Increased software and services for the tablet market will drive long-term growth

If you look at the last few of Apple’s quarterly reports, it consistently shows the sales of the iPad have been falling from the quarter a year preceding. Thus, the sales of the iPad in the most recent quarter were lower than the same quarter a year ago. After you hear this same story quarter after quarter, you may want to believe that the iPad is a dying business with sales continuing the decline for years to come.

But, when you listen to Apple CEO Tim Cook’s remarks, he says he is very bullish about the future of the iPad. Is he just trying to fool the financial analysts or does he know something that the financial analyst don’t know? In truth, Cook is right. The iPad isn’t a dying business. If that’s true, how do you reconcile the quarter after quarter results that shows iPad sales falling and being bullish on the future of the iPad?

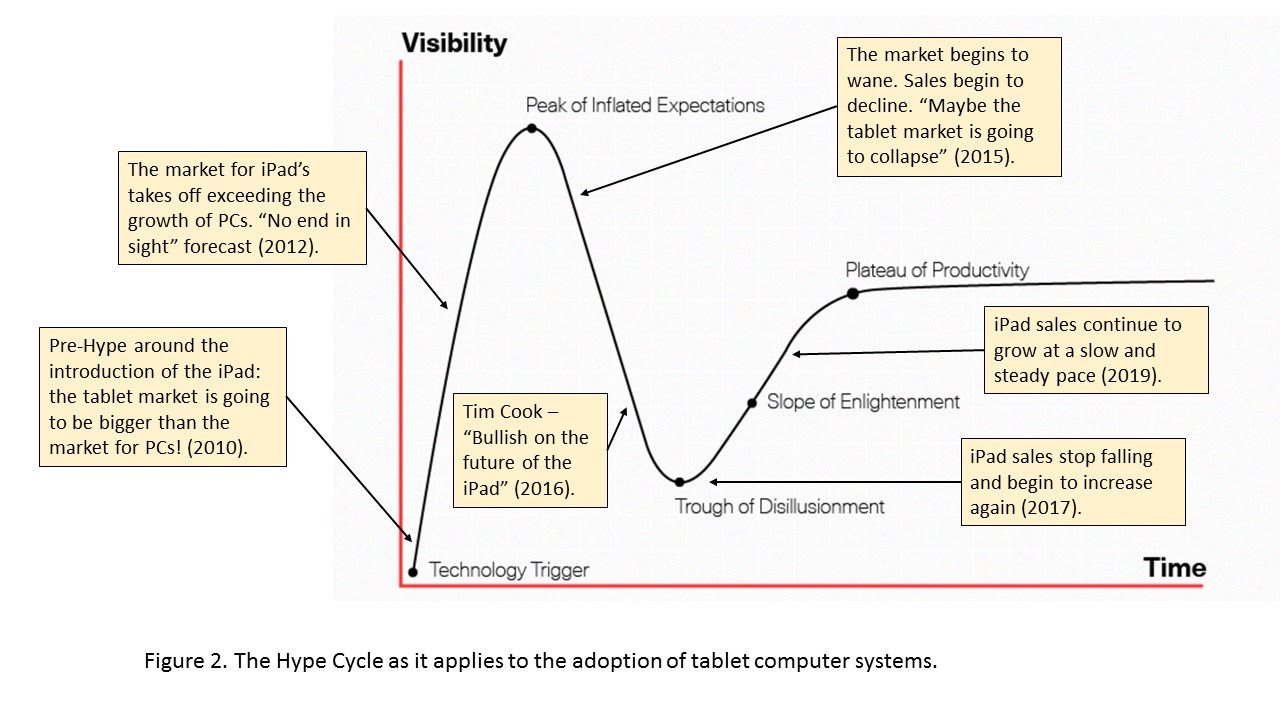

I believe the answer lies in an interesting market dynamic originally coined by Gartner as the “hype cycle,” although it has been used generically in many different market situations. Figure 1 shows the general shape and major callouts of the hype cycle.

From this, you can see the cycle starts with some “technology trigger” in which a product demonstrates something that hasn’t been able to be done before. There is a great deal of hype over what this means so sales take off at a torrid rate. Optimistic predictions abound. But then, the market suddenly level off at what’s called the “peak of inflated expectations” where the hype levels off and so do sales.

At this point, sales begin to decline in what is often called the “oh s—” phase when everyone starts to think that maybe this was all a big mistake. The market is often called to be “tanking” and may never recover. You then get to the bottom of the fall in what’s called the “trough of disillusionment” when everyone is disillusioned over the market crashing.

But, then something strange happens: the market starts to increase again. You get people who figure out the true market dynamics and reach a new positive “slope of enlightenment” where there is now a long, slow steady increase in market adoption for metrics that are not based on hype but on true market adoption and lasting market adoption reasons. From there, the market goes throw some plateauing but this phase is different from almost every product. Late market adoption continues through multiple product updates until some revolutionary new technology causing a dramatic new shift.

Now, take a look at Figure 2 where we consider the specific market adoption issues around the creation and market adoption of the iPad (and tablets overall, but the iPad is the predominant leader and serves as a good pedagogical example).

The hype for the iPad was immense. It was the first new product category since the iPhone in 2007, and expectations and forecasts were off the chart. People (including yours truly) stood in line early on the morning on shipment day to make sure that they could get a first day shipment of the new iPad.

I was around No. 6 in line when I got to the entrance to the Wellington Green Mall around 4:30. The first in line was there before 4 am. The store had paper put up to cover the windows. Just before the store opened at 8:00 am, the staff all came out and applauded to everyone who was in line. It was like being at a live concert.

The sales took off from there. Up they went for two years as Apple reported higher and higher sales. Newer, faster models came out over time plus those which included cellular wireless, which was deemed “way too expensive” when the first few models of iPad came out, but has become the standard today due to lowering the cost of LTE data plans, and the introduction of family and corporate group pricing.

Jump forward to the last couple of years when the pinnacle was reached and sales started to decline. I can remember people saying, “Oh, this is just a small calendar adjustment.” But, fall they kept going until this year, analysts started asking Cook, “Why are you still bullish on the iPad when sales keep going down?”

Well, the answer rests in the hype cycle. Because the iPad was so over hyped, the sales were actually higher than expected – higher than anyone had forecast including Apple. However, as the market corrects itself downward, you can see that iPad sales will likely start increasing again sometime next year or soon thereafter.

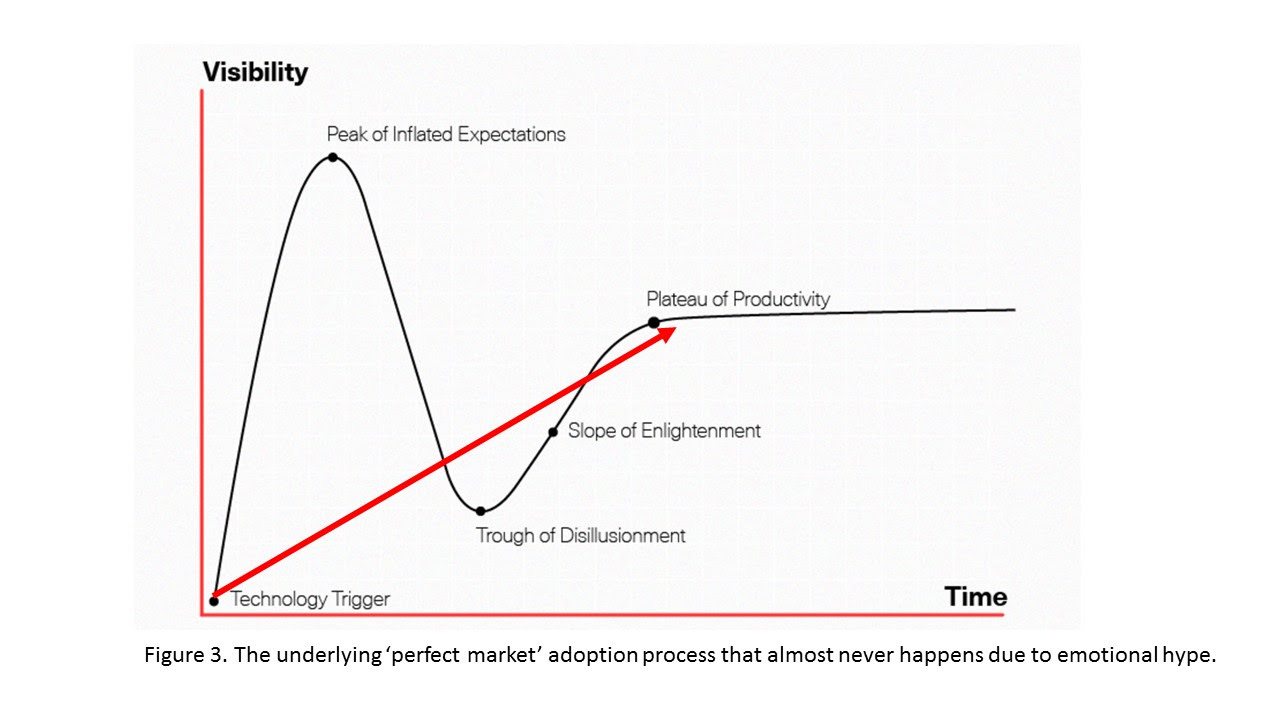

The fundamentals are there: the iPad is a necessary tool for most everyone in business to have – the truly portable computer while away from the home/office. People may hold on to them longer than PCs or smartphones, but the fundamental need is there for a long-term market. You can see what a perfect market adoption would look like in Figure 3.

Here, the red arrow shows what a steady, long-term growth would look like. You can see it is lower during the over-hype phase but ends up at just about the same place over time. In this adoption process, sales never zoom up out of control nor do they hit bottom like the “trough of disillusionment.” But, people’s emotions get caught up into exciting new products so the adoption has these ups then downs then back on track.

In a way, the over-hype phase helps the company making the new product recover the research and development costs quicker so it’s not a bad thing to have increased sales in the beginning of the life of a new class of products. However, if you are the head of product marketing and went into a board meeting with an over-hyped forecast, you’d likely be called a fool when, in fact, you were the genius to have known exactly how the market was going to develop. Also, it’s hard to tell people that the market is going to recover when sales are decreasing. Cook isn’t a fool. He knows about the hype cycle and can see as inventories start to drop that the period of “enlightenment” with increased sales is soon upon us.

The tablet market, and, specifically, the iPad’s “golden days” are still in front of Apple. Don’t worry, the decreased sales are only temporary. I can firmly forecast that after these adjustments are over, people will begin buying new iPads again – likely next year or soon thereafter.

J. Gerry Purdy, Ph.D., is the principal analyst with Mobilocity and a research affiliate with Frost & Sullivan. He is a nationally recognized industry authority who focuses on monitoring and analyzing emerging trends, technologies and market behavior in mobile computing and wireless data communications devices, software and services. Purdy is an “edge of network” analyst looking at devices, applications and services as well as wireless connectivity to those devices. He provides critical insights regarding mobile and wireless devices, wireless data communications and connection to the infrastructure that powers the data in wireless handheld devices. Purdy continues to be affiliated with the venture capital industry as well. He spent five years as a venture adviser for Diamondhead Ventures in Menlo Park, California, where he identified, attracted and recommended investments in emerging companies in the mobile and wireless industry. Purdy had a prior affiliation with East Peak Advisors and, subsequently, following its acquisition, with FBR Capital Markets. Purdy advises young companies that are preparing to raise venture capital, and has been a member of the program advisory board of the Consumer Electronics Association that produces CES, one of the largest trade shows in the world. He is a frequent moderator at CTIA conferences and GSM Mobile World Congress. Prior to funding Mobilocity, Purdy was chief mobility analyst with Compass Intelligence. Prior to that, he owned MobileTrax LLC and enjoyed successful stints at Frost & Sullivan and Dataquest (a division of Gartner) among other companies.

Editor’s Note: Welcome to Analyst Angle. We’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.