Light-licensing models for 3.5 GHz band open new ways to deploy and operate wireless networks

Despite the impressive number of slide decks explaining what 5G is, we still do not know for sure what it will encompass once the standardization work is completed. What is increasingly clear, however, is that 5G will be larger than previous Gs – it has a wider scope that can change the way we deploy, operate and profit from mobile networks. It will be a toolbox from which mobile operators and other service providers will choose different elements to deploy at different times. It is unlikely that operators will turn 5G on at a specific date. Rather, it will be an incremental process, and it is starting already.

An example of the gradual transition to 5G is the introduction of new frameworks for spectrum allocation and use. Regulatory work for the 3.5 GHz and millimeter wave (mmW) bands has started already, and will continue in parallel with, but separate from, 3GPP standardization. At the same time, the use of high-frequency bands in new regulatory regimens is going to be a defining element of 5G; that will bring a massive increase in RAN capacity, with a combination of more efficient air interface and more extensive spectrum reuse.

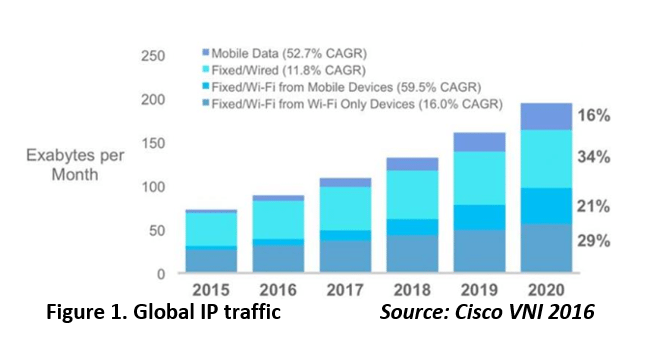

Spectrum allocations for public access are mostly for license-based cellular bands and for unlicensed technologies like Wi-Fi today, and LAA in the future. Cellular bands excel at providing coverage across operators’ footprints, but Wi-Fi carries much more traffic (50% of the worldwide fixed and mobile IP traffic by 2020, compared to cellular’s 16%; Figure 1). This is astonishing if we consider that this traffic is all carried through the 2.4 GHz and 5 GHz bands in unlicensed environments where interference is difficult to control. The foundation for this widespread Wi-Fi adoption and a stunning (and largely unpredicted) success in regulation has been the coupling of a more intensive spectrum reuse with low-cost, easy-to-manage equipment.

New regulatory frameworks developed at the FCC in the US for the 3.5 GHz Citizen Broadband Radio Service (CBRS) band and in the 2.3 GHz band in other countries go even further to combine the flexibility of unlicensed Wi-Fi, with the protection of licensed cellular spectrum for those – service providers, venue owners, neutral hosts – who invest in the infrastructure and operate it. The expected increase in spectrum re-use compared to cellular bands translates in higher wireless capacity.

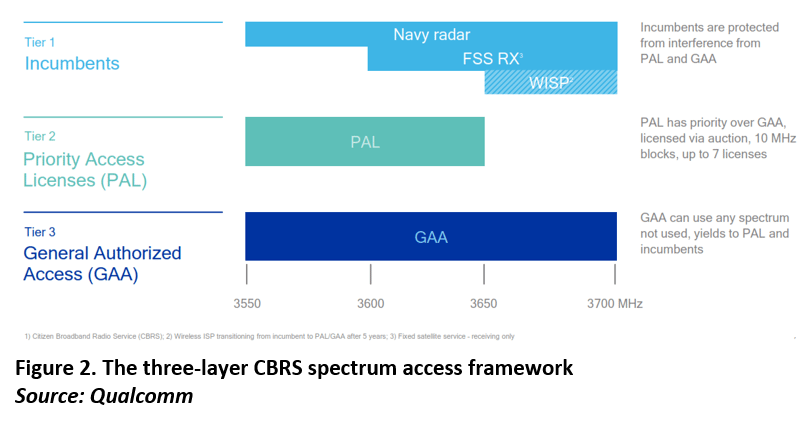

In the US, FCC Part 96 established CBRS in the 3550–3700 MHz frequency band with a three-tiered use model (Figure 2):

- Grandfathered Wireless Broadband Access for incumbent licensees (e.g., military, satellite, WISPs), whose use of the band is protected from interference from other users (3650–3700 MHz).

- Priority Access Licenses (PAL), granted through auction, bestowing operators the right to use 10 MHz channels for two three-year periods (3550–3650 MHz).

- General Authorized Access (GAA), available to any entity, provided it is registered and coordinates spectrum use with a Spectrum Access System (SAS) on a shared basis – i.e., there is no protection from interference (3550–3700 MHz, except for channels used by Grandfathered Wireless Broadband Access and PAL licensees).

The six-year duration of the license limits the attractiveness of PAL. Operators have a longer time horizon for deployments and may feel that their investment is not sufficiently protected.

The strongest interest is for GAA. It could trigger new deployment, operation and ownership models because it is crucially different from both the licensed and unlicensed regimens.

Unlike licensed models, GAA spectrum use is open to any entity that has physical access to a location. The entity does not need a license or need to be a service provider. Physical access is also required for licensed-band deployments (e.g., operators need to have access to a cell tower), but in that case real estate owners cannot use the spectrum, but they benefit from coverage and can extract rent from the cellular infrastructure, so they typically facilitate licensed deployments. With GAA, real estate owners compete with mobile operators and other service providers in using the CBRS spectrum. Like with Wi-Fi, allowing a mobile operator to deploy its own infrastructure may result in interference, and real estate owners may decide to block or limit deployments by mobile operators. This is a common occurrence with Wi-Fi.

Unlike unlicensed models, GAA does not allow occasional use of the CBRS band. For instance, users cannot use their mobile devices or routers to act as mobile or temporary access points. As a result, within a stadium, the owner is protected against interference from unknown sources – unlike with Wi-Fi, which everybody can use wherever they go, both to receive and transmit.

These differences from established regulatory frameworks for spectrum use create the potential for a stronger role – in terms of control and investment – for real estate owners. But does this mean mobile operators and other service providers will stay out of CBRS – as they initially did with Wi-Fi? I do not believe this will happen, because service providers fulfill an essential role that real estate owners are not equipped to take on: reliable and consistent service across locations and integrated across wireless interfaces. But the relationship between real estate owners and service operators is bound to change. This can happen in ways that will benefit both, as well as improve the subscriber experience. And this change is already under way, as operators rely more on Wi-Fi offload using venue-based and residential Wi-Fi infrastructure, as they plan to use LTE in unlicensed bands, and as residential users and venue owners take a larger role in providing access.

What should we expect the 3.5 GHz band in the US and the 2.3 GHz band in other markets to be used for? These bands are well suited to small-cell densification deployments in both indoor and outdoor environments. They allow network operators to move beyond interference-prone co-channel deployments, in which macro and small cell layers share the same spectrum channel, and instead use the 3.5 GHz/2.3 GHz spectrum exclusively for small cells.

This approach not only eliminates the need to manage co-channel interference, it encourages neutral host deployments, in which a third party deploys and operates a network that is shared by multiple service providers (as is frequently the case in DAS deployments). Or it could be a venue owner or a mobile operator that provides the access to multiple service providers. Venue owners like this model, because it allows them to meet their visitors’ expectation that they will have access to any service provider. Mobile operators have learned from DAS deployments that neutral host models can work, but they need to become comfortable with not having direct control over the RF access. Neutral hosts can provide sufficient transparency and performance KPIs to ensure that service providers get the RAN access they are paying for.

Venue owners are more and more willing to pay for the infrastructure, too. The advantage is that they can choose how to deploy it, and they can provide access to multiple operators, monitor performance, and have a say in which services operators support. In turn, this lifts the capex burden from operators, which continue to struggle with how to deploy outdoor or indoor small cells in mid-size venues.

Shared-access regulatory frameworks in the 3.5 GHz and 2.3 GHz bands not only provide more spectrum, they have the potential to push the Wi-Fi/cellular integration model further, change ecosystem roles, and establish new models for sharing cost and ownership of the wireless infrastructure.

Figure 1. Source: Cisco VNI 2016

Figure 1. Source: Cisco VNI 2016

Figure 2. Source: Qualcomm

Figure 2. Source: Qualcomm

To learn more on this topic, register for the Analyst Angle Webinar: 3.5 GHz: assessing technology, deployment options and business models