France-based telecom operator Orange is pushing into the mobile banking space, highlighting new opportunities for operators

The new voice in the telecom industry may not be a voice at all. It may just be “bank.”

Orange Telecom, which has around 28 million mobile clients in France alone, is taking a majority position in Groupama Banque, elbowing in on the banking industry even as banking is being as disrupted as telecom. The company’s plan? To bring banking services to its customers through trusted mobile applications and experiences.

Orange Bank is expected to launch in France in early 2017, with a plan to convert 2 million mobile subscribers to financial services, around 7% of its base. Orange said after that it will expand into Spain and Belgium.

This is a brilliant move, as leading “formerly known as telecom” companies continue to push into more services, with payments and now banking being obvious adjacencies.

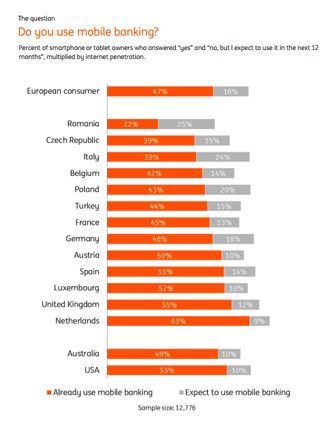

Growth market? Here are a few statistics from the recent ING Global Banking report – the opportunities are obvious even if the strategy to transform from a mobile telecom company into a mobile services company, including banking and shopping, is still considered disruptive.

According to ING’s study, published in June, mobile banking is gathering momentum with nearly half of European smartphone or tablet users active. And another 16% plan to switch to mobile banking in the next year.

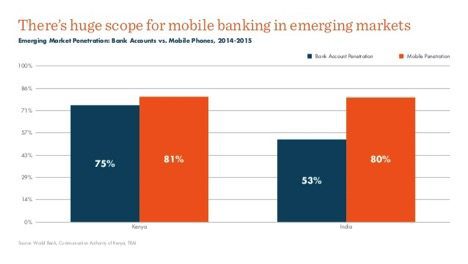

The opportunity is tremendous in emerging markets, where Orange has signed agreements designed to strengthen its presence in three West African countries, for example, one with Bharti Airtel International for the acquisition of subsidiaries in Burkina Faso and Sierra Leone and one with Cellcom Telecommunications Limited regarding the acquisition of a subsidiary in Liberia. The World Bank continues to study the trends, including in countries where citizens currently have more mobile subscriptions than bank accounts.

Orange already offers some financial services via Orange Money, which it launched in the African Union’s Ivory Coast in 2008. The service, which enables users to pay bills and transfer money, now operates in 14 countries and has 18 million customers.

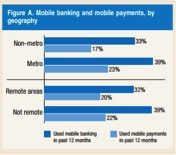

In large markets, including the U.S., around one-third of the population actively banks via their mobile devices, according to the U.S. Federal Reserve.

Orange is the new bank

Stéphane Richard, Orange’s chairman and CEO, described the acquisition as “a major step forward in our ambition to diversify into mobile financial services.” He said the move “aims to bring mobile banking into a new dimension.”

Thierry Martel, Groupama’s CEO, said the deal would enable his group to leverage Orange’s technical know-how and expertise in digital services.

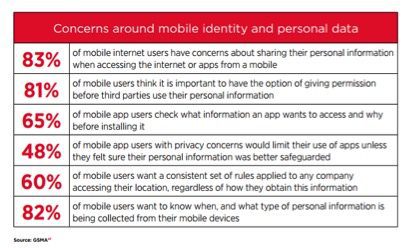

It seems absolutely critical for mobile operators like Orange to closely partner with experts. The GSMA earlier this year published its report on the state of the mobile world, and included this table:

The other side of the coin

The majority acquisition of Groupama by Orange came less than one month after Orange’s attempt to acquire Bouygues Telecom fell apart. This move would have consolidated France’s telecom market, and the shift in strategy is being watched closely by other telecoms – and financial institutions around the world.

Same goes for financial analysts tracking the valuation of both telecoms and banks. French banks are under investor pressure to close branches, reduce headcounts and embrace new technology to improve their balance sheets. For example, when Société Générale announced at the end of 2015 it would close 20% of its branches by 2020 – its stock price rose.

More than a marriage of convenience for these industries: convenience for consumers

The government of France still owns nearly one quarter of Orange, a former state monopoly. They are clearly on board, confirming the new services will include current accounts, savings, loans, insurance services and payment facilities.

The digital platform designed for mobile phones will use Groupama Banque’s banking license and will continue to serve nearly half a million customers with deposits over 2 billion euros ($2.2 billion).

As disruptive as all this sounds, it is great news for consumers whose lives will be transformed by these mobile banking and payment services; as long as all the security, reliability and support are fully baked into these emerging applications.

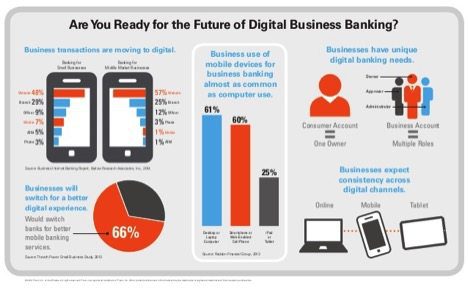

And these benefits are not just for consumers – businesses are moving to digital and mobile banking equally as fast with plenty of upside benefits:

In closing, bravo to Orange and Groupama for taking this step, which may actually prove to be another step in its transformation path. Let’s see how the market – and markets – respond.

Editor’s Note: In an attempt to broaden our interaction with our readers we have created this Reader Forum for those with something meaningful to say to the wireless industry. We want to keep this as open as possible, but we maintain some editorial control to keep it free of commercials or attacks. Please send along submissions for this section to our editors at: [email protected].