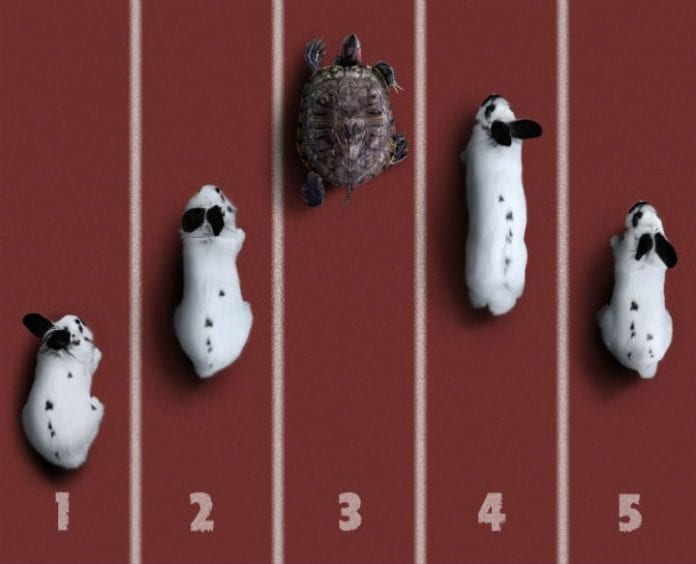

In its immediate attempts to right its financial ship, is Sprint hampering its competitive position going forward against rivals Verizon, AT&T and T-Mobile?

Time for the third – and last – article on the immediate outlook for Sprint. And in the words of Billy Joel, “these are the last words I have to say” … for a while, anyway.

Rather than look at the current state of Sprint and what it is, or is not, doing, let us look ahead and assume the current cost cutting is successful, the debt payments due in the next few years get paid, the subscriber base does not defect en masse and the business stabilizes. Since Sprint has cut capital spend significantly for fiscal year 2016 – a topic of much discussion here in Dallas at the Wireless Infrastructure Show – and pushed out any significant small cell spend into fiscal year 2017, the network is unlikely to improve significantly in the next 15 months. As we said previously, what you see today from Sprint’s network is what you are going to get for the next year or so.

So what will Sprint look like in January 2018? How will it compare with T-Mobile US, AT&T Mobility and Verizon Wireless by that point? And what are Sprint’s differentiators likely to be?

The good news for Sprint is that it gets to benefit, just like the other mobile operators, from the latest smartphones and devices; there is no deficit here for a consumer. There also is no differentiator; I can buy the latest Samsung Galaxy or Apple iPhone from any of the big mobile operators. I will also likely have improved access to voice-over-LTE and high-definition voice, although as a consumer it may be tough to notice.

By 2018, AT&T will have far closer integration and cross-selling of DirecTV and will likely have been offering programming content across multiple delivery networks for some time. In other words, I will be able to buy a programming package from AT&T that I can access over LTE or my third-party broadband connection, as well as satellite and U-verse. AT&T will decommission its 2G network and refarm the spectrum for use by LTE – it is also refarming some 3G spectrum, although not turning off the network altogether – in 2017, which will obviously improve the LTE capacity.

Verizon Communications will likely have sold more landline assets (data centers, more of the local exchange carriers, etc.), putting the capital to work in the LTE network. Verizon Wireless also will, by 2018, be making far more noise about “5G” and may have even “launched” 5G services, although these will be based on pre-IMT-2020 standards. But from a consumer perspective, it will be “hello, 5G.” Oh, and if you think Verizon has failed with Go90, think again. The company’s plans for video and content delivery, plus the ability to monetize it, extend far beyond today’s limited offering. By January 2018, you could be watching football and basketball games via Verizon Wireless LTE, and they could be monetizing your eyeballs.

T-Mobile US appears ready to push into small cells and continue its capital spend on the network. Like Verizon and AT&T, T-Mobile US is also participating in the 600 MHz auctions. But rather than wait for the broadcasters to vacate the spectrum after the auction, T-Mobile US appears to want to move more quickly and get that low-band spectrum to use. It is unlikely it will have launched by January 2018, but a quarter or two later is not impossible. T-Mobile US will also have worked out how to monetize Binge On, not from the consumer, but from the advertisers.

This is the world of 2018 in which Sprint must be able to compete – a wireless world where the competition is getting some (not the majority and not all) of its revenue from sources other than consumers. A world where success is not just measured in speed and coverage, but by the ability to access specific content and programming. Think of the success Netflix has had with proprietary programming such as “House of Cards.” Now apply something similar to AT&T, Verizon Wireless or T-Mobile US and you get the idea.

The price of success for Sprint today – survival – is that it is unlikely to be able to compete from a content perspective tomorrow. Surviving today is not enough when your competitors are investing in network, product and content. Sprint’s challenges are therefore likely to continue for some time; today it must right the financial ship and tomorrow it must invest in network. But the day after tomorrow, it is all about content and programming and things that leverage an improved network. This will be a long road for Sprint and it is likely to be chasing its competitors for years to come.

Iain Gillott, founder and president of iGR, is an acknowledged wireless and mobile industry authority and an accomplished presenter. Gillott has been involved in the wireless industry, as both a vendor and analyst, for more than 20 years. The company was founded in 2000 as iGillottResearch in order to provide in-depth market analysis and data focused exclusively on the wireless and mobile industry. Before founding iGR, Gillott was a group VP in IDC’s telecommunications practice, managing IDC’s worldwide research on wireless and mobile communications and Internet access, telecom brands, residential and small business telecommunications and telecom billing services. Prior to joining IDC, Gillott was in various technical roles and a proposal manager at EDS (now Hewlett-Packard), responsible for preparing new business proposals to wireless and mobile operators.

Editor’s Note: Welcome to Analyst Angle. We’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.