Will 5G prove the savior to the mobile telecom market’s bottom line, or will the lack of significant IoT and 5G use cases result in continued revenue pressure?

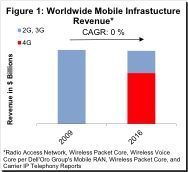

We estimate the overall mobile infrastructure equipment market including hardware, firmware and software is on pace to decline materially in 2016, and overall market revenue will likely be on par or slightly lower than overall infrastructure revenue in nominal dollar terms in 2009, implying “4G” has up until this point produced no topline growth for the infrastructure vendors in nominal terms and declined slightly in real terms (Figure 1).

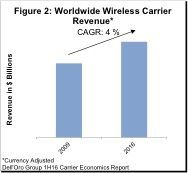

At the same time, our estimates suggest worldwide currency-adjusted mobile carrier revenue has grown at a compounded annual growth of 4% since the inception of 4G (Figure 2).

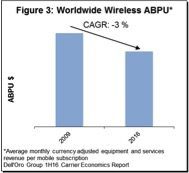

The diverging trends between carrier and vendor revenue growth is a result of operators’ ability to capitalize on a growing subscription installed base, which has up until this point been robust enough to compensate for the estimated 3% annual decline in revenue per subscription (Figure 3).

The challenge carriers are presented with now is that subscription growth is slowing and the magnitude of the growth matches the decline in average billing per user, and as a result we estimate carrier revenue was flat year-over-year during the first half of 2016. With the smartphone in its current form soon approaching its 10-year anniversary, it is perhaps no surprise service providers and vendors are excited about the opportunities and potential topline upside with “5G.” But despite all the hype around the “internet of things” and 5G, the fundamental question still remains: Will 5G reverse current vendor and wireless carrier trends?

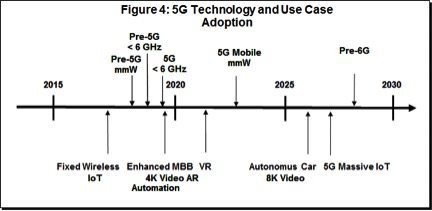

Our position is that 5G coupled with the right use cases could drive incremental growth for the vendors and carriers, but the likelihood today is greater that it will not reverse current trends. Our thesis is built on a confluence of factors including operators’ overall 4G and 5G strategies; the availability of new nontelco capital; and any potential shift in capital expenses from wireline to wireless. A number of assumptions about the adoption of various use cases have been adopted for these projections (Figure 4).

It has been assumed that a widely successful launch of at least one new game-changing application/technology/service is required to stimulate enough new money to offset other demand and supply challenges facing the industry, including a maturing smartphone market and the ongoing shift from macro cell sites to small cells. While we are not suggesting that a lack of innovation is the driving force behind our forecast, we are merely acknowledging that 5G investments beyond the typical consumer smartphone use case will likely be spread out over time and dependent on the success of nontraditional applications, which by default will have an inherent uncertainty when it comes to the impact on the ecosystem and timing of adoption.

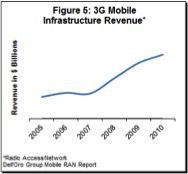

Naturally these are working hypotheses rather than exact forecasts, and the uncertainties surrounding the timing and magnitude of the next potential game-changer would add to the margin of error included in producing these estimates. Because, just as it was extremely challenging in 1996 to forecast that a successful smartphone for the masses would not be launched until 2007 when the vision for today’s smartphone was already a reality and there were multiple smartphone products on the market, it is equally challenging today to separate the next winner from the next smartwatch, setting aside the additional challenge of forecasting the exact timing of these events. However, it is important to assess an expected value of these events occurring, because if history is any indicator of future performance, the launch of the Apple iPhone in 2007 was a major driver of the 3G upgrade cycle and another successful game-changer will likely be a boon for 5G investments (Figure 5).

Editor’s Note: In the Analyst Angle section, we’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.