Jim Patterson lines up what Sprint, AT&T and TWC have on their plates for 2016

This week, we will attempt to condense several earnings reports into “to do” lists. This is a new format and feedback is welcome. While we will list up to 10 items on the company’s lists, we’ll try to keep with the theme of brevity and only focus on one or two of them.

Sprint’s ‘to do’ List

1. Increase operating profits to pay down debt.

2. Maintain customer service levels with 2,000 fewer Sprint-employed agents?

3. Demonstrate the value of the Sprint LTE Plus network (gross adds, churn).

4. Densify the network at a more profitable cost structure than competitors.

5. Introduce a foundational price plan that replaces “half off.”

6. Drive churn down to T-Mobile US or AT&T Mobility levels (prepaid and postpaid).

7. Figure out a way to merge with T-Mobile US.

8. Fix retail prepaid.

9. Strengthen business/enterprise.

10. Long haul, long-term fiber strategy.

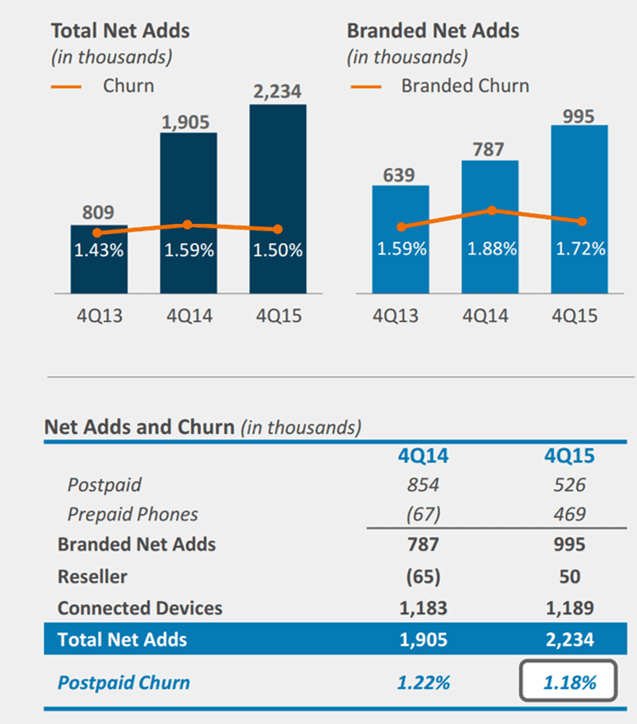

Sprint’s list is long, yet at the same time short. They announced earnings last week clearly showing prime postpaid retail subscriber growth (501,000 total postpaid net additions; 366,000 postpaid phone net additions; 1.62% monthly retail postpaid churn). But they did so with an offer that was more comprehensive than the 2014 “half off” promotion and goes against the rationale offered in 2014 of “when you have a great network, you don’t have to compete on price. [But] when your network is behind, unfortunately you need to compete on value and price.” Either the network improved (which it did broadly for voice and text, and in a few cities for data) and Sprint should be able to compete without broad 50% off promotions, or it didn’t.

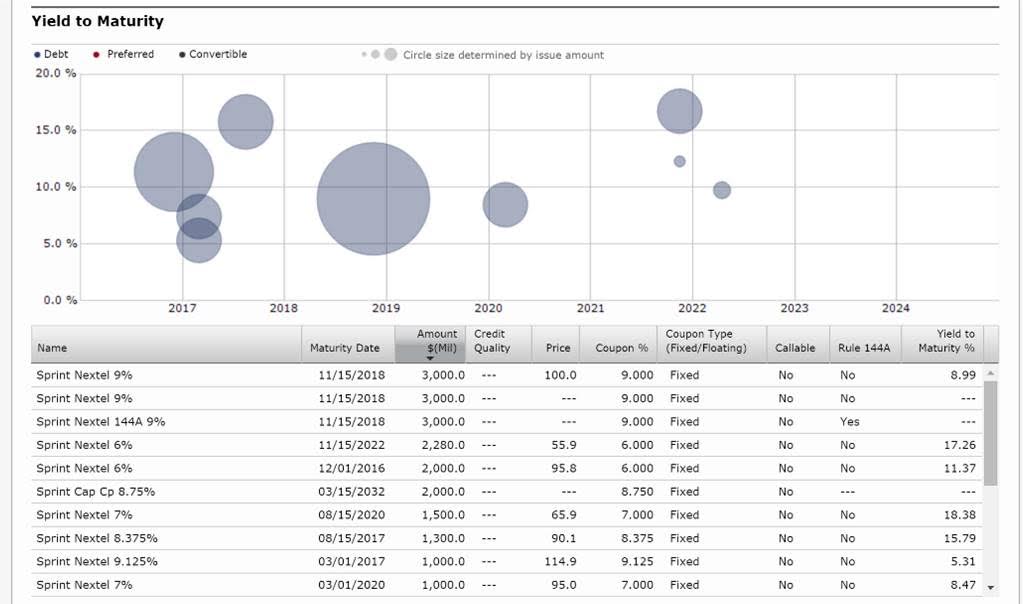

Nearby is a chart of Sprint debt by amount, yield to maturity and due date according to Morningstar. As the chart shows, approximately $4.3 billion of debt will come due in the next 18 months. While it should not be difficult to roll a small portion of that amount, it has been very clear from recent Sprint presentations their intent is to pay off as much of this as possible (One thing that is rarely discussed in Sprint earnings is the drag that $2.1 billion in annual interest payments place on the other cash needs of the company).

To put into perspective, AT&T pays about 9% of their annual earnings before interest, taxes, depreciation and amortization (cash flow) in interest expense. Verizon Communications’ figure is slightly higher at 10%. Sprint’s is a whopping 30% for calendar year 2015. Sprint has to get their debt costs under control and rolling the debt that is due soon is not an option.

Many operating items (specifically having to do with their LTE Plus network expansion) are also on the list. After their earnings call, I am convinced 50% off is going to lose its luster (as early as the first quarter) and another foundational plan will need to take its place. Finally, Sprint needs to build a more balanced wireless business, as their traditionally strong presence with enterprise customers has become diminished over the past several years. There’s still room for a strong No. 3 contender (20% plus market share) and T-Mobile US’ efforts to date have been on smaller businesses.

AT&T’s ‘to do’ list

1. Translate the promise of “TV Everywhere” (specifically in home, on smartphone and in car) into higher satellite/wireless gross adds and lower satellite/wireless churn.

2. Continue to expand basic bundles between satellite, wireless and broadband (better productivity, installation processes, etc.).

3. Realize more cost synergies from the DirecTV acquisition.

4. Exceed LTE buildout promises made for Mexico and drive higher EBITDA.

5. Deploy advanced wireless services (1.7/2.1 GHz) spectrum acquired in early 2015 (for $18 billion) to support growth.

6. Position 60 million broadband-enabled homes to better compete with cable in 2016.

7. Continue to expand GigaPower (56 markets).

8. Grow profitability of “business services” through expansion of NetBond products and services.

9. Expand leadership in connected car and “Internet of Things.”

10. Win the FirstNet deal and implement as quickly as possible.

AT&T announced earnings last Tuesday afternoon and their earnings call can be summarized in one word: transitions. Taken in total, they represent a transformation, but AT&T is going through a series of transitions right now that open them up to opportunities.

First, the company has made a disciplined decision to deselect single and double-line customers who want less data (call it 1 gigabyte or less with minimal to no video viewing). AT&T provided some information on these customers in their earnings supplement and they are leaving in droves. In 2015, over 3.2 million feature phones have either moved to smartphones (1.4 million or 44%) or have left for other providers including AT&T Mobility’s own Cricket brand (an increase of 1.6 million customers in the past year).

There is some merit to this strategy from an acquisition perspective. Store representatives and the best inbound call center salespeople need to spend their time on acquiring larger bundles, not haggling over charges for a $50 to $75 per month voice-centric customer bundle. With 75% of Cricket’s gross additions coming on $50 or higher rate plans (disclosed on the call) and the ease of transition from an AT&T branded smartphone to Cricket (a SIM card swap), netting the prepaid and postpaid growth figures makes sense (213,000 retail wireless phone customer nets in Q4; 165,000 customers in total for 2015). It does not justify, however, the fact AT&T Mobility continues to lose postpaid branded customers.

The unlimited plan introduction for existing DirecTV customers (which is a precursor to a TV Everywhere offer) is an excellent start. Unlimited is easy to sell (and they now have a counter to Sprint’s and T-Mobile US’ unlimited products) and service. The current AT&T product is a very good value (four lines with unlimited everything for $180 per month), especially for the fourth family member (who is free). While AT&T CEO Randall Stephenson was not going to make product introduction headlines on the call, it was pretty clear the offering would involve cross-device viewing of premium content (e.g., HBO or Cinemax or Showtime or all of the above) for one low monthly fee.

There’s a lot more to talk about with AT&T, including their surprise profitability improvement in business wireline (we’ll try to talk about this in conjunction with CenturyLink’s and Level 3’s earnings). AT&T has a lot on their plate and their performance in IP broadband was downright dismal (it’s not clear that the new network can attract new customers). If 2014 was a transition year for U-verse broadband, 2015 should have shown some strength. Starting in the second quarter, IP broadband net additions began to come in at 33% to 50% of 2014 levels. Speeds of 45 megabits per second might be enough bandwidth for many customers, but if the competition is offering 100 Mbps for a similar price, AT&T’s offer will not be as attractive.

If broadband takes a back seat to Mexico and DirecTV throughout 2016, AT&T’s current market share will slip from 25% (15 million customers on a base of 60 million deployed as discussed on the call), to 20% or worse. Can AT&T have a competitively advantaged home strategy against cable providers without a broadband presence? That’s a really tough question for AT&T to answer.

Time Warner Cable’s ‘to do’ list

1. Complete the three-way merger with Charter and Bright House networks.

2. Continue to take home broadband share from AT&T and Verizon.

3. Manage postpromotional churn (especially for phone and video).

4. Grow commercial services revenues faster in 2016 than 2015.

5. Improve competitiveness in enterprise services through a cable consortium.

6. Raise awareness and usage on metropolitan Wi-Fi deployments, particularly in major metropolitan areas (New York City, Los Angeles and Dallas).

7. Match or exceed 2015 customer care improvements by reinventing self-care.

8. Manage total capital spending to between 16% and 17% of revenues.

9. Translate learnings from the New York City “no set top box” video offering into a meaningful product in 2017.

10. Complete the three-way merger with Charter and Bright House networks.

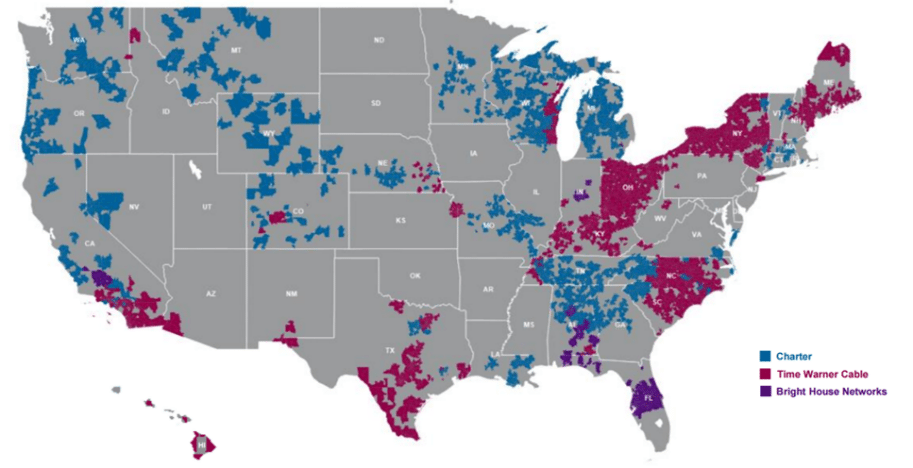

Time Warner Cable hosted what is likely to be their next to last earnings call as a separate company and they are finishing strong. Most important on their “to do” list is the completion of the merger with Charter and Bright House networks. Their initiative list begins and ends with that, not only because they have been in “merger mode” for over two years (which creates employee strain), but also because they need the combined benefit to improve their programming costs (which rose a whopping 9.7% year-over-year in the fourth quarter).

A lot of TWC’s unit growth is coming from promotions (particularly digital phone). As these promotions expire it will be interesting to see how TWC keeps these customers from cancelling service or leaving. Commentary on their retention strategies was light on their earnings call.

The second focus area worth mentioning is capital spending and the relationship to commercial services growth. TWC over-indexed on capital, particularly when measured as a percent of revenue, in 2015 ($4.4 billion on a revenue base of $23.7 billion). If the company tries to keep capital at a low level in Q1 and Q2 (13% or lower) the Maxx initiative will lose momentum. While TWC has been taking market share in Los Angeles and Dallas (and stemming losses to FiOS in New York City), potentially they have an even greater opportunity in Rochester, New York (Frontier), North Carolina (AT&T), Louisville, Kentucky (AT&T), Ohio (AT&T) and San Antonio (AT&T) where independent local exchange carrier plant is not broadly strong and where loop length matters.

More importantly, however, these markets are important for business growth. Line extensions and inbuilding agreements are not cheap, but TWC should strive to add at least 70,000 additional sites that add an existing $1 billion in revenue potential in 2016. That upside could completely eliminate the downside from expiring promotions with exploding rates.

Bottom line

Every company has a “to do” list entering 2016. Each is different and not every company will (or can) complete their full list. Execution of their most important items is important, but does not guarantee competitive success.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at [email protected] and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Photo copyright: coramax / 123RF Stock Photo