This week, we are focusing on the state of wireline connectivity through the lens of one of the largest U.S. providers, CenturyLink. We’ll also provide some initial thoughts on T-Mobile US’ inclusion of video streaming services in the majority of their plans.

Verizon’s response to strategic asset sale: ‘factless … conjecture … speculative … no foundation’

Fran Shammo, CFO at Verizon Communications, was interviewed last week by Jennifer Fritzsche, senior analyst at Wells Fargo Securities as a part of Wells Fargo’s annual Technology, Media and Telecom Conference (transcript here). Fran spoke on a wide range of topics and reiterated many of the same points covered on Verizon’s third-quarter earnings call.

When discussion came to the possible sale of data center assets, Shammo was extremely succinct in his response:

“I think these are the same reporters and bankers who keep telling me I’m going to buy Dish. They are fact less, they are conjecture, they are speculative and there’s no foundation behind these comments. So the question I kind of wonder about is are our competitors trying to get the enterprise customer a little antsy about Verizon and their continued support? I think we’ve shown it. This is part of our portfolio and we will continue to support our enterprise customers. These rumors and speculative information is just ridiculous, so there’s really no comment to make beyond that.”

Shammo also went on to talk about capital spending, stating there would be a higher allocation of wireless spending in next year’s $17.5 billion to $18.0 billion range (which he reiterated would be closer to $17.5 billion due to the divestiture of FiOS assets to Frontier in California, Florida and Texas). Shammo also indicated enterprise wireline (data center) growth would be organic in nature and customer driven (Verizon is already spending several hundred millions of dollars per year).

Having tracked Shammo’s comments for six years, there’re several things to read into both his comments above and throughout the transcript as it relates to wirleine. First, Verizon clearly sees growth in areas of wireline, and they are attempting (through a tough stand in union negotiations) to make the case for a concentrated and scalable cost structure. This is the only way they believe they can right the share-of-decisions ship against cable.

Second, Verizon is walking a pricing tightrope – they need to find the optimal price point to maximize profitability. As many economics majors know, being a 42% (Verizon FiOS Internet share; video is lower at 36%) participant in a duopolistic structure might be the best mix that they can achieve in their FiOS regions. That is, until Comcast, Time Warner and Cablevision begin to challenge their postpaid wireless business. Then all bets are off. More on this topic in December, but it appears Verizon has some capital/cash flow opportunities in wireline, which they could use to improve the deteriorating enterprise situation that we documented last week.

CenturyLink: more speed = more capital need

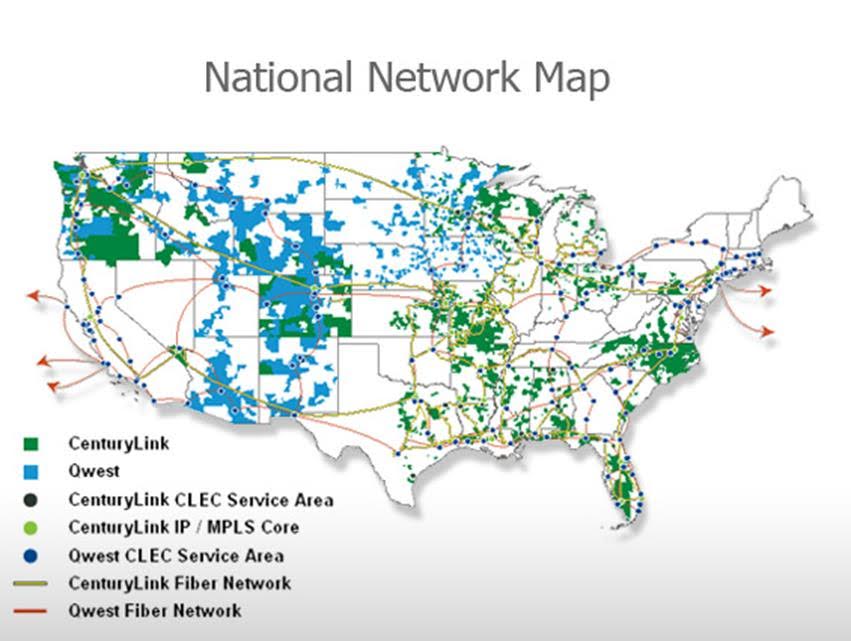

CenturyLink announced earnings on Nov. 4. For those of you who are not familiar with the company and its transformation, CenturyLink started their most recent phase of inorganic growth in 2008 with the acquisition of Embarq Communications, which was a spinoff of Sprint’s local telephone operations. In 2010, CenturyLink acquired Qwest Communications, yielding today’s national footprint (see nearby network map), and followed up with the acquisition of cloud and data center provider Savvis Communications in 2011.

From these mergers came a lot of integration activity. Savvis became CenturyLink Technology Solutions in 2014, and was later folded under the CenturyLink Business organization in 2015 (note: unlike Verizon, the topic of last week’s column, CenturyLink appears to be holding their own on the Gartner ratings – for more information see here). Qwest, Embarq and legacy CenturyTel continued to streamline and centralize operations, and in 2014 CenturyLink began a more aggressive expansion of its gigabit-capable passive optical network to better compete with cable high-speed Internet solutions.

CenturyLink’s earnings were driven by several dynamics, which are not unique to many of the U.S. wirleine providers:

1. Legacy voice and special access (T1, DS3) revenues are quickly being replaced by wireless or cable alternatives.

2. New revenues are not growing (in absolute terms) as fast as legacy revenues.

3. Cost structures are not dropping as fast as legacy revenues. In particular, programming cost structures for Prism TV, CenturyLink’s IPTV product, are challenging overall consumer margins (meaning more growth may not lead to scale-like margin growth).

All of these things came to fruition in the latest earnings report. On the CenturyLink Business front, strategic revenues have actually fallen by 0.7% over the last eight quarters (overall revenues have fallen 5.9%), while costs of service have risen 1.8% (more here – see pages 9 and 11).

The Consumer business is a lot better thanks to GPON and Prism TV (driving strategic revenues up 11.7% over last eight quarters). Overall Consumer revenues are essentially flat, however (0.9% growth over the past eight quarters) and costs are rising thanks to programming and labor increases (up 2%). A better story than the Business segment, but lots of room for improvement.

To resume mid-single digit growth, more capital is needed for GPON and Prism TV deployments. While the company has deployed fiber-to-the-premise solutions to 490,000 businesses, there are needs for at least another 200,000 builds. The same capital need exists as CenturyLink expands from their 780,000 residential footprint.

This capital fight is going on across the traditional wireline provider community as cable continues their march to gigabit speeds with the introduction of DOCSIS 3.1 (see Cox’s September announcement here).

Look at the nearby chart, which outlines CenturyLink’s actual uses of operating cash flow in 2014. Capital expenditures of $3 billion equated to 16.7% of total operating revenues, a figure that would be fine for most cable companies (Comcast’s 2014 cable segment capital spending was in the 16% to 17% range), but for cable and collocation (especially in the growth stage that CenturyLink is currently in), the figure should be higher (approximately $3.6 billion if CyrusOne’s capex to revenues ratio is used).

This is why CenturyLink’s strategic assessment of their 58 collocation centers makes a lot of sense. The capital intensity per dollar of revenue compared to traditional (or even new) network spending is close to 3x. The dividend from competitors is lower than CenturyLink’s current yield (CyrusOne = 3.39%; Equinix = 2.51%; DuPont Fabros = 6.29%; Rackspace does not pay a dividend). And network spending needs to increase to ensure the value of the local exchange franchises remains intact. Provided that they can work a deal that allows more capital and time to be spent on value-adding data analytics service companies that they have bought, a partial monetization of this asset makes a lot of sense for shareholders and customers.

Binge On!

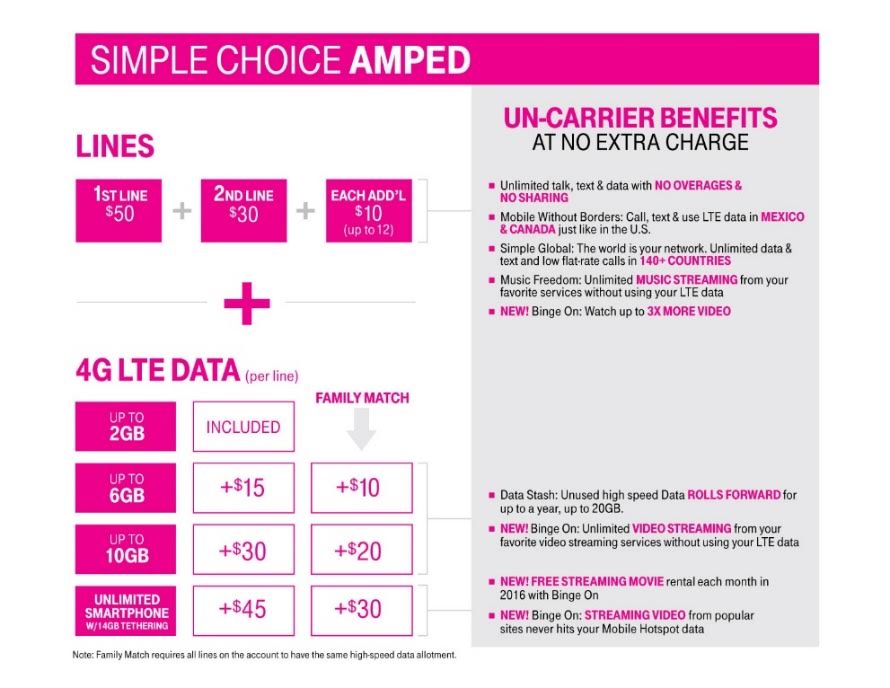

T-Mobile US announced across the board changes in their pricing structure (including a $15 per month spike in their unlimited plan pricing), but this was overshadowed by their unlimited video viewing (Binge On) announcement. Binge On compresses the video feed to 480p, which is probably good enough for all but the highest-end smartphones (with 5.5-inch or larger screens).

Both Sprint and AT&T were quick to question T-Mobile US’ network capabilities and overall business model at the Wells Fargo industry conference. Sprint CFO Tarek Robbiati’s prediction that “the hangover will come” was the headline – if it doesn’t, Sprint’s subscriber growth will most certainly dip back into negative territory.

Network armageddon is unlikely unless large amounts of customers are simultaneously accessing Netflix or Hulu from the same cell site. Even then, it would need to be a disproportional increase (which would correspond to supernormal subscriber growth) to materially impact overall service quality. The likelihood that issues will emerge in a particular market (e.g., New Orleans where T-Mobile US has a low RootMetrics raing) are higher, but the chances of this happening system wide are remote. We’ll include more on Binge On after trying it out firsthand, but it’s very unlikely the service quality is going to inhibit service adoption. Explaining to customers that T-Mobile US will not be able to control service quality in a Wi-Fi environment and removing the “10 GB for all” and “Two for $100 unlimited” offers are likely to be more concerning to customers.

Net-net, T-Mobile US stole the show for the fourth quarter with Binge On. They will likely affect cord cutting with their Sling $14 per month promotion, and every other carrier (but particularly Sprint) has to respond to their video-centric pricing structure. This is not a promotion, but a strategic necessity for the No. 3 provider. It just happens to also be one that will super-size their postpaid customer base and raise average revenue per user.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at [email protected] and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.