Power scarcity and thermal limits are major challenges for the AI data center buildout, observes Dell’Oro Group – but that the industry is redesigning infrastructure, doubling down on cooling, and spending its way out of a corner.

In sum – what to know:

Power constraints – shifting from chips to infrastructure, as Dell’Oro forecasts the DCPI market for power, cooling, and physical systems will grow at a “mid-teens” CAGR to $80bn by 2030.

Mitigation strategies – mean DC redesigns, where operators build differently – slab layouts, new power architectures, direct liquid cooling – rather than wait for grid capacity to catch up.

Essential cooling – is rising to the top of the stack; thermal management is now forecast to rival the UPS market in value by 2030 as cooling becomes a primary constraint for AI infra.

An interesting press note from analyst house Dell’Oro Group says “power constraints and technology disruption” will hit the AI mad house where it hurts – in the brick-and-steel construction of big-brassed AI engine rooms. Except that the AI real-estate market has such a head of steam that it seems like nothing, not even crippling energy scarcity, will knock it off its path completely. The industry has “mitigation strategies” to stay on track, writes Dell’Oro Group.

As such, the global market for ‘data center physical infrastructure’ (DCPI) will grow at a “mid-teens” compound annual rate (CAGR) over the next five years to be worth $80 billion by 2030. It says: “Demand signals remain exceptionally strong, [but] power scarcity has become an increasingly binding constraint on near-term expansion, with on-site generation evolving from a contingency option to a practical necessity for large AI campuses.”

But first, to explain: the DCPI forecast covers the sale of everything that lets IT equipment exist within a data center – and stay powered and not melt. Which means, everything but the IT hardware itself – the servers, storage, silicon, and software; plus also bricks and steel, and land fees. It is mostly about power infrastructure (power supplies, distribution units, busways, switchgear, transformers, DC systems, turbines, engines, and battery storage).

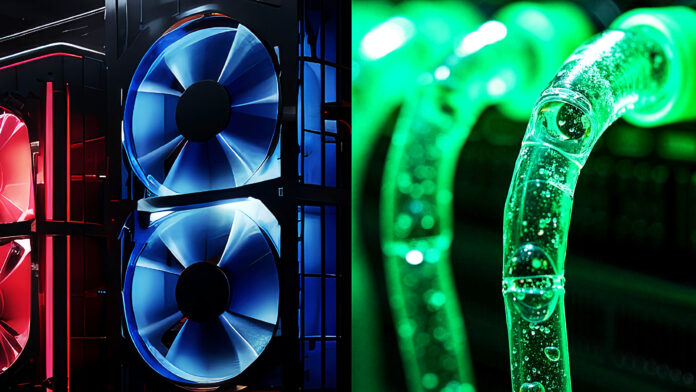

Which is where “power scarcity” really shows up. But it also covers thermal management, as the counterpoint to escalating power loads – conditioning units, cooling towers, heat exchangers, pumps, and manifolds. Which is the fastest-growing DCPI segment on the grounds AI chips are busting traditional cooling systems. Cooling is no longer just a support system, but a definitive part of data center design – is contributing logic for the double-digit forecast.

There is other componentry, too: racks, cabinets, floor structures, cabling systems, control systems, other pre-fab components. The conclusion is that AI has shifted the bottleneck away from, or at least in parallel to, graphics chips (GPUs), and towards core infrastructure – as well as to people, as reported yesterday. DCPI equipment for power, cooling, and basic setup is not just a line-item on a spreadsheet, but something to plan, procure, and sweat over.

As above, Dell’Oro Group says operators have “creative mitigation strategies” to deal with the chaos, without really explaining them. Alex Cordovil, research director at the firm, remarked: “The DCPI market is undergoing a period of profound structural transformation. Technology disruption is cascading across the stack as rising chip thermal design power and the approach of the one-megawatt rack force fundamental changes in facility design.”

He added: “Despite power constraints, operators are deploying creative mitigation strategies to bring capacity online, supporting our decision to revise the DCPI growth outlook upward.” As such, the response is more about redesign than relief, it seems. Operators are building AI centres with slab-based layouts, new power distribution architectures, and direct liquid cooling, and relying on hyperscaler, colocation, and neocloud firms to absorb rising capital costs.

So despite the power constraints, the market will continue to spend on DCPI gear, and DC capacity will continue to come online. Spend more and build differently – is the market’s mitigation motto. Dell’Oro Group’s five-year forecast says thermal management, as a DCPI sub-segment, will grow at a 20 percent CAGR and reach the value of the UPS market by the end of the decade – traditionally the largest and most critical DCPI category.

Cooling is now a primary architectural and capital constraint, it suggests. In parallel, the market for direct liquid cooling will “surge”, says Dell’Oro Group – surpassing $8 billion by 2030, as it “transitions from an enabling option to a foundational technology for AI factories”. It notes that Nvidia’s latest Vera Rubin compute tray designs eliminate fans entirely, enabling fully liquid-cooled configurations.

As well, it writes: “Cabinet PDU and busway sales will expand as overhead busway systems become the default architecture for slab-based AI factories; emerging DC power distribution architectures are expected to influence deployment choices toward the end of the decade. Service providers – including cloud, colocation, and neocloud operators – are forecast to grow DCPI spending at roughly five times faster than enterprise.”

This reflects the “increasing complexity and capital intensity of AI-ready infrastructure”, as noted above. Power availability is now a “binding constraint”, it says. “Grid interconnection delays and transmission bottlenecks [are] driving surging demand for natural gas turbines and reciprocating engines as operators deploy on-site generation to bring multi-hundred-megawatt and gigawatt-scale campuses online.”