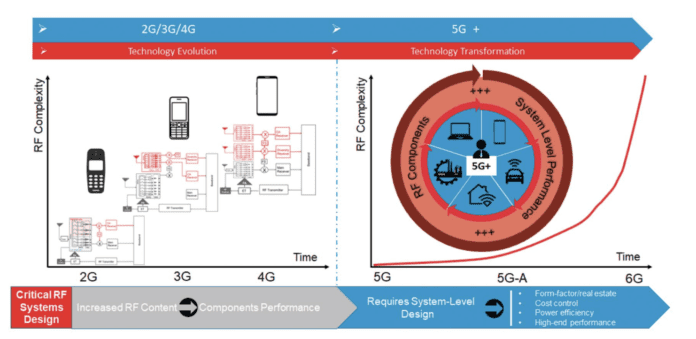

As the mobile industry continues its transition to 5G, outperforming its predecessor generations on nearly every metric at launch, it brings with it a host of extremely complex challenges for vendors to overcome if this demand explosion across all price tiers and device types is to continue. With 5G promising innovative features and functionalities to support high-bandwidth and low-latency applications, the addition of a multitude of new Radio Frequency (RF) components for supporting new radio bands and combinations becomes necessary, leading to substantial changes in the design of mobile devices.

Indeed, the growing number of new frequencies supporting 5G and the variety of multiplexing methods used significantly increases the complexity of the RF Front End (RFFE) and exponentially expands frequency band combinations to over 10,000.

Figure 1. 5G Technology transformation creating rising complexity of the RFFE

The RFFE represents the pathway between the antenna throughout to the modem via the transceiver unit. It deals with analogue RF signals coming in and out of the antenna and allocates several components as power amplifiers and trackers, receive diversity modules, filter products, and antenna tuners. The increase in 5G RFFE complexity comes from the addition of new components, specially filters, to cope with the growing amount of new frequency band combinations and radio technologies to be allocated in a very limited Printed Circuit Board (PCB) real estate and the necessity to integrate all these components to operate seamlessly from antenna to the modem.

Solving this design burden that RFFE complexity is putting on devices is becoming paramount for the leading Original Equipment Manufacturers (OEMs). 5G is set to become a massive opportunity across both sub-6 Gigahertz (GHz) and Millimeter Wave (mmWave), so OEMs will need to intelligently manage their smartphone designs across the entire product portfolio to increase economies of scale, harmonize the user experience, and reduce the number of Stock Keeping Units (SKUs) needed to factor in the regional spectral differences and operator variations. The design of RF systems and the choice of appropriate RFFE components will become key for OEMs to differentiate their products, solving the integration of the entire 5G cellular system design into their devices, from the antenna to the modem.

To overcome these challenges, OEMs will need to move away from RF and RFFE assembly and adopt a system-level radio design to maximize device performance without compromising overall device design, time-to-market, or cost. It is also clear that systems design across multiple air interfaces will help enhance the overall performance of devices, helping OEMs accelerate time to innovation, quickly commercialize devices and support new frequency bands. It is here that the use of RFFE modules and help from end-to-end specialized RF solutions providers will offer welcome support to OEMs, which will help greatly with cellular system design and speed time to market. This delegation of modem-to RF system design brings with it advantages and is expected to become a mainstream approach.

Figure 2. Key 5G RFFE complexities best resolved through implementation of system level design

Only a few players offer an RF system-level approach and Qualcomm is leading the pack. It is no coincidence that the company finds itself in this position, having gained first-mover advantage and RF module experience when starting its journey 8 years ago, taking in the creation of the RF360 solution and acquisition of TDK along the way. Qualcomm has also built up an enhanced set of 5G components and solutions that have already been through significant updates and improvements, far ahead of any competitors, which has been extended to the mid-tier and other device types beyond smartphones to bring a broader reach of 5G globally.

While Qualcomm’s competitors have done some sterling work catching up with 5G modem performance, the majority are still in the very early stages of developing RF product portfolio and designs. In contrast, RF suppliers have done a great job of customizing and improving the performance of individual components, but OEMs are often left to fend for themselves when integrating these into their devices. This can lead to a lengthy time-to-market for end devices, the creation of many SKUs, and a complex RF system design that could potentially interfere with overall device industrial designs.

To mitigate the RF gap in their portfolio, some modem suppliers, notably MediaTek and Samsung, joined forces with leading RF components suppliers including Skyworks, Qorvo, and Murata to create the OpenRF Consortium in October 2020. The goal is to provide guidelines for OEMs to build open, configurable, and end-to-end antenna to modem reference designs where they can mix and match RF components and modems from various suppliers. However, ABI Research does not expect these reference systems to be ready for adoption any time before 2023 at the earliest, concluding that it is still too soon to evaluate how successful the OpenRF consortium will be in future.

Figure 3. Qualcomm’s drive to lead RF systems level approach was no overnight success

The reality is that OEMs delegate the RFFE to a third party, but if they were to wait for other solutions to offer anything approaching Qualcomm’s level of integration, they could face a lag of 2 to 3 years, losing time-to-market and consequently market share. All competitors are still lagging behind Qualcomm and will likely do so for many years as it will require significant investment in RF know-how via some much-needed rationalization and consolidation. This becomes even more important as the 5G market moves to unlock experiences and growth beyond mobile phones to reach new form factors, such as notebooks (“always connected” PCs), mobile broadband routers, and Fixed Wireless Access (FWA) equipment, as well as adjacent market segments including automotive and infra-structure, creating experiences central to mobile services.

Leading the charge to 5G is the availability of smartphone models, which have quickly become more diverse and have a wide variety of price points, accelerating affordability and exploding global volume sales. Such a fast speed of 5G adoption can only be achieved through resolving RFFE complexity. To highlight this growing requirement and market importance, the table below showcases the use of Qualcomm’s 5G RFFE portfolio, listing current design wins in flagship models from major smartphone vendors.

Figure 4: Assessing leadership in 5G Sub-6 GHz and mmWave smartphones – Qualcomm continues expanding design wins in current flagship models