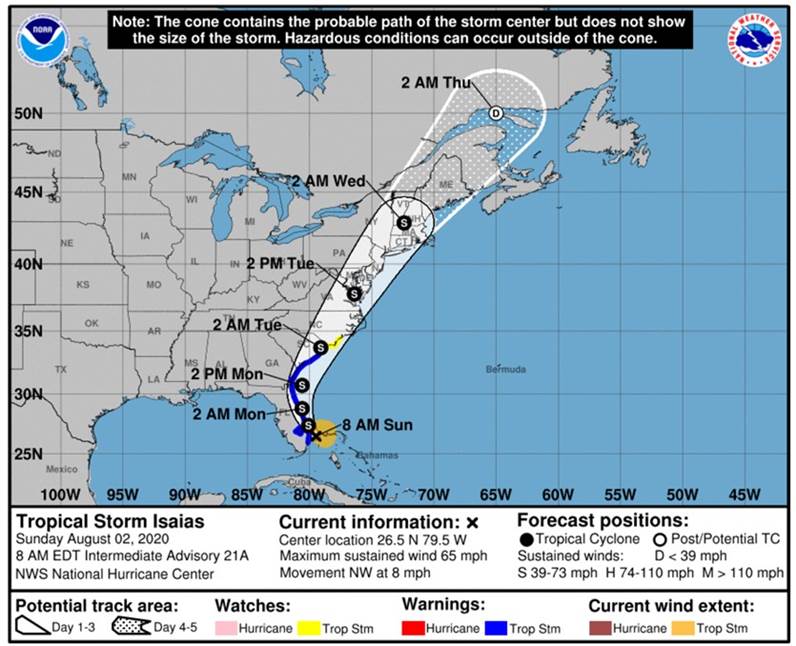

Greetings from Davidson, North Carolina. Hard to believe it’s already August, but the weather forecasters are already tracking hurricanes (cone above/ left). Lots of wind, and some greatly needed rains for the Tar Heel state to follow – typical summertime activity in the Carolinas.

Greetings from Davidson, North Carolina. Hard to believe it’s already August, but the weather forecasters are already tracking hurricanes (cone above/ left). Lots of wind, and some greatly needed rains for the Tar Heel state to follow – typical summertime activity in the Carolinas.

We had an earnings downpour this week and, while I will try to be as brief as possible, this column will likely run a little longer than normal. We are also posting several new CEO interviews (and other interesting articles) this week to the site (keeping the total to 10) just in case you need additional reading materials. The earnings Bingo cards were also a hit, and we will definitely post a set prior to T-Mobile’s earnings this week.

In this week’s Brief, we will cover the Fab 5 and the Telecom Top 5 returns, talk a bit about the tech hearing, touch on the Fab 5 cash flows, and then turn the rest of our attention to broadband: Comcast, Charter, AT&T, and Verizon. At the end, we will provide a brief update and some thoughts on the latest CBRS round results.

The week that was

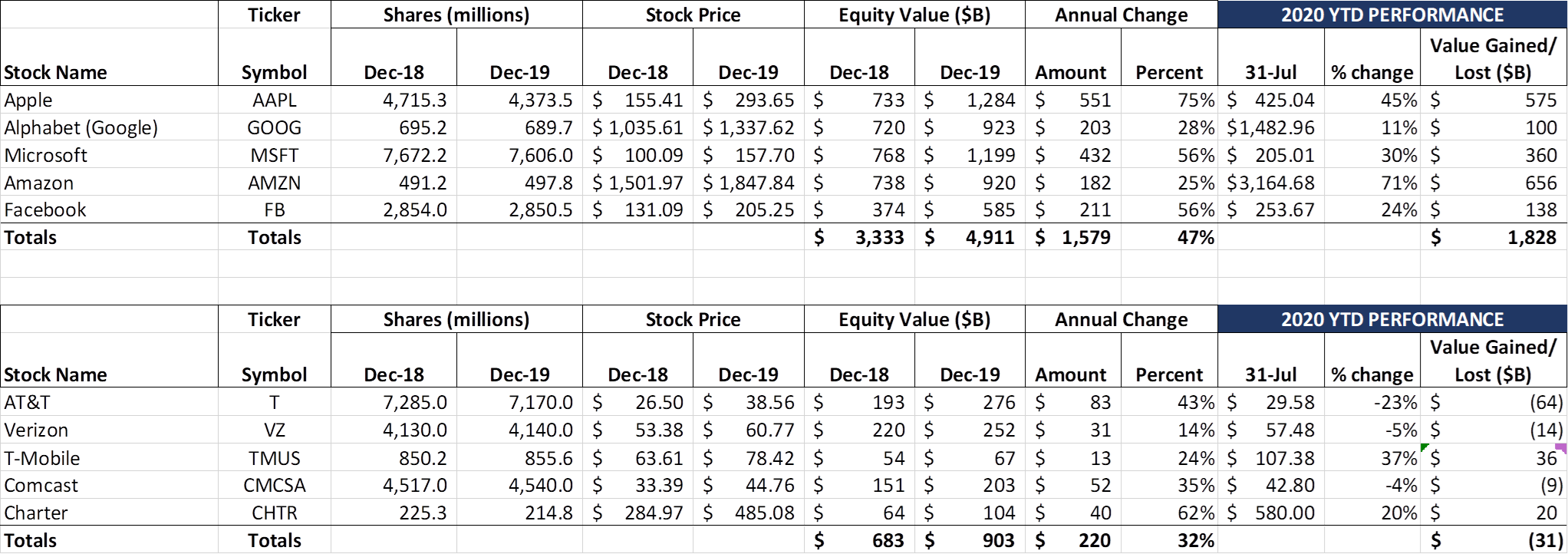

Apple gained more value this week than the entire equity market value of AT&T (and surpassed Aramco as the most valuable company on earth). Facebook, the latest boycott target, gained $65 billion in equity market capitalization this week and has added an entire new T-Mobile of value in seven months. Comcast (earnings discussed below) held on to most of their June/ July gains through a very tough broadcast/ cable/ film production environment.

Apple gained more value this week than the entire equity market value of AT&T (and surpassed Aramco as the most valuable company on earth). Facebook, the latest boycott target, gained $65 billion in equity market capitalization this week and has added an entire new T-Mobile of value in seven months. Comcast (earnings discussed below) held on to most of their June/ July gains through a very tough broadcast/ cable/ film production environment.

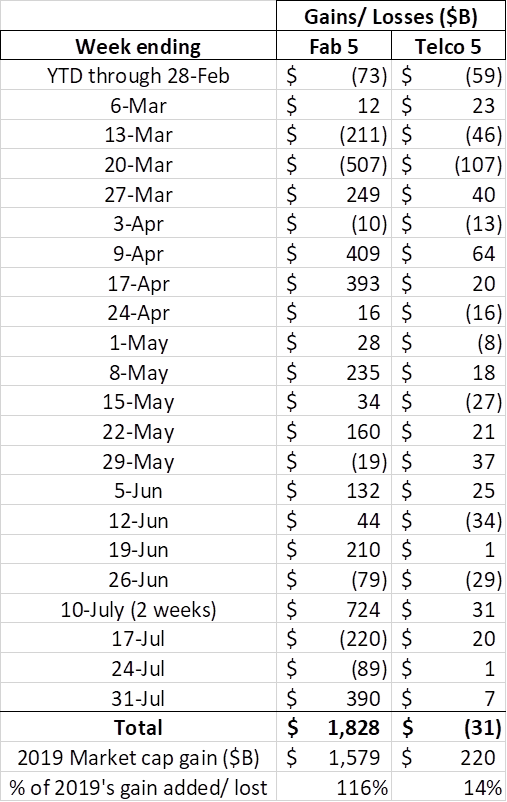

Overall, the Fab 5 gained $390 billion in equity market capitalization this week, while the Telco Top 5 gained $7 billion. So far in 2020, the Fab 5 have gained over $1.8 trillion in value while the Telco Top 5 have lost $31 billion. Since the beginning of 2019, the Fab 5 have gained over $3.4 trillion in market capitalization while the Telco Top 5 have gained just under $190 billion ($18 dollars of market cap created for the Fab 5 for every dollar created by the Telco Top 5).

How are they doing it? We do not have time to go into each of the Fab 5 earnings in this column, but here’s a pretty good summary by company based on their SEC 10-Q filings:

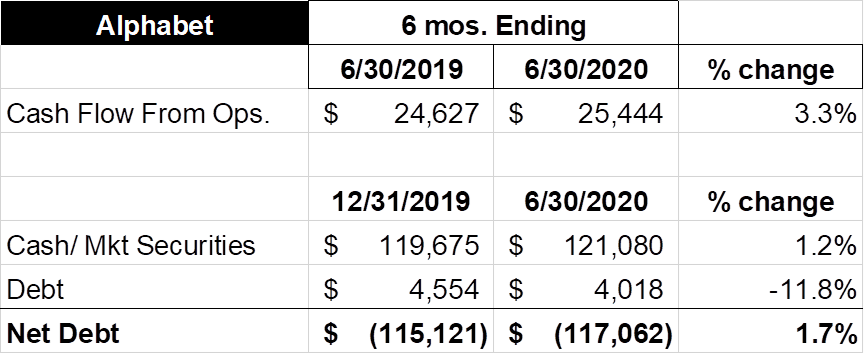

Alphabet (Google) had its first quarterly decline in ad revenue in the history of the company (8% decrease versus 2Q 2020). For the first 6 months of the year, this figure was up less than 1%. Cash flow from operations for the first six months of the year was up slightly more than revenues (3.3%).

Alphabet (Google) had its first quarterly decline in ad revenue in the history of the company (8% decrease versus 2Q 2020). For the first 6 months of the year, this figure was up less than 1%. Cash flow from operations for the first six months of the year was up slightly more than revenues (3.3%).

Through all of this, Alphabet’s net debt has managed to decrease, thanks to a $536 million decrease in total debt levels. While this is not the prettiest of pictures, they have managed to grow their market capitalization by $100 billion thus far this year. Around 12% of Google’s total equity market value is comprised of the cash less debt on their balance sheet ($117 billion/ $1.015 trillion market cap) – this is the highest % of any of the Fab 5. Bottom line: Cash flows are challenged, but Alphabet has plenty of cushion to weather the storm.

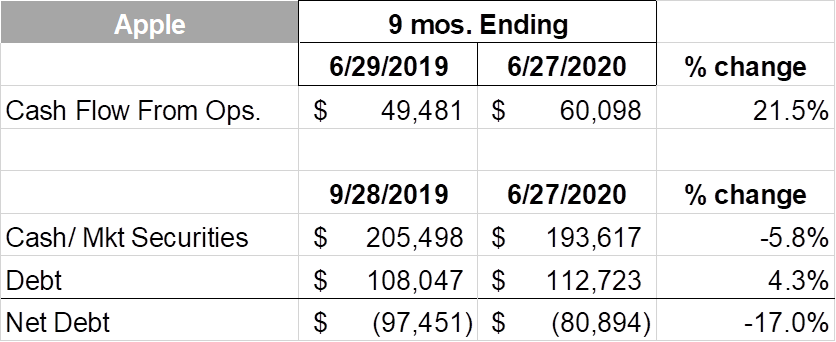

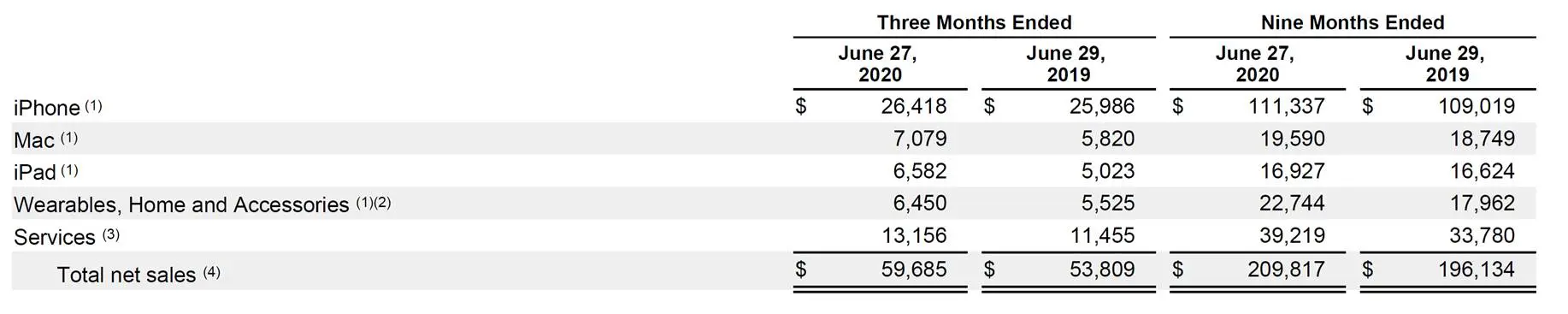

Apple is in a different situation form Google, relying more on hardware sales with minimal advertising exposure (note: figures represent 9 months of totals as opposed to 6 months for each of the remining Fab 5). As we noted at the beginning of the COVID-19 pandemic, Apple had the iPhone SE (value priced device) ready to serve those customers who could purchase the device online (most stores were closed, and carrier receivables were down materially in the quarter). For the 9 months, however, the Cupertino giant managed to increase cash flow from operations by 21.5% and continue to manage their net debt level to $81 billion. The unit sales figures from their press release tell the story perfectly:

Apple is in a different situation form Google, relying more on hardware sales with minimal advertising exposure (note: figures represent 9 months of totals as opposed to 6 months for each of the remining Fab 5). As we noted at the beginning of the COVID-19 pandemic, Apple had the iPhone SE (value priced device) ready to serve those customers who could purchase the device online (most stores were closed, and carrier receivables were down materially in the quarter). For the 9 months, however, the Cupertino giant managed to increase cash flow from operations by 21.5% and continue to manage their net debt level to $81 billion. The unit sales figures from their press release tell the story perfectly:

iPhone revenues were up 1.7% thanks to the launch of the iPhone SE. Unit sales were up even faster, although the company indicated that iPhone 11 was the top seller in the quarter. Bottom line: To the extent at-home activities drive technology upgrades (such as remote learning), Apple has a leg up on their competition. They have plenty of cash to weather a delay in the launch of a new device, and are picking up switchers with the iPhone SE. No company benefits more from a global recovery than Apple.

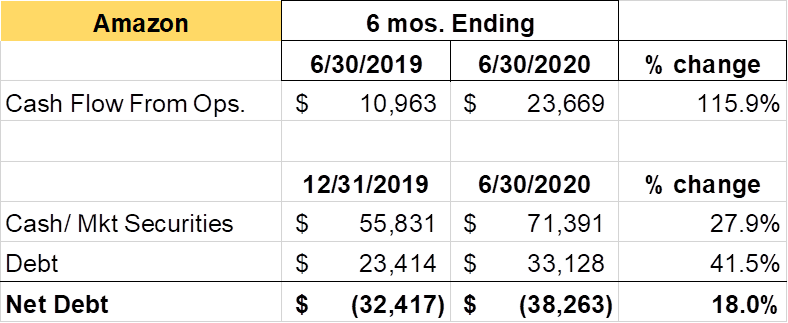

Amazon has been the largest beneficiary of the COVID-19 crisis, with both cloud and on-line marketplace businesses growing at strong double-digit rates in the quarter (more details on page 24 in their 10-Q here).

Keeping with their historical norm, Amazon continued to invest in their cloud and logistics infrastructure in the quarter (over the last 12 months, they have invested over $24 billion in PP&E, putting them ahead of both AT&T and Verizon in capital spending). Amazon’s success, however, could be their downfall. In what was described as “authentic” testimony by Vox (article here), CEO Jeff Bezos clearly did not diminish the drumbeat of increased regulation and potential separation of retail operations from the platform (CNET has an excellent summary of his responses here). As we mentioned in our comments on the Sanders-Biden task force, it is highly likely that a “clean sweep” of Congress will lead to more regulation, including the review of all mergers from the Trump administration. Activist Executive and Legislative branches can only mean one thing: More time and resources devoted to Washington DC and selected larger states. It could be a very good payday for experienced Legislative Affairs and anti-trust specialists but will definitely result in increased Bezos/ Cook/ Pichai/ Zuckerberg time preparing for and ultimately testifying. That carries a significant opportunity cost (just ask Bill Gates).

Keeping with their historical norm, Amazon continued to invest in their cloud and logistics infrastructure in the quarter (over the last 12 months, they have invested over $24 billion in PP&E, putting them ahead of both AT&T and Verizon in capital spending). Amazon’s success, however, could be their downfall. In what was described as “authentic” testimony by Vox (article here), CEO Jeff Bezos clearly did not diminish the drumbeat of increased regulation and potential separation of retail operations from the platform (CNET has an excellent summary of his responses here). As we mentioned in our comments on the Sanders-Biden task force, it is highly likely that a “clean sweep” of Congress will lead to more regulation, including the review of all mergers from the Trump administration. Activist Executive and Legislative branches can only mean one thing: More time and resources devoted to Washington DC and selected larger states. It could be a very good payday for experienced Legislative Affairs and anti-trust specialists but will definitely result in increased Bezos/ Cook/ Pichai/ Zuckerberg time preparing for and ultimately testifying. That carries a significant opportunity cost (just ask Bill Gates).

We are going to save Facebook and Microsoft summaries for next week to devote more time to telecom earnings. But common threads weave their way through each of the Fab 5 stories:

- High investment (even during COVID-19) to create continued competitive advantage

- Selective broadening of markets (e.g., iPhone SE or Apple Card) over time

- These investments result in increased scale economies to handle faster growth

- Global exposure (and global investments) which de-risk singular geographic exposure (but expose companies to increased foreign exchange volatility)

- Freedom to operate in an increasingly (American) deregulatory environment

- Because of a-e, ability to hire the most talented people across the globe

- Negative net debt and strong cash cushions.

These are several threads that weave the value creating fabric of the Fab 5.

The importance of fiber-based broadband relationships

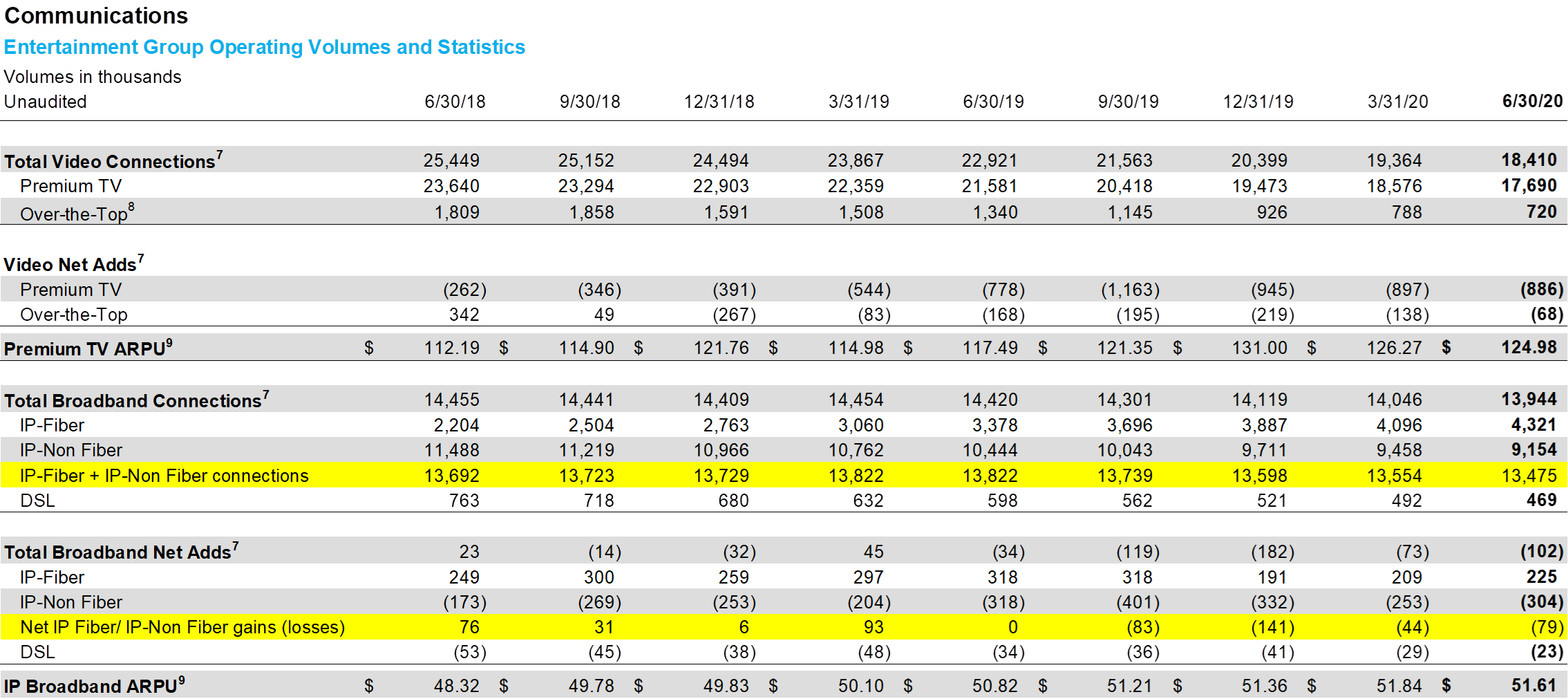

With Comcast and Charter earnings announcements this week, we have a critical mass to assess share gains and losses. As a reminder, here are AT&T’s consumer fiber results (yellow highlighted rows have been added):

Regardless of their stated strategy, AT&T’s achieved result is strikingly clear: IP Fiber gains barely offset IP-Non Fiber losses until early in 2019, and have turned negative since then. Over the last four quarters, AT&T’s non-DSL base has fallen by 347K customers. This represents over $200 million in annualized revenue losses and, given the capital intensity of broadband to the home, likely over $150 million in operating income losses.

It’s important to note that AT&T has lost share in markets like Los Angeles (Charter is their main cable competition), San Diego (Cox), San Francisco (Comcast), Dallas/ Ft. Worth (Charter), Houston (Comcast), Austin (Charter), San Antonio (Charter), Atlanta (Comcast), Chicago (Comcast), Detroit (Comcast), Cleveland (Charter), Miami (Comcast), Kansas City (Charter/ Comcast), St. Louis (Charter), Raleigh (Charter) and Charlotte (Charter). These losses are broad-based in large part because, as AT&T indicates in their investor package, it can only market “its 100% fiber network to 14 million customer locations in parts of 85 major metro areas.” Contrast that with Comcast and Charter, who can readily market 600 Mbps (former) and 300 Mbps (latter) speeds across entire metropolitan areas.

Despite activist shareholder predilections (re: memos publicized late last summer), more fiber is needed now for AT&T. Increasing penetration from 16% to 31% is great, but shouldn’t AT&T have an even greater penetration across much larger percentages of the 85 metro areas where they already have deployed fiber? Can AT&T better retain IP Non-Fiber customers who decide not to upgrade to fiber? These trends are not friendly to AT&T and threaten their vision. They also serve as a punctuation to the Randall Stephenson legacy.

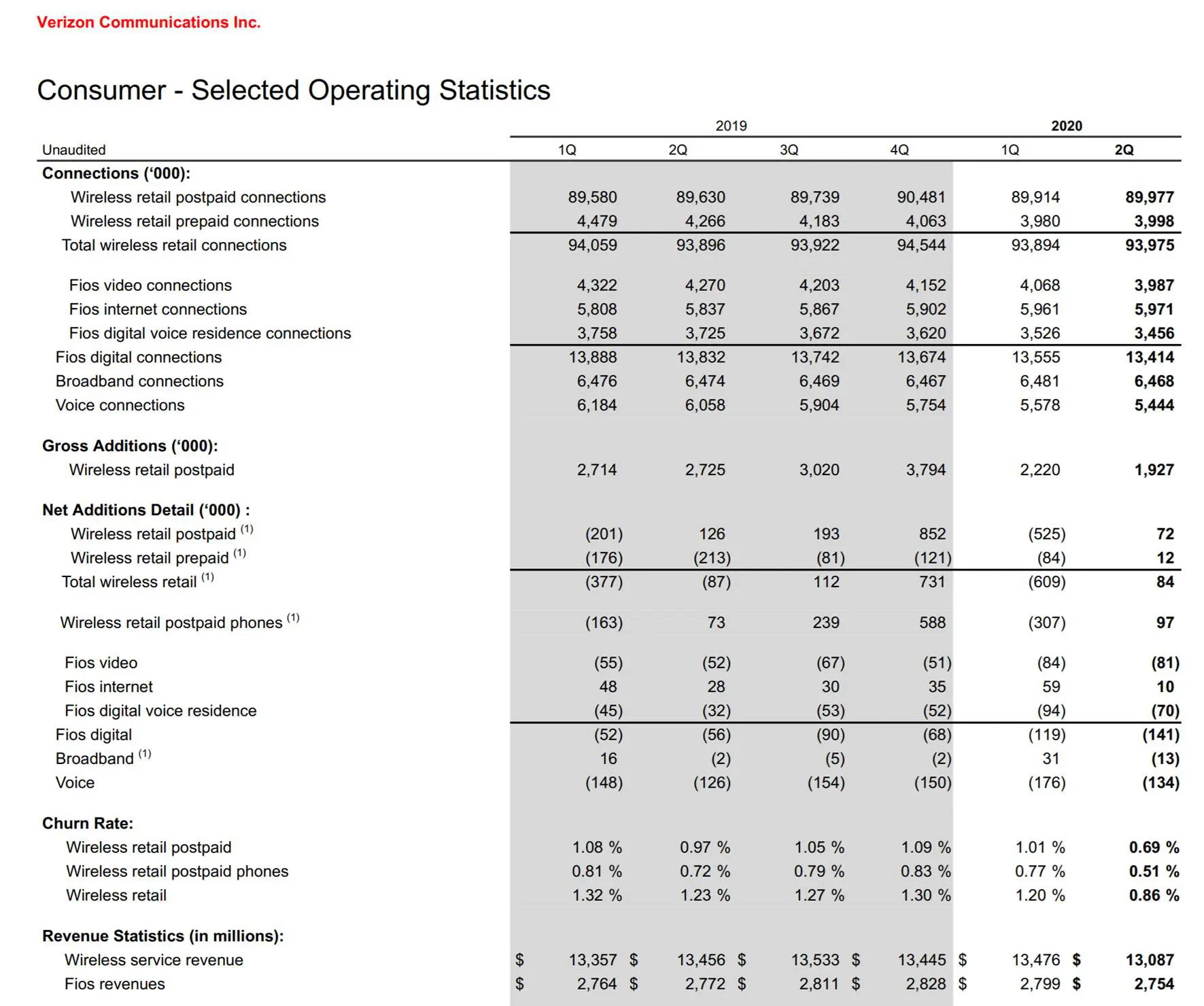

On to Verizon, where the story is only slightly better. Here are the FiOS/ broadband 6-quarter trends for Big Red:

FiOS Internet connections have grown 2.8% (or 163K) over the last six quarters, with 42% of that coming in the last six months. Total broadband connections have largely stayed flat during the same period. FiOS revenues have also been relatively flat, although they were making steady (proportional) growth heading into the end of 2019. Assuming that FiOS now passes more than 18 million homes (about 4 million more than AT&T), that would still put overall FiOS penetration in the low to mid-30% range. Better than AT&T, but not the percentage market shares we see below with cable. In fact, Altice reported 42,000 more net adds in the current quarter (including COVID-19 related adjustments) in their smaller footprint than Verizon and had added more residential broadband customers in the last four quarters than Verizon FiOS.

FiOS Internet connections have grown 2.8% (or 163K) over the last six quarters, with 42% of that coming in the last six months. Total broadband connections have largely stayed flat during the same period. FiOS revenues have also been relatively flat, although they were making steady (proportional) growth heading into the end of 2019. Assuming that FiOS now passes more than 18 million homes (about 4 million more than AT&T), that would still put overall FiOS penetration in the low to mid-30% range. Better than AT&T, but not the percentage market shares we see below with cable. In fact, Altice reported 42,000 more net adds in the current quarter (including COVID-19 related adjustments) in their smaller footprint than Verizon and had added more residential broadband customers in the last four quarters than Verizon FiOS.

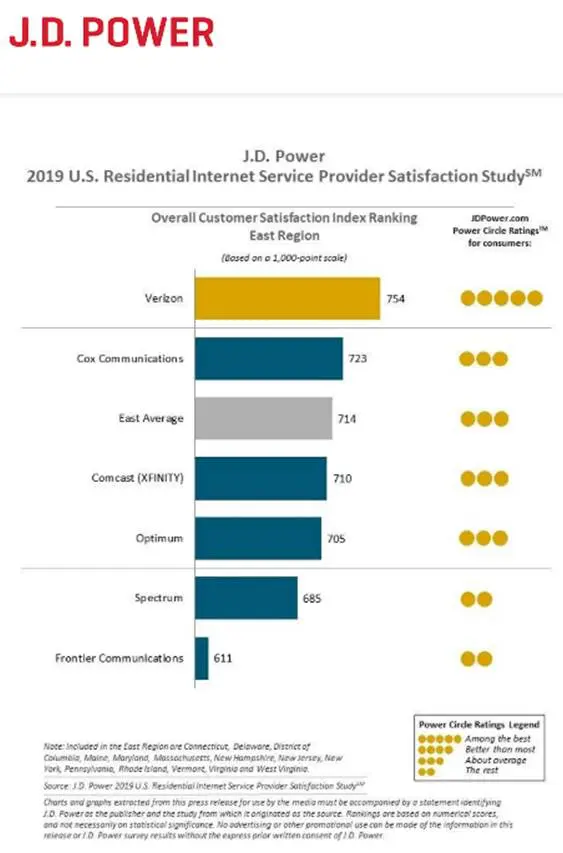

Bottom line: FiOS forms the basis for One Fiber in Verizon’s traditional territory. It is validated by several outlets (including J.D. Power – see nearby chart) as the highest scoring residential Internet service provider (ISP) in the United States. Yet it fails to gain (and one could probably argue with the Altice data, likely is losing) market share against a less popular product. That calls into question Verizon’s ability to manage their consumer product portfolio (which in the case of FiOS, incudes bundled TV + Internet quality). Verizon is primed to win, but appears to be willing to settle for second place in the residential broadband contest. This allows Comcast and Spectrum the opportunity to leverage their advantage in residential areas to price more aggressively the surrounding small and medium businesses.

Comcast and Charter, on the other hand, are exceeding all expectations on broadband, handily beating fiber-based alternatives and deftly playing their hand to maximize profitability. Here’s the broadband trend at Comcast (full file here):

Comcast has added 3.36 million residential High Speed Internet customers in the last 10 quarters. They added more broadband customers than Verizon and AT&T added in the last eight quarters. They have 6 million more revenue generating broadband customers than Verizon and AT&T combined. And Comcast is the biggest competitor to CenturyLink in the former US West legacy territory, covering Denver, Portland, Seattle, Tacoma, Boise, Salt Lake City (Cox is the primary supplier in Phoenix and Las Vegas). And, it appears that Comcast’s average revenue per user is close to 20% higher than AT&T’s ARPU ($61+ for Comcast versus $51+ above).

What does more scale mean for Comcast? Here’s how Comcast Cable’s CEO, Dave Watson, described it on the call:

“Our #1 priority remains broadband. With only 50% of the homes and businesses in our footprint taking our data products, there is plenty of room for growth as we continue to gain share of an expanding market. We are optimistic about the runway ahead, and we will continue to invest in our broadband network to ensure we have great reliability as well as product innovation. It’s much more than speed. Our customers find value in our gateways, the management and control that xFi enables, coverage with our xFi pods and most recently, Flex. We took the creative energy that we focused on video and have applied it to broadband. We’ve got the best product and best innovation engine out there, and we’re leaning in. We’re also very focused on customer retention, and our churn remains at all-time lows. With new products like Mobile and Flex, we give our customers additional opportunities to find even more value in our data service and drive retention to record levels.”

Strong broadband provides a robust streaming platform. Flex provides an alternative to TV (which keeps broadcasting relevant to those customers who are ready to ditch their traditional set-top box), and Peacock streaming servers can be positioned in every Comcast node to deliver high-quality service within the “broadband garden.”

Bottom line: While we have a lot of questions surrounding Xfinity Mobile’s performance, especially compared to Charter/ Spectrum’s terrific quarter (more on that when we discuss T-Mobile’s earnings next Sunday), Comcast has the right formula for broadband. They are lapping Verizon, AT&T, and CenturyLink and setting the stage for a significantly superior streaming experience with Peacock. One might argue that for wireline, they are demonstrating to AT&T what a well-executed content+connectivity vision and strategy can produce.

Just when you think it can’t get any better for cable, Charter announced spectacular earnings on Friday. Here’s a summary of their broadband additions over the last ten quarters (full trending package here):

Even when the 242K net additions from Charter’s Remote Education Offer and Keep Americans Connected programs are omitted, the company still added 600K net new residential Internet customers. That’s nearly 2x the growth that Comcast experienced in the quarter, and the Philly cable giant has over 6 million more passings.

Together, Comcast and Charter (backing out special programs) added somewhere between 930K and 1 million customers in the quarter, making them the “go to” connectivity source for homes across the US.

We disclosed the markets where Charter competes against AT&T above, and they also have a fierce competitor with FiOS in the New York City metro. Even with that environment (which included COVID-19 install difficulties in April and May throughout the Northeast), Charter thrived.

Bottom line: Broadband forms the basis for residential customer relationships. That cable won is not a surprise – they have been winning for over a decade. All it takes to create a bad day for AT&T and Verizon is a family-friendly wireless play (a la T-Mobile’s soon to be introduced four lines for $100 plan). Cable can make this a reality through more investment in licensed and unlicensed spectrum throughout the neighborhood (or apartment complex), slowly reducing their dependency on Verizon for traditional wireless capacity. This wireless densification is affordable because cable has extremely strong residential broadband penetration.

CBRS auction results: Round 16 ends – total bids exceed $1 billion

This was the week where we discovered whether the CBRS auction would be similar or different to traditional licensed spectrum auctions. After fifteen additional rounds, it’s clear that for many markets it’s going to look a lot like the AWS auctions of years past. As noted by Sasha Javid in his excellent CBRS tracker here, there’s still a ways to go in the bidding for Los Angeles, Puerto Rico, Chicago, Dallas, New York and Houston. Have a look at the tracker in the link above for the attest data (probably worth bookmarking).

That’s it for this week. Next week, we will incorporate what is expected to be very strong earnings and subscriber growth from T-Mobile into our overall wireless earnings picture. Look for the T-Mobile 2Q earnings bingo card by Tuesday evening on the www.sundaybrief.com website. We will also be posting several new links in the online-only post called “Ten second quarter interviews to watch” most evenings.

Thanks again for the subscriber referrals – several new subscribers were added this week. Please keep the comments and suggestions coming. And if you have friends who would like to be on the email distribution, please have them send an email to [email protected] and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!