Bidding activity for larger markets continues to outstrip supply, as FCC 600 MHz incentive auction prepares for faster pace

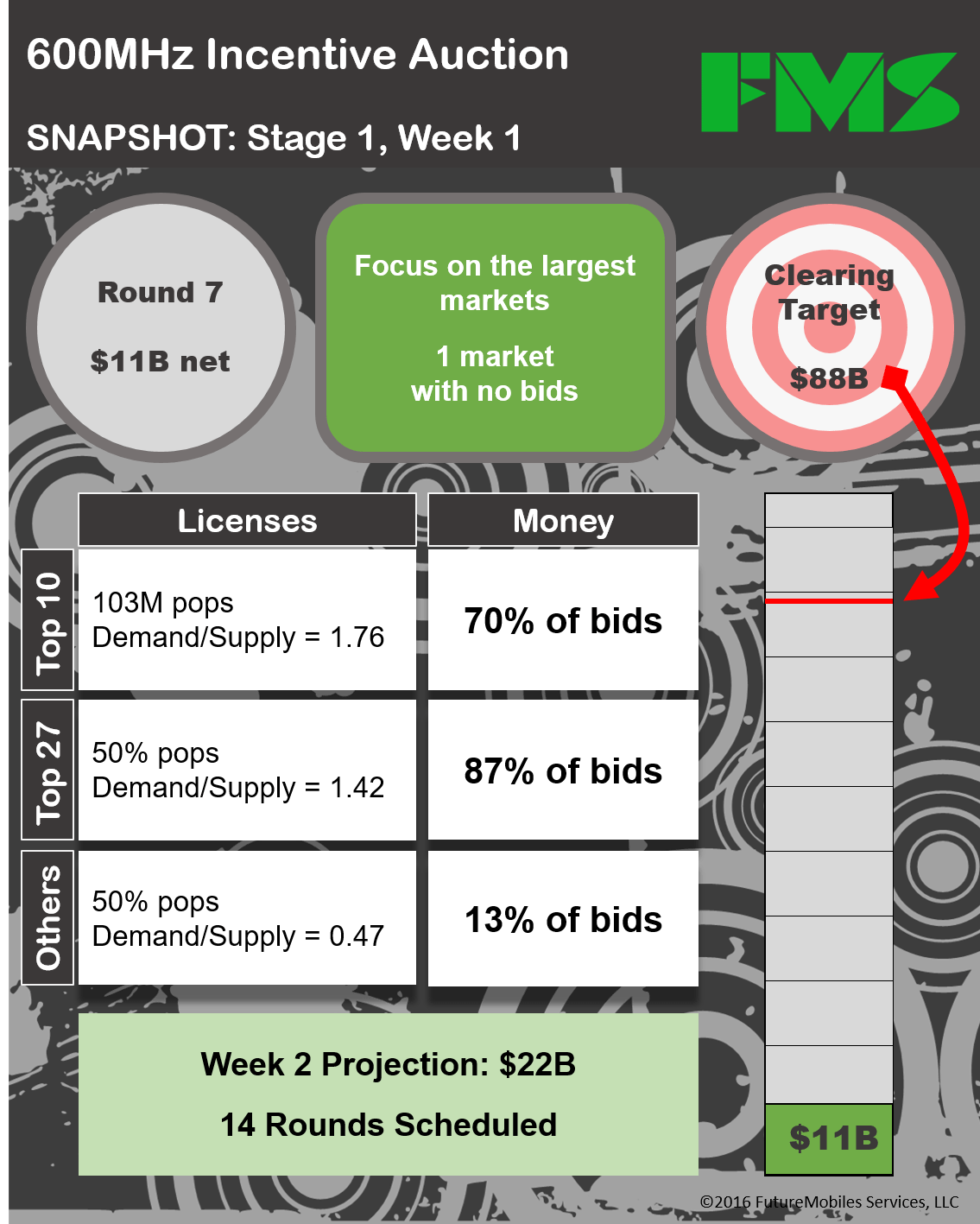

The Federal Communications Commission’s 600 MHz incentive auction entered its eighth round of bidding having scored more than $11.5 billion in total auction proceeds connected to “winning” bids, with just under $11 billion in net auction proceeds.

The final two rounds of bidding to close out last week tacked on around $1 billion in new high bids, including continued strong over-demand for some of the auction’s largest markets. The FCC is offering up various blocks of spectrum across 428 partial economic areas, with each block containing 10 megahertz of spectrum.

For example, the FCC is offering up 10 spectrum licenses centered on New York City, which have scored 29 bids at $181 million per license through round seven of the proceedings. The five licenses centered on Los Angeles have drawn 19 bids at $134 million per licenses, while the 10 licenses centered on Chicago have drawn 24 bids at $66.3 million per license.

Madan Jagernauth from Future Mobile Services noted the auction’s 27 largest markets accounted for 87% of net proceeds through round seven, with the 10 largest markets accounting for 70% of total bids. Jagernauth said he expects the auction to hit $22 billion in total proceeds by the end of this week.

The current total is still significantly short of the more than $86 billion that will be needed to meet the financial demand of television broadcasters willing to sell those spectrum assets.

The FCC managed to clear a total of 126 megahertz of spectrum from television broadcasters as part of the reverse auction. Factoring in additional clearing and administrative charges, the bidders will need to post winning bids in excess of $88 billion in order for the current forward auction results to count. That amount came in well above expectations, leading many to note the FCC will likely need to conduct additional bidding stages in order to hit financial levels in line with bidding demand.

FCC Chairman Tom Wheeler acknowledged the government agency may need to conduct further reverse auction stages should forward auction bidding not meet the current $86 billion clearing target. Those additional stages could result in less spectrum being transitioned from television broadcasters to mobile telecom operators, as well as the potential for the auction to stretch into next year.

“The auction is a market-based mechanism for matching supply with demand,” Wheeler explained. “Until the forward bidding concludes, we will not know whether the demand meets the large supply offered by broadcasters. Depending upon that response, it’s possible that we would need to move to additional stages to find the level where demand meets supply. The commission intentionally designed the auction to account for the possibility that supply and demand might not match at the initial clearing target. It’s something we planned for, and we’re fully prepared to implement if the need arises.”

Analysts had been predicting the forward auction could generate up to $50 billion in total bids on 100 megahertz of post-packaged spectrum.

“The FCC will need to attract big bucks and several new bidders if the 600 MHz forward auction is going to be completed before the end of 2016,” noted Berge Ayvazian, senior analyst and consultant at Wireless 20/20. “Carrier war chests have been stretched in recent years and together AT&T, T-Mobile and Verizon may bid as much as $30 billion. So it may be up to newcomers such as Comcast to reach the clearing cost of more than $86 billion, and a second stage of the reverse auction may be needed later this year.”

RCR Wireless News recently spoke with Dan Hays, principal at PwC’s Strategy& division, to get his insight into the auction proceedings, including any potential impact on the launch of “5G” services.

Similar to recent spectrum auctions, the FCC is only releasing bidding information on markets and not on which bidders have placed those bids. The current auction has 62 qualified bidders, including the likes of Verizon Wireless, AT&T Mobility, T-Mobile US, U.S. Cellular and C Spire.

The FCC previously said it will set aside 30 megahertz of the repackaged spectrum for carriers that do not already control a significant amount of sub-1 GHz spectrum holdings, which is predominately made up of AT&T and Verizon Communications.

T-Mobile US is expected to be the most aggressive bidder for the set-aside spectrum, with some predicting the carrier could spend up to $10 billion on licenses. While not eligible for the set-aside licenses, analysts predict AT&T could bid between $10 billion and $15 billion for licenses – having committed to at least $9 billion in bids as part of gaining approval of its DirecTV acquisition – while Verizon is predicted to bid around $10 billion.

Sprint, which has sat out all of the FCC’s recent spectrum auctions, announced last year it would again sit out the competitive bidding process. The carrier noted a need to focus on improving its network and that it already had sufficient spectrum due to its vast portfolio in the 2.5 GHz spectrum band.

The auction is currently scheduled to include a pair of two-hour bidding rounds today, with the FCC moving to three one-hour bidding rounds beginning tomorrow.

Bored? Why not follow me on Twitter

Photo copyright: drogatnev / 123RF Stock Photo