Dell’Oro Group looks at challenges facing small cells as they try to garner scale in the consumer and enterprise space

At a high level, small cells have moved from the hype phase to reality. The Dell’Oro Group estimates the nonresidential small cell market approached 300,000 to 400,000 commercially deployed units/nodes in 2015, suggesting the small cell market is materializing at a faster pace than originally envisioned – the Dell’Oro Group in 2012 expected there would be 200,000 to 300,000 nonresidential small cells deployed by 2015.

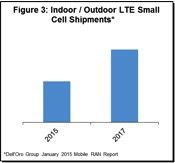

With the faster-than-envisaged adoption of small cells, the focus is now shifting to how quickly deployments will scale. More specifically, indoor enterprise deployments are widely recognized as a great opportunity for small cells. And despite the fact indoor small cell shipments improved significantly in 2015, and the indoor installed base is roughly three-times the size of the outdoor small cell installed base, the question is not if outdoor will catch up, the question is really why is the ratio three-to-one and not 30-to-one, and when will we get there?

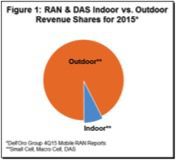

The diverging trends between supply and demand is creating tremendous opportunities. Carriers have focused intensely on outdoor coverage and capacity over the past couple of years and independent testing suggests outdoor performance significantly outperforms that of indoor performance. At the same time, Ericsson recently suggested 80% the data is consumed indoors and only three in 10 find the performance acceptable indoor, yet more than 90% of the cellular equipment capital expense is allocated for the outdoors.

Even as the carriers are shifting focus from outdoor macro coverage to densification, the 3x-to-1x installed base between indoor and outdoor can be misleading. If we normalize the data to take into account the 10x-to-20x delta in EIRP between indoor and outdoor deployments and factor in the known data supply and demand asymmetry between the outdoors and indoors, it is becoming abundantly clear operators are still prioritizing outdoor KPIs over indoor KPIs, even with small cells.

What is holding back carriers from shifting more capex towards indoor small cells? Four key factors continue to influence indoor small cell capex

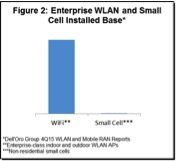

–Wi-Fi with its inherent neutral host capabilities is compelling for many enterprises and the performance is acceptable in many indoor settings. And even though enterprise WLAN market growth slowed to a six-year low in 2015, the technology is the de facto standard for enterprises worldwide. And just as there are on-going efforts to enhance the 3GPP road map, there are on-going efforts to advance the 802.11 road map, and one should not exclude the possibility of a narrowing performance gap between 3GPP and 802.11 down the road, which can curb the demand for 3GPP based small cells in some enterprise settings – particularly in the not overly crowded enterprise scenario.

–The service packages carriers provide today are not conducive for streaming or downloading the majority of the video content on the cellular network. There have been some progress recently in the U.S. market with new video offers that enable consumers to stream some content without tapping into their data plans; however, the time consumers spend downloading and streaming video content on their smartphones using the cellular network is still negligible –which is to some degree curbing the need for high performance networks indoor.

–Outdoor small cell deployments are more an extension of the macro network than indoor small cells, and therefore carriers are still more comfortable with outdoor deployment processes than they are with indoor deployments, even if it means they need to deploy a tree and send a postcard for every small cell or place them in manholes – which shows the length carriers are willing to go through to not deal with the hassle of entering a building. Progress has been made with indoor deployments and carriers are finally at the point where they are comfortable having the enterprises themselves deploy a few units per building. But the majority of the operators are not prepared to entrust enterprises with installing tens or hundreds of small cell access points per building if the RF carrier is operating on the same carrier frequency as the outdoor macro.

–If current operator revenue growth rates persist – Dell’Oro Group estimates currency adjusted worldwide wireless carrier revenue advanced at a compound annual growth rate of 0% to 1% between 2012 and 2015 – there simply will not be sufficient telco capex around for carriers to optimize performance both for the outdoor and indoor markets. Capital intensity levels tend to fluctuate in the short-term, but they will normalize over time – limiting the upside in telco capex.

Taking into account all the factors listed above and carriers macro roadmaps, a 30-to-one ratio between indoor and outdoor small cell shipments is not realistic in the near term, unless some capex is offloaded from the service provider to the enterprise. The true “enterprise small cell” market – small cells purchased and managed by the enterprise – is in the very early stages, but it is evolving. However in order to get to a 30-to-one as opposed to a 10-to-one ratio between indoor and outdoor shipments, a neutral host model and an RF carrier that is not interfering with the outdoor macro will likely be essential.

Until then, get used to relying on LTE in the public access domain and Wi-Fi in the enterprise.

Stefan Pongratz is responsible for Dell’Oro Group’s Mobile RAN market research program, and brings over 10 years of experience in the engineering and manufacturing fields.

Editor’s Note: Welcome to Analyst Angle. We’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.