In connection with the presale of the LG V20 smartphone, the T-Mobile LTE network is getting a capacity infusion from its AWS-3 spectrum licenses

As part of kicking off the presale of the LG V20 smartphone, T-Mobile US is touting itself as the first domestic carrier to launch commercial services across the AWS-3 spectrum band.

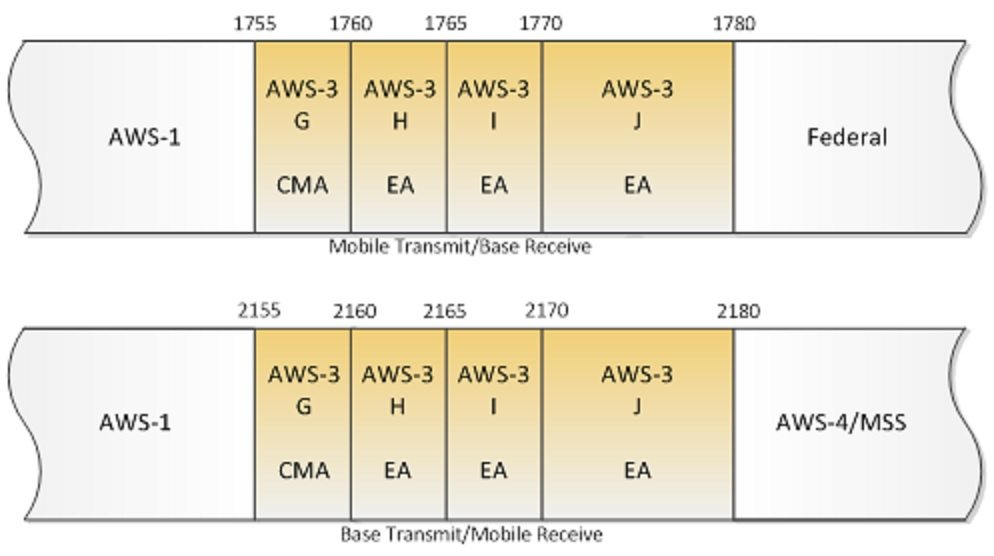

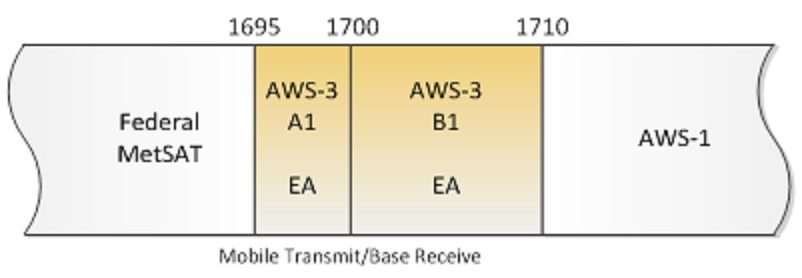

The carrier noted the AWS-3 spectrum, which is in the 1.7/2.1 GHz bands and is in the process of being migrated from use by the Department of Defense, will be used to provide additional capacity for its LTE service. However, the carrier has so far not said which markets will be the first covered with the new spectrum resources.

T-Mobile US last year spent just under $1.78 billion on winning licenses during the Federal Communications Commission’s record-setting Auction 97 proceedings. The auction itself raised $44.9 billion in gross proceeds for 50 megahertz of licensed and 15 megahertz of unlicensed spectrum spread across the 1.7/2.1 GHz bands.

AT&T Mobility and Verizon Wireless were the big winners of AWS-3 spectrum, with the former handing over nearly $18.2 billion in winning bids and the latter $10.4 billion. AT&T said it plans to begin tapping into the spectrum in 2017, with Verizon Wireless still mum on its plans.

T-Mobile US currently relies on AWS-1 spectrum in the 1.7/2.1 GHz spectrum bands adjacent to the AWS-3 licenses it acquired in Auction 97. The carrier also is using 700 MHz spectrum it has acquired from license holders and is refarming 1.9 GHz spectrum currently supporting its GSM/HSPA-based 2G and 3G networks for its LTE service. In some markets the carrier is aggregating its various spectrum assets to form wider channels in support of higher network speeds.

The carrier also is participating the in the FCC’s ongoing 600 MHz incentive auction process, having previously argued successfully for the FCC to set aside up to 30 megahertz of spectrum for carriers that do not already control a significant amount of sub-1 GHz spectrum holdings, which is predominately made up of AT&T and Verizon Communications. T-Mobile US is expected to be the most aggressive bidder for the set-aside spectrum, with some predicting the carrier could spend up to $10 billion on licenses.

Television broadcasters that currently control the 600 MHz spectrum are required to vacate those licenses no later than 39 months after the auction ends.

Bored? Why not follow me on Twitter