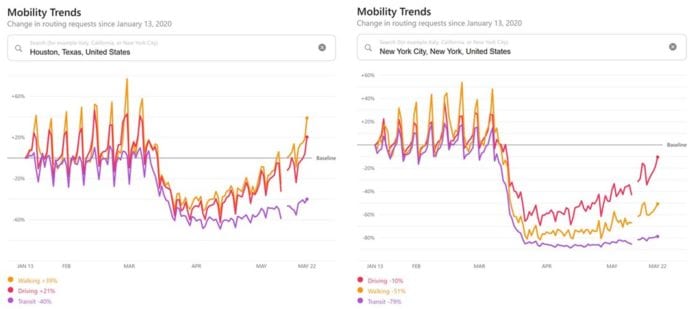

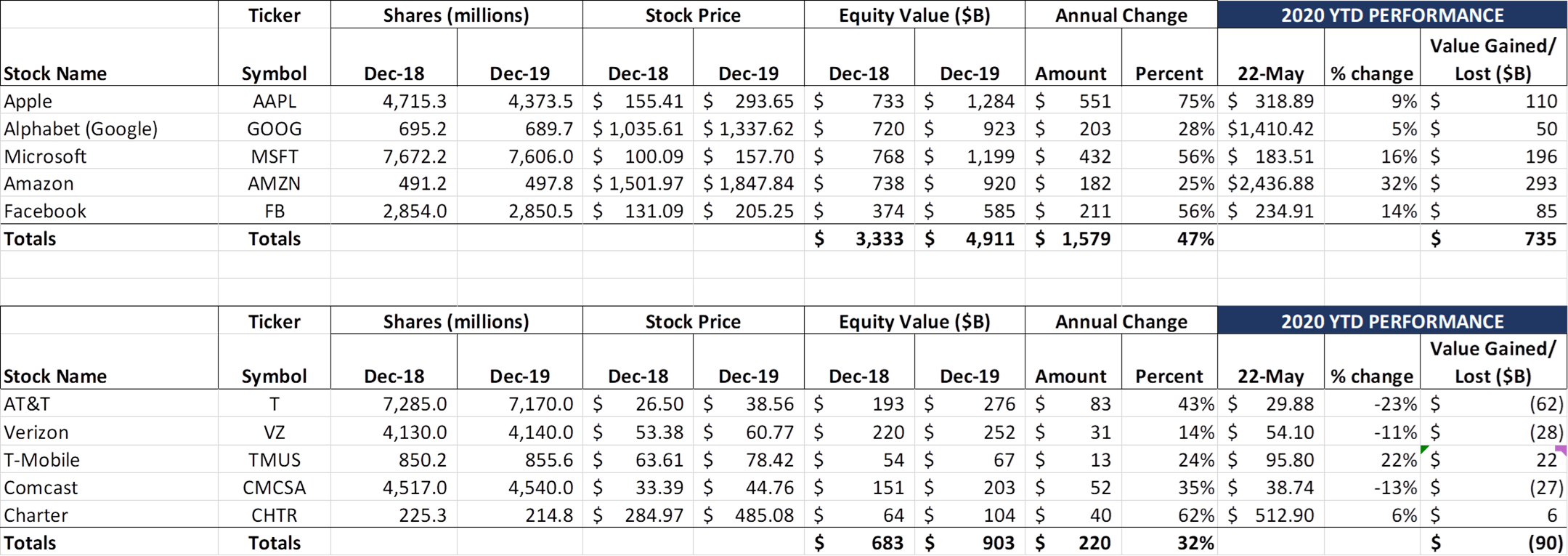

There’s a familiar phrase used in the markets called “Sell in May and go away.” That may be a phrase to describe a few of the Telco Top 5 stocks, but overall, May heads into its final week with some tailwinds. The Fab 5 will likely finish the month tracking to an annualized gain of $1.3-1.4 trillion, and the Telco Top 5 gaining $100 billion in market capitalization since the March 20 lows (but not back to the pre-COVID 19 loss level of -$59 billion). This week, Facebook hit an all-time share price high (+$69 billion wk/wk), and investors saw reason to reinvest in Comcast (+$13 billion wk/wk). Verizon and AT&T continue to be viewed as “safe” stocks but are not enjoying the gains of their cloud compatriots.

Three stocks trail the S&P’s gains since the beginning of 2019 (these returns exclude dividends): Verizon (+1.3%), AT&T (+12.8%) and Comcast (16.0%). Even with dividends included, however, Verizon would likely continue to trail the S&P (16.5% return without dividends, and an 18-19% return with six quarters of dividends). T-Mobile (+50%) and Charter’s (+80%) returns over the nearly 17-month period would trounce the index averages, lifting the Telco Top 5 average above the S&P 500.

Three stocks trail the S&P’s gains since the beginning of 2019 (these returns exclude dividends): Verizon (+1.3%), AT&T (+12.8%) and Comcast (16.0%). Even with dividends included, however, Verizon would likely continue to trail the S&P (16.5% return without dividends, and an 18-19% return with six quarters of dividends). T-Mobile (+50%) and Charter’s (+80%) returns over the nearly 17-month period would trounce the index averages, lifting the Telco Top 5 average above the S&P 500.

Strong cash balances to provide liquidity, low debt levels to provide available leverage, recovering/growing global addressable markets and strong share prices make the Fab 5 even more eager to pursue M&A activity. We have discussed Microsoft’s two large purchases in the last eight weeks, but the remaining members have also been active. Here are a sample of transactions since March 1:

Fab 5 Company Invested in/ Acquired

Facebook

Facebook

Microsoft

Microsoft

Apple

Apple

Apple

Google

Google

Two additional items that are worth mentioning: a) Google completed their $2.6 billion acquisition of Looker in mid-January (data analytics for Google Cloud), and b) Many rumors circulated this week that Amazon might be a big part of JC Penney’s post-bankruptcy future (Forbes analysis of combination justification here). While most of their acquisitions will be cash, having a growing stock price increases attractiveness.

Apple iPhone SE Availability Update

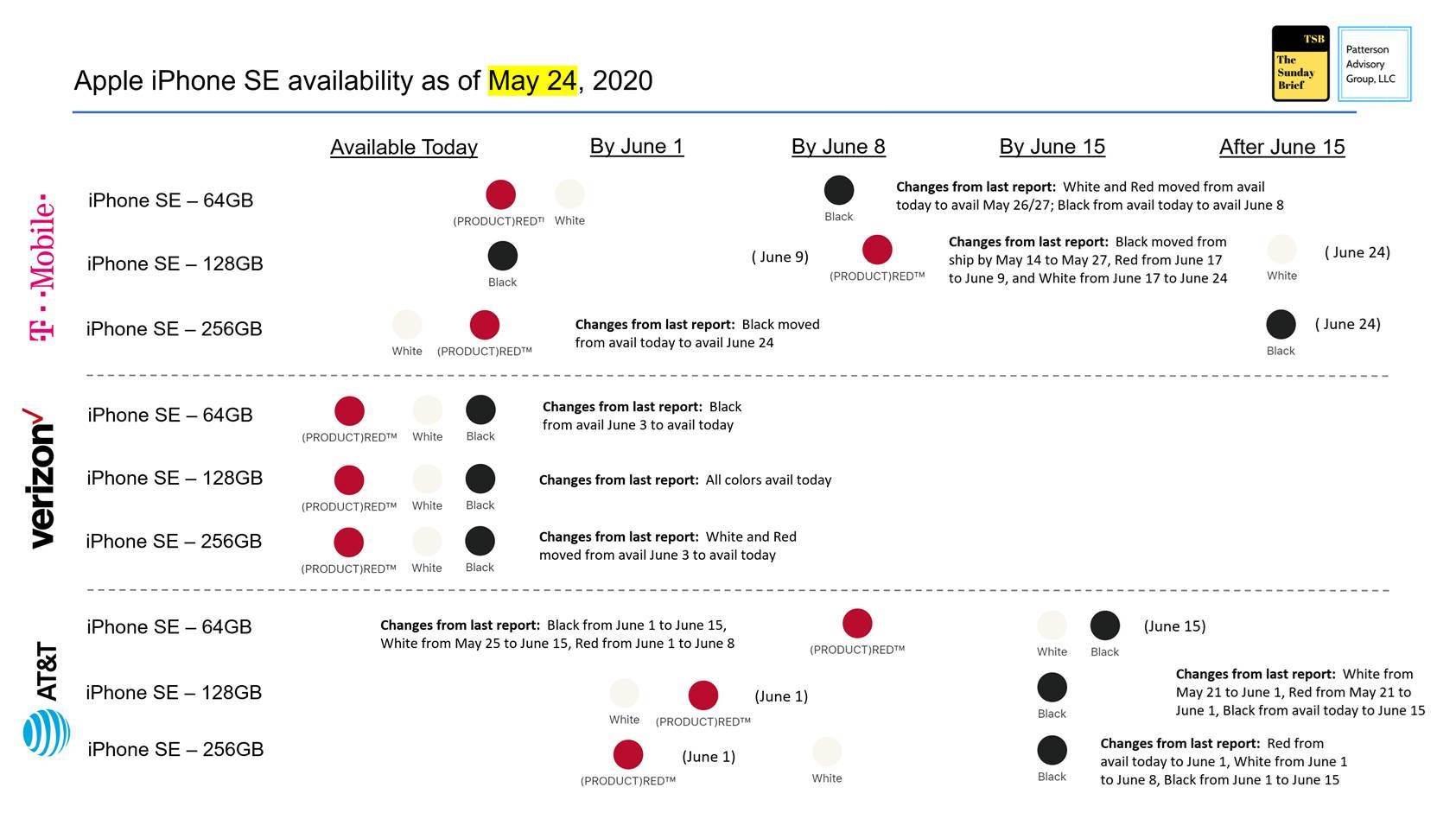

Last week, we surmised that increased economic activity might have an impact on iPhone SE availability throughout May. We were not wrong in that assumption as the revised iPhone SE availability chart shows:

As many of you remember from the iPhone 11 analysis late last year, being out of stock isn’t necessarily an indicator of strong gross add performance (it could be a bad sales forecast, or that more stores are closed now in a given geographic area, or a conscious decision to promote another device such as the costlier iPhone 11). Many factors come into play, with work from home (WFH) network quality and plan affordability rising in the rankings.

However, we did see a positive correlation between availability of Apple devices and gross additions for AT&T last November. And we know that Ma Bell has consistently been 1-2 weeks out on online stock on a device that is low-end Apple. If you want the iPhone SE in black, be prepared for a wait from AT&T (and, for some storage options, T-Mobile). One can only imagine what the demand would have been if they had introduced a wider array of colors (purple and green did very well with the iPhone 11 launch).

For the iPhone 11 (as opposed to the iPhone Pro and Pro Max), Verizon began to show widescale availability by the 5th week after launch. We are through the fourth week of availability, and, like clockwork, the iPhone SE is fully in stock. But that was also the case in November (with a few color exceptions) for AT&T. This time is different, and, unless it’s indicative of an upgrade acceleration (possible), then its probably a sign that AT&T is seeing gross add share gains from the iPhone SE launch.

It’s a lot harder to make the statement that general availability for T-Mobile stores indicates a slow start because of the extra variable called the Sprint merger. Magenta could have learned some lessons from the iPhone 11 launch (likely), or they could be balancing existing iPhone SE demand with iPhone 11 inventories (also likely), or they could be hitting an economic wall as customers say “not now” on new phone commitments (unlikely given the low monthly payment, but possible). There will be several layers of puts and takes in T-Mobile’s 2Q numbers, and the iPhone SE is not a deciding factor one way or another.

Another indicator that overall iPhone SE sales are robust is Best Buy and Apple Store availability. For most size/ color combinations, Apple is targeting delivery between June 5-9 (10-15 days). Our Best Buy update also shows most color/ size combinations are out of stock:

Availability Status iPhone SE Color/ Storage Options

SOLD OUT – May 2 Red 128GB; Red 256GB; Black 128GB; Black 256GB

SOLD OUT – May 10 White 64GB; Black 64GB; all colors – 128GB; White, Red – 256 GB

SOLD OUT – May 24 White 64GB; Red 128GB; all colors – 256GB

We will extend our analysis for one additional week to make sure that longer store hours and increased store openings do not further strain inventories. Overall, we think that the iPhone SE was a well-timed launch and served its purpose, driving a small increase in upgrades with minimal/moderate impact to iPhone 11 demand. Small is beautiful for many smartphone users.

Acceleration after the storm

We have spent a lot of Sunday Briefs talking about post-COVID 19 changes and have done our best to predict post-PPP timing (an exercise that reminds me of nailing jello to a wall). Several of you sent comments over the last two weeks asking a slightly different question that is easier to answer with precision: “What will accelerate?” We took this to mean more than a simple spin on the data (e.g., higher unemployment likely leads to an acceleration of mortgage defaults) but far deeper trends. This week, we will examine several accelerating trends that we think will impact telecommunications companies.

- Accelerating first-run movie releases through streaming/ Video on Demand (VOD). Perhaps the hardest hit sector besides theme parks, live sports and airlines is the movie production/ broadcast theater industry. Since the beginnings of content redistribution, first-run movies have been launched through theaters prior to VOD/ streaming venues. COVID-19 has jolted this model, and, if recent news turns into a trend, opening releases might be measured across millions of households along with thousands of theaters.

The content development and feature film distribution business model is ripe for change. Apple TV+ has been in the market for six months, with Disney+ slightly less – their lineups are still attractive, but the allure of newer platforms (NBC Peacock, HBO Max, others) remains a threat. Both companies have deep pockets (Apple has over $94 billion in cash and near-term marketable securities, while Disney has more than $14 billion), both platforms have gained subscribers through discounted/ bundled offerings, and competition for viewers is growing every day (reminder: HBO Max launches this Wednesday – all of the details are in this CNET article). Good content, regardless of its initial distribution strategy, is always welcome.

Given this backdrop, it’s no surprise to see Apple TV+ emerge the victor (rumored $70 million price tag) for worldwide distribution rights for Tom Hanks’ World War II thriller Greyhound (more from 9to5Mac here and Variety here). They need new content and theaters will struggle in the near term to generate more revenues than VOD/ streaming in a COVID-19 atmosphere (just ask the Comcast folks who released Trolls World Tour entirely through VOD and generated more than $100 million in revenues in the process – more in this must read Wall Street Journal article). With many still cautious about venturing out, why not explore distribution alternatives?

The implications could be very positive for content distributors – more revenues (either through VOD or through increased subscriptions), low incremental distribution cost, and increased value to customers (which could create more attachment to cable and/or satellite services at the margin). The launch of first-run VOD could be positive as well for Amazon, Roku, Netflix, and other streaming platforms. If the economics described in the WSJ article above are maintained through the summer, expect a new “Battle Royale” between content producers and theater complexes. Simultaneous release with theaters spells trouble for AMC, Cinemark and Regal who desperately need paying, concession-consuming customers. More Greyhound exclusive worldwide release announcements pits Apple against theater owners, and we have a pretty good idea who wins that war.

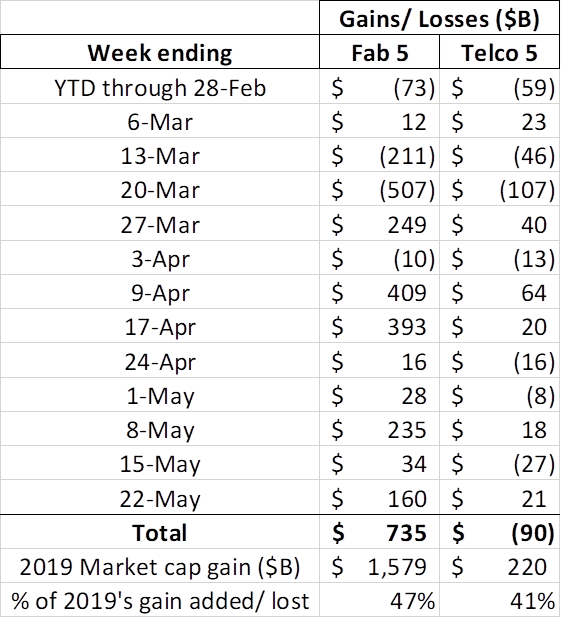

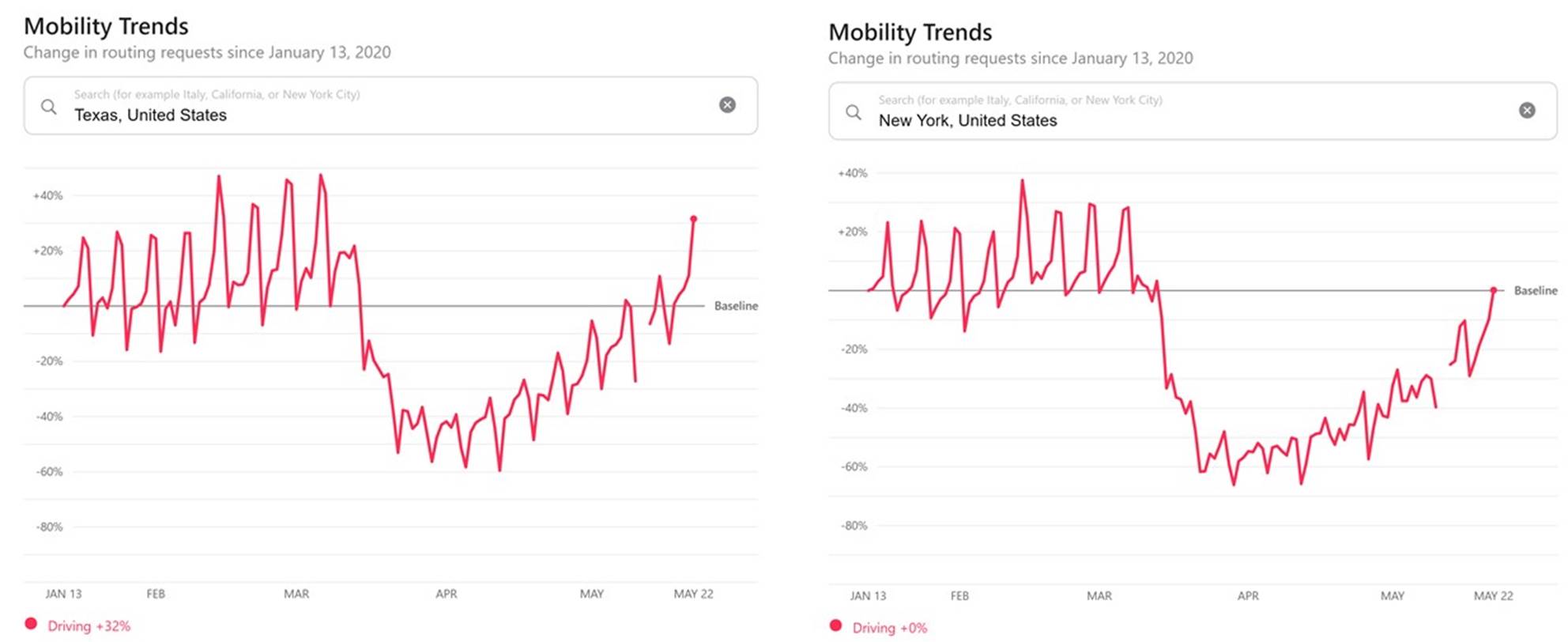

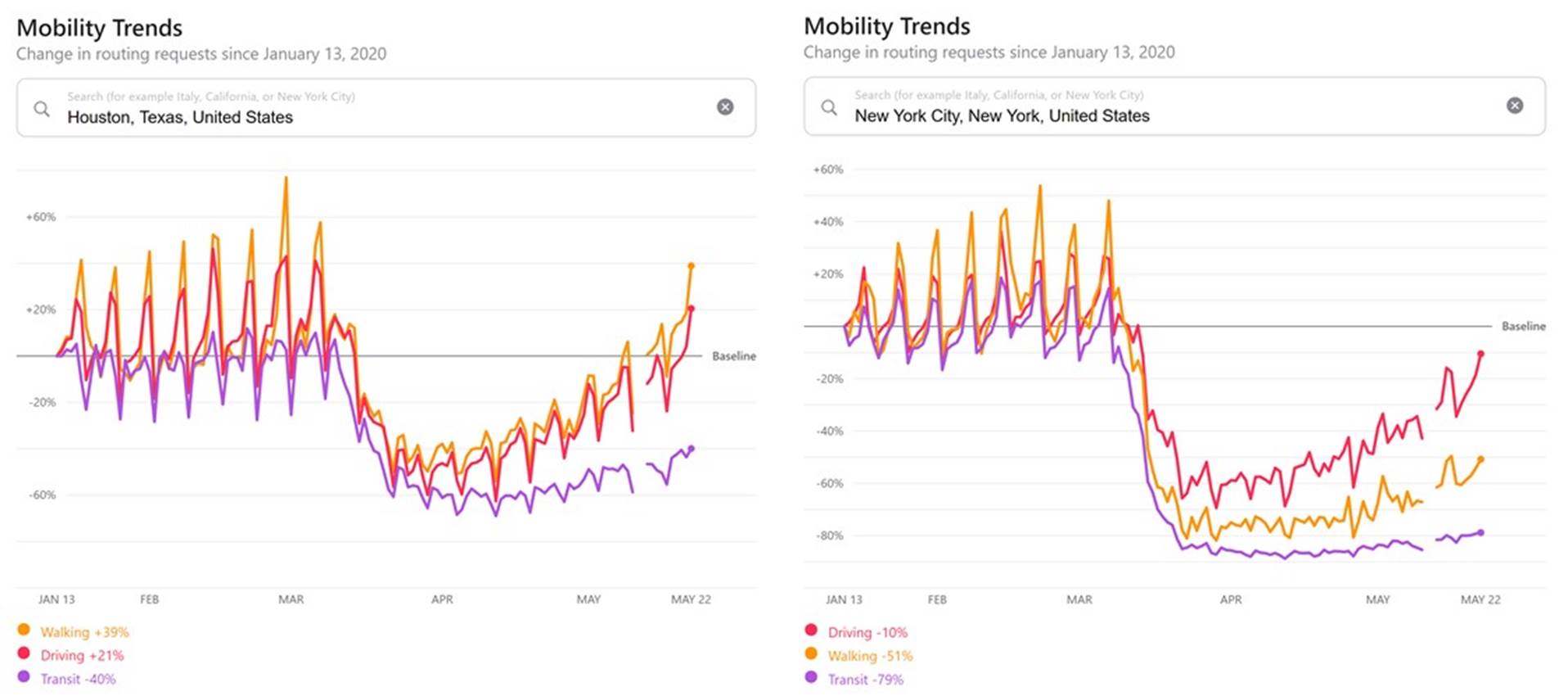

- Accelerating highway traffic as driving replaces transit and flying for many this summer and fall. Both Apple (site here) and Google (site here) are tracking the COVID-19 recovery using phone activity (Apple Maps requests for driving instructions drives the nearby graphs).

Many factors drive increased driving instructions, but the trend is undeniable – more driving directions activity is leading to more highway/street traffic. And, while Texas is close to/ ahead of the January 13 baseline level (the dips in driving indicate weekend traffic), New York state is not far behind (NYC shown in the second chart).

As we have discussed previously in a Sunday Brief called “The Great American Move,” urbanites are embracing suburbia in greater numbers for living and working. Even if commuters were brave enough to embrace public transit, there likely are fewer bus/ rail/ subway options in suburbia than in downtown.

The implication of this to telecom operators is that suburban commutes are going to drive new traffic patterns. As shown nearby, public transit travel patterns are going to be replaced by road/ sidewalk coverage. Comcast and Spectrum might end up being winners here to the extent that this trend drives increased use of the Cable Wi-Fi SSID (outdoor Wi-Fi). But public transit is the least desired option for the near term, and connectivity requirements are moving to highways and sidewalks.

Increased travel is not confined to state highways, however. The RV industry is experiencing a record resurgence in the wave of COVID-19 health concerns. This CNBC interview with Airstream’s CEO, Bob Wheeler, describes the dynamics facing RV renters, buyers, and manufacturers this summer. Increased RV needs could drive additional Hotspot usage on both interstate and local highways.

Bottom line: While not the jolt felt with shelter-in-place orders, how commuters travel is going to move away from mass transit to highways and sidewalks. This change will drive more 4G LTE traffic today, and potentially 5G traffic in 2021.

- Accelerating retailer closures (and possible re-openings). Operating a department store chain was difficult prior to COVID-19. As consumers adopt digital retail purchasing in greater numbers, maintaining profitable sales per square foot levels is downright daunting. As malls attempt to reopen, many are concerned about the solvency of their anchor tenants (Macy’s, JCPenney, Lord & Taylor, Dillard’s, and the few Sears stores that remain). Many smaller stores have co-tenancy clauses that allow them to demand rent relief or renegotiate leases in the event that large spaces remain vacant for long periods of time.

Each tenant in a store has a POS system for payments and at least one phone line to field customer calls. Many employees of these companies benefit from corporate discounts on their wireless phone bills. Some malls have sophisticated distributed antenna systems (DAS) which carry their own set of monthly expenses and have been extremely underutilized. With fewer locations and fewer employees, those revenue streams and investments are at risk. Retail specialty firm Green Street Advisors predicts that 50% of the department stores anchoring America’s malls are going to close in the next 18 months. That’s a lot of empty real estate and accelerated job losses. A full list of current store closures is tracked by Business Insider here. Caution: it’s a pretty dismal picture.

Offsetting this is growth in online ordering and return activity (see recent Statista chart below). Americans are growing more comfortable with on-line ordering of most apparel (including higher ticket items) because of the speed of returns and overall positive customer experience. More logistics alternatives will emerge to satisfy increased demand but expect many Americans to continue to order a wider variety of goods online, and for total retail locations to shrink.

The impact on telecommunications companies is easy to identify. Fewer locations mean fewer connections, and frequent renegotiations means lower unit pricing. Those retailers who replace the defunct department store may not have the same allegiance to copper solutions (or incumbent brand loyalty) provided by the previous anchor tenant. This could result in underutilized assets for AT&T, Verizon, CenturyLink, Comcast, Charter, Altice and others at some building locations.

Bottom line: After liquidity issues have been addressed, and recovering order flow mitigates any risk of insolvency, management teams will turn to improved productivity and increased competitiveness strategies as a way to “make lemonade” out of the last three months of volatility “lemons.” Greater digital infrastructure needs will drive increased technology and communications service requirements. As we have seen in other recessions, those companies who can use technology to produce a meaningful competitive advantage will generate disproportionate value. The COVID-19 recession will be very unforgiving for companies who simply settle for a return to the past.

Now for the request: One acceleration that we did not discuss is the role of machine learning and artificial intelligence in the quest for a cure. But the parallels between the advancements in developing cures and diagnosing illnesses and the development of the microprocessor/ semiconductor industry after WW II are striking (for more about the development of this industry I strongly recommend Michael Malone’s excellent book The Intel Trinity). While Business Insider has a very good chronicle of the current developments (see attached email item), we are asking for your thoughts to the question “Is biomedicine the next catalyst for technology?” Articles, anecdotes, thoughts, opinions especially welcome.

Next week will contain the traditional market analysis and the iPhone SE backorder status, but we will discuss lessons learned from The Intel Trinity and hopefully begin to answer the previous question. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here. If you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!