A new report from OpenSignal found Verizon and T-Mobile at opposite ends of Wi-Fi connectivity, with unlimited data availability, customer mix as reasons.

One impact of domestic wireless carriers moving towards “unlimited” data plans appears to be less reliance on offloading their data usage onto Wi-Fi networks, according to a new report from OpenSignal.

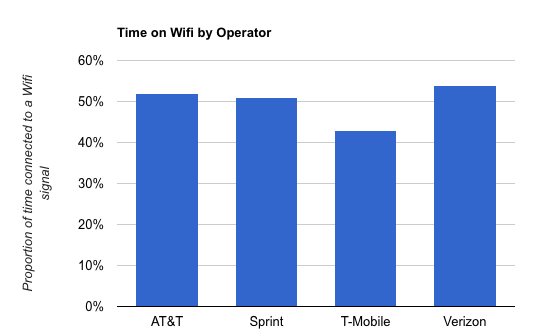

The firm noted that in looking at data connection usage of the market’s four nationwide operators during the first quarter of this year it found T-Mobile US customers spent the least amount of time using Wi-Fi, while Verizon Wireless customers spent the most time accessing data services via a non-cellular connection. The numbers came from smartphone users that had downloaded the OpenSignal application.

The data showed T-Mobile US customers were connected to a Wi-Fi network 43% of the time, compared with 51% for Sprint customers, 52% for AT&T Mobility customers and 54% for Verizon Wireless customers. OpenSignal noted a simplistic way to interpret the numbers would be in connection to the length of availability of unlimited data plans for customers, with those plans typically removing the overage worry from the minds of customers.

“T-Mobile and Sprint have been selling unlimited data plans for some time now, while AT&T and Verizon only recently reintroduced unlimited as an option for new subscribers,” wrote OpenSignal’s Kevin Fitchard, in a blog post. “Customers that don’t have to worry about data overage charges have less incentive to seek out free or cheap Wi-Fi connections. It’s perhaps no coincidence that the two operators with lowest time-on-Wi-Fi scores are the ones with customer most accustomed to not counting the megabytes they consume. But that’s also a rather simplistic explanation. There are lots of reasons why one operator’s customers could be finding Wi-Fi signals more than others.”

Further digging into the numbers, Fitchard noted a potential impact from some operators having more robust Wi-Fi networks and back-end systems that can automatically switch a customer from the cellular network to the Wi-Fi network, as is the case with AT&T Mobility. The diversity of a customer base was also cited as enterprise customers often switch to an office Wi-Fi network when at work or are more likely to pay for a Wi-Fi connection when traveling.

“Our smartphones spend a lot of time at home and in the office passively connected to our local networks,” Fitchard added. “But that passive connectivity can tell us some interesting things as well. If an operator’s customers skew young, their time on Wi-Fi numbers will skew low. Younger folks tend to go out more, leaving the familiar embrace of their home networks.”

Bored? Why not follow me on Twitter.